Fiscal Policy

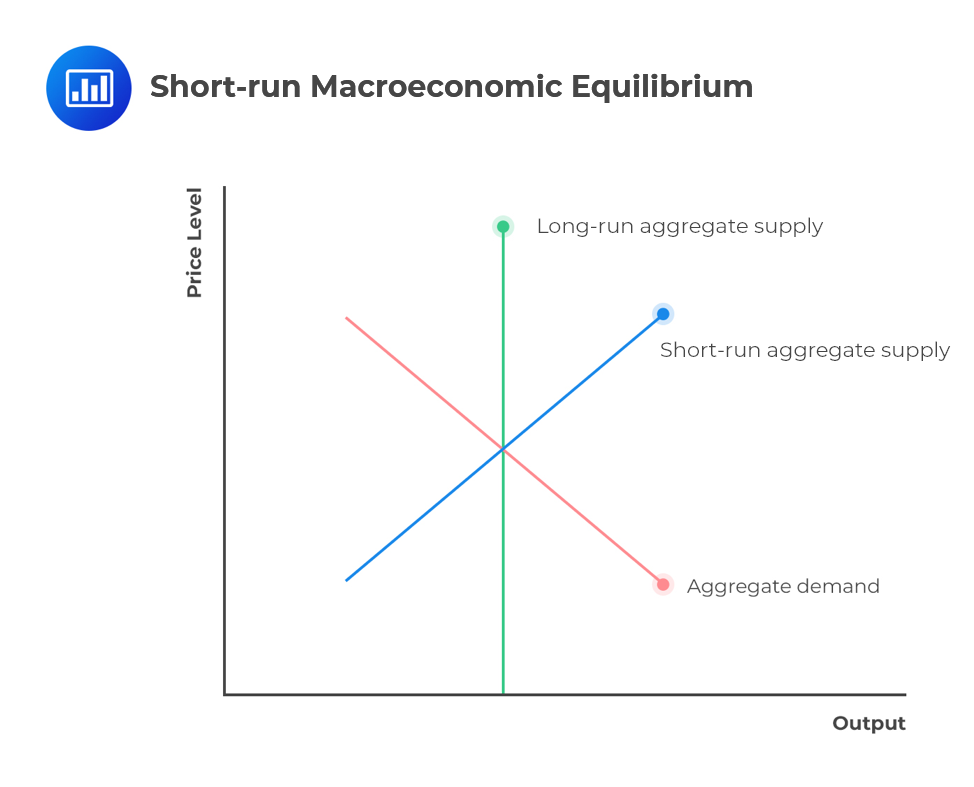

Short-run macroeconomic equilibrium only occurs when the amount of real GDP demand equals the amount of GDP supply. On a graph, this happens at the point where the AD curve intersects the short-run average supply curve, exactly on the long-run aggregate supply curve.

In the short-run, aggregate demand can decrease unexpectedly, leading to an excess supply of goods and services. As a result, prices of goods and services will fall. With a fall in prices, unemployment will increase. Moreover, as prices go down, the output level will also go down.

The aggregate supply curve will shift to the left, but resource costs will end up falling as time passes. This will subsequently shift the aggregate supply curve to the right. Therefore, the output level will revert to the initial level when the economy was at full employment, with low price levels.

If aggregate demand increases suddenly in the short-run, the output level becomes greater than the normal price levels at full employment. This is due to the differences between current prices and the prices anticipated by resource providers.

The unemployment rate will be lower than the naturally expected level. Price levels will decline in the long run to the point consistent with full employment. Prices will then increase, causing inflation.

A decrease in the short-run aggregate supply will instigate a fall in the amount of the available resources. As a result, the cost of acquiring the resources will rise, and consequently, the aggregate supply curve will shift upwards and leftwards. Output levels will fall at higher prices.

In the short run, an unexpected increase in aggregate supply will most likely shift the SRAS curve to the right. Output and income are expected to expand beyond the consistent level in relation to full employment and at lower prices. If the shift in the SRAS curve is temporal, then the SRAS curve will, with time, return to its normal level. Likewise, output and prices will go back to their initial levels.

However, if an event causes a permanent change in the economy, both the SRAS and LRAS curves will shift to the right. As a result, output will increase at lower prices.

Question

When both aggregate supply and aggregate demand increase, which of the following most likely occurs?

A. A rise in inflation

B. An increase in the employment level

C. GDP stays constant

Solution

The correct answer is B.

Higher aggregate demand and aggregate supply raise GDP, hence lowering unemployment. As a result, the employment level increases.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.