Tools of Fiscal Policy

The government possesses two major fiscal tools for influencing the economy. These tools... Read More

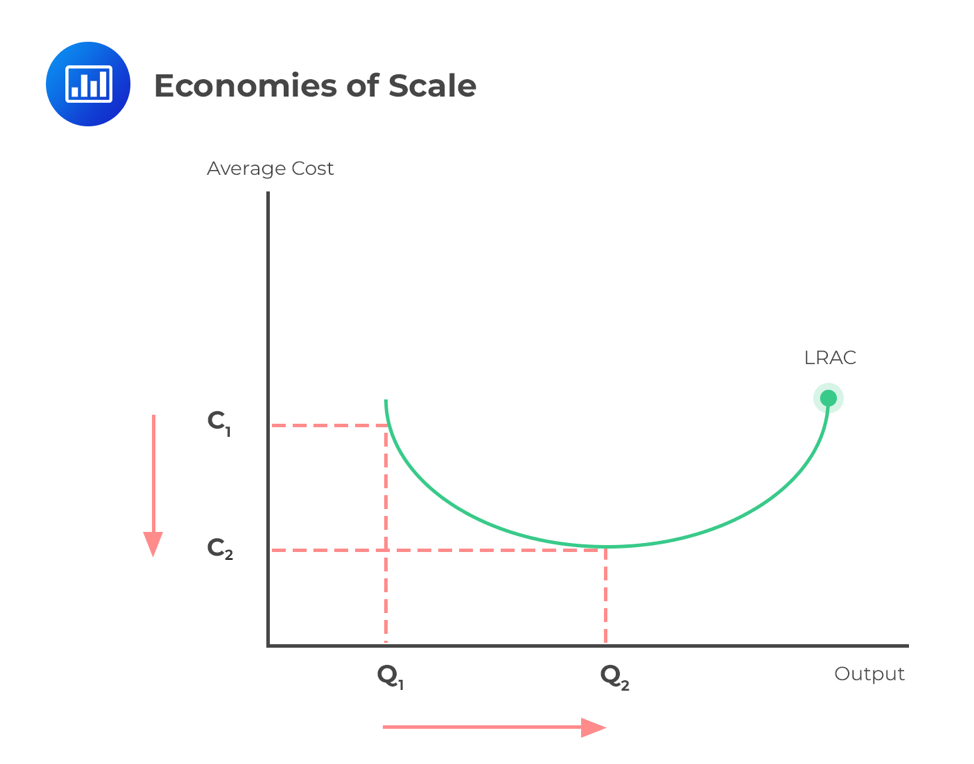

Economies of scale refer to the cost advantage brought about by an increase in the output of a product. Economies of scale arise due to the inverse relationship between the per-unit fixed cost and the quantity produced – the greater the production, the lower the fixed costs per unit. This is because the production costs have been spread out over a large number of goods. As a result, synergies and operational efficiency cause a reduction in variable costs. From this, economies of scale can be divided into two categories:

Economies of scale can result from:

A family wants to print wedding invitation cards for their daughter’s wedding. Printing 500 cards costs $1,000. However, printing 1,000 invitation cards will cost them $1,500. Therefore, while printing 500 cards will cost them $2 per invitation card, printing 1,000 copies will cost $1.5 per card. This is because the price will fall after the initial set-up costs of the printer have been covered. As a result, this leaves only a marginal extra printing cost for every additional card.

Note that LRAC represents long-run average costs.

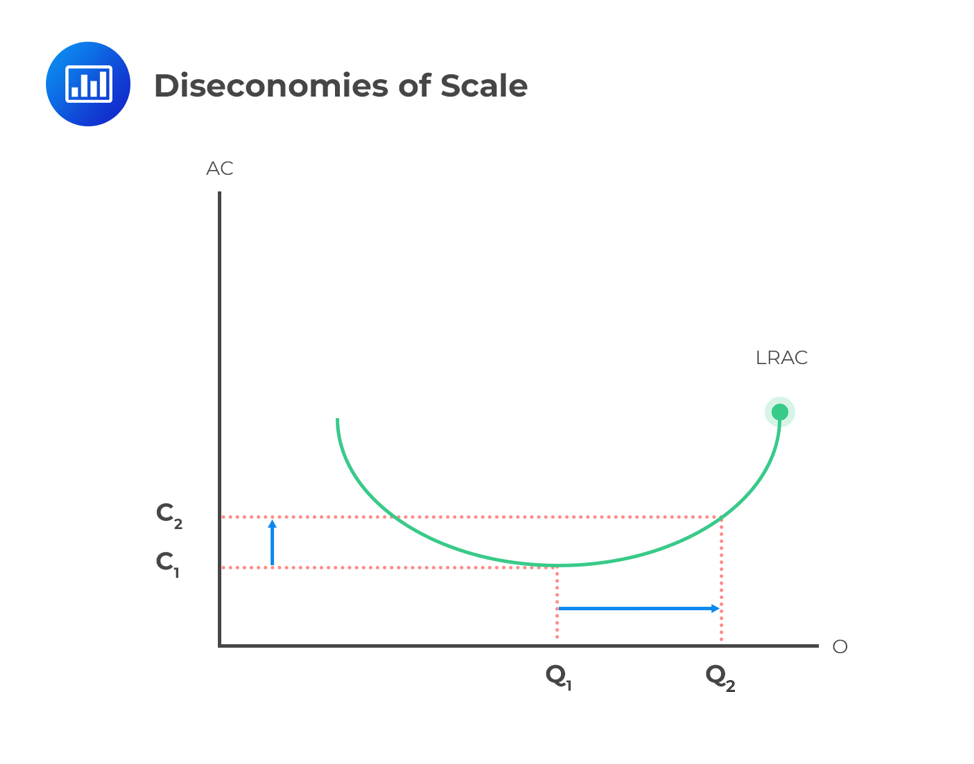

Diseconomies of scale occur when the cost per unit increases with an increase in the quantity produced. This means that any attempt by a firm to increase its output will transcend to a corresponding increase in the unit cost associated with the unit increase in output.

This usually happens when a firm becomes too big. It is represented on the following graph when going from Q1 to Q2. Beyond point Q1, which is the ideal firm size, producing more goods increases per-unit costs.

Some factors that may lead to diseconomies of scale include:

Question

A firm that increases the quantity it produces without any change in per-unit cost is experiencing:

A. economies of scale.

B. diseconomies of scale.

C. constant returns to scale.

Solution

The correct answer is C.

An increase in output proportional to an increase in input would be considered a constant return to scale. This is neither an economies nor diseconomies of scale.