Exercise Value, Time Value, and Moneyn ...

The exercise value, time to expiry, and price of the underlying relative to... Read More

Forward and futures contracts share similar features; however, how they are traded and the resulting cash flows mean forward and futures contracts with the same underlying asset may trade at a different price.

Comparable forwards and futures have symmetric payoff profiles at expiration. However, the pricing and valuation differ over the life of the comparable contracts. Remember that futures are exchange-traded derivative contracts. As such, the distinguishing features of future contracts include posting initial margin, daily mark-to-market, and settlement of gains and losses.

On the other hand, a forward contract is an OTC contract where the credit terms are privately negotiated between the counterparties, and there are no daily mark-to-market (MTM) settlements. Consequently, forward contracts are riskier than futures contracts.

One specific risk is counterparty risk, which is the risk that one party will default on the agreement. A forward contract is more prone to counterparty risk, particularly because settlement only occurs at maturity as a one-time cash settlement.

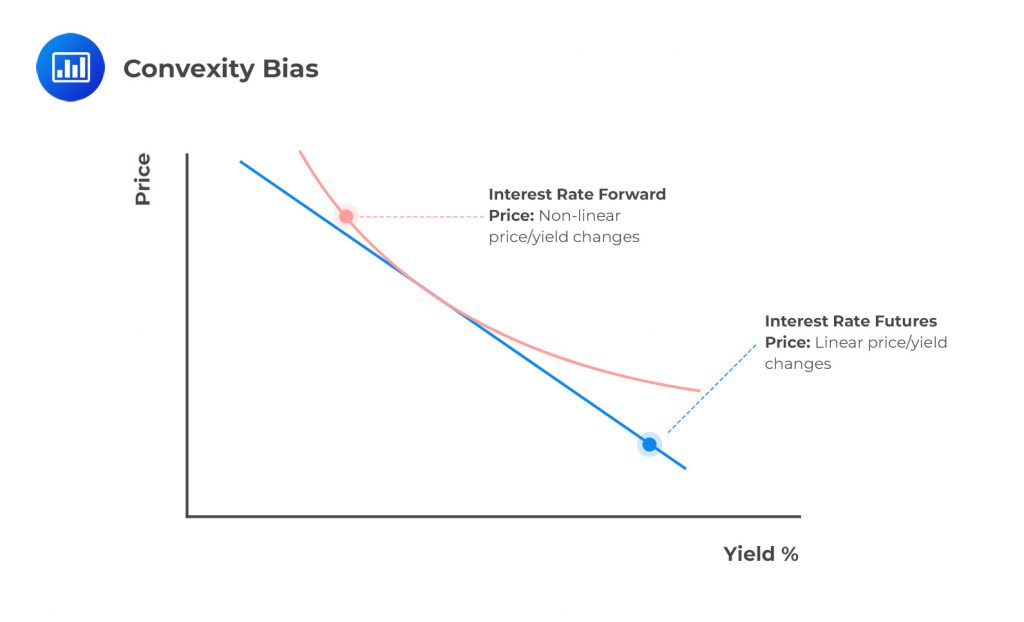

Convexity bias occurs when there are different price changes between interest rate futures and forward prices. Interest rate futures have a fixed linear payoff profile for a given change in basis point. On the other hand, interest rate forward (for example, FRAs) have non-linear relation with the basis point change (convexity property).

Consequently, convexity bias causes the percentage price change to be greater in absolute value when MRR decreases than when it increases for a forward contract compared to a futures contract.

Despite the differences in (FRAs) pricing and valuation of futures and forwards, there are instances where their prices are equal. The following assumptions must hold for the futures and forward prices to be identical:

What happens when the above assumptions do not hold? For instance, if there is a positive correlation between futures prices and interest rates, the long futures contract is more profitable than the comparable long forward contract. Rising futures prices generate futures profits that are reinvested in periods of rising interest rates. Falling futures prices, on the other hand, attract losses incurred during periods of falling interest rates.

When there is a negative correlation between the futures prices and interest rates, short futures contracts are more attractive than comparable short forward positions. This is because falling futures prices result in profits that are reinvested in periods of high-interest rates. Rising futures prices result in losses incurred during periods of falling interest rates.

The emergence of central clearing of derivatives has resulted in futures-like margining requirements for over-the-counter (OTC) derivative dealers. For instance, dealers are required to post cash or highly liquid securities to a central counterparty. The dealers then impose the same requirements on the derivative end-users.

As such, such a clearing structure on OTC derivatives has reduced the differences in prices between exchange-traded futures and OTC forward contracts.

Question

Which of the following statements is most likely true?

A. If there is a positive correlation between futures prices and interest rates, a long futures contract is more profitable than comparable long forward contracts.

B. If futures prices and interest rates are negatively correlated, short forward positions are more attractive than a comparable short futures contract.

C. Central clearing of derivatives increases the difference in futures and forward prices.

Solution

The correct answer is A.

When futures prices rise with interest rates, the profits from the long futures position can be reinvested during periods of high interest. On the other hand, losses incurred when futures prices fall occur during decreasing interest rates.

B is incorrect. When there is a negative correlation between the futures prices and interest rates, short futures positions are more attractive than comparable short-forward positions. This is because falling futures prices result in profits that are reinvested in periods of high-interest rates. Rising futures prices result in losses that are incurred during periods of falling interest rates.

C is incorrect. A clearing structure on OTC derivatives has reduced the differences in prices between exchange-traded futures and OTC forward contracts.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.