Call & Put Option Profits and Payo ...

Call and put options have basic formulas for determining the value, profit, and... Read More

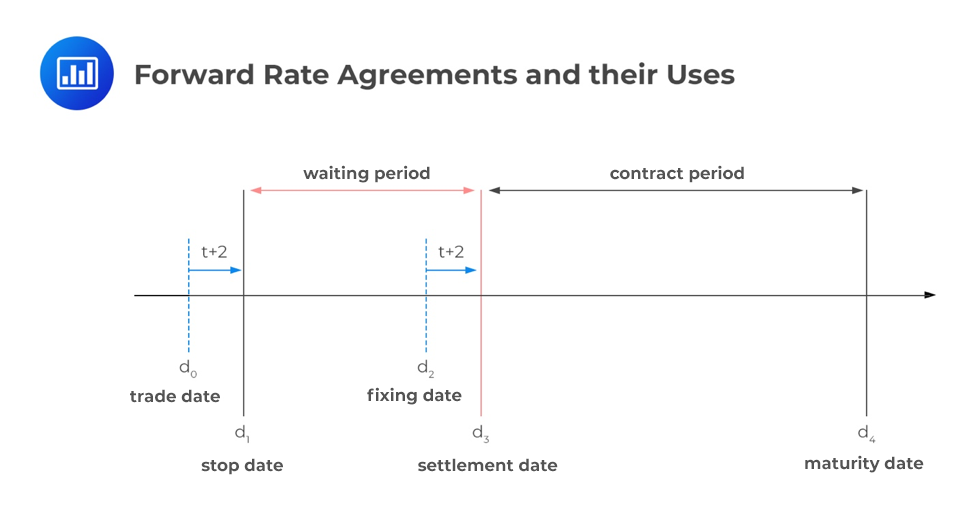

A forward rate agreement (FRA) is ideal for an investor or company who would like to lock in an interest rate. They allow participants to make a known interest payment at a later date and receive an unknown interest payment. This helps in protecting investors from volatility in future interest rate movements. By entering into an FRA, the parties agree on an interest rate for a stated period starting on a future date, based on the specified principal amount at the contract initiation.

A forward rate agreement buyer enters into the contract to protect himself from any future increase in interest rates. On the other hand, the seller enters into the contract to protect himself from any future decline in interest rates. For example, a German bank and a French bank might enter into a semiannual forward rate agreement contract where the German bank will pay a fixed rate of 4.2% and receive the floating rate on the principal of €700 million.

Since FRAs are cash-settled on the settlement date – the start date of the notional loan or deposit – the interest rate differential between the market rate and the FRA contract rate determines the exposure to each party. It’s important to note that there are no principal cash flows as the principal is a notional amount.

FRA contracts are over-the-counter (OTC), meaning that the contract can be structured to meet the user’s specific needs. In addition, FRA’s are often based on the LIBOR rate, and they represent forward rates, not spot rates. Remember, spot rates are necessary for determining the forward rate, but the spot rate is not equal to the forward rate.

Question

Two parties enter an agreement to borrow $15 million in 90 days for a period of 180 days at 2.5% interest. Which of the following choices describes the time frame of this FRA?

A. The settlement date is in 90 days, and the interest period is 180 days

B. The settlement date is in 90 days, and the contract expires in 180 days

C. The settlement date is in 90 days, and there will be reinitiation of the contract every 90 days for 180 days (2 settlements)

Solution

The correct answer is A.

The party in the long position agrees to borrow $15 million in 90 days (settlement date). Then, it will incur a 2.5% interest rate for the remaining 180 days of the contract.