Put-Call-Forward Parity for European O ...

Another important concept in the pricing of options has to do with put-call-forward... Read More

[vsw id=”00HzgJftwpU” source=”youtube” width=”611″ height=”344″ autoplay=”no”]

In an options contract, two parties transact simultaneously. The buyer of a call or a put option is the long position in the contract, while the seller of the option, also known as the writer of the option, is the short position.

It is important to differentiate between the long and the short party in a contract. The buyer is always said to be the long option. This is quite easy to see for a call option. However, for a put option, the long position in a put is betting that the underlying price will drop. As such, the long position in a put option is synonymous with being short the underlying.

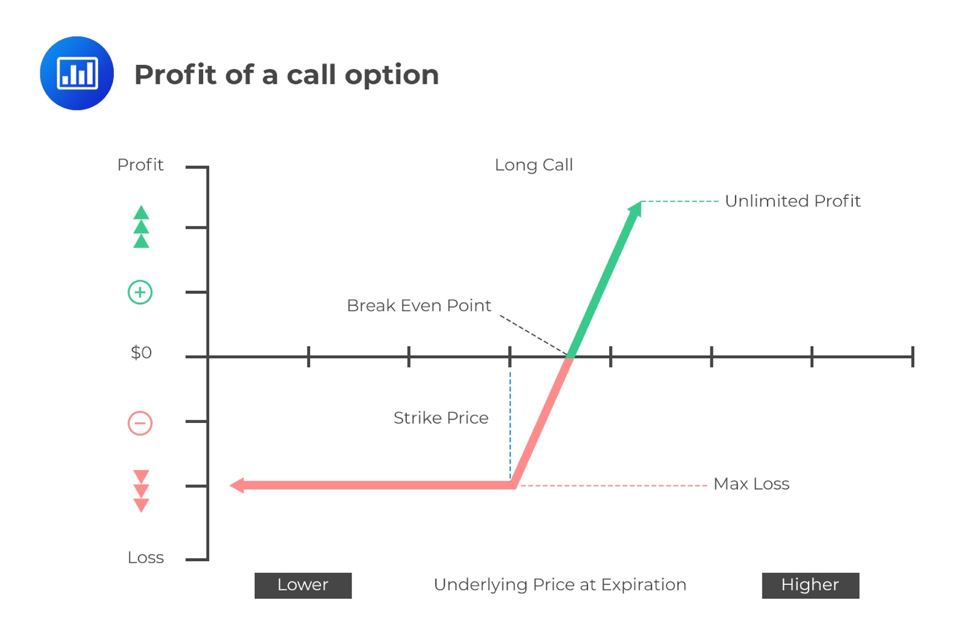

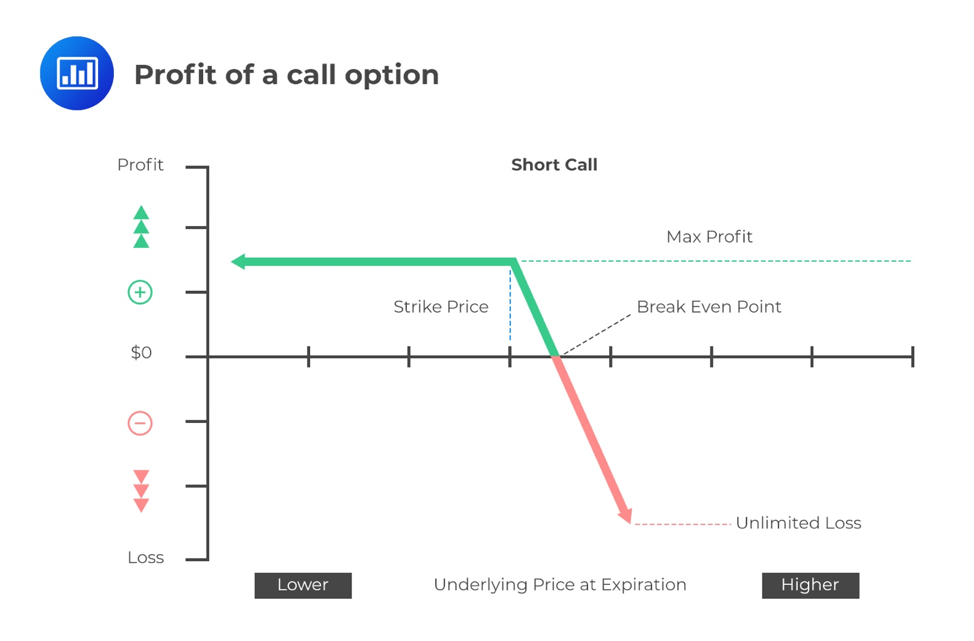

The payoff profiles of a call option are represented as follows:

$$ \text{Payoff for a call buyer} = max(0,S_T – X) $$

$$ \text{Payoff for a call seller} = -max(0,S_T – X) $$

Where

ST is the price of the underlying at expiration; and

X is the exercise price.

Using the payoff profile and the price paid for the option, the profit equation can be written as follows:

$$ \text{Profit for a call buyer} = max(0,S_T – X) – c_0$$

$$ \text{Profit for a call seller} = -max(0,S_T – X) + c_0 $$

where c0 is the call premium.

The buyer of the call option has no upper limit on its potential profit and a fixed downside loss equal to the premium. The seller has unlimited losses and a gain limited to the premium:

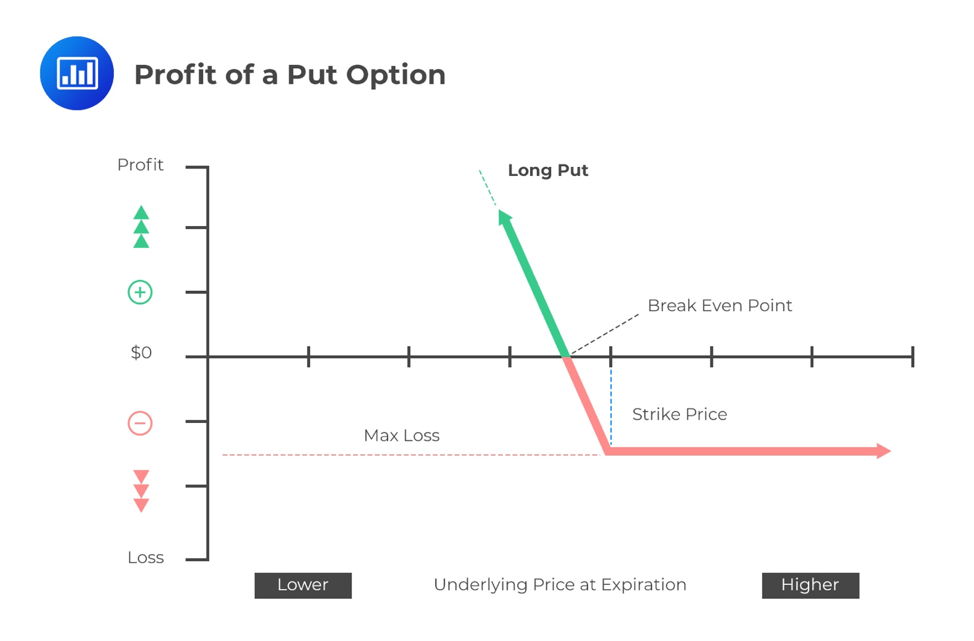

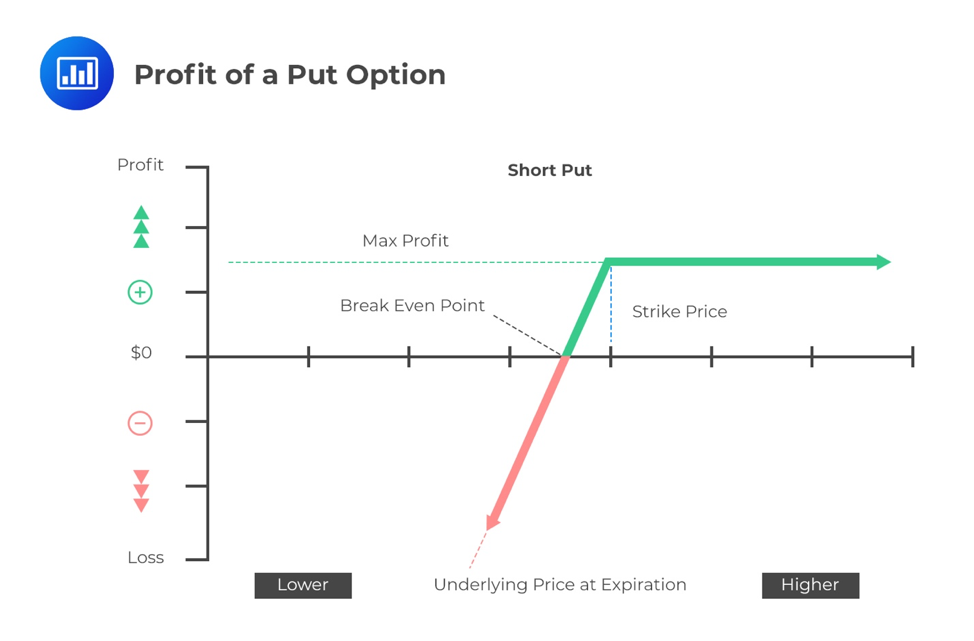

By now, if you have well understood the basic characteristics of call options, then the payoff and profit for put option buyers and sellers should be quite easy – you replace “ST − X” by “X− ST.”

The payoff and profit profiles of a put option are represented as follows:

$$ \text{Payoff for a put buyer} = max(0,X-S_T) $$

$$ \text{Payoff for a put seller} = -max(0,X-S_T) $$

$$ \text{Profit for a put buyer} = max(0,X-S_T) – p_0$$

$$ \text{Profit for a put seller} = -max(0,X-S_T) + p_0 $$

Where p0 is the put premium.

The put buyer has a limited loss and, while not completely unlimited gains, as the underlying price cannot fall below zero, the put buyer does gain as the price falls. As such, purchasing a put option is like purchasing insurance. In the same vein as for call options, the put seller has nearly unlimited losses, and his gains are limited to the put premium paid to him by the put buyer:

Call and put options can be used in combination with each other and with the underlying asset to produce a wide range of potential payoff profiles.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.