Series 7 vs CFA: Which Path Fits Your ...

If you’ve ever found yourself stuck wondering series 7 vs cfa, trust me,... Read More

There’s no getting around it, financial reporting and analysis is a big part of the CFA level 1 curriculum, and there is a lot of material with which you’ll need to become familiar. As one of the largest sections of the exam, you will want to be familiar with the FRA formula sheet information, as many of the questions will involve giving you a snippet of information from a financial statement and asking you to calculate a specific value from that. Knowing which data points go into specific formulas will be necessary to get a good score here.

There are four financial statements that are used to summarize a company’s financial positions and performance. The statement of financial position (Balance Sheet) provides a description of the company’s financial position at a particular point in time. The statement of comprehensive income (Income Statement) shows the company’s financial results over a specified time period. The Statement of Changes in Equity provides information on the changes in owners’ investments in the company over time, including the balances at the beginning and end of the reporting period and the changes that occurred during. The statement of cash flows (Cash Flow Statement) shows a company’s sources and uses of cash during a specified period.

These statements are prepared according to specific standards based on where the company is located. US GAAP (“Generally Accepted Accounting Principles”) applies to a company in the United States and IFRS (“International Financial Reporting Standards”) is used everywhere else. In addition to the primary statements described above, there will usually be supplementary notes included in a company’s financial statement disclosures. These notes include important information about risks the company faces, estimates used in preparing the financial statements, and the performance of specific business units within the company.

The curriculum specifies a 6 step framework for financial statement analysis, which goes as follows:

The purpose of having standards for the preparation of financial statements is to provide consistency between different companies. As an analyst, you would be expected to utilize information from financial statements to influence investment decisions, and having standards to which these statements must conform makes it easier to compare widely different companies. There are currently two sets of standards used throughout the world, US Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS). These have been converging over time to align more closely with IFRS, but companies in the US must still adhere to GAAP. It will be important to understand where these standards differ in their reporting requirements.

The Conceptual Framework outlines the primary characteristics behind IFRS, which are Comparability, Verifiability, Timeliness, and Understandability. Two primary assumptions that impact how financial statements are prepared are Accrual Accounting and “Going Concern”. As covered earlier, accrual accounting means revenue and expense items must be recorded when recognized, and going concern is the assumption that a company will continue in business for the foreseeable future. IFRS also requires consistency of item classification from one reporting period to the next.

There are several important differences in how GAAP and IFRS define revenue and expense recognition. IFRS includes the word “probable” in its definition of when revenue should be recognized, specifically that it needs to be recognized when it is probable to provide a future economic benefit to the reporting company. GAAP does not include the word probable in its criteria for revenue recognition.

The income statement provides information on the financial performance of a company over a specified period of time. There are several required elements that must always appear on the income statement. Revenue is the top line on the income statement and is the amount of sales that the company took in. Expenses are all outflows and depletion of assets that occurred during the reporting period. Gross Profit is the amount of revenue left after subtracting the cost of goods. Operating Profit is sometimes referred to as Earnings Before Interest and Taxes (EBIT) and is the revenue left after subtracting all operating expenses. Net Income, also known as Profit or Loss, appears at the bottom of the income statement.

An important consideration in the preparation of financial statements is Revenue Recognition. IFRS and GAAP differ on the guidance for when revenue is to be recognized.

IFRS instructs that revenue should be recognized when the following conditions are satisfied:

The US GAAP criteria for determining when revenue is to be realized are:

Revenue recognition can be calculated using the new converged standard. The new converged standard proposes that revenue should be recognized in a five-step framework:

For recognition of expenses, both IFRS and US GAAP rely on the principle of Matching. This means that expenses associated with specific revenue are to be recognized in the same period as those revenues. There are several methods by which this can be applied. The Specific Identification Method is used when individual inventory items that are sold can have their exact costs matched to each item. This typically applies to items that are large and unique, such as expensive jewelry. More commonly, the First In First Out (FIFO) method is used to match expenses with sales. Both IFRS and GAAP allow for FIFO, which allocates the sales expenses of the oldest inventory item to each additional sale. In the Weighted Average cost method, the average cost of goods available for sale is allocated to each sale. Another method is the Last In First Out (LIFO) method, which is allowed only by the US GAAP. This assumes that the newest goods for sale are sold first. The problem with this method is that the older items might stay indefinitely in the inventory, therefore not accounting for inflation or obsolescence.

The use of different expense methods can have a big impact on a company’s reported profits. In an environment of rising prices, LIFO will cause reported income to be lower (each new item in inventory was more expensive than the last, so Cost of Goods Sold will be higher), which will also cause tax expenses to be lower (less profit means less taxable income). You will definitely see questions about comparing FIFO and LIFO effects on financial statement values.

The Earnings Per Share (EPS) value calculated on the income statement is an important metric in a company’s performance but can be complicated to determine if a company has a complex capital structure. The simple formula for EPS only includes the weighted average shares outstanding, but this needs to be adjusted for new shares or potential new shares if the company has stock options or convertible debt that could be used to create new shares. The formulas for each condition appear in your formulas sheet. These securities can have either dilutive or antidilutive effects, depending on whether the inclusion in the formula decreases or increases EPS, respectively. Securities that have an antidilutive effect cannot be included in the calculation of diluted EPS under IFRS or GAAP.

The balance sheet illustrates a company’s total assets and sources of capital at a particular point in time. There are three elements that make up the balance sheet. Assets are the resources which a company owns or controls and will use to derive future economic benefits. Liabilities are anything that the company owes. Equity is the owners’ residual interest in the company after deducting the liabilities. They make up the basic accounting equation:

$$ Assets = Liabilities + Equity $$

Balance sheets are useful for highlighting a company’s abilities to meet its operating liquidity needs, keep up with debt obligations, and make distributions to shareholders. There are some limitations to this reporting, however. Not all items on the balance sheet are measured in the same manner, so some items may reflect historical costs while others are at current market value. The values presented as current were only current at the time for which the balance sheet was prepared.

Both IFRS and GAAP require companies to report current and non-current assets and liabilities separately. Current assets are those held for trading or that are expected to be sold or used up within the next reporting period, including cash, trade receivables, and inventories. Non-current assets are expected to be held or used up over longer periods of time. These long-lived assets represent the infrastructure of the company, including property plant and equipment, goodwill, and long-maturity financial assets. Current liabilities are expected to be settled within one reporting cycle. These include trade payables and accrued expenses. IFRS requires some current liabilities (trade payables and some accruals) be considered part of working capital and must always be classified as current, regardless of the when they will be settled. Non-current liabilities will be settled in greater than a year or reporting cycle, such as deferred tax liabilities.

Current assets such as cash or marketable securities are typically valued at current market prices. Trade receivables are reported at their net realizable value, which includes an estimate of collectability. Inventories are valued at either the lower of cost and net realizable value (IFRS) or the lower of cost and market value (GAAP). Non-current assets are usually valued using the cost model (GAAP and IFRS) or the revaluation model (IFRS). For Property, Plant, and Equipment, the cost model is the historical cost of the item less accumulated depreciation and the revaluation model is the fair value at the date of revaluation less subsequent accumulated depreciation. Investment Property (which is used to generate non-operating income) can be valued using the cost model or the fair value model, but under the fair value model, all gains or losses arising from a change in the fair value of the property are recognized on the income statement. Goodwill is capitalized when realized under both IFRS and GAAP. Rather than amortized over time, goodwill must be periodically tested for impairment. Impairment losses are charged against income when they occur.

Liabilities are also reported base on whether they are current or non-current. Current assets include Trade Payables and Accrued Expenses that will be settled in the following reporting period. Non-current payables include long-term loans and deferred tax liabilities.

There are a number of liquidity and solvency ratios in your ratio sheet, downloadable in the AnalystPrep.com’s platform, that you can use to evaluate a company’s financial health based on information found in the balance sheet. Expect to see questions asking you to calculate those ratios and use them to rate the financial situation of an example company.

There are three primary components of the cash flow statement. Cash Flow from Operations is derived from the day-to-day activities of the company. Cash Flow from Investing Activities results from the purchase and sale of assets not related to the normal activities of the business. Cash Flow from Financing Activities results from capital financing activities.

There are a number of differences in cash flow classification between US GAAP and IFRS. IFRS allows interest paid or received to be classified as either operating or investing, but GAAP requires it to be under operating. GAAP requires dividends received to be classified as operating, but IFRS allows them to be either operating or investing. Dividends paid must be classified as financing activities under GAAP, but can be either financing or operating under IFRS.

Cash Flow from Operations can be reported using the Direct or the Indirect Method, but both IFRS and GAAP encourage the direct method. Under the direct method, each cash inflow and outflow related to cash receipts or payments is shown. This eliminates the impact of accruals. The indirect method provides only the net results of receipts and payments. It uses net income and a series of adjustments to reconcile to the operational cash flow figures.

There is a multi-step process for converting cash flows from the indirect method to the direct method. Net income in disaggregated into total revenues and total expenses, then non-operating and non-cash items are removed from aggregated revenues and expenses into the relevant cash flow items, and then finally the revenue and expense accrual amounts are converted to cash flow amounts. Expect questions on the exam asking you to go through these steps.

Just like for the information regarding the other financial statements, there are a number of ratios using information from the cash flow statement to determine the financial health of the reporting company. This includes formulas like Free Cash Flow to the Firm and Free Cash Flow to Equity that will definitely appear on the exam. Be sure to familiarize yourself with these equations by doing practice questions.

Two common techniques for analyzing company financial data are Ratio Analysis and Common-Size Analysis. Ratio Analysis evaluates a company’s past performance using financial ratios. These can be used to project future results, but are also limited by judgments made in the calculations, ratios that might provide conflicting results, and heterogeneity of a company’s operating activities over time. Common-size Analysis involves calculating all financial statements inputs as a percentage of total revenue or assets to facilitate comparisons between different companies.

Several categories of ratios are used for performance analysis. Activity Ratios such as Inventory Turnover are used to measure how efficiently a company uses its resources to perform normal business functions. Liquidity Ratios measure a company’s financial health and ability to meet short-term obligations. Common examples include the Current Ratio and Quick Ratio that compare liquid assets to short-term financial liabilities. Solvency Ratios are similar to liquidity ratios but are used to measure the ability to meet long-term obligations. Profitability Ratios measure a company’s ability to generate profits from its resources. Valuation Ratios measure the quantity of an asset or cash flow that is associated with ownership of a specific capital claim. Examples of all of these appear in your formula sheet.

When calculating ratios that involve items from the balance sheet and income statement, there are a few concerns that must be addressed. Since the income statement represents activity over time and the balance sheet is a snapshot, there are certain best practices to ensure appropriate calculation methodology. For example, in a ratio where there is an income statement or cash flow statement item in the numerator and balance sheet item in the denominator, you should use an average value of the balance sheet item over the reporting period.

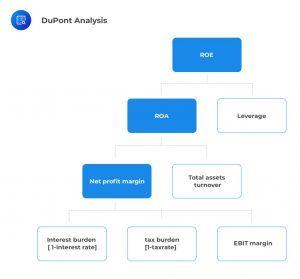

The DuPont Analysis method of decomposing Return on Equity is an important part of the financial analysis section. It is a way of breaking down the ROE into component parts in order to better analyze the drivers of returns. The specific formulas for the DuPont method appear in your formula sheet, but the concept is illustrated below:

Both IFRS and GAAP require the breaking out of results for individual business segments if certain requirements are met. This includes any business segment that constitutes more than 10% of total company revenue or profit. Companies are able to combine individual business segment results if the segments are small and share common factors that allow for sensible grouping, such as the type of business or sales locations.

Inventories and Cost of Goods Sold are two important items contained within a company’s financial statements. Amounts held in inventory represent assets for sale that will eventually show up on the income statement as Cost of Goods Sold when sales are made. There is a choice made by companies whether these items appear on the balance sheet as inventory in the first place, or just expensed as soon as they are acquired. By putting them on the balance sheet as assets until sales are made, companies can defer recognizing them as expenses until a later period. If costs are included in inventory that should have been expensed right away, it overstates profitability in the reporting period and inflates inventory values on the balance sheet.

Both IFRS and GAAP require costs to be included in inventories if they represent items such as the purchase price of goods, transportation costs, or other costs incurred to acquire these goods and make them available for sale. Both frameworks exclude costs from inventory (and require them to be expensed) if they represent abnormal costs related to product waste and administrative overhead.

There are four methods for valuing inventory as it relates to calculating the Cost of Goods Sold: Specific Identification, First-In First-Out (FIFO), Last-In First-Out (LIFO), and Weighted Average Cost. LIFO is only permitted under GAAP, but both systems permit the use of the other three. Specific Identification is for goods that are not interchangeable and are typically produced for individual projects. The cost of each of the goods is matched to the physical flow and sales for that good. FIFO assumes that the oldest items in inventory are sold first as each additional sale takes place. LIFO assumes that sales come from the newest items in inventory. Weighted Average Cost gives each item in inventory a cost equal to the average value of all inventory.

You will be asked to both calculate inventory and cost of goods sold values, given sales and balance sheet items, and also to explain the impact that using one valuation method over another would have on things like Profit and Tax Expense. Assuming an environment of rising prices over time, inventory values will be sorted as FIFO > Weighted Average > LIFO. Net profit is affected the same way. Your formula sheet contains the necessary equations to calculate these figures.

For companies under GAAP that use the LIFO method, there is a requirement to disclose what is known as the LIFO Reserve. This refers to the difference between the reported LIFO inventory and what the inventory amount would have been under FIFO. The equation is:

LIFO Reserve = FIFO Inventory Value – LIFO Inventory Value

This value is important because being able to convert between financial statements using the different systems will definitely appear on the exam. Related to this is the phenomenon known as a LIFO liquidation. This occurs when more inventory is sold than is added back, so some of the older (typically less costly) items in inventory are sold. This will cause a rise in profit margins that is not sustainable into future periods.

IFRS and GAAP differ on how inventory balances are to be calculated, with IFRS requiring the lesser of Cost and Net Realizable Value and GAAP requiring the lesser of Cost and Market Value. The Net Realizable Value calculated for IFRS must be reassessed each reporting period, and any declines below the previous carrying amount must be reflected as a writing down of the inventory value and recognized as an expense on the income statement. Future increases (reversals) of the Net Realizable Value must also be recorded, though they can only go back to the original value before the write down was made. Under GAAP, value write-downs cannot be reversed.

Long-lived assets are resources that are expected to provide benefits to the company over multiple reporting periods. The costs of these assets are usually capitalized, rather than expensed at once. This means that their costs are allocated across multiple reporting periods. This applies to the costs for purchasing or building property or other resources, including the interest costs incurred if the company takes out loans.

Intangible Assets are another type of long-lived asset. The accounting treatment for these will vary depending on how the intangible asset was acquired. When they are acquired in business situations that are not business combinations, the assets are recorded at fair value at the time of acquisition. If they are developed internally, the costs of development are expensed as incurred under both GAAP and IFRS. GAAP differs slightly in that it requires the capitalization of certain costs related to software development. For intangibles acquired through a business combination, the purchase price is allocated to each asset acquired based on its fair value at the time, with any excess price recorded as the intangible asset Goodwill.

It’s important to understand the impact of expensing compared to capitalizing expenditures on a company’s financial statements. Expensing a cost rather than capitalizing it will reduce profits in the first year, but then increase it in the following years. Capitalizing will result in higher shareholders’ equity in the early years because the higher first-year profits will increase retained earnings. Capitalizing expenses also increases the reported cash flow from operations.

Long-lived (tangible) assets are depreciated over time to reflect the allocating of its cost over its entire useful life. There are three primary methods of depreciation used in financial reporting. The Straight-Line Method allocates the cost by an equal portion in each year of the asset’s useful life. The Accelerated Method uses a greater cost in the early years that declines as the asset reaches the end of its life. In the Units of Production method, the cost is allocated based on the actual of the asset. It’s important to note that, in some countries, the methods used in the financial statements will differ from what is used for tax purposes. This will cause the tax expense computed on the income statement to be different than actual tax expenses in the period.

Similarly to the depreciation of tangible assets, intangible assets are amortized if they have a calculable, finite useful life. This would include items like a patent or copyright that has a specific expiration date. The calculation of amortization is similar to that of depreciation, including having the same three methods for calculating it. While the total accumulated amortization expense will be the same no matter what method is used, it can have a significant impact on the financial statements, especially in the early years.

While not allowed under GAAP, IFRS permits the use of the Revaluation Model as an alternative for calculating the carrying value of an asset. This model uses the current fair value (less accumulated depreciation or amortization) as the carrying value of the asset. Under this approach, it’s possible for the value of a long-term asset to exceed its historical cost. Decreases in carrying value and future increases (up to the original value) are treated as profit or loss on the income statement. An increase in value above the original asset value is recorded as equity in a Revaluation Surplus Account.

Impairments are recorded if the carrying amount of an asset exceeds the recoverable costs. Intangible assets with indefinite lives are tested at least annually for impairment. If an asset is no longer used for operations and is listed as Held for Sale, it must be tested for impairment. IFRS allows reversals of impairments if the recoverable amount exceeds the previous carrying amount, but GAAP does not allow for a reversal of an impairment once it has been recorded.

Investment properties, which are used to generate non-operating returns, can be valued using either a cost model or fair value model under IFRS. The company must make additional disclosures about its fair value determinations if it uses that approach. The company must also use the same model for all of its investment property. If the company uses the fair value model and transfers a property from inventory to investment property, then the change between the inventory carrying amount and the fair value is recognized as a profit or loss.

Income Before Taxes is reported on a company’s income statement and is calculated based on the applicable reporting standards, while Taxable Income is the portion of total income subject to income taxes by the taxing authority. These two may differ depending on how tax policy overlaps with reporting standards. These differences can include things such as revenues and expenses being recognized in different reporting periods for tax and accounting purposes, different carrying amounts for assets and liabilities, or tax losses from prior periods being brought forward and reducing taxable income in later periods.

Deferred Tax Assets arise when a company’s taxable income is greater than its accounting profit. This creates an excess tax payment by the company over its expected tax expense that the company can recover in future periods. When the opposite occurs, and a tax deficit is created, this is a Deferred Tax Liability.

Any asset or liability that will create taxable economic benefits (positive or negative) to the company will have a Tax Base. This is the amount that will be deductible for tax purposes once the benefits are realized in the future.

When income tax rates change, all deferred tax assets and liabilities are adjusted to reflect the new tax rate. As a result, the balance sheet of a company is affected by changes in tax rates, just like the earnings and cash flow statements. If it is likely that a deferred tax asset may not be fully realized in the future, GAAP requires the creation of a Valuation Allowance to account for the loss of value. This new item reduces the value of the deferred tax asset down to its new anticipated recovery value.

When calculating the value of certain balance sheet items related to taxation, there are differences in how tax rates are applied. Current taxes payable are determined using the tax rates as of the balance sheet reporting date, while deferred taxes are measured at the rates expected to apply when the assets are realized.

Companies must include disclosure about many of their tax-related financial statement items. These include the specific tax provisions that led to their calculations and treatment of specific items, detailed information about how tax assets and liabilities were determined, and whether any valuation allowances are applied.

There are several important differences in the impact of tax-related items depending on whether GAAP or IFRS standards apply. For example, IFRS allows revaluations to be calculated as deferred tax assets, whereas GAAP does not allow revaluations at all. Also, IFRS allows deferred tax items to use projected tax rates that have been “Substantively Enacted” even if they are not fully in effect, but GAAP requires the use of rates that are fully enacted in law.

All 3 Levels of the CFA Exam – Complete Course offered by AnalystPrep

Bonds are contractual promises made by a company to pay bondholders in the future in exchange for receiving cash in the present. There are two cash flows associated with bond repayment: periodic interest payments and the final face value of the bond. The market value of the company’s bonds is the present value of the future payments discounted to a present value. The cash proceeds received from issuing bonds are reported as cash flows from financing. Bonds are initially reported as a liability on the balance sheet at the amount of cash proceeds net of issuance costs under IFRS, whereas GAAP requires bonds to be reported at the amount of proceeds with no concern given to costs of issuance.

The discount or premium for bonds issued at a price other than par is amortized over the life of the bond using one of two methods. The Straight Line Method amortizes equal portions of the premium or discount over each reporting period. The Effective Interest Rate Method (which is required by IFRS and preferred under GAAP) applies the market rate in effect when a bond is issued to the current amortized cost to obtain the interest expense for that period.

When bonds are redeemed (repaid), the difference between the cash required to redeem the bonds and the carrying value of the bonds on the balance sheet is booked as a gain or loss on the extinguishment of the debt. As stated before, IFRS includes debt issuance costs as part of the bond’s carrying amount. Under GAAP, these issuance costs are accounted for as a separate item and are amortized over the life of the bonds. The gains or losses resulting from the extinguishment of debt are disclosed as a separate line item on the income statement if the amount is material.

There is typically a line item under non-current liabilities on the balance sheet for the total amount of a company’s long-term debt that is due more than one year in the future. The portion of long-term debt due in the next 12 months is included as a current liability. The notes for the financial statements will include more detailed disclosures of a company’s outstanding debt. These disclosures can also include details about more complex debt contracts, such as convertible debt or bonds issued with warrants.

Companies that wish to obtain the use of an asset can choose to purchase or lease them. In a lease agreement, a lessor grants the right to use an asset to a lessee for a specified period of time in exchange for periodic payments. There are a number of advantages to leasing an asset compared to purchasing it. Leases typically provide less costly financing compared to a purchase. Lessors may be in a better position to take advantage of tax benefits of ownership, be better able to bear risks associated with ownership, or may enjoy economies of scale for servicing assets.

A lessee will prefer an operating lease to a financial lease. This is because the reported assets, debts, and expenses are higher in the early years under a finance lease.

There are two types of retirement plans which a company can provide for its employees. In a Defined-Contribution Plan, the company contributes a defined amount to the plan. In a Defined-Benefit Plan, the company is responsible for providing a specified future benefit to its employees in retirement.

The financial reporting requirements for defined-benefit plans are more involved than for defined-contribution plans. A company balance sheet will reflect a net pension asset (liability) if the fair value of the pension fund’s assets is higher (lower) than the present value of the estimated pension obligation. In each reporting period, the change in net pension asset or liability is recognized as profit or loss under Other Comprehensive Income.

There are several types of solvency ratios that you can use to analyze a company’s ability to meet its long-term debt obligations. The two types of these formulas are leverage and coverage ratios. Leverage Ratios are based on balance sheet items and measure how equity capital is used to finance a company’s assets compared to debt capital. Coverage Ratios use income statement information to measure a company’s ability to cover its debt-related payments. You can find all of these ratios on AnalystPrep’s ratio sheet.

All 3 Levels of the CFA Exam – Complete Course offered by AnalystPrep

The goal of financial reporting statements is to provide a complete picture of the financial performance and position of a company. Two components of how well this is done are the quality of financial reporting and the quality of reported results. The Quality of Financial Reporting refers to how relevant, complete, neutral, and error-free the actual financial statements are. Low-quality reporting makes it difficult to compare a company to its peers or to get an accurate understanding of how well the company is doing. Poor Earnings Quality means the actual results of the company are misleading or unsustainable.

High-quality earnings indicate strong returns from the company’s assets and sustainable sources of revenue. These earnings are a good indicator of the company’s ability to continue operating well into future reporting periods. High-quality reporting allows an analyst to make accurate assessments of a company’s performance. The quality of earnings and the quality of reporting are interrelated but exist as separate concepts to be judged in exam questions.

Companies have to use judgment within the guidelines of the reporting standards in calculating their financial performance. More aggressive accounting techniques use creativity to overstate financial performance. This approach impacts the sustainability of the company’s earnings because decisions that overstate current period performance will cause an understatement of future reporting periods. Conservative accounting tends to understate current period results but does not cause sustainability concerns. Using conservative methods has several benefits, including reducing the possibility of litigation and protecting the interests of regulators.

Company management can have incentives that encourage the production of low-quality earnings reports. Concerns about missing market expectations for earnings can lead to more aggressive accounting techniques in order to artificially meet public targets. Certain market conditions make it easier for low-quality reporting to occur. Poor internal controls or lax regulatory oversight can create opportunities for companies to overstate performance. Poorly designed managerial incentives create motivations for questionable decisions.

Market authorities create regulatory regimes that enforce the quality of reporting for public companies. Requirements for disclosure of specific details in financial statements, managerial commentary about judgments and calculations, and review of reported performance by market regulators help to maintain the quality of reporting by market participants.

There are a number of accounting choices that company managers make when preparing financial statements. Assumptions regarding inventory cost (FIFO vs LIFO), accrual vs. cash accounting methods, and depreciation methods can have a significant impact on reported results without changing the underlying strength or weakness of the company’s performance.

Companies can follow several strategies to achieve successful performance that you can identify through their past financial statements. Companies that focus on product differentiation and minimizing input costs lead to higher gross margins. Strategies that manage liquidity through maintaining adequate coverage of cash flow obligations and avoiding excessive debt constraints will have stronger balance sheet ratios but may show lower resource utilization ratios.

Reported financial results can be used to forecast future performance. Forecasting company sales is typically based on a top-down approach that uses industry and macroeconomic trends to determine future period growth. Individual company past sales are also used to determine potential results for specific business units. Performance ratios from prior periods can then be used to calculate forecasts for profitability and cash flow measures. Valuation models use this approach over several periods to construct estimated values of a company or its equity.

Financial statements are also used to determine the credit quality of companies. The quality of a company’s financial performance is a good indicator of its ability to continue meeting its financial obligations in the future.

Analysts routinely use information from financial reporting to influence equity investment decisions. The standardization of financial statements is intended to make it easier to compare relative performance and positions of different companies. Methods such as stock screeners use various valuation, solvency, and performance ratios to filter out less desirable companies for potential equity investments.

It is often necessary to make adjustments to financial statement information to facilitate comparisons between companies. Items like inventory cost methods that differ between otherwise related companies need to be accounted for in making sure that comparisons are as valid as possible. Other common areas requiring adjustments include depreciation methods, accounting values of intangibles such as goodwill, and off-balance sheet finance arrangements such as operating leases. It is important to understand how these various approaches differ in their impact on financial results (covered earlier) in order to make these adjustments and improve the accuracy of relative performance comparisons.

Reinforce CFA Level I Financial Reporting & Analysis with exam-style practice questions covering statements, ratios, accounting treatments, and step-by-step solutions.

If you’ve ever found yourself stuck wondering series 7 vs cfa, trust me,... Read More

If you’ve made it to the CFA Level 3 exam, first off, congratulations!... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.