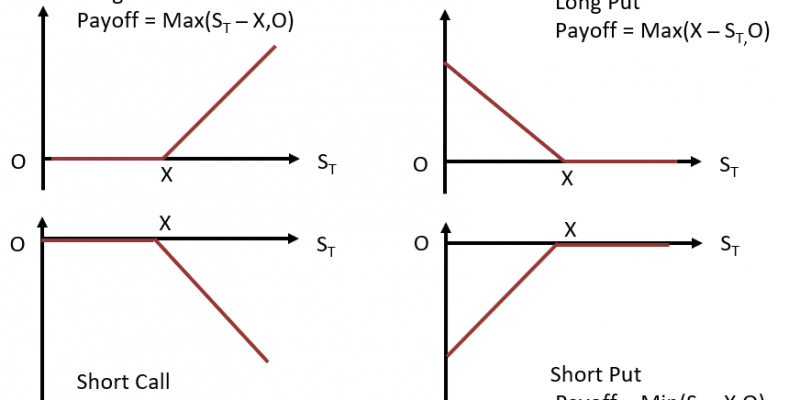

Options Payoffs and Profits (Calculations for CFA® and FRM® Exams)

Understanding call and put option payoffs is a must for mastering derivatives in the CFA® or FRM® exams—and for real-world trading strategies. This guide breaks down option payoff and profit formulas, shows you how to calculate each, and includes cha1rts…

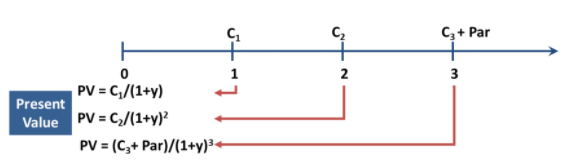

Bond Valuation (Calculations for CFA® and FRM® Exams)

Bond valuation is an application of discounted cash flow analysis. The general approach to bond valuation is to utilize a series of spot rates to reflect the timing of future cash flows. Value, Price, and TVM Value can be described as…

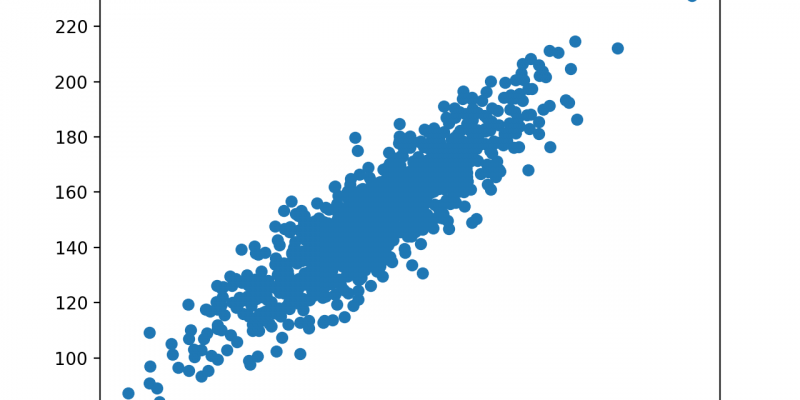

Covariance and Correlation (Calculations for CFA® and FRM® Exams)

The covariance is a measure of the degree of co-movement between two random variables. For instance, we could be interested in the degree of co-movement between the variables X and Y, where we can let: X = interest rate Y…