All you need to know about Becoming an ...

Investment banking careers are among the most demanding but rewarding financial careers. Working... Read More

So, you’re eyeing the CFA® Level I exam? You’re not alone!

With recent updates to the curriculum and exam structure, it’s more important than ever to stay informed and plan your preparation strategically. Whether you’re wondering about the latest exam dates, what’s changed in the syllabus, or how to approach your study plan, this guide has you covered.

At AnalystPrep, we break down the essential details—from updated topic weights to practical preparation tips—so you can focus on what matters most: passing the CFA Level 1 exam on your first attempt.

Staying informed about CFA Level 1 dates is crucial for effective exam preparation. For 2025, the CFA Level 1 test dates are set to be as follows:

Make sure to register early to take advantage of lower fees. Remember, if you’re considering CFA defer options, check with the CFA Institute to understand how this might affect your journey. Keeping track of these CFA exam dates ensures you’re well-prepared and can strategize your study schedule accordingly.

Let’s cut to the chase. The CFA Level I exam is tough—but here’s the thing: it’s not impossible. With a strategic study plan and the right resources, you can absolutely pass the CFA exam. But make no mistake, this isn’t the kind of exam you can cram for the night before. It requires dedication, time, and a solid understanding of the fundamentals.

In 2025, as the financial landscape continues to evolve, the CFA Institute has made several updates to ensure that candidates are equipped with the skills needed to succeed in today’s markets. This means you’ll be tested on more current, real-world applications, making the CFA Level I exam even more relevant. But with relevancy comes a bit of complexity, which is where AnalystPrep’s resources come into play. We’ve updated our prep materials to reflect these changes and to ensure you’re well-prepared to tackle even the trickiest questions of the CFA Level I.

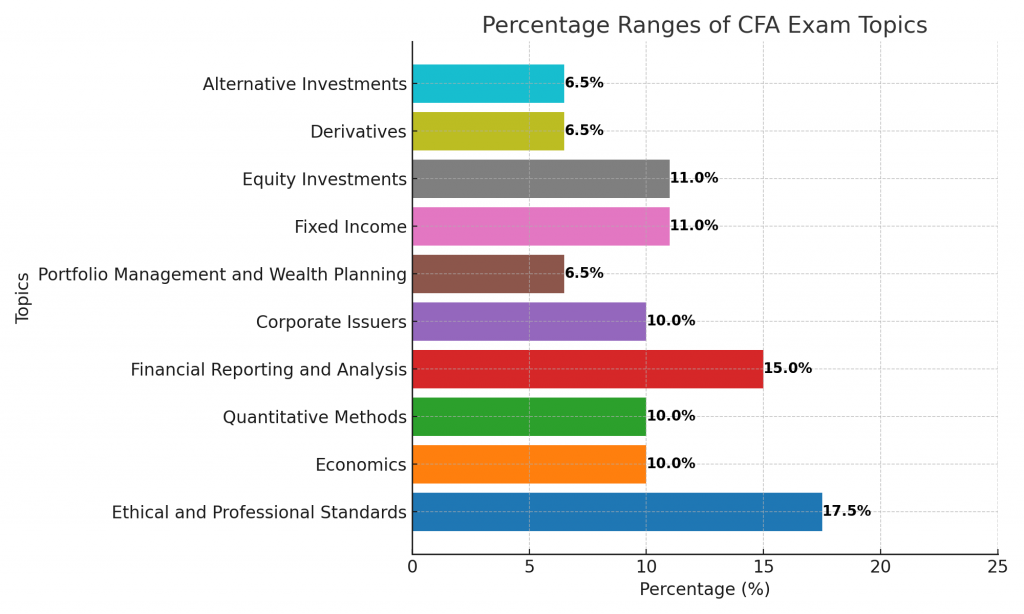

CFA Level I remains the foundation of the three levels of the CFA program. It covers a broad range of topics that are critical to building your knowledge base in finance and investment management. However, with the updates in 2025, you’ll notice a stronger emphasis on practical applications and data-driven decision-making. Here’s a breakdown of the topics you’ll encounter in the CFA Level I exam:

Now, these CFA Level I topic weights might look familiar if you’ve researched past CFA exams, but keep in mind that the 2025 updates make the exam feel more interconnected. For example, the focus on ethical standards isn’t just about memorizing rules—it’s about understanding how ethics intertwines with every investment decision. This is where your deeper grasp of these topics will come into play, and with AnalystPrep’s detailed study notes, you’ll find plenty of examples that connect the dots between theory and practice in the CFA program.

Let’s be candid—preparing for the CFA exam Level 1 in 2025 isn’t just about hitting the books. You need a plan. A solid, realistic plan that takes into account your personal schedule, strengths, and weaknesses.

First, give yourself at least six to nine months to prepare for the CFA Level 1 exam. Yes, that’s right—nine months. You’re going to need every bit of that time to cover the vast syllabus and ensure you understand it thoroughly. AnalystPrep offers personalized study plans that can help you pace yourself. Trust us—rushing through the material just won’t cut it.

In 2025, you’ll also want to leverage a mix of resources:

But here’s where many candidates slip up. Simply reading and memorizing is not enough. You need to apply what you learn. AnalystPrep’s question banks are structured to test your understanding through a variety of scenarios, ensuring that by the time you sit for the CFA Level 1 exam, you’re not just familiar with the material—you can apply it confidently in a range of contexts.

Cost is a crucial factor to consider, and it’s no secret that pursuing the CFA® designation is a significant financial commitment. For 2025, here’s what you can expect for the CFA Level 1 exam:

These fees reflect the CFA Institute’s most recent pricing structure for 2025, and it’s essential to factor them into your exam preparation budget.

Let’s talk strategy. If you register early, you can save a significant amount. That’s money you can potentially reinvest in better prep materials (like those from AnalystPrep!). Don’t forget that rescheduling comes with a hefty price tag, so choose your CFA Level 1 test date carefully.

A common question we get at AnalystPrep is whether the CFA Level 1 exam results expire. The answer? No, they don’t expire. Once you pass, it’s done—forever. You can move on to Level II without worrying about retaking Level 1 CFA down the road. However, if you’re planning to take a break before progressing to Level II, just keep in mind that the financial world is always changing. Taking too long between levels could mean you’ll need to brush up on new content.

If you’re already thinking ahead to CFA Level II (we admire your confidence!), here’s what you need to know: CFA Level I focuses on basic knowledge and comprehension, while CFA Level II dives deeper into analysis and application. In 2025, you’ll notice that the transition between the levels is even more pronounced due to the increasing use of real-world case studies and vignettes at Level II.

CFA Level I exam questions are designed to test your broad understanding of fundamental concepts. You’ll face 180 multiple-choice questions that cover a wide range of topics, from ethics to derivatives. Conversely, Level II will challenge you with vignettes—case studies with multiple questions that require deeper analytical skills. It’s a more nuanced, complex exam, and this shift will demand that you go beyond memorization and into application and synthesis.

Our advice? Don’t underestimate CFA Level I just because it’s “easier.” It’s foundational, and if you master these concepts now, you’ll be in a stronger position for Levels II and III. AnalystPrep’s study tools are built to help you establish a solid foundation, so by the time you reach those higher levels, you’re not just scrambling to keep up—you’re thriving.

Related Articles:

Self-study has always been a viable option for the CFA Level I exam, and in 2025, that hasn’t changed. But here’s the thing: going it alone can be tough. You need to be incredibly disciplined and resourceful. If you’re considering the self-study route for CFA Level I, make sure you’re using a variety of resources. The CFA curriculum should always be your starting point, but supplements like AnalystPrep’s study guides, question banks, and video tutorials can make a world of difference.

Our top tip for self-studiers in 2025? Set clear, measurable goals. It’s easy to get lost in the sheer volume of material, but breaking it down into smaller, manageable pieces can help keep you on track. As you navigate your self-study journey, remember that having a well-rounded approach will better prepare you for the CFA Level I exam and help you understand the core concepts thoroughly.

After months of studying and successfully passing the CFA Level I exam, the next big question on your mind will probably be: what now? Passing Level I opens up several career doors, even though you’re only at the beginning of your CFA journey. In 2025, the financial industry is more dynamic than ever, and employers are increasingly looking for candidates who demonstrate not only technical knowledge but also adaptability and strategic thinking.

Here are some roles you might explore after passing CFA Level I:

Many candidates we’ve worked with at AnalystPrep have found that passing CFA Level I gives them a competitive edge in the job market, even if they’re still working toward full CFA charterholder status. It signals to employers that you’re serious about your career and willing to put in the hard work. The CFA program Level 1 sets the foundation for advanced roles in finance, making it an invaluable step toward your future success.

The CFA Institute has announced important CFA Level 1 changes for 2025, aimed at enhancing practical knowledge and exam relevance.

Key Updates Include:

Looking for updated study materials? AnalystPrep covers all the latest CFA Level 1 changes for 2025.

Wondering about the updated CFA Level 1 exam structure for 2025? Here’s a quick breakdown:

| Component | Details |

|---|---|

| Exam Format | Computer-Based |

| Total Duration | 4.5 Hours (with Break) |

| Number of Questions | 180 (Two Sessions) |

| Question Type | Multiple Choice (MCQs) |

Prepare smarter by understanding the new CFA Level 1 exam structure and practicing with timed mock exams.

Stay ahead of the curve with AnalystPrep’s updated CFA Level 1 study materials. Our resources cover all the latest CFA Level 1 changes for 2025 and provide exam-like practice questions to boost your confidence.

Start Your Preparation Now with AnalystPrepCandidates often ask, “What’s the hardest module in CFA Level 1?” Based on exam feedback, the toughest topics are:

Focus your efforts on these sections to boost your score and increase your chances of passing the CFA Level 1 exam 2025.

Many candidates aim for a 70% CFA Level 1 passing score, but is that really enough?

Take an AnalystPrep mock test to see if you’re hitting the recommended CFA Level 1 passing score before exam day!

The CFA Level I exam is undeniably demanding, but it’s far from insurmountable. Success hinges on not just hard work, but strategic, well-informed preparation. As you look ahead to your journey through the CFA program, it’s crucial to remember that each stage of the process builds on the last. Mastering CFA Level I sets the tone for your future progress, and the habits you cultivate here will serve you well in Levels II and III.

However, beyond mere understanding of the CFA exam structure and content, success comes from leveraging high-quality resources and developing a disciplined approach to study. With AnalystPrep, you gain access to expertly crafted materials that align with the latest CFA Institute curriculum, tailored to help you navigate the most challenging areas of the exam. From adaptive question banks to mock exams that mirror the real testing experience, AnalystPrep offers a holistic approach to your CFA preparation.

But more than that, it’s about mindset. You’re not just preparing for an exam — you’re building the foundation for a career in finance. The discipline, analytical skills, and deep understanding of financial concepts that the CFA curriculum fosters will differentiate you as a professional. Stay focused, remain adaptable, and commit to mastering not only the material but also the strategies necessary to excel.

Your journey doesn’t end with Level I; it begins there. With the right preparation tools, including AnalystPrep’s comprehensive resources, you’ll not only pass the CFA Level I exam but thrive in your future endeavors. So, as you embark on this path, remember: every challenge you face now prepares you for greater success down the road. Keep your end goal in sight— becoming a CFA charterholder — and stay confident in your ability to achieve it.

1. What are the CFA Level 1 exam dates for 2024?

The CFA Level 1 exam date 2024 is typically offered in February, May, August, and November. Check the CFA Institute website for the specific CFA exam dates 2024.

2. What are the topic weights for CFA Level 1?

Understanding CFA Level 1 topic weights can help you prioritize your study efforts. The exam covers various topics, including Ethics, Quantitative Methods, Financial Reporting, and more. Each topic has a different weight, so be sure to focus on the areas that contribute most to your overall score.

3. How much does it cost to take the CFA Level 1 exam?

The CFA exam cost varies based on your registration timing. The early registration fee is $990, while the standard fee is $1,290. Don’t forget to include the one-time enrollment fee of $350 if you’re registering for the first time.

4. How many levels are there in the CFA program?

The CFA program consists of three levels: Level I, Level II, and Level III. Each level builds on the previous one, requiring deeper understanding and application of financial concepts.

5. Can I defer my CFA Level 1 exam?

Yes, you can CFA defer your exam under certain circumstances. Check with the CFA Institute for specific guidelines and implications for your registration.

6. What is the CFA registration fee?

The CFA registration fee varies based on when you register. Make sure to register early to take advantage of the lower fees.

7. What are the CFA fees in India?

CFA fees in India can differ due to currency fluctuations and local regulations. It’s best to check the CFA Institute’s official site for the latest fee structure applicable to your region.

Practice CFA Level I exam-style questions, review key topics, and build a structured study strategy for the 2025 CFA exam cycle.

Investment banking careers are among the most demanding but rewarding financial careers. Working... Read More

Have you ever thought about how investing in your employees’ professional development can... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.