After completing this reading, you should be able to:

- Explain the motivations for revising the Basel III framework and the goals and impacts of the December 2017 reforms to the Basel III framework.

- Summarize the December 2017 revisions to the Basel III framework in the following areas:

- The standardized approach to credit risk.

- The internal ratings-based (IRB) approaches for credit risk.

- The CVA risk framework.

- The operational risk framework.

- The leverage ratio framework.

- Describe the revised output floor introduced as part of the Basel III reforms and approaches to be used when calculating the output floor.

The Basel framework is part of a raft of measures that have been introduced following high-impact financial crises in recent years. The overall goal is to strengthen the banking system and avoid systemic vulnerabilities.

Motivations for Revising the Basel III Framework

The initial phase of the Basel III framework was announced in 2010. It focused on the following objectives:

- To increase the quality of bank regulatory capital to cover unexpected losses. Minimum Tier I capital rose from 4% to 6%.

- To increase the capital requirement to mitigate market risk in times of stress.

- To constrain banks’ borrowing rate (leverage) and, hence, avoid a build-up of debt which would exacerbate financial pressure during a downturn.

- To improve liquidity by requiring banks to hold liquid assets that can sufficiently run a bank for 30 days during times of stress.

- To limit procyclicality by requiring banks to hold sufficient retained earnings that can be drawn down during periods of economic stress.

The Basel III reforms announced in 2017 sought to complement the initial phase of the Basel III reforms. In particular, they sought to restore credibility in the calculation of risk-weighted assets and improve the comparability of ratios across banks:

- To improve the standardized approaches for credit risk, credit valuation, operation risk, and credit valuation adjustment (CVA).

- To restrict the use of internal evaluation models by placing limits on the inputs used to calculate capital requirements under the internal ratings-based approach.

- To further limit the leverage of global systematically important banks (G-SIBS) by introducing a leverage buffer.

- To replace the existing Basel II output floor with a more robust risk-sensitive floor built upon the Basel III standardized approaches.

December 2017 Revisions to the Basel III Framework

The Standardized Approach to Credit Risk

Credit risk is undoubtedly the biggest source of risk for banks. As such, it contributes towards a significant part of regulatory capital requirements put in place. The committee’s improved standardized approach for credit risk seeks to:

- To increase the sensitivity of the credit risk-standardized approach requirements by introducing new exposure classes and additional credit evaluation tools.

- To further limit reliance on external credit ratings by introducing additional due diligence requirements.

- To make use of more risk-sensitive approaches in the assessment of commercial real estate exposures that go beyond the widely applied flat risk weight.

- To further break down retail exposures into smaller distinct components that can be analyzed in greater detail.

- To align definitions with the internal ratings-based approach (IRB) by introducing a new definition for default.

The Internal Ratings-based (IRB) Approaches for Credit Risk

Under the IRB approach, banks are allowed to use their internal rating systems conditional on approval by their supervisors. Banks can use:

- The advanced IRB approach (i.e., use their internal estimates of risk parameters such as the probability of default (PD), exposure-at-default (EAD), and the loss-given-default (LGD).

- The foundation IRB approach (i.e., use only their internal estimates of PD).

The main motivation behind changes to the credit risk IRB approach is to introduce similar capital requirements that enhance comparability across banks and address lack of robustness in modeling certain asset classes.

The main changes include the following:

- Provision of greater specification of parameter estimation practices. Exposures secured by non-financial collateral, such as haircuts to the collateral, have since increased. For unsecured exposures, the LGD has been reduced from 45% to 40%.

- Banks no longer have the option to use the advanced IRB approach for certain asset classes. The advanced IRB approach allows banks to estimate PD and EAD in certain scenarios, particularly when there are insufficient data to model exposure in precise terms. Instead, they are now required to use the Foundation IRB approach, which introduces fixed values for the LGD and EAD.

- Where the advanced IRB approach remains available, minimum input floors have been adopted (for internal estimates of PD or EAD) in a bid to ensure a minimum level of conservatism in the estimation process.

The CVA Risk Framework

In the most recent global financial crisis (2007/2008), banks suffered huge losses resulting from CVA risk – losses related to the deterioration of a counterparty’s creditworthiness in derivative contracts. In the aftermath of the crisis, the committee enhanced the CVA framework. Objectives include:

- To enhance risk sensitivity: The revised CVA framework takes the exposure component of CVA risk as well as the risk of associated hedges into account.

- To enhance the robustness of the CVA framework: CVA risk is complex. It captures changes in counterparty credit spreads and other market risk factors. The updated guidelines remove the use of an internally modeled approach and instead emphasize the use of two main methods:

- The standardized approach (SA-CVA).

- The simpler basic approach (BA-CVA).

In addition, banks with minimal engagement activities in derivative transactions can use their credit counterparty risk (CCR) capital requirements as a proxy for their CVA charge. A bank whose centrally cleared derivatives are worth EUR 100 billion or less may calculate its CVA capital charge as a simple multiplier of its counterparty CCR charge.

- To improve the consistency of the CVA framework: The standardized and basic approaches of the revised CVA framework have been revised to be consistent with the approaches used in the revised market risk framework.

The Operational Risk Framework

The operational risk capital requirement can be summarised as follows:

$$ \text{Operational risk capital} = BIC \times ILM $$

We seek to now further define each term from the equation.

The Business Indicator Component (BIC)

$$ \text{Business Indicator Component} = \left( BIC \right) =\sum { \left( { a }_{ i }\times { BI }_{ i } \right) } $$

The Bl (Business Indicator) is the sum of three components:

- The interest, leases, and dividends component.

- The services component.

- The financial component.

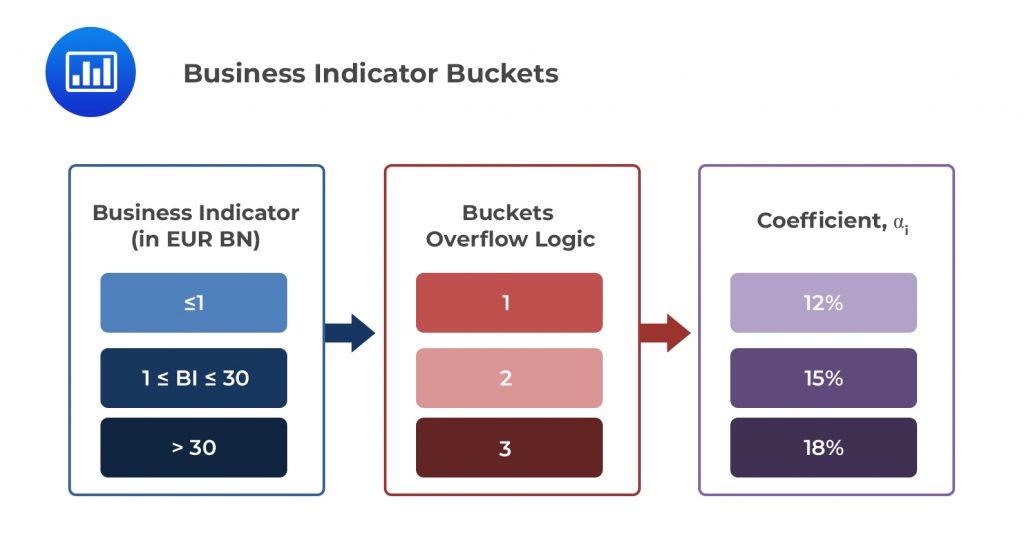

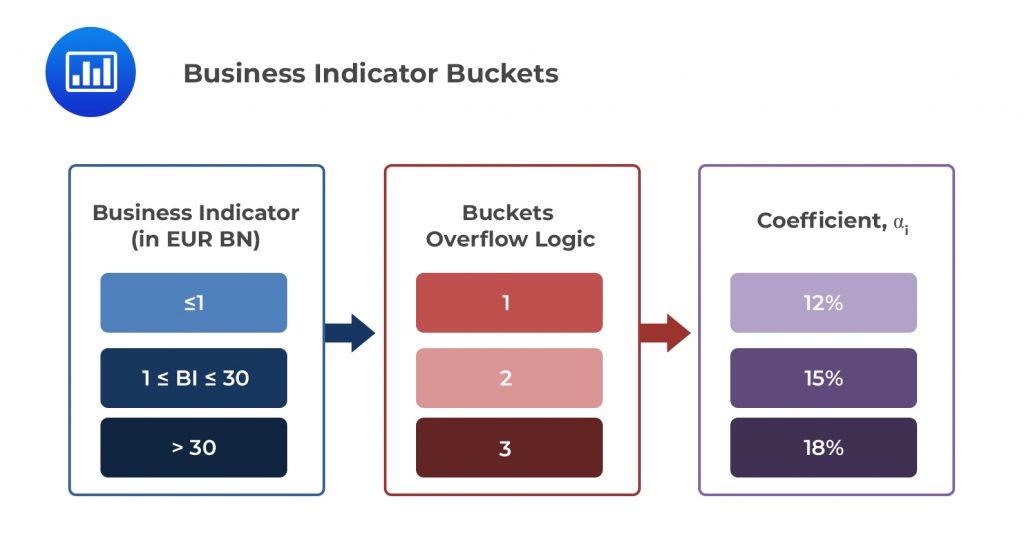

The business indicator is a set of marginal coefficients multiplied by the Bl based on three buckets (where i = 1, 2, 3 denotes the buckets). As the business indicator expands (in € billion), the coefficient applied becomes larger. The buckets are summarized in the table below:

Example 1: Calculating the BIC of a Bank With a BI of €50bn.

Example 1: Calculating the BIC of a Bank With a BI of €50bn.

$$

\small{\begin{array}{l|c|c|c}

\textbf{BI Bucket}& \textbf{1} & \textbf{2}& \textbf{3} \\ \hline

\textbf{BI Range} & ≤ €1 \text{ billion} & €1 \text{ billion} < BI ≤ €30 \text{ billion} & ≥€30 \text{ billion} \\ \hline

\textbf{Marginal BI Coefficient, } \bf{{ a }_{ i }} & 0.12 & 0.15 & 0.18 \\ \hline

\textbf{Calculation} \bf{{ a }_{ i }} & €1bn × 12\%

= €0.12bn & €(30 – 1) × 15\% = €4.35bn & €(50 – 30) × 18\%= €3.6bn \\

\end{array}}

$$

By summing the 3 buckets, we arrive at a BIC of €8.07 billion.

The Internal Loss Multiplier (ILM)

The Internal Loss Multiplier is a function of the BIC and the Loss Component (LC), where the latter is equal to 15 times a bank’s average historical losses over the preceding 10 years. It is noteworthy that firms with less than 20 years of data must use a minimum of 5 years of data.

The Leverage Ratio

The leverage ratio is a complement to the risk-weighted capital requirement and prevents a situation where banks take on unsustainable levels of debt. To mitigate the externalities or, rather, the ripple effect associated with the failure of G-SIBs, the leverage ratio is set at 50% of a G-SIB’s risk-weighted higher-loss absorbency requirements. For example, a G-SIB subject to a 4% risk-weighted higher-loss absorbency requirement would be subject to a 2% leverage ratio buffer requirement.

Capital distribution constraints are imposed on entities that do not meet the leverage ratio requirement.

The Revised Output Floor

The Basel III reforms set a floor in capital requirements calculated under internal models at 72.5% of those required under standardized approaches. Due to the potential impact of the floor, the 72.5% requirement is expected to be implemented in phases over a five-year period from 2020 to 2026.

When calculating the floor, banks will be expected to take the following risks into account:

- Credit risk: Banks must use the revised standardized approach for credit risk. Notably, the floor must be applied at the asset class level.

- Counterparty credit risk: Banks with derivative exposures must measure the associated counterparty credit risk using the standardized approach. The resulting amounts must be multiplied by the relevant borrower’s risk weight.

- Credit valuation adjustment risk: Banks must use the standardized approach for CVA, the basic approach, or 100% of the bank’s counterparty credit risk capital requirement.

- Securitization framework: For assets in the banking book, the external ratings-based approach, the standardized approach, or a risk weight of 1250% is applicable.

- Market risk: Banks will be required to use the standardized approach for market risk. A risk weight of 1250% applies when computing the default risk charge component for any securitizations featured in the trading book.

- Operational risk: Banks are required to use the standardized approach for operational risk.

Practice Question

Which of the following changes has Basel III set forth with reference to the changes in credit risk?

- New exposure classes and evaluation tools have been introduced.

- Definitions within the internal ratings-based approach (IRB) have been aligned to those under the standardized approach.

- Retail exposures have been aggregated to simplify the analytical process.

- Introduction of further due diligence requirements to limit reliance on external credit rating.

A. All of the above.

B. I, III, and IV.

C. II and III.

D. I, II, and IV.

The correct answer is: D).

III is incorrect. A more granular treatment applies to retial exposures. This is the distinction between different types of retail exposures.

Example 1: Calculating the BIC of a Bank With a BI of €50bn.

Example 1: Calculating the BIC of a Bank With a BI of €50bn.