Machine Learning and Prediction

After completing this reading, you should be able to: Explain the role of... Read More

After completing this reading, you should be able to:

Clearing refers to the use of a central counterparty (CCP) to mitigate risks associated with the default of a trading counterparty.

CCP clearing means that a CCP becomes the legal counterparty to each trading party, providing a guarantee that it will honor the terms and conditions of the original trade even in the event that one of the parties defaults before the discharge of its obligations under the trade.

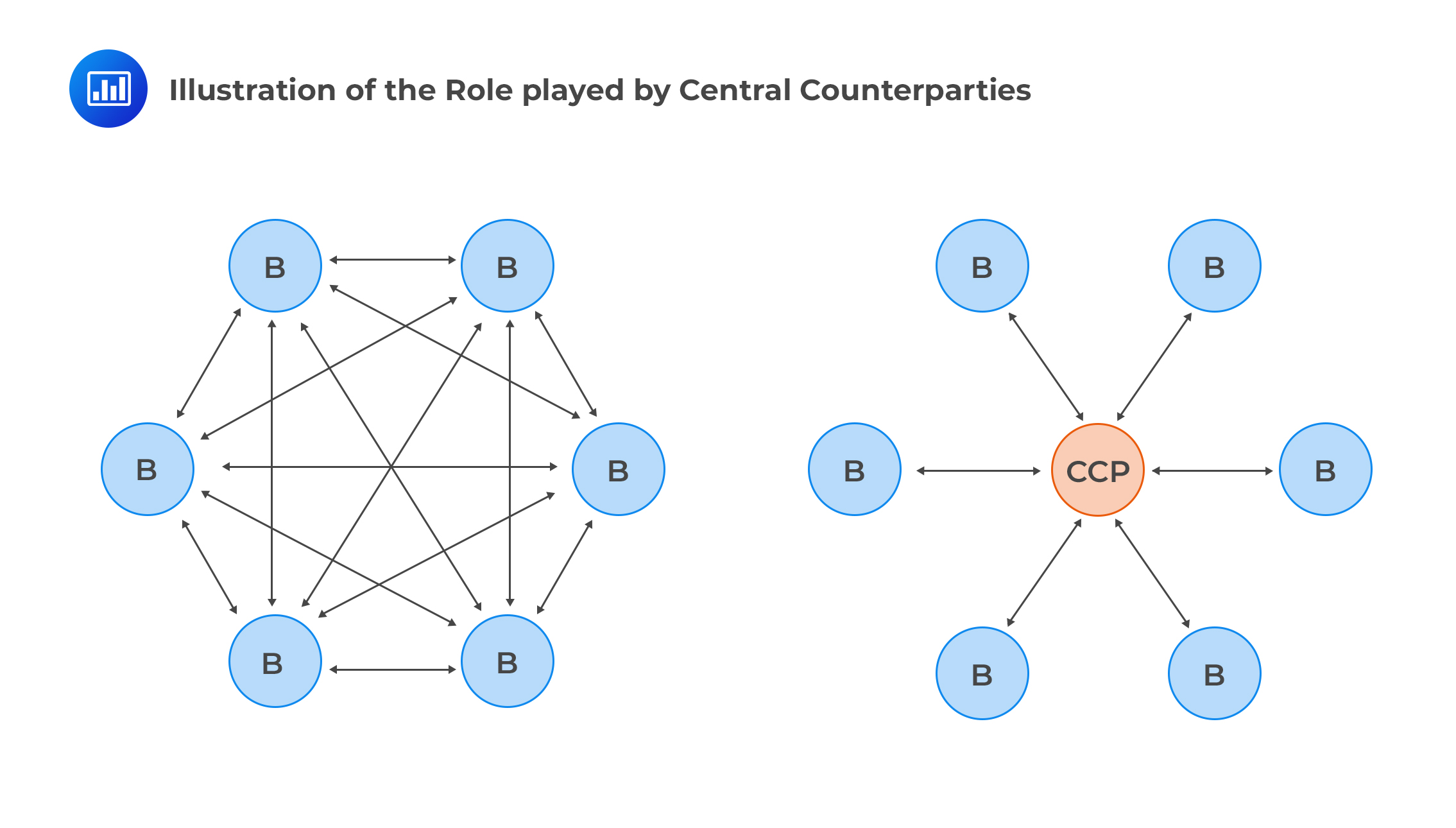

Although a bit simplistic, the following view helps to show the role played by CCPs in trading. Each of the six entities denoted B represents a dealer bank.

The first figure shows six traders trading bilaterally, i.e., traders are trading directly with each other. The second diagram illustrates traders trading through a CCP.

The first figure shows six traders trading bilaterally, i.e., traders are trading directly with each other. The second diagram illustrates traders trading through a CCP.

CCPs are commonly used in exchange-traded markets. CCPs use various ways to protect themselves from losses that may be incurred if a member defaults. These include:

Recent years have seen an increased use of CCPs in the OTC markets.

$$ \begin{array}{l|l} \textbf{Exchange-Traded Markets} & \textbf{OTC Markets} \\ \hline \begin{array}{l} \text{Most contracts last a few} \\ \text{months with only a few that last} \\ \text{for more than a year} \end{array} & \begin{array}{l} \text{Contracts last for at least ten} \\ \text{years} \end{array} \\ \hline \text{Average trade is small} & \text{Average trade is relatively big} \\ \hline \text{Contracts trade continuously} & \begin{array}{l} \text{Contracts trade intermittently} \\ \text{making OTC markets less} \\ \text{liquid} \end{array} \\ \hline \begin{array}{l} \text{Variation margin can be} \\ \text{directly determined from} \\ \text{market prices} \end{array} & \begin{array}{l} \text{Models are needed in order to} \\ \text{determine variation margin} \end{array} \\ \end{array} $$

CCPs can be involved in both mergers and acquisitions.

Regardless of whether they are trading in the OTC markets or in exchange-traded markets, CCPs operate in a similar way.

If the initial margin does not sufficiently cover the losses, the variation margin will be exhausted before using default fund contributions.

The equity of a CCP will be at risk only upon exhausting the default fund contributions of all members of the CCP.

To cover their costs, CCPs charge per trade. They make profits on the excess initial margin of members. These profits may be shared out among members if the CCP is owned by members.

Margin requirements and default fund contributions may be reduced so as to attract a lot of traders. This will, in the long run, increase credit risks to the CCP.

Regulations were introduced after the 2007-2008 financial crises. The increased use of derivatives in OTC markets can be attributed to these regulations.

They were formulated mainly to hedge against systematic risk, the risk that one member defaulting could result in possible losses to the other members trading with the defaulted member.

The three major regulations affecting OTC markets as defined by the G-20 Pittsburgh meeting are:

Conditions to be satisfied before CCPs clear transactions:

In CCPs, the position of the members of the CCPs is transferred to the CCP. Members of the CCP agree to post initial margin and variation margin and in addition, they also agree to make the required default fund contributions.

Novation is the term used to describe the transfer of a contract from one party to another party.

A central counterparty interjects itself between a buyer and a seller through a process called ‘Novation’ and becomes a seller to the buyer and a buyer to the seller. By novating the trade, the CCP guarantees settlement of the trade even if one of the parties were to default on their obligation, thereby eliminating counterparty risk.

Transactions not done through the CCP are known as uncleared transactions.

In the period, 2016-2020, new rules require that both the initial margin and the variation margin must be posted. This differs from the earlier pre-crisis period where OTC traders were only required to post variation margin, and also during this period, OTC markets were cleared bilaterally.

It is possible for traders to trade using different CCPs. In such a scenario, members of a CCP will trade with non-members bilaterally. Bilateral clearing involves two parties in a transaction agreeing on how they will be cleared, what netting arrangements they would prefer, and what will be used as collateral in case of any.

Compared to banks, CCPs are much simpler and more transparent. The activities of a CCP are:

A clearing member may default on one or more transactions. Following a default event, a host of other problems may come up. These include:

Such events include:

Note that non-default and default losses may be correlated. The default of a member might cause market disturbance and increase the likelihood of operational or legal problems.

OTC transactions are not standardized; they trade less frequently and their prices are not so transparent. For these reasons, valuation models are needed when determining the initial margin requirement and default fund contributions of traders. However, these valuation models may use subjective assumptions.

Generally, the more liquid an investment is, the lower the returns. CCPs need to consider the constraints of investments before investing so as to ensure that their investments can be easily converted to cash whenever the need arises.

Centralization of various functions fosters efficiency, but on the downside, it creates a fertile ground for operational bottlenecks. For example, the CCP may have to contend with frequent system failures due to heavy traffic. What’s more, segregation and the movement of margin and positions through a CCP is prone to legal risk, depending on the jurisdiction.

Other risks include custody risk in case of failure of a custodian, wrong-way risk, foreign exchange risk, concentration risk, and sovereign risk.

There are several ways through which a clearing member can experience CCP-related losses:

Prior to gaining membership, there are several mechanisms through which a prospective member can assess the risks faced by a member of the CCP. Such mechanisms may involve scrutinizing:

Non-clearing members who clear indirectly through a CCP are usually faced with different risks, most of which may closely resemble those of clearing members. In addition, however, non-clearing members may have an additional layer of protection:

In the last four decades, we’ve had several high-profile CCP failures and near-failures. Common sources of these failures include:

Some of the lessons we can learn from these past failures include:

Question

A financial analyst is reviewing different investment instruments and wants to understand the distinctions between exchange-traded options and over-the-counter (OTC) options. Which of the following statements correctly describes a fundamental difference between these two types of options?

A. Exchange-traded options require physical delivery, while OTC options only permit cash settlements.

B. Exchange-traded options are typically traded between individual investors, while OTC options are usually traded between large financial institutions.

C. OTC options contracts are customizable, while exchange-traded options contracts follow standardized terms and conditions.

D. Exchange-traded options are typically less liquid than OTC options due to more stringent regulations.

Solution

The correct answer is C.

Exchange-traded options are traded on regulated exchanges and come with standardized contracts. These contracts have fixed terms and conditions such as strike prices, expiration dates, and other features. In contrast, OTC options are traded directly between parties without going through a regulated exchange, allowing for customization of contract terms to fit specific needs.

A is incorrect as both exchange-traded and OTC options can be either physically settled or cash-settled, depending on the contract.

B is incorrect as both exchange-traded and OTC options can be traded between various entities, including individual investors and financial institutions. The primary difference lies in the customization and standardization of the contract terms, not necessarily the parties involved.

D is incorrect because exchange-traded options are generally more liquid due to being traded on a public exchange, which usually offers more transparency and ease of trading compared to OTC options, where you have to find a counterparty willing to take the other side of the trade.

Things to Remember

- Exchange-traded options are traded on regulated exchanges and come with standardized contracts, having fixed terms and conditions such as strike prices and expiration dates.

- OTC options are traded directly between parties without a regulated exchange, allowing for customization of contract terms to fit specific needs.

- The main difference between these two types of options lies in the flexibility of the contract terms. Exchange-traded options follow standardized agreements, while OTC options allow customization.

- Both types of options can be traded between various entities, and settlement can be either physical or cash-based for both. The liquidity factor typically favors exchange-traded options due to transparency and ease of trading.