Model Risk

The objective of this chapter is to identify and explain modeling assumption errors... Read More

After completing this reading, you should be able to:

A contingency funding plan (CFP) is a liquidity management tool that links the stress test results and other related information as inputs to the CFP governance, decision framework, and menu of contingent liquidity actions.

Institutions manage low-impact and high-probability events as part of their business-as-usual (BAU) funding and liquidity risk management activities. On the other end, they use CFPs to address high-impact low-probability events. Institutions use CFPs to develop and implement their financial and operational strategies for effective management of contingent liquidity events.

While smaller institutions have included CFPs as part of their broader business continuity plans, larger institutions have created more formal CFPs. There is no universality related to establishing CFPs. However, firms should consider the following factors when designing or refreshing their CFPs.

When designing or refreshing a CFP, institutions should envisage their specific business and risk profiles. Specific business profiles include the scope of business activities, geographic and foreign exchange (FX) coverage, legal entity structures, and products/asset classes. Moreover, institutions should have a consistent alignment of their risk appetite statement to the CFP framework, through quantifiable early warning indicators, limits, and escalation levels.

Similar to enterprise risk management (ERM), capital management, and business continuity and crisis management, CFP is an integrated part of an institution’s risk management and the broader risk management framework. CFP should be blended with other ERM components to increase its effectiveness and consistency. This is so because there is an allowance for a CFP to leverage and reference existing controls and processes.

Additionally, it is essential to link a CFP to business continuity and crisis management as it reinforces significant operational and communication protocols during a financial crisis.

A valid CFP is operationally ready and in a position to strike a balance between specifying recommended contingency actions while giving the management enough flexibility and discretion to make informed decisions as the crisis emerges.

The CFP needs to include a menu of possible contingency actions that management can undertake in various stress scenarios and at graduated levels of severity, which are alienated from EWIs, triggers, and contingency actions. The institution can then get a structured roadmap, outlining potential liquidity risks, and the related management actions that it can quantify for various stages of the liquidity crisis.

A profound understanding of both strategic and tactical aspects of an institution is essential when developing operational readiness in a CFP.

Involving several stakeholders provides a robust forum in which potential issues or challenges can be openly discussed and addressed. Such groups include the asset-liability committee (ALCO), risk and capital committee, investment committee, business units, finance, corporate treasury, risk, operations, and technology. These stakeholders should be involved when capturing the pertinent elements of the CFP as part of the design to ensure successful coordination from an execution standpoint.

An institution needs to be coordinated internally to ensure timely communication in case of a crisis. Additionally, external communication to clients, counterparties, and regulators with timely and precise information is critical as it aids in the reinforcement of confidence in the institution and mitigation of potential risk. Furthermore, this inhibits rumors and fears from further precipitating, thus adversely impacting the institution.

Institutions can develop their CFPs using an integrated framework that addresses people, process, data, and reporting dimensions, deliberating the critical design considerations discussed in the previous session. They should customize their CFP framework to their business and risk profiles.

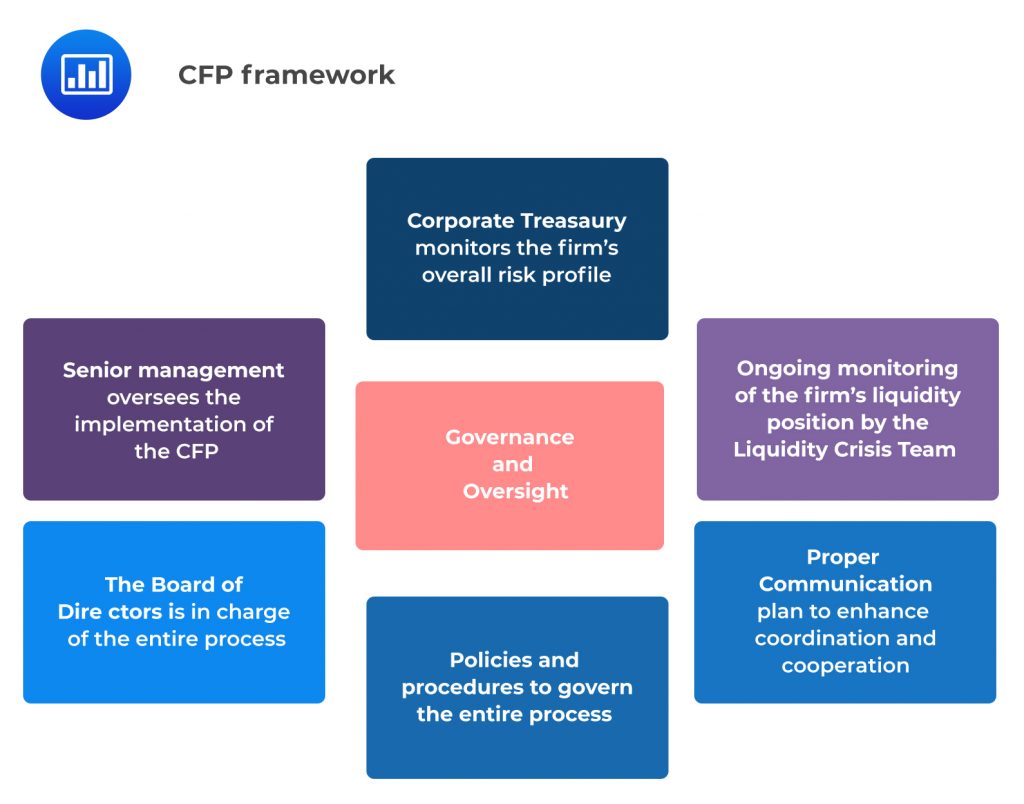

The major components of a CFP framework include the following:

To develop a valid CFP, an institution should come up with well-defined roles and responsibilities, as well as a robust communication strategy that provides timely coordination and communication among internal and external stakeholders. The organizational roles and communications plan should be justified by well-defined policies and procedures and reinforced through CFP periodic testing and simulation exercises.

Corporate treasury, management committee, liquidity crisis team, and board of directors have critical roles in CFP design and implementation. The following descriptions should be the starting point for institutions in defining specific CFP roles and responsibilities. These roles should be adjusted to suit the organizational structure, capabilities, and coverage/responsibilities of the institution:

Corporate Treasury

The treasury monitors the ongoing business, funding, risk, and liquidity profile as part of its BAU activities. The treasury can consult the CFO and others to invoke the CFP and convene the liquidity crisis team (LCT) regarding a review of the markets, and liquidity stress testing results, among others.

Liquidity Crisis Team (LCT)

The LCT undertakes continuous monitoring of the institution’s liquidity profile. Moreover, it provides recommendations on CFP actions, designs the CFP, and submits it to the senior management for review and approval. The LCT members include senior members of the institution’s business and supporting functions, geographies, and legal entities.

Management Committee

The senior management oversees the LCT and does a consultation with the board of directors to monitor the institution’s liquidity risk profile and review specified recommendations for the coordination of the CFP actions during a crisis.

Board of Directors

During a financial crisis, the board of directors serves as an advisor and counsel to the management committee and the Liquidity Crisis Team (LCT).

In CFP, a communication strategy and plan are essential to ensure enough notification, coordination, issue reporting, and escalation. The various groups across the institution should work in concert, relying on each other to ensure information is available on time to support management decision-making.

In any crisis, transparent and timely communication helps the institution to demonstrate a sense of control and confidence that management understands future challenges and has a plan of action.

Coordination points can vary across institutions, depending on their size, complexity, and organizational structure. The following is an example of such coordination:

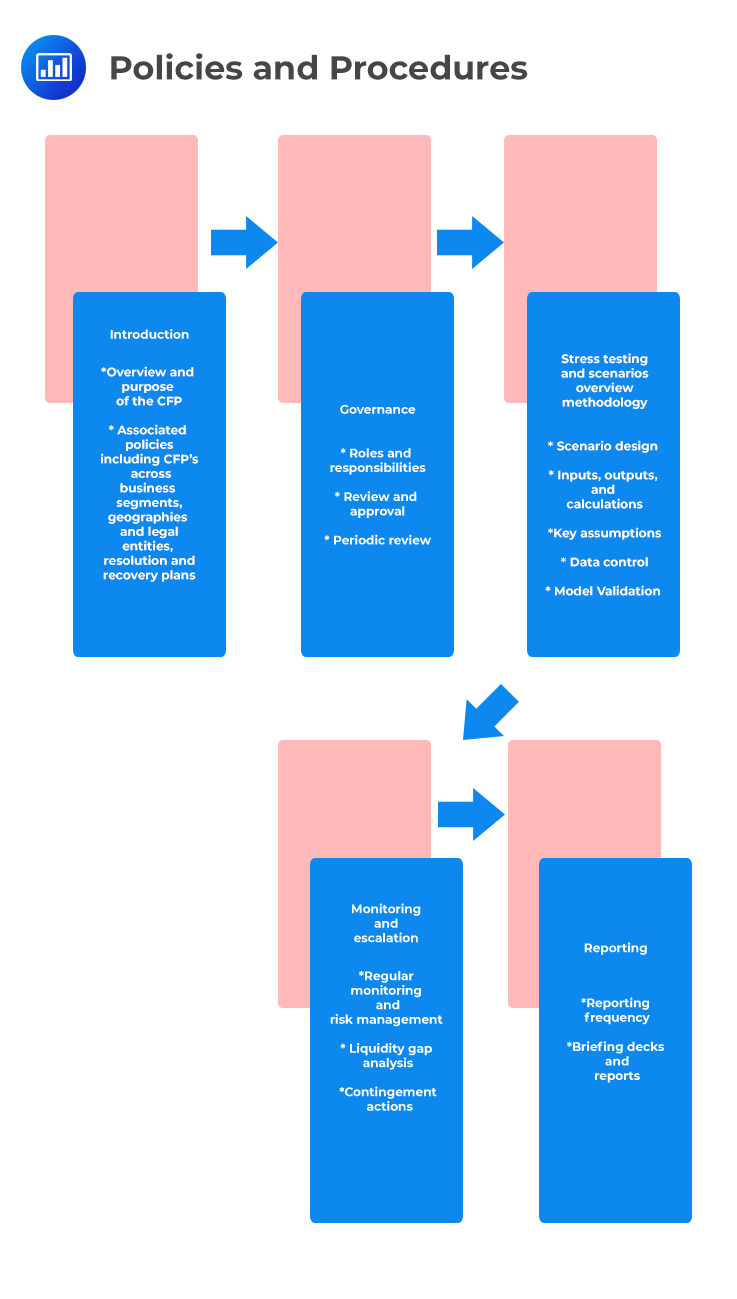

Policies and Procedures

Institutions should endeavor to document their CFPs. Documentation should capture all aspects of the CFP, including the governance structure, processes, data, and reporting activities. A CFP policy outline may look like this:

An institution’s CFP stress scenario must coordinate with those in its liquidity stress testing framework, recovery, and resolution frameworks. The liquidity stress testing scenarios should cover both the systematic risk and idiosyncratic risks. The stress testing scenarios should deal with market liquidity and funding liquidity for stress periods.

Institutions employ the liquidity stress testing framework to ensure appropriate measuring and monitoring of these stresses on their liquidity profile. On the other hand, the CFP should provide a mechanism for escalating an emerging crisis to management’s attention and ensuring actionable responses are attained.

Additionally, the CFP may contain other liquidity-related stress scenarios. These scenarios might be beyond the institution’s broader monitoring and limit structure. However, they ensure effective contingency plans are in place when certain events that could potentially impact liquidity occur.

Institutions can utilize liquidity gap analysis to develop contingent actions or capital recovery actions. The institution should include a spectrum of business scoping activities, pricing initiatives, and potential expense control actions that strengthen the institution’s liquidity position. An institution can gauge whether such contingent actions are suitable for application based on the nature and amount of capital shortfall, timing and pattern of the expected capital shortfall, estimated capital relief from the contingent action, and the ability of the institution to implement internal or external activities related to such contingent actions.

Some contingent actions include but are not limited to, the following:

The systemic and idiosyncratic nature and amount of the stress events significantly influence the availability and the potential impact of the above contingent events. Deposit runoffs, an increase in the cost of funding, and cash deposit requirements are among the market factors that can impact an institution’s ability to take contingent actions.

The management should try to predict these challenges hand in hand with the effects they may pose on its liquidity responses. CFP should also document alleviating actions that management would consider taking to address such challenges.

The CFP framework should include a portfolio of measures to monitor the current liquidity profile and the expected impact of potential liquidity events. Factors that affect the institution’s liquidity position can be represented by the market (external) and business (internal) measures and liquidity health measures (internal). These measures form a set of Early Warning Indicators (EWIs) that provide advance signaling of possible liquidity problems at the onset. This enables the management to assess and make the necessary steps as the crisis worsens.

Early Warning Indicators

Early warning indicators such as substantial changes in levels and volatility of the equity markets, a significant dip in the institution’s stock price, and dramatic changes in the business’ revenues from a specific geographic area, should warn the management. Following these signs, the management should evaluate how fluctuating market conditions and the institution’s business strategy may be adversely affected and thereby proactively take timely actions of oncoming market disruptions.

Market and Business Factors

Institutions need to track information on macroeconomic, institution-specific, and industry measures to monitor market trends. Mainly, they should look for EWIs encompassing market and business factors such as a substantial and unanticipated decline in the stock market indices, a spike in the market volatility, and a decline in the quality of assets, among others.

Liquidity Health Measures

We have seen that the macroeconomic and industry measures offer a timely signal of a potential pending liquidity crisis. However, institutions should also monitor several liquidity health ratios to help quantify the impact of the liquidity risks and to support decision-making on CFP actions under consideration.

Some of the necessary liquidity health measures include the following:

Projected net funding requirements to current unused funding capacity: Gauges the funding and borrowing required to finance an institution’s increased lending activities and banking activities. It measures the institution’s future lending obligations in proportion to the total funds available at the institution.

Non-core funding to long-term assets: Measure the percentage of long-term funding requirements that are supported by less stable sources of funding. High non-core funding to long-term assets ratio implies a high dependence on volatile funding sources.

Overnight borrowings to total assets: Measure the dependence on overnight funding to finance the institution’s assets as the use of this source of funding exposes the institution to increased liquidity risk.

Short-term liabilities to total assets: Measure the funding levels that should be rolled over within a predetermined short-term period, for example, under 30 days, or 60 days, to support the institution’s assets.

The liquidity health measures for institutions with advanced liquidity risk management abilities include daily liquidity position reporting, Liquidity Coverage Ratio (LCR), and the Net Stable Funding Ratio (NSFR).

The liquidity health measures should be monitored continuously over the crisis. However, note that their importance is related to their associated limits.

Escalation Levels

In designing the CFPs, institutions should develop a series of escalation levels adequately leaning to the scenarios, contingency actions, and liquidity measures. There exist no guidelines on the number of escalation levels to be developed. However, the most commonly used are three to five escalation levels.

The frequency with which several measurements employed to monitor and manage liquidity risk are generated, assessed, and reported is essential in ensuring that the institution’s liquidity risk monitoring and measuring framework adequately supports the objectives of the CFP. Many institutions employ daily reporting of the liquidity profile to the treasury function and the funding desks. However, increasing the frequency of liquidity management reporting can benefit several institutions that do not report daily.

It is vital for the reporting of liquidity management to carry contextual information and qualitative guidance. This aids senior management in its approach to perceiving the institution’s liquidity profile.

Additionally, reports should show the methods used to dictate liquidity coverage for upcoming liabilities and funding needs. Moreover, they should elaborate on the level of coverage estimated by these measures. Further, institutions should ensure that existing reports capture intraday liquidity positions and track exposure to contingent liabilities and capacity usage in funding sources.

Finally, consideration should be given to the distribution of liquidity risk reports within the institutions, their usage by management and the board in making strategic decisions, and the appropriateness of the information, given their audience.

Practice Question

Which of the following statements best represents the relationship between contingency funding planning and liquidity stress testing?

A. Contingency funding planning simulates extreme but plausible scenarios, while liquidity stress testing serves as an action plan during liquidity shortfalls.

B. Both contingency funding planning and liquidity stress testing simulate extreme but plausible scenarios to identify vulnerabilities.

C. Contingency funding planning serves as an action plan detailing the steps to take during liquidity shortfalls, while liquidity stress testing simulates extreme but plausible scenarios.

D. Both contingency funding planning and liquidity stress testing serve as action plans during liquidity shortfalls.

Solution

The correct answer is C.

Contingency funding planning serves as an action plan detailing the steps to be taken during liquidity shortfalls. On the other hand, liquidity stress testing is a tool that simulates extreme but plausible scenarios to identify potential vulnerabilities in the bank’s liquidity position.

A is incorrect: This statement incorrectly swaps the roles of contingency funding planning and liquidity stress testing. It is the liquidity stress testing that simulates scenarios, while the contingency funding planning provides an action plan.

B is incorrect: While liquidity stress testing simulates extreme scenarios to identify vulnerabilities, contingency funding planning does not. Instead, CFP provides an action plan to be followed during liquidity shortfalls.

D is incorrect: This choice incorrectly attributes the action plan role to both contingency funding planning and liquidity stress testing. While CFP does serve as an action plan during liquidity shortfalls, liquidity stress testing does not. Instead, liquidity stress testing identifies potential vulnerabilities through simulated scenarios.

Things to Remember

- Contingency funding planning (CFP) is an essential aspect of a bank’s liquidity risk management. It ensures preparedness when facing real-world liquidity challenges.

- A well-developed CFP can help banks respond swiftly and decisively during adverse conditions, minimizing potential disruptions and costs.

- Regularly updating and testing the CFP is crucial to ensure its effectiveness. This involves incorporating lessons from past crises, changes in the bank’s business model, and shifts in the financial market landscape.

- While liquidity stress testing highlights potential vulnerabilities, the CFP is where practical solutions and responses to those vulnerabilities are outlined.

- Effective integration of both liquidity stress testing and CFP ensures that banks not only identify risks but also have actionable strategies to address them.

Prepare for FRM Part II by evaluating contingency funding strategies and liquidity stress testing frameworks used by financial institutions.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.