Strategic Choices in Currency Management

The approach to managing currency risk in a portfolio varies widely among participants.... Read More

Private real estate debt and equity investments are unique types of investments that have specific characteristics. These characteristics are derived from the economic value that these investments can generate from current and future agricultural use or the timber growth cycle, as well as capital appreciation. For instance, a private real estate equity investment in a vineyard not only generates income from the sale of grapes but also appreciates in value over time due to the growth of the vines and the increasing demand for wine.

Investing in private real estate debt and equity presents unique due diligence and valuation challenges. These challenges are a result of the specific characteristics of these investments and the economic value they can generate. For example, valuing a private real estate debt investment in a timber plantation requires understanding the growth cycle of the trees, the future demand for timber, and the costs associated with harvesting and selling the timber.

Private real estate equity investments, such as in agricultural properties, may offer higher risks due to uncertainties like crop yields but can also provide higher returns due to demand for agricultural products.

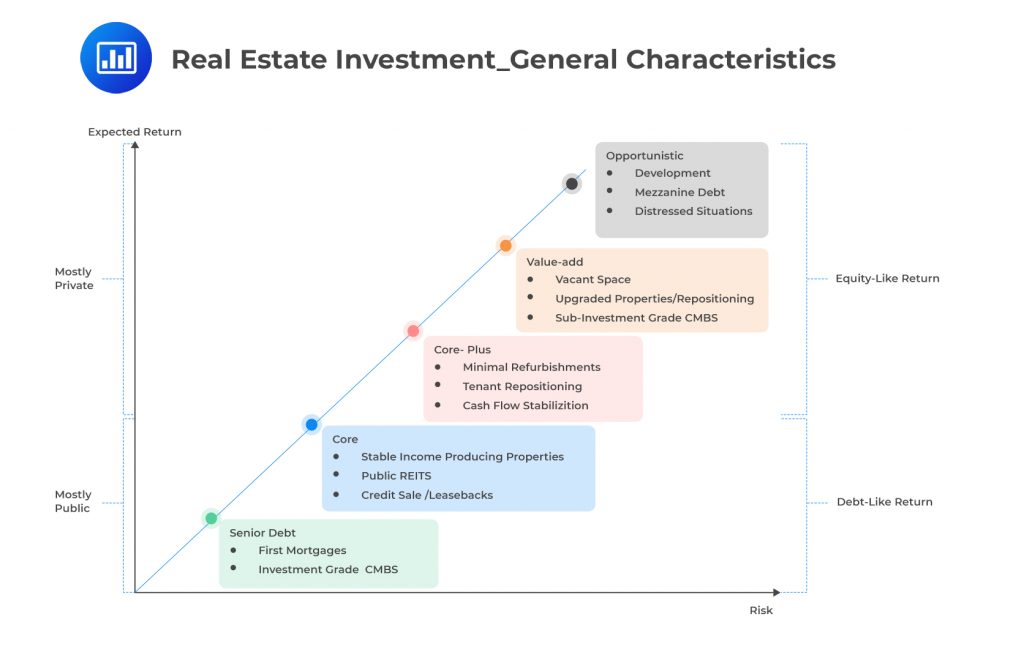

Notable for longer investment periods, reduced liquidity, and greater control over value-add and opportunistic investments.

Private real estate funds differ from public market funds, featuring either open-end interval funds with liquidity constraints or closed-end funds requiring upfront capital commitment and having a finite lifespan.

Interval funds allow limited redemption (e.g., 5% of total assets quarterly) without a predetermined maturity date.

Closed-end funds have a set lifespan, necessitating an initial capital lockup and eventual property sale to distribute returns.

Funds can be structured as real estate limited partnerships or limited liability companies, managed by general partners (GPs) and funded by limited partners (LPs).

GPs may also create separately managed accounts for bespoke investments tailored to the specific goals and risk tolerances of high-net-worth individuals.

Real estate development is a multifaceted business, encompassing activities that range from the renovation and re-lease of existing buildings to the purchase of raw land and the sale of developed land or parcels to others. Developers are the coordinators of the activities, converting ideas on paper into real property.

Before constructing buildings on undeveloped or reclaimed land, developers must first establish the physical and economic feasibility of a project. The initial step in the planning process is to assess a project’s physical feasibility, which represents the site’s best economic use, in compliance with local laws and regulations. For instance, a developer looking to build a residential complex in a suburban area would need to consider zoning laws, environmental regulations, and the physical characteristics of the land. Zoning requirements often restrict economic use and require provisions for setback or distance to property lines and circulation, such as security and emergency access to buildings or facilities.

Economic feasibility involves weighing a property’s future economic use by residential or commercial tenants versus construction and operating costs to determine whether the project will meet or exceed required rates of return for debt and equity investors upon completion. For example, if a developer is considering building a shopping mall, they would need to estimate the potential rental income from tenants, compare it with the construction and operating costs, and see if the project would provide a satisfactory return to investors.

Net Operating Income (NOI) is a key property income measure that ignores financing costs and taxes. It is calculated as the effective gross income minus operating expenses and property maintenance allowance and given by $$ \begin{align*} NOI & = \text{Effective gross income} – \text{Operating expenses} \\ & – \text{Property maintenance allowance} \end{align*} $$

Where:

In simple terms, NOI is the income left over after all the operating expenses have been paid. For example, if a property generates $100,000 in rent and has operating expenses of $20,000, the NOI would be $80,000.

The initial project return to both debtholders and equityholders can be estimated on the basis of NOI versus project cost. $$\text{Project return} = \frac{NOI}{\text{Project cost}}$$ This is a crucial metric for investors as it gives them an idea of the profitability of the project. For instance, if the project cost is $1,000,000 and the NOI is $80,000, the project return would be 8%.

The required rate of return on a property is often referred to as the capitalization rate, or cap rate. The direct capitalization approach divides a single year’s net operating income by the cap rate to estimate a property’s value.

$$\text{Property value} = \frac{\text{Expected NOI}}{\text{Capitalization rate}}$$

For example, if a property has an NOI of $80,000 and the cap rate is 8%, the property’s value would be $1,000,000.

The Riverside Plaza project is a mixed-use development that includes residential, commercial, and retail spaces. The project aims to leverage the scenic river views to attract high-income tenants and shoppers, ensuring a high occupancy rate and premium rental income.

$$ \begin{array}{l|l} \textbf{Description} & \textbf{Details} \\ \hline \text{Total Residential Units} & {800 \text{ units}} \\ \hline \text{Average Unit Size} & {900 \text{ ft}^2} \\ \hline \text{Commercial Space} & {50,000 \text{ ft}^2} \\ \hline \text{Retail Space} & {30,000 \text{ ft}^2} \\ \hline { \text{Estimated Monthly} \\ \text{Rent} } & { {\text{Residential: MYR}3.50 \text{ per ft}^2} \\ {\text{Commercial: MYR}5.00 \text{ per ft}^2} \\ {\text{Retail: MYR}7.00 \text{ per ft}^2} } \\ \hline \text{Occupancy Rate} & { {\text{Residential: }90\%} \\ { \text{Commercial: } 85\%} \\ { \text{Retail: } 80\% } } \\ \hline \text{Operating Expenses} & {25\% \text{ of gross rent}} \\ \hline \text{Cost Details} & { { \text{Land: MYR}20,000,000} \\ {\text{Construction: MYR}150,000 \text{ per residential unit} } \\ {\text{Commercial and Retail Build-out: MYR}15,000,000} } \end{array} $$

The Riverside Plaza project consists of residential, commercial, and retail spaces, strategically leveraging the scenic river views. The project’s Net Operating Income (NOI) upon completion can be calculated as.

The NOI is calculated as follows:

$$ \begin{align*} \text{Annual Gross Rent (Residential)} & = 800 \times 900 \times \text{MYR} 3.50 \times 12 \times 90\% \\ & = \text{MYR} 27,216,000 \\ \text{Annual Gross Rent (Commercial)} & = 50,000 \times \text{MYR} 5.00 \times 12 \times 85\% \\ & =\text{MYR} 2,550,000 \\ \text{Annual Gross Rent (Retail)} & = 30,000 \times \text{MYR} 7.00 \times 12 \times 80\% \\ & = \text{MYR} 2,016,000 \\ \text{Total Annual Gross Rent} & = \text{Annual Gross Rent (Residential)} \\ & + \text{Annual Gross Rent (Commercial)} \\ & + \text{Annual Gross Rent (Retail)} \\ & = \text{MYR} 31,782,000 \\ \text{Operating Expenses} & = \text{Total Annual Gross Rent} \times 25\% \\ & = \text{MYR} 7,945,500 \end{align*} \\ \text{NOI} = \text{Total Annual Gross Rent} – \text{Operating Expenses} = \text{MYR} 23,836,500 $$

The computed NOI of MYR 23,836,500 for the Riverside Plaza project reflects the income generated from its operations, providing insights into its profitability and efficiency upon completion.

The total project cost is calculated by summing up the costs of land acquisition, construction of residential units, and commercial and retail build-out expenses.

The project return is determined by the formula:

$$ \text{Project Return} = \left( \frac{\text{NOI}}{\text{Project Cost}} \right) \times 100\% = \frac{\text{MYR} 23,836,500}{\text{MYR} 155,000,000} = 15.38\%$$

This return indicates the profitability and efficiency of the investment in the Riverside Plaza project, providing a key metric for investors to assess the project’s financial viability.

Land acquisition is a critical step in property development, involving the purchase of land usually through a mix of equity and debt, with the debt often secured against the property itself.

Ensuring the land is free of liens or tax obligations is crucial to avoid obstacles during the development process. For example, developers might secure a loan with the land as collateral to clear financial encumbrances.

Before starting construction, developers must obtain project plan approvals, including necessary building permits and zoning exemptions or amendments, to ensure compliance with local regulations.

An option agreement is a strategy used by buyers to secure the right to purchase a property at a set price within a specific period, allowing time to resolve any issues or secure approvals without the obligation to buy immediately.

Investing in and operating an existing property as a strategy can provide immediate income with plans for future renovation and value enhancement, such as purchasing an apartment building to collect rent before eventual renovation.

The construction phase presents higher execution risks than property operation, due to potential delays and disruptions.

Examples of construction delays include labor disputes (e.g., 2007 Broadway Stagehand Strike), supply chain disruptions (e.g., 2020 global semiconductor shortage), and adverse weather conditions (e.g., 2012 Superstorm Sandy).

Market price volatility, such as sudden increases in steel prices, can lead to cost overruns, affecting the overall budget of construction projects.

Changes in market dynamics during construction delays can impact future income assumptions, potentially leading to financial losses if a project is sold for less than its total incurred costs.

It is crucial to manage and mitigate risks during the construction phase to ensure project completion and avoid financial losses.

This phase is characterized by increased risks as the project nears completion, mainly due to the need to balance rising costs against expected rental income. Projects can be designed for specific tenants or for multiple commercial or residential tenants, affecting the approach towards leasing and risk management. Developers employ pre-leasing of undeveloped or unfinished spaces as a risk mitigation strategy, often combined with incentives to attract tenants. Examples of incentives include reduced rent or free amenities for a period in exchange for lease commitments, aiming to reduce vacancy risks and secure early income. Pre-leasing helps in creating a buzz, ensuring exclusivity, attracting more tenants, and providing a steady income stream to offset development costs. Careful planning and strategic decisions are required to balance costs with rental income, making pre-leasing a key strategy in mitigating risks during this phase.

Marks the transition to lower property risk with the establishment of long-term tenant commitments.

REITs often buy and hold income-producing properties during this phase, while private investors may have varying roles, such as speculative development or indefinite operation.

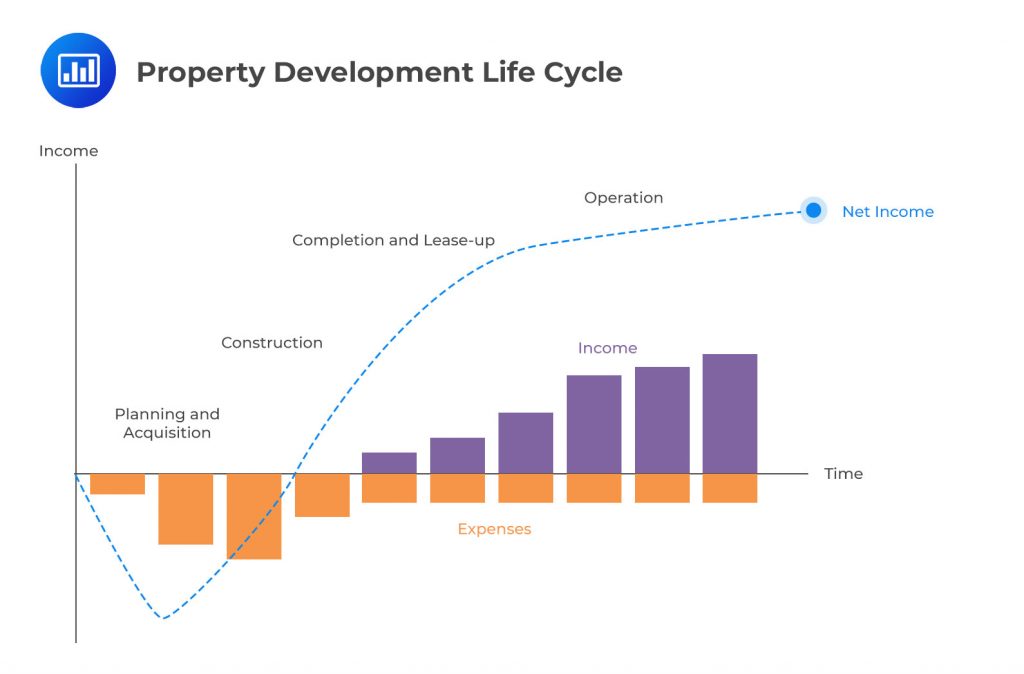

Timing: The need for capital varies, increasing from site purchase through construction and completion.

Type of Funding: Different loans are used at different stages, with acquisition and development loans for land preparation and construction loans for building. For instance, an acquisition and development loan (ADL) may be used to purchase and prepare land for a specific construction use, while a construction and development loan is outstanding during the building phase. ADLs and construction and development (C&D) loans disbursed over time typically accrue interest over the period of negative cash flow and are later replaced by a long-term mortgage loan. Equity may also be drawn down over time as a project meets certain milestones.

Debt and equity capital may be drawn down over time, often replaced by long-term mortgage loans upon reaching certain milestones.

The Loan-to-Value ratio (LTV) is calculated as:

$$LTV = \frac{\text{Debt outstanding}}{\text{Current property value}}$$

The Debt Service Coverage ratio (DSC) is calculated as:

$$DSC = \frac{NOI}{\text{Debt service}}$$

A lower LTV and a higher DSC indicate greater creditworthiness. Real estate lenders often target an LTV of 0.8 or lower, whereas a DSC of 2x or greater is generally considered strong, with a minimum target of 1.2x to 1.4x. Equity investors, on the other hand, evaluate before-tax returns using actual or expected Net Operating Income (NOI) less debt service using an equity dividend rate.

Equity investors assess before-tax returns based on Net Operating Income (NOI) less debt service using an equity dividend rate which is calculated as:

$$\text{Equity dividend rate} = \frac{\text{Before-tax cash flow}}{\text{Property purchase price} – \text{Debt outstanding}}$$.

Where Before-tax cash flow is calculated as:

$$\text{Before-tax cash flow} = NOI – \text{Debt service}$$

Construction and development loans (C&D) carry a higher interest rate than mortgage loans due to greater default risk during construction.

Delays, disruptions, and changing market conditions pose significant execution risks.

A forced sale before completion can lead to financial losses, highlighting the speculative nature of these investments without upfront mortgage commitments.

Repayment of C&D loans relies on project completion and securing permanent financing, while positive rental cash flows and future project income are crucial for equity returns.

Practice Questions

Question 1: Consider an investor who is looking to diversify their portfolio and is considering private real estate debt and equity investments. They are aware that these types of investments have certain unique characteristics and challenges. In the context of private real estate debt and equity investments, which of the following statements is most accurate?

- These investments do not offer any distinctive risk and return features and hence do not play a significant role in strategic asset allocation.

- These investments do not present any unique due diligence and valuation challenges as they are similar to other types of investments.

- These investments have specific characteristics derived from the economic value they can generate and present unique due diligence and valuation challenges.

Answer: Choice C is correct.

Private real estate debt and equity investments indeed have specific characteristics derived from the economic value they can generate and present unique due diligence and valuation challenges. These investments are typically illiquid, have long investment horizons, and are subject to unique risks such as property market fluctuations, regulatory changes, and environmental risks. The due diligence process for these investments is complex and requires a deep understanding of the real estate market, the property’s condition, and the borrower’s or developer’s financial situation. The valuation of these investments is also challenging due to the lack of comparable transactions, the unique characteristics of each property, and the need to forecast future cash flows and property values. Therefore, these investments can play a significant role in strategic asset allocation due to their potential for high returns and diversification benefits, but they also require a high level of expertise and due diligence.

Choice A is incorrect. Private real estate debt and equity investments do offer distinctive risk and return features. They can provide diversification benefits, potential for high returns, and a hedge against inflation. Therefore, they can play a significant role in strategic asset allocation.

Choice B is incorrect. Private real estate debt and equity investments do present unique due diligence and valuation challenges. They are not similar to other types of investments due to their illiquidity, long investment horizons, and unique risks. The due diligence and valuation processes for these investments are complex and require a deep understanding of the real estate market and the specific property.

Question 2: An investor is planning to buy a property with the intention of generating income from it while planning for future development. Which strategy would be most suitable for the investor in this scenario?

- Entering into an option agreement

- Acquiring the land through a combination of equity and debt, secured by the property itself

- Buying and operating an existing property with the intention of renovating it in the future

Answer: Choice B is correct.

Acquiring the land through a combination of equity and debt, secured by the property itself, is the most suitable strategy for an investor planning to buy a property with the intention of generating income from it while planning for future development. This strategy allows the investor to leverage their investment, increasing the potential return on equity. The property itself serves as collateral for the debt, reducing the risk for the lender and potentially allowing for more favorable loan terms. This strategy also provides the investor with the flexibility to develop the property in the future, as they have full ownership of the land. Furthermore, the income generated from the property can be used to service the debt, making this a potentially self-sustaining investment strategy.

Choice A is incorrect. Entering into an option agreement would give the investor the right, but not the obligation, to purchase the property at a later date. While this could potentially be a part of a broader investment strategy, it does not directly address the investor’s goal of generating income from the property in the near term.

Choice C is incorrect. Buying and operating an existing property with the intention of renovating it in the future could potentially generate income, but it does not necessarily align with the investor’s goal of planning for future development. Renovating an existing property can be a complex and costly process, and it may not provide the same level of flexibility or potential return as acquiring land for future development.

Glossary:

Private Markets Pathway Volume 2: Learning Module 6: Private Real Estate Investments; LOS 6(a): Discuss important private real estate investment features

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.