Role and Framework of Capital Market E ...

Capital market expectations involve setting likely risk and return parameters for a portfolio.... Read More

Portfolio construction combines investment philosophy with its technical implementation. This process is guided by a manager’s beliefs about adding value using key elements:

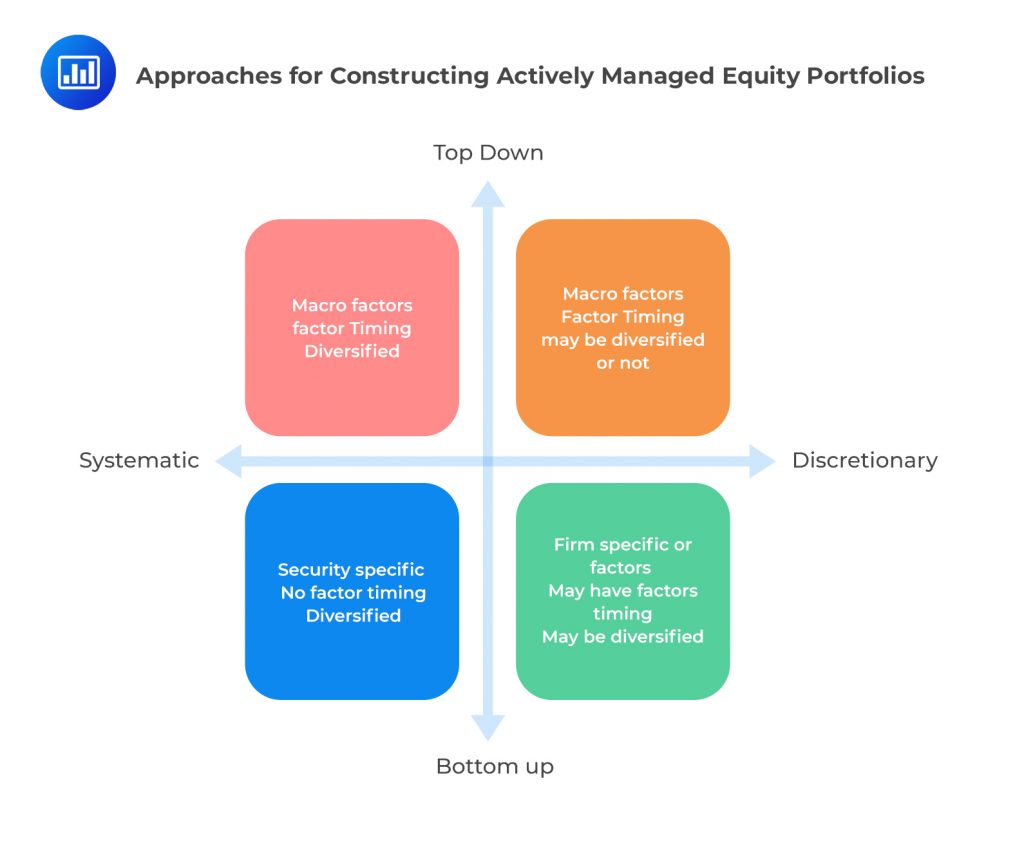

The manager’s portfolio construction process should mirror her beliefs about the nature of her skills in these areas. Investment approaches can generally be categorized as either systematic or discretionary, and bottom-up or top-down. These approaches can also vary in the extent to which they are benchmark aware versus benchmark agnostic.

Each manager’s investment approach is implemented within a framework that specifies the acceptable levels of active risk and Active Share relative to a clearly articulated benchmark. Active Share is a measure of how similar a portfolio is to its benchmark. A manager may emphasize these dimensions to varying degrees as he attempts to differentiate his portfolio from the benchmark.

This continuum represents the extent to which a manager relies on a systematic (rules-based) approach versus a discretionary (judgment-based) approach. For instance, a systematic approach might involve using a predefined algorithm to decide on investments, akin to how robo-advisors operate. Conversely, a discretionary approach might involve a manager using their expertise and judgment, similar to Warren Buffet’s investment strategy.

This continuum represents the degree of active versus passive management of the portfolio. Active management, like that practiced by George Soros, involves frequent portfolio adjustments in response to market conditions. In contrast, passive management, as exemplified by Vanguard’s index funds, involves fewer changes and typically follows a benchmark index.

This continuum represents the extent to which a manager uses internal resources (like in-house research) versus external resources (like third-party research) in managing the portfolio. For example, a firm like BlackRock might rely heavily on its internal research team, while a smaller investment firm might utilize external research services.

Investment processes are crucial in the world of finance, and they can be broadly categorized into two types: Systematic and Discretionary. Both have their unique characteristics and methodologies, and are used based on the investor’s preference and investment goals.

Systematic investment strategies are designed around the construction of portfolios that aim to extract return premiums from a balanced exposure to known, rewarded factors. For example, a systematic strategy might involve investing in a broad range of stocks in the S&P 500 index to minimize idiosyncratic risk. The strategies are adaptable to a formal portfolio optimization process, where the manager must carefully consider the parameters of that optimization, such as maximizing the Sharpe ratio or minimizing volatility.

Discretionary investment strategies, on the other hand, involve a greater depth of understanding of a firm’s governance, business model, and competitive landscape. For instance, a discretionary manager might focus on a few select tech companies, using her judgment to evaluate the relative importance of this information and assign appropriate weights to each security. These strategies are generally more concentrated portfolios, reflecting the depth of the manager’s insights on company characteristics and the competitive landscape.

Investment strategies are typically divided into two main categories: top-down and bottom-up. The top-down approach starts with a comprehensive understanding of the global geopolitical, economic, financial, social, and public policy environment. For instance, an investment manager might predict that tech companies like Apple will outperform traditional manufacturing companies like Ford, based on the current economic climate and then adjust their portfolio to reflect these views.

Conversely, a bottom-up approach begins with the assessment of the risk and return characteristics of individual securities. For example, an investment manager might expect Amazon to outperform Walmart, Pfizer to outperform Johnson & Johnson, and Samsung to outperform Sony, and construct a portfolio based on these specific stock forecasts.

Both strategies rely on returns from factors. However, top-down managers tend to focus on macro factors, while bottom-up managers emphasize security-specific factors. A top-down investment process contains an important element of factor timing. For instance, a manager might shift the portfolio to capture returns from rewarded or unrewarded factors, such as country, sectors, and styles, based on the current geopolitical climate.

Bottom-up managers may adopt styles such as Value, Growth at Reasonable Price, Momentum, and Quality. These strategies are often built around documented rewarded factors. Both a bottom-up stock picker and a top-down sector rotator can run concentrated portfolios. Both a bottom-up value manager and a top-down risk allocator can run diversified portfolios. Some managers will incorporate elements of both top-down and bottom-up investment approaches.

Strategy implementation is a critical aspect of management, involving the use of various building blocks or fundamental elements. These include resources, processes, and organizational structure. The choice of implementation strategy can significantly influence the emphasis on these building blocks.

For instance, a company like Apple, focusing on innovation, might prioritize resources and processes, investing heavily in research and development. Conversely, a company like Walmart, focusing on cost reduction, might emphasize organizational structure, streamlining operations for efficiency.

Practice Questions

Question 1: A portfolio manager is in the process of constructing a new investment portfolio. She is considering various aspects such as factor exposures, timing, position sizing, and the breadth or depth of her expertise. She is also contemplating whether to adopt a systematic or discretionary approach, and whether to be benchmark aware or benchmark agnostic. What does the term ‘Active Share’ refer to in the portfolio construction process?

- The proportion of the portfolio invested in shares.

- A measure of how similar a portfolio is to its benchmark.

- The active trading strategy of the portfolio manager.

Answer: Choice B is correct.

Active Share is a measure of how different a portfolio is from its benchmark. It is a statistical measure that quantifies the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. Active Share is calculated by taking the sum of the absolute differences of the weight of each holding in the fund’s portfolio and the weight of each holding in the benchmark index, and dividing by two. A high Active Share indicates a high degree of differentiation from the benchmark, while a low Active Share indicates a high degree of similarity to the benchmark. This measure is used by portfolio managers to assess the potential for outperformance or underperformance relative to the benchmark. It is also used by investors to understand the degree of active management being employed by the portfolio manager.

Choice A is incorrect. The proportion of the portfolio invested in shares is not what is referred to as Active Share in the portfolio construction process. This is a simple measure of the allocation of the portfolio’s assets, not a measure of how different the portfolio is from its benchmark.

Choice C is incorrect. The active trading strategy of the portfolio manager is not what is referred to as Active Share. While the trading strategy may influence the Active Share, it is not the same thing. The trading strategy refers to the approach the manager uses to select and trade securities, while Active Share is a measure of how different the portfolio is from its benchmark.

Question 2: A portfolio manager is considering her skill in generating alpha through the timing of portfolio exposures to rewarded and unrewarded factors. What does ‘alpha’ refer to in the portfolio construction process?

- The manager’s ability to outperform the market or benchmark.

- The manager’s ability to minimize risk in the portfolio.

- The manager’s ability to maximize the portfolio’s return on investment.

Answer: Choice A is correct.

Alpha, in the context of portfolio construction, refers to the manager’s ability to outperform the market or benchmark. It is a measure of the active return on an investment, gauging the performance of an investment against a market index or other benchmark which it is expected to mirror. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or other benchmark which it is expected to mirror. Investors use alpha to measure a portfolio manager’s performance, to see how much value the manager adds, or subtracts, from a fund’s return. A positive alpha of 1.0 means the fund has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha would indicate an underperformance of 1%. Therefore, alpha is a measure of the manager’s skill in generating returns that are not attributable to the general movement of the market.

Choice B is incorrect. While minimizing risk is an important aspect of portfolio management, it is not what is referred to as ‘alpha’ in the portfolio construction process. Minimizing risk is more closely associated with the concept of ‘beta’, which measures the volatility of an investment in relation to the market as a whole.

Choice C is incorrect. Maximizing the portfolio’s return on investment is a goal of portfolio management, but it is not what is referred to as ‘alpha’. Alpha specifically refers to the excess return or value added by the manager’s skill in selecting and timing investments, over and above the return that could be expected given the portfolio’s exposure to systematic risk (as measured by beta).

Portfolio Management Pathway Volume 1: Learning Module 3: Active Equity Investing: Portfolio Construction;LOS 3(b): Discuss approaches for constructing actively managed equity portfolios

Master CFA Level III Portfolio Management with exam-style item sets, QBank drills, and full mock exams designed to sharpen your portfolio construction and asset allocation decisions under exam conditions.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.