Forecasting Fixed-income Returns

To inform the asset allocation process and adequately set client expectations, analysts must... Read More

The section on currency management will start with a concise review of foundational concepts. Subsequently, it will assume that the candidate possesses a strong understanding of these concepts throughout the rest of the section.

\( \textbf{Note: This reading uses the “P/B” convention to express exchange rates.} \)

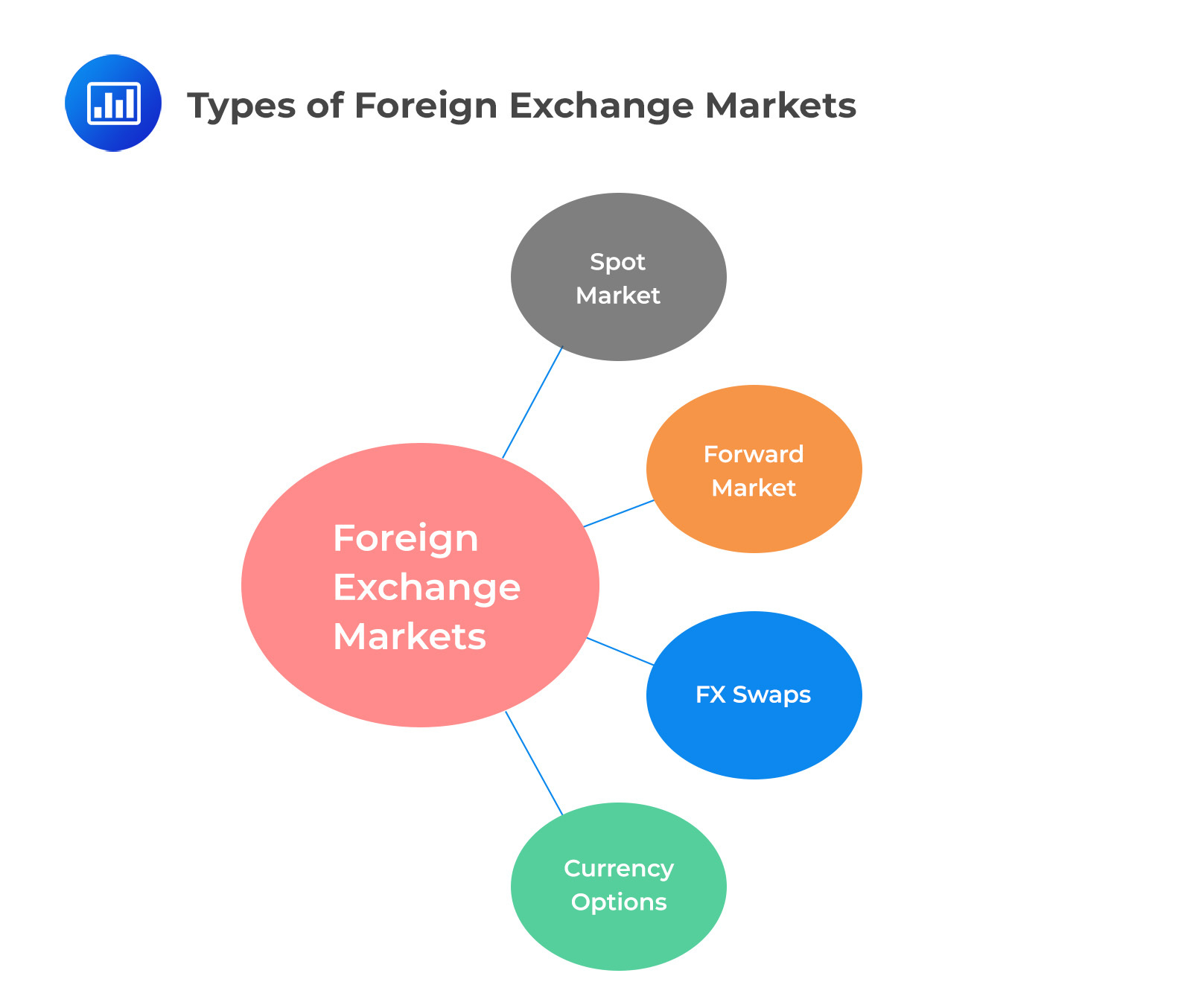

The spot market in currency exchange involves immediate transactions at current market rates. It contrasts with forward markets, where future trades are agreed upon in the present. Spot markets are more intuitive and are often what investors think of when exchanging foreign currency (like exchanging currency at an airport in a new country).

Currency exchange rates are quoted as the price of one unit of the base currency, expressed in terms of another currency (the price currency). The following are the naming conventions for some of the most frequently traded currencies worldwide:

$$ \begin{array}{c|c} \textbf{Symbol} & \textbf{Country} \\ \hline \text{USD} & \text{US Dollar} \\ \hline \text{EUR} & \text{Euro} \\ \hline \text{GBP} & \text{Great British Pound} \\ \hline \text{JPY} & \text{Japanese Yen} \\ \hline \text{MXN} & \text{Mexican Peso} \\ \hline \text{CNY} & \text{Chinese Yuan} \end{array} $$

One crucial convention to remember is that the base currency is always the currency being transacted upon. When selling a currency pair, the base currency is in the denominator. Conversely, the base currency is also in the denominator when buying a currency pair.

For example:

The currency quote $1.2451/GBP means “one Great British Pound equals 1.2451 US dollars.” In other words, you would need to pay $1.2451 to purchase one GBP.

Bid/Ask

Aside from the pairing convention, most quotes in the spot market also contain a bid and an asking price. The bid is the price at which the market maker will buy. The ask is the price at which the counterparty will sell.

Bid/Ask Table:

$$ \begin{array}{c|c|c} \textbf{Quote} & \textbf{Bank} & \textbf{Investor} \\ \hline \text{Bid} & \text{Buys base} & \text{Sells base} \\ \hline \text{Ask} & \text{Sells base} & \text{Buys base} \end{array} $$

Where:

Bank – the market maker, the counterparty that earns the bid and asks spread, the side of the trade offering liquidity.

Investor – not the market maker, the side that pays the bid and ask spread, the side of the trade using liquidity.

Forward markets involve agreeing to lock in a price for a transaction that will take place on a specific future date. This allows participants to mitigate the risk of price fluctuations and uncertainties in the future. A forward quote can be expressed in forward points in forward markets, which adjust the spot quote. The forward price is obtained by adding or subtracting the forward points from the spot price, depending on whether it’s a premium or discount. To convert forward points to a more manageable format, they are usually divided by 10,000, making it easier to work with the figures. This division allows traders and investors to understand better the impact of the forward points on the overall transaction pricing.

Example

$$ \begin{array}{c|c|c|c|c} {\textbf{GBP/USD}} & {\textbf{Spot} } & {\textbf{Forward}} & {\textbf{Adjusted} } & \textbf{Forward} \\ & \textbf{Price} & \textbf{Points} & \textbf{Points} & \textbf{Price} \\ \hline \text{Bid Price} & 1.2451 & -6.6 & -0.00066 & 1.24444 \\ \hline \text{Ask Price} & 1.2511 & -5.1 & -0.00051 & 1.25059 \end{array} $$

In the context of the GBP/USD currency pair:

The market participant can enter a 1-month forward contract to buy GBP at a discount (1.24444) or sell GBP at a premium (1.25059) compared to the current spot price.

The mark to market of a forward position is the cash flow value at contract expiry, discounted by the appropriate rate to determine its present value.

An FX swap is a financial instrument that involves two currency exchange transactions – a spot transaction and a forward transaction. It allows two parties to exchange currencies at the outset and then reverse the exchange at a later date.

For example, let’s consider a EUR/USD FX swap between Counterparty 1 and Counterparty 2:

The key feature of FX swaps is that the two transactions are agreed upon simultaneously but settled on different dates. The primary purpose of FX swaps is to manage currency exposure, especially for companies conducting international business and needing to hedge against foreign exchange rate fluctuations.

It’s essential to note that the above explanation reflects the general mechanics of FX swaps. Still, the specific terms and conditions may vary based on the agreements between the parties involved.

$$ \begin{array}{c|c|c} \textbf{Type of Transaction} & {\textbf{Exchange principal} } & {\textbf{Interim Interest} } \\ & \textbf{amount at initiation} & \textbf{Payments} \\ \hline \text{Currency swap} & \text{Yes} & \text{Yes} \\ \hline \text{FX Swap} & \text{Yes} & \text{No} \end{array} $$

FX swaps contain two legs: the initial purchase and the final sale. These are often equal, in which case they are said to be matched. If one leg of the trade is more significant, they are mismatched.

Currency options offer investors an additional method to manage currency risk. Nevertheless, they make up a small percentage of the overall daily volume in foreign exchange markets. These options function like equity options but often include many exotic option. Exotic options differ from standard European or American options and may have features such as floating strike prices based on moving averages (Asian options) or other complexities.

Understanding the returns from a foreign exchange transaction involves two key components. Firstly, it’s converting one currency to another to utilize that currency for some purpose. The exchange rates between the two currencies may change during the transaction period, resulting in a return from exchange rate movements.

Secondly, the total return also comprises the return from the actual use of the currency, typically involving interest earned while holding the currency as a deposit. The formula to calculate the total return on domestic currency is:

$$ \text{Total Return on domestic currency} = (1+R_{FC})\times (1+R_{FX}) – 1 $$

Where:

\(R_{FC}\) = Return on the foreign currency.

\(R_{FX}\) = Return due to exchange rates.

Put simply, investors need to consider two factors when dealing with foreign currency: the productivity of the new currency acquired through the exchange and the changes in its value compared to their domestic currency during the holding period. Both aspects are crucial in evaluating the overall performance of the foreign exchange transaction.

Risk decomposition works in the same way as return decomposition for foreign currency exchange. There is virtually no difference for small terms; you can use the same equation.

$$ \text{Total Return on domestic currency} = (1+R_{FC}) \times (1+R_{FX}) – 1 $$

Where:

\(R_{FC}\) = Return on the foreign currency.

\(R_{FX}\) = Return due to exchange rates.

To calculate a more precise figure, especially when the two returns are significant, it’s essential to consider the correlation between the currency pair. The mathematical basis for foreign currency risk and return decomposition follows standard portfolio return decomposition. When the correlation is a perfect +1, the FX pair standard deviations’ decomposition equals the simple weighted average of the two currency standard deviations. With a correlation less than +1, there will be a diversification benefit. While candidates can use a weighted average to approximate the pair’s risk in terms of standard deviation, it may slightly overstate the actual risk. It should only serve as a starting point for a reasonable estimate.

$$ \sigma^2 (R_{DC}) \approx \sigma^2 (R_{FC}) + \sigma^2 (R_{FX}) + 2\sigma (R_{FC})\sigma (R_{FX}) \rho (R_{FC}, R_{FX}) $$

Where:

\(\sigma^2 (R_{DC})\) = Variance of the domestic currency.

\(R_{FC}\) = Return on the foreign currency.

\(R_{FX}\) = Return due to exchange rates.

\(\rho(R_{FC}, R_{FX})\) = Correlation of currency returns.

Question

What is the expected return for an Australian investor holding a US asset?

$$ \begin{array}{c|cc|cc} & \underline{\textbf{AUD}} & & & \underline{\textbf{USD}} & \\ \hline & \text{Today} & \text{Expected} & & \text{Today} & \text{Expected} \\ \hline \textbf{Asset Price} & 100.69 & 101.50 & & 101.00 & 99.60 \\ \hline \textbf{USD/AUD} & 1.2900 & 1.3100 & & & \end{array} $$

- -2.892%.

- 0.25%.

- 6.3%.

Solution

The correct answer is A.

Step one:

$$ \left(\frac {99.6}{101} \right) – 1 = -0.01386 = \text{Return of the foreign currency} $$

Step two:

$$ \left(\frac {\left(\frac {1}{1.31} \right)}{\left(\frac {1}{1.2900} \right)} \right) – 1 = -0.01527 = \text{Return on currency exchange rate} $$

Step three:

$$ \text{Together they make }(0.98614 \times 0.98473) = -0.02892 \text{ or } -2.892\% $$

In the second step, converting the bid/ask price from a base AUD to a base USD quote is crucial. This is necessary because we treat AUD as this investor’s domestic currency. Therefore, their own currency (AUD) should appear in the numerator since the initial investment was made in USD after the conversion. This concept is consistently applicable in currency investment calculations.

Return calculations can only be made when a currency is the base currency.

A and B are incorrect. They both overestimate the expected returns.

Reading 3: Currency Management: An Introduction

Los 3 (a) Analyze the effects of currency movements on portfolio risk and return

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.