Liquidity Management

Liquidity In the field of finance, liquidity is a term that refers to... Read More

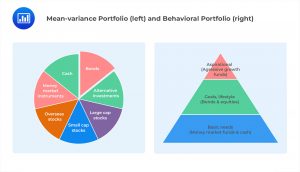

Behavioral portfolios differ from traditional mean-variance portfolios. Rather than seek the optimal combination of assets that produces the highest risk-adjusted returns and utility to the investor, behavioral portfolios are generally structured in layers. Even though these portfolios are not technically optimal, they can be useful in constructing portfolios that:

Portfolio layers are based upon the bias of mental accounting, and they do not achieve economically optimal portfolios. The inspiration behind portfolio layers is the need to build a portfolio that is separated by aspirations. A pyramid is often used to represent the process. The following diagram compares a mean-variance portfolio (left) with a behavioral portfolio (right).

Question

Which of the following assets would most appropriately be placed in the aspirational layer of a behavioral portfolio?

- Venture capital seed fund.

- Off-the-run treasury bills.

- Consumer staples ETF.

Solution

The correct answer is A:

The aspirational layer represents the loftiest goals and dreams of a client. An example might be to set up a charitable foundation in the investor’s name. While exciting and high-minded, this goal likely comes after the client meets their basic needs, such as shelter and food, and more common mid-range goals, such as sending children to college or retiring comfortably.

Since it is less important, this layer should contain the riskiest assets, which are also likely to produce the highest returns.

B and C are incorrect: Defensive stocks (Consumer staples ETF) and treasury bills are more conservative investments than venture capital funds.

Reading 2: Behavioral Finance and Investment Processes

Los 2 (d) Explain how behavioral finance can be applied to the process of portfolio construction

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.