FCFF and FCFE Valuation Approaches

Present Value of FCFF The free cash flow to the firm (FCFF)... Read More

The following results are obtained from regressing the price of the US Dollar Index (USDX) on inflation rates and real interest rates.

$$\small{\begin{array}{l|c}\textbf{Regression Statistics}\\ \hline\text{Multiple R} & 0.8264\\ \hline\text{R Square} & 0.6830\\ \hline\text{Adjusted R Square} & 0.5924\\ \hline\text{Standard Error} & 5.3537\\ \hline\text{Observations} & 10\\ \end{array}}$$

$$\small{\begin{array}{l|l|l|l|l}{}& \textbf{Coefficients} & \textbf{Standard Error} & \textbf{t Stat} & \textbf{P-value}\\ \hline\text{Intercept} & 81 & 7.9659 & 10.1296 & 0.0000\\ \hline\text{Inflation rates} & -276 & 233.0748 & -1.1833 & 0.2753\\ \hline\text{Real interest Rates} & 902 & 279.6949 & 3.2266 & 0.0145\\ \end{array}}$$

Test the null hypothesis that the inflation rate is equal to 0 against the alternative hypothesis that it is not equal to 0 at the 5% significance level and interpret the results

We are testing the hypothesis:

\(H_{o}:b_1=0\) vs. \(H_1:b_1≠0\)

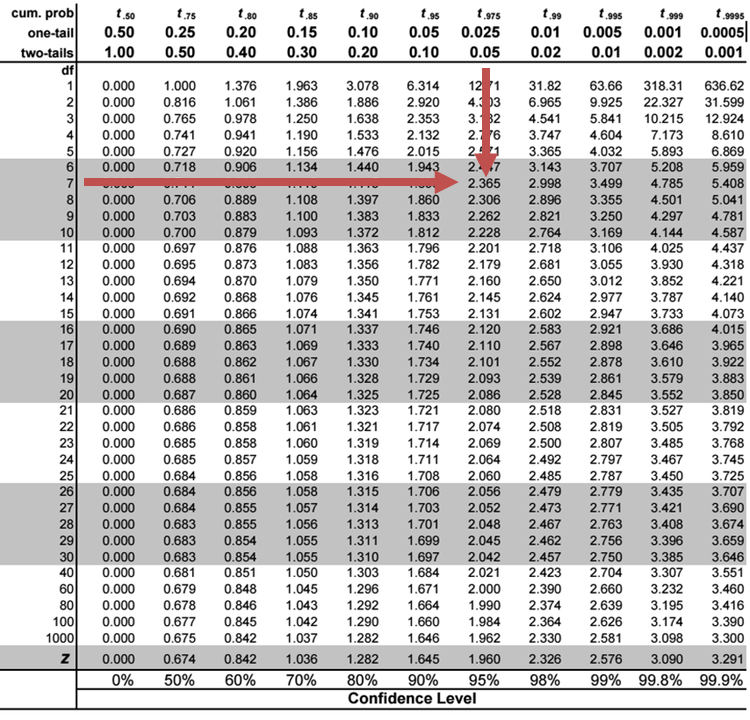

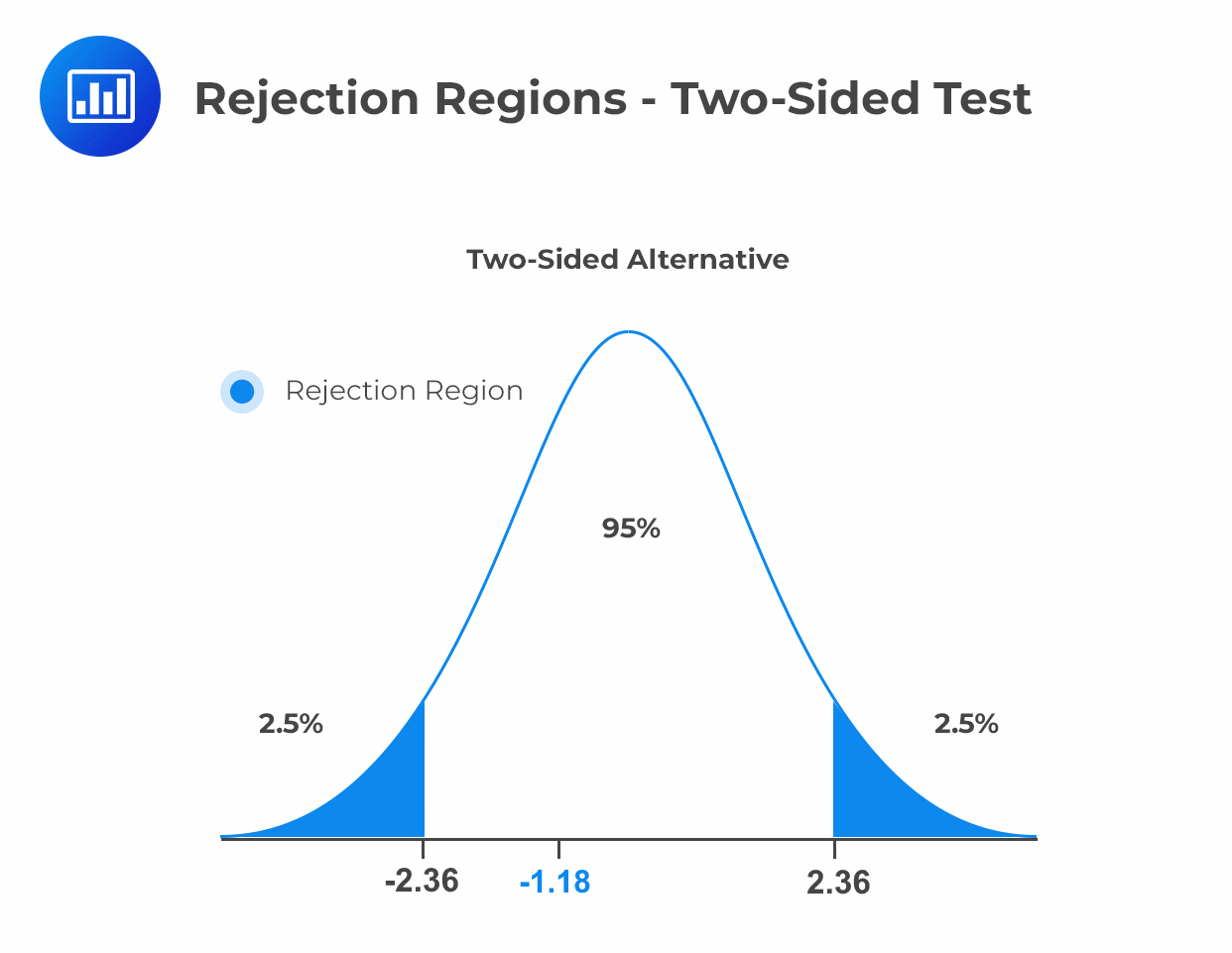

The 5% two-tailed critical t-value with \(10 – 2 – 1 = 7\) degrees of freedom is 2.365

The null hypothesis is rejected if the t-statistic is either greater than 2.365 or smaller than –2.365 (the critical value).

$$t=\frac{\widehat{b_{j}}-b_{H0}}{S_{\widehat{b_{j}}}}$$

$$\begin{align*}t&=\frac{-276-0}{233.0748}&\\&=-1.18\end{align*}$$

The t-statistic of -1.18 is between the upper and lower critical t-values of –2.3646 and 2.3646. We cannot reject the null hypothesis and must conclude that the inflation rate regression coefficient is NOT statistically significantly different from 0 at the 5% significance level.

Reading 2: Multiple Regression

Reading 2: Multiple Regression

LOS 2 (d) Interpret the results of hypothesis tests of regression coefficients