Explain the Types of Heteroskedasticit ...

One of the assumptions underpinning multiple regression is that regression errors are homoscedastic.... Read More

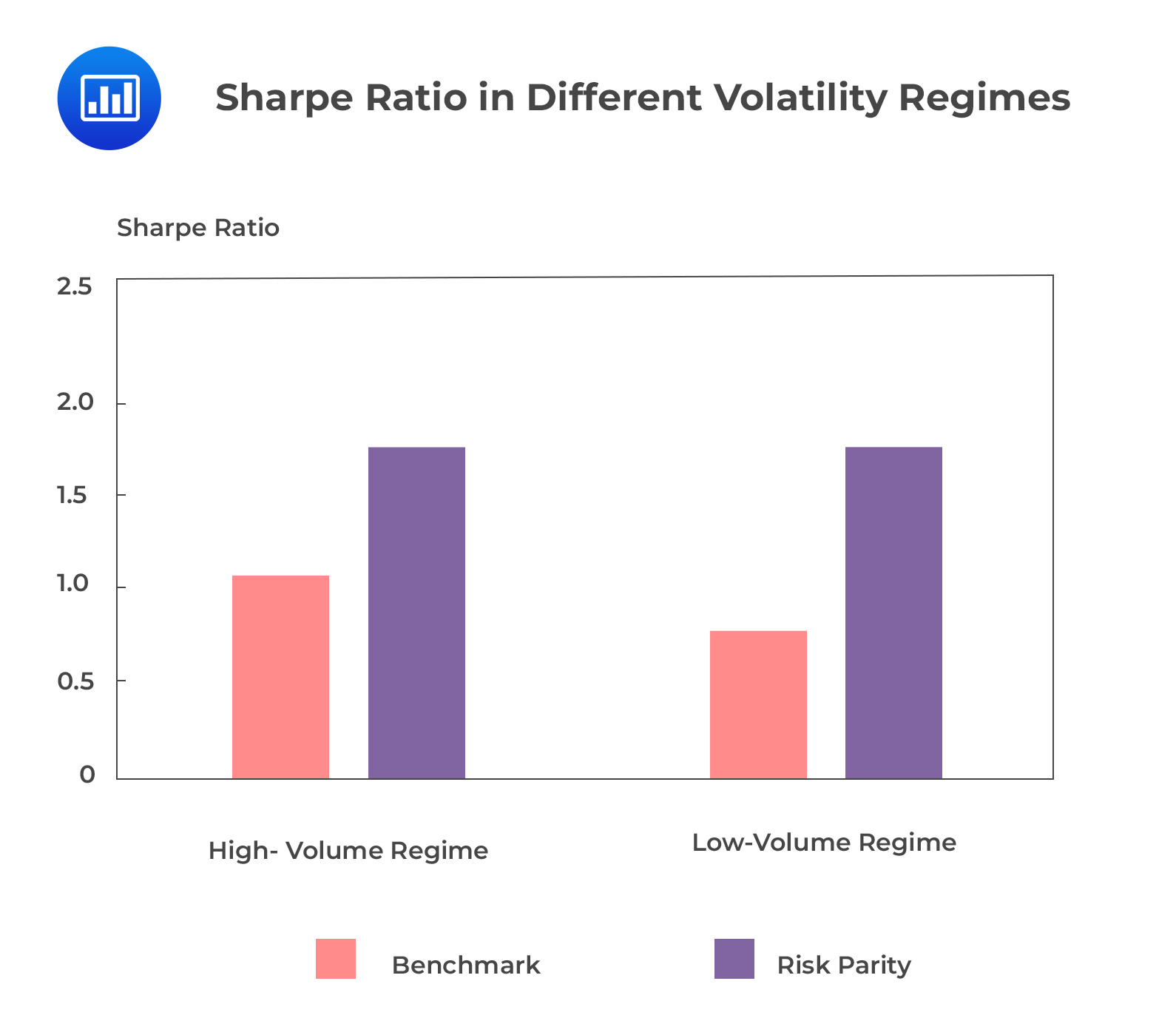

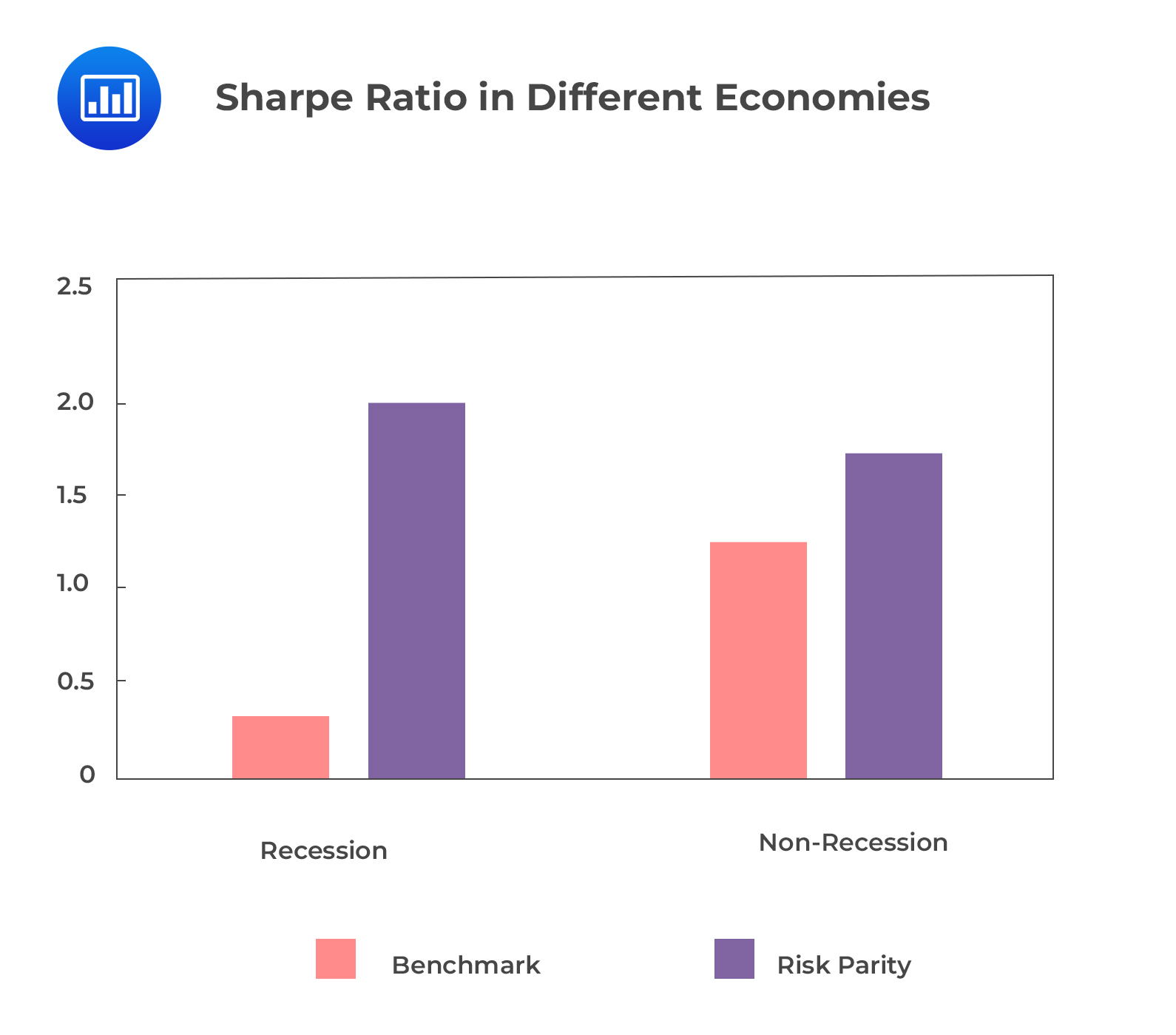

Historical scenario analysis is a form of backtesting that examines the risk and performance of an investment strategy at different structural breaks and structural regimes. The most common types of regime changes are from economic expansion to recessions and from high-volatility to low-volatility.

These two regimes can examine the risk parity and benchmark portfolio:

Question

Mark Jayden conducted a historical scenario analysis to examine the effect of regime changes on his portfolio. He observed that the portfolio had negative skewness and a fat tail to the left in a recession regime. Which of the following is the conclusion that Jayden will most likely make about the his portfolio?

- Lower average returns.

- Higher average returns.

- Cannot be determined.

Solution

The correct answer is A.

Excess kurtosis and negative skewness indicate lower average returns in a recession regime.

B is incorrect. Low kurtosis and positive skewness indicate a higher average return in a recession regime.

C is incorrect. It can be determined that excess kurtosis and negative skewness indicate lower average returns.

Reading 42: Backtesting and Simulation

LOS 42 (e) Evaluate and interpret a historical scenario analysis.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.