Beta Estimation

Beta Estimation for a Public Company For public companies, beta is estimated through... Read More

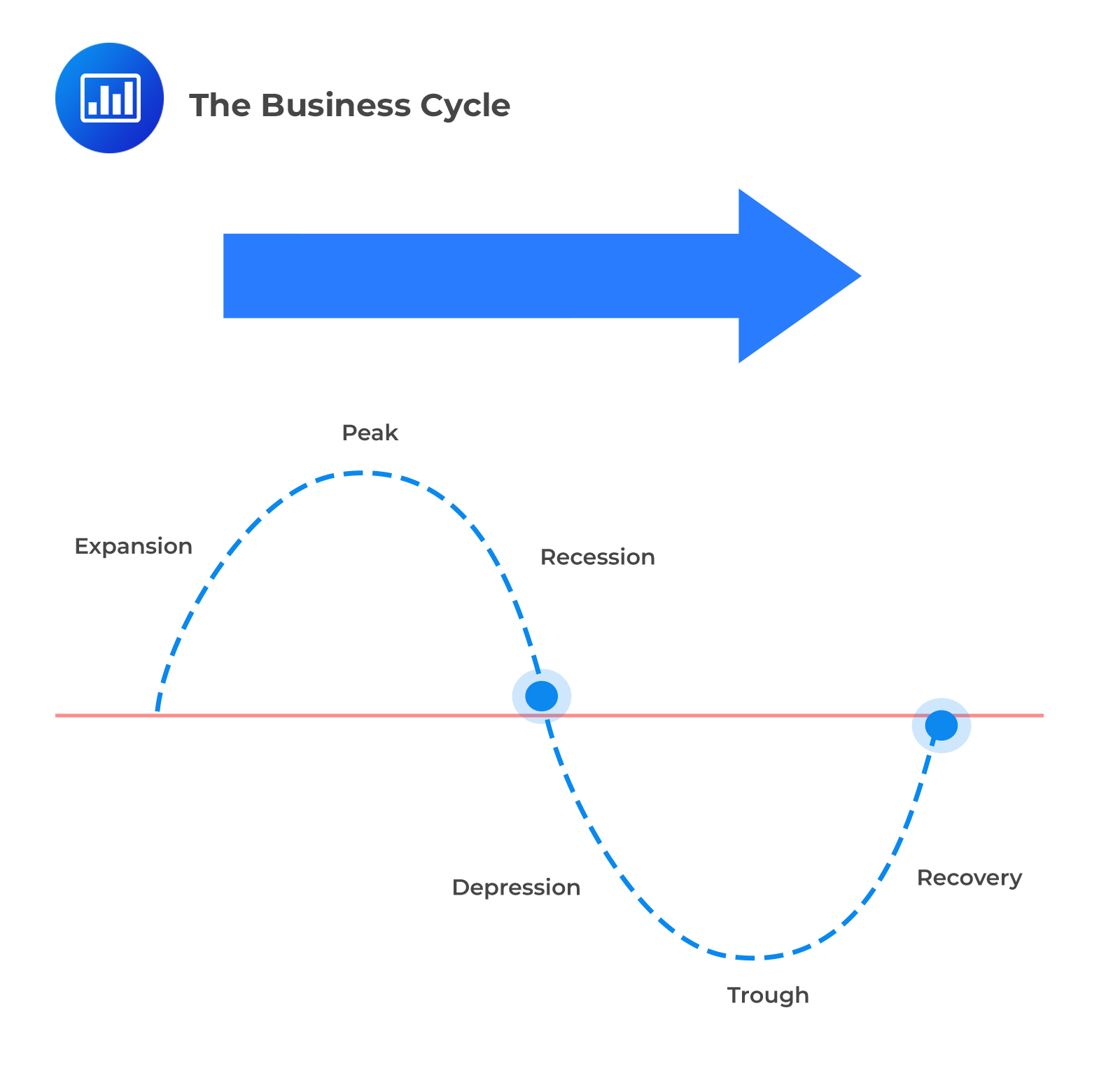

Earnings and business cycles have a very close relationship. Investors should, therefore, have a good understanding of the business cycle to make projections of earnings. Even then, it is worth noting that the effect of the business cycle on the profitability of the business cycle differs across companies. This is because of the varying characteristics of different companies.

The goods that a company produces and the services it offers play an important role. It is worth clarifying that some goods and services are insensitive to economic conditions. Some of such goods include toiletries. People will neither use the bathroom less because of a recession nor use it more because the economy is booming. Companies providing such products are called defensive or non-cyclical companies. Defensive companies have earnings that are stable during business cycles.

The goods that a company produces and the services it offers play an important role. It is worth clarifying that some goods and services are insensitive to economic conditions. Some of such goods include toiletries. People will neither use the bathroom less because of a recession nor use it more because the economy is booming. Companies providing such products are called defensive or non-cyclical companies. Defensive companies have earnings that are stable during business cycles.

A rise in the profitability of cyclical companies indicates the likelihood of a future improvement in the broader economy. Cyclical companies produce consumer and durable products and are, therefore, more sensitive to the business cycle phase. Their revenues fluctuate depending on the rate of economic growth.

Earnings growth is also determined by other factors, including the experience of the management, the financial structure of a firm, among others. However, these factors may not show a good relationship with the business cycle. For example, in a booming economy, all managers will seem to be generating profits for their companies, even those that lack experience.

Question

Which of the following statements about the business cycle and earnings growth expectations is least likely accurate?

- Defensive industries have earnings that are relatively stable to changes in the business cycle.

- The sensitivity of earnings of a corporate bond to variations in the business cycle is positively correlated with the level of cyclicality.

- Cyclical industries tend to have earnings that are stable and immune to variations in the business cycle.

Solution

The correct answer is C.

Cyclical industries produce consumer and durable products and are therefore more sensitive to the business cycle phase. Their revenues fluctuate depending on the rate of economic growth. In other words, revenues are higher in periods of economic expansion and lower in periods of economic downturn.

A is incorrect. Defensive industries comprise any business whose immunity to business cycles relatively stable. The earnings of such an industry are unaffected by economic fluctuations. The industry usually deals with the production of utilities, healthcare products, among others.

B is incorrect. The sensitivity of the earnings of a corporate bond to variations in the business cycle is positively correlated with the level of cyclicality. Earnings are higher in periods of economic expansion and are lower in periods of economic downturn.

Reading 43: Economics and Investment Markets

LOS 43 (h) Explain how the phase of the business cycle affects short-term and long-term earnings growth expectations.