An Overview and Categorization of Hedg ...

Hedge funds are a complex aspect of alternative investments, with advantages and disadvantages.... Read More

Backward induction involves working backward from maturity to time 0 to determine a bond’s value at each node. It makes the following assumptions:

$$V=0.5\left[\frac{V_u+C}{1+i}+\frac{V_d+C}{1+i}\right] $$

Where:

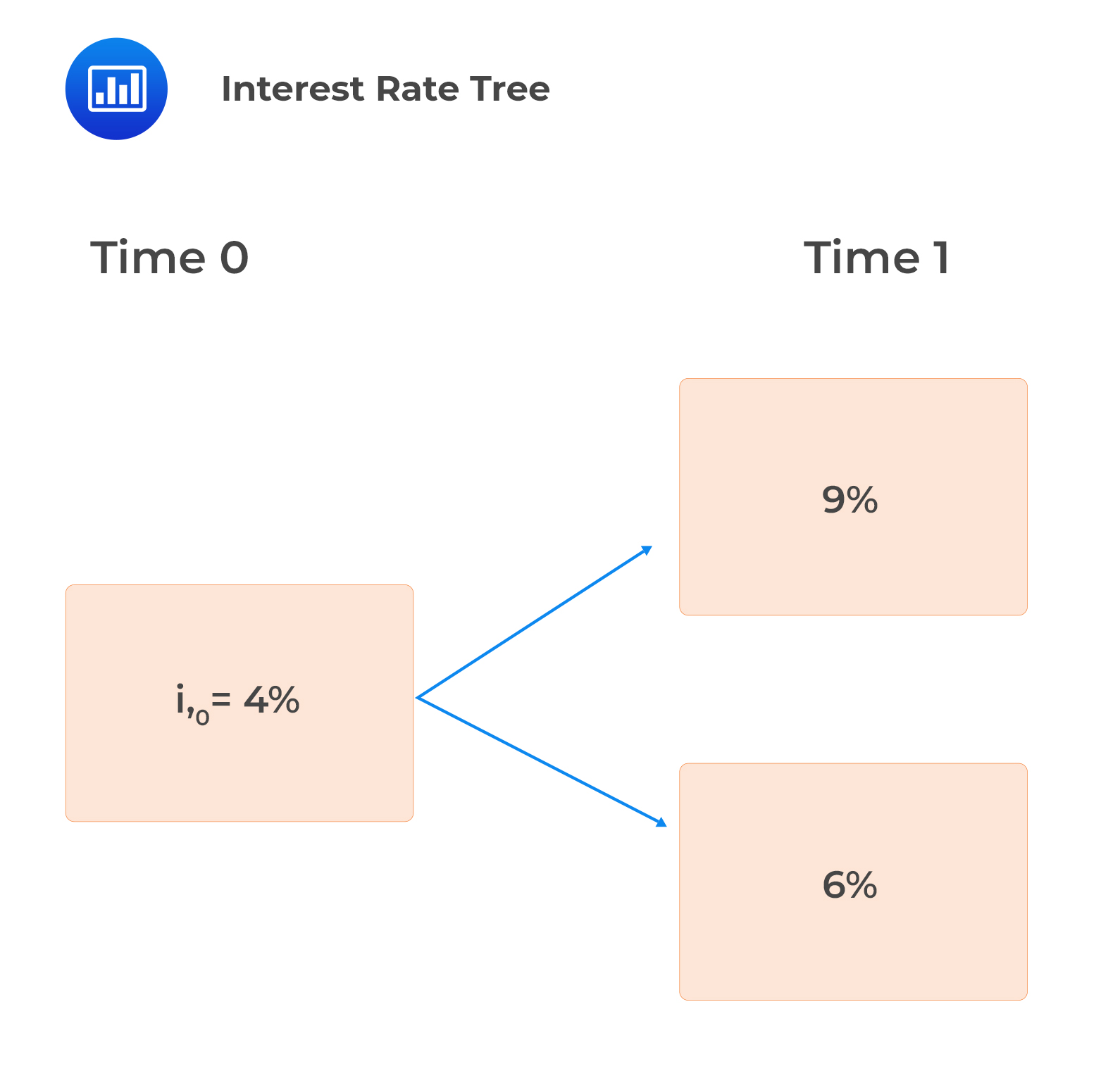

A two-year bond with no embedded options pays 8% annual coupons. Given the following interest rate tree, find the values of the bond at each node, i.e., \(V_{1,u},\) \(V_{1,d}\) and \(V_0\).

Solution

Solution

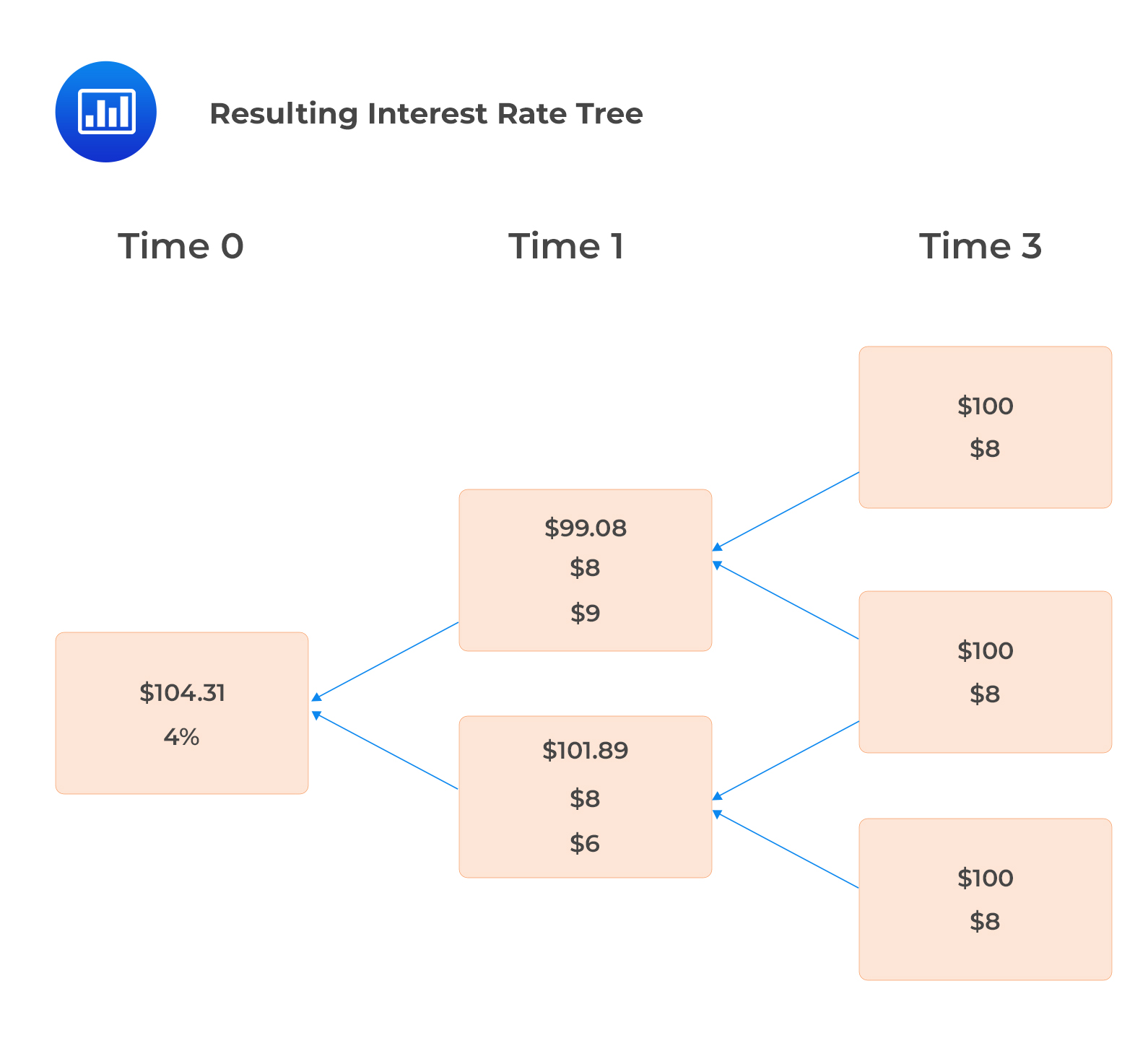

$$ \begin{align*} V_{1,u} &=0.5\times\left[\frac{100+8}{1.09}+\frac{100+8}{1.09}\right]=$99.08 \\ V_{1,d}& =0.5\times\left[\frac{100+8}{1.06}+\frac{100+8}{1.06}\right]=$101.89 \text{ and}\\ V_0 &=0.5\times\left[\frac{99.08+8}{1.04}+\frac{101.89+8}{1.04}\right]=$104.31 \end{align*} $$

The resulting interest rate tree is as shown below:

Question

Exhibit 1 is a binomial interest rate tree related to a bond with annual coupons of 4% with a face value of $100 that matures in three years.

Based on Exhibit 1, the price of the bond is closest to:

- $101.90.

- $103.87.

- $105.51.

Solution

The correct answer is C.

$$ V=0.5\left[\frac{V_u+C}{1+i}+\frac{V_d+C}{1+i}\right] $$

The cash flow at Time 3 is 104, the redemption of par value ($100) plus the final coupon payment ($4)

Node values for time two are determined as follows:

$$ \begin{align*} & \text{Upper node: }\frac{104}{1.03}=100.97 \\ & \text{Middle node: }\frac{104}{1.02}= 101.96 \\ & \text{Lower node: }\frac{104}{1.01}= 102.97 \end{align*} $$

Time 1

$$ \begin{align*} & \text{Upper node: } 0.5\times\left(\frac{100.97+4}{1.035}+\frac{101.96+4}{1.035}\right)= 101.90 \\ & \text{Lower node: } 0.5\times\left(\frac{101.96+4}{1.025}+\frac{102.97+4}{1.025}\right)= 103.87 \end{align*} $$

Time 0

$$ \text{Node value: } 0.5\times\left(\frac{101.90+4}{1.013}+\frac{103.87+4}{1.013}\right)= 105.51 $$

Therefore, the price of the bond is $105.51.

This can be shown in the interest rate tree framework.

Reading 29: The Arbitrage-Free Valuation Framework

LOS 29 (e) Describe the backward induction valuation methodology and calculate the value of a fixed-income instrument given its cash flow at each node.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.