Analyzing Operating Margins and Sales ...

A dividend is a distribution of profits paid to shareholders. The payment of dividends to shareholders is not a company’s legal obligation, and they are subject to different tax treatment for both the shareholder and the company.

A payout policy is a set of principles that guide a company on how to pay out its dividends to shareholders and how shares are repurchased. Capital structure decisions along with dividend payout decisions involve senior management and the board of directors. Analysts and investors closely monitor them because the distribution of dividends to shareholders affects financial ratios and investment returns. Dividends also provide vital information about a company’s future performance. The different forms of dividends include the following.

Many companies pay out cash dividends on a regular schedule. However, the frequency of dividend distribution may vary from one market to another. A record of consistent dividends over a long period is important to many companies and shareholders because it implies that the company has consistent profits. Regular and increasing dividend payouts indicate to investors that the company is growing and will share profits with shareholders. Share prices increase with regular increases in dividend payouts.

A dividend reinvestment plan (DRP) is a reinvestment plan that allows shareholders to reinvest a portion or all of cash dividends from a company. There are three types of DRPs:

Offering DRP has several advantages:

Some disadvantages of offering DRP are:

A special dividend is a dividend that supplements regular cash dividends. Alternatively, it is a dividend paid by a company that does not distribute dividends on a regular schedule. In cyclical industries, companies may choose not to distribute dividends during an economic downturn when earnings are low and instead use the money for their operations.

A liquidating dividend occurs when:

A liquidating dividend returns capital instead of distributing earnings or retained earnings.

Stock dividends are a non-cash form of dividends that occur when a company pays out additional shares of its common shares to shareholders instead of cash. This leads to a reduction of cost per share held by shareholders. Stock dividends are a win for the shareholder who ends up with more shares, and the firm did not have to spend actual money issuing the shares. Stock dividends are not taxable to shareholders.

However, the increase in the number of outstanding shares is offset by a proportional decrease in earnings per share and the share price. This implies that stock dividends do not change the value of each shareholder. Paying stock dividends is advantageous to a company because it encourages long-term investment in the company, which lowers equity. Additionally, payment of stock dividends increases the stock’s float, improving the shares’ liquidity and dampening share price volatility. Unlike cash dividends, stock dividends do not affect a company’s capital structure because cash dividends reduce asset and shareholders’ equity.

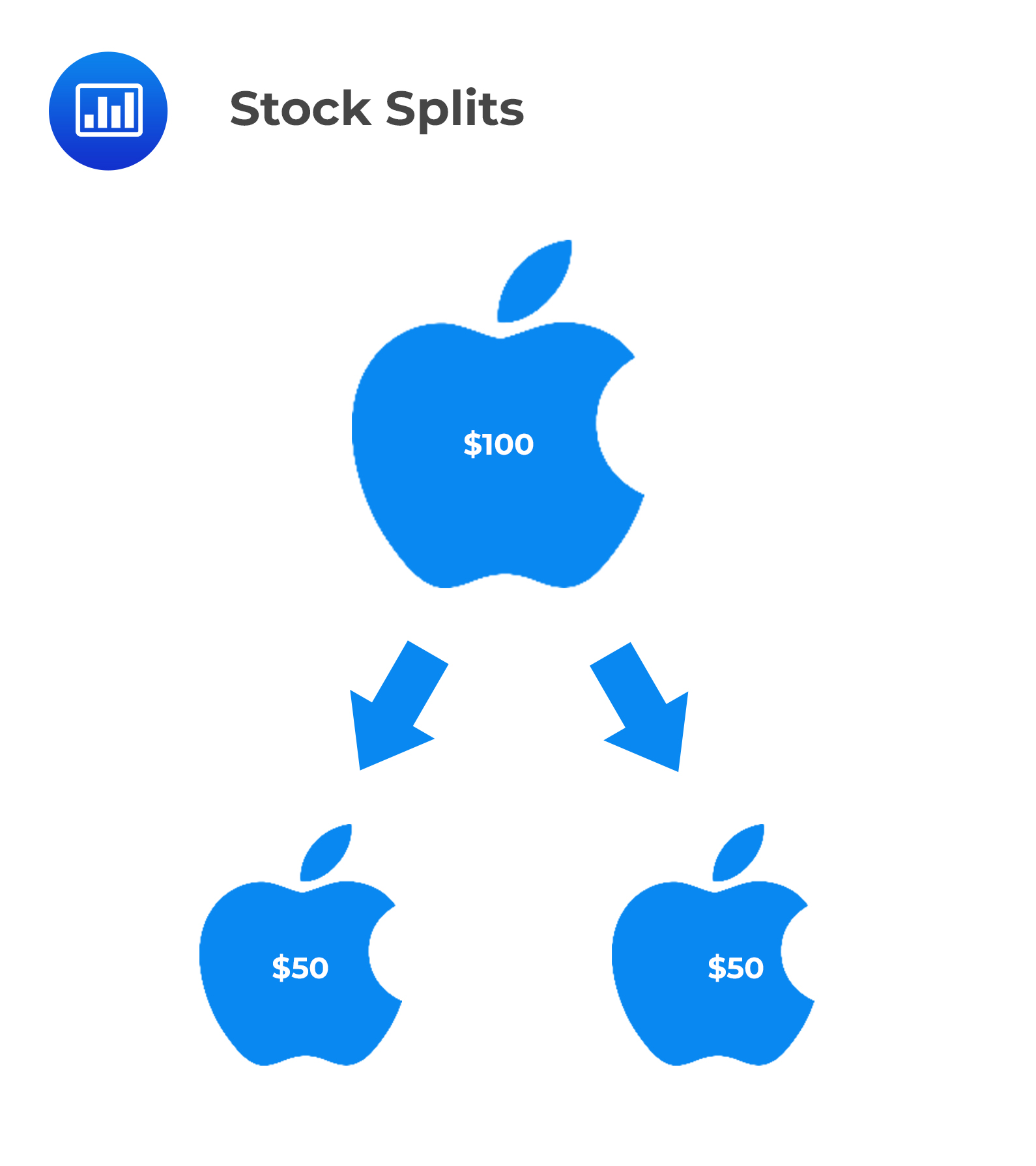

Stock splits, just like stock dividends, have no economic effect on the company, and the shareholder’s total cost basis is unchanged. In a stock split, the shareholder will have twice as many shares after the split; thus, earnings per share will decrease by half while P/E and equity market remain unchanged. The dividend yield will also be unchanged, assuming the corporation maintains the same dividend payout ratio. The most common splits are three-for-one and two-for-one. However, five-for-four or seven-for-three splits sometimes occur.

Example: Two-for-One Stock Split

Example: Two-for-One Stock Split$$\small{\begin{array}{l|c|c} {}& \textbf{Before Split} & \textbf{After Split} \\ \hline\text{Number of outstanding shares} & \text{\$6 million} & \text{\$12 million} \\ \hline\text{Stock price} & \$60 & $30= \bigg(\frac{$60}{2}\bigg) \\ \hline\text{Earnings per share} & \$3 & $1.5= \bigg(\frac{$3}{2}\bigg)\\ \hline\text{Dividends per share} & \$1 & \$0.5= \bigg(\frac{$1}{2}\bigg)\\ \hline\text{Dividend payout ratio} & 1/3 & 1/3\\ \hline\text{Dividend yield} & 1.66\% & 1.66\%=\bigg(\frac{$0.5}{$30}\bigg)\\ \hline\frac{\text{P}}{\text{E}} & 20 & 20 = \bigg(\frac{$30}{$1.5}\bigg)\\ \hline\text{Market value of equity} & \$ 360\ \text{million} & $360\ \text{million} =($30×12)\\ \end{array}}$$

From the example above, we see that although the stock split causes the number of outstanding shares to double, the market value of the shares remained the same ($360 million) because all share data have been reduced by 50%. A split is announced after a period where the stock price has risen, and many investors speculate that the stock price will continue to rise.

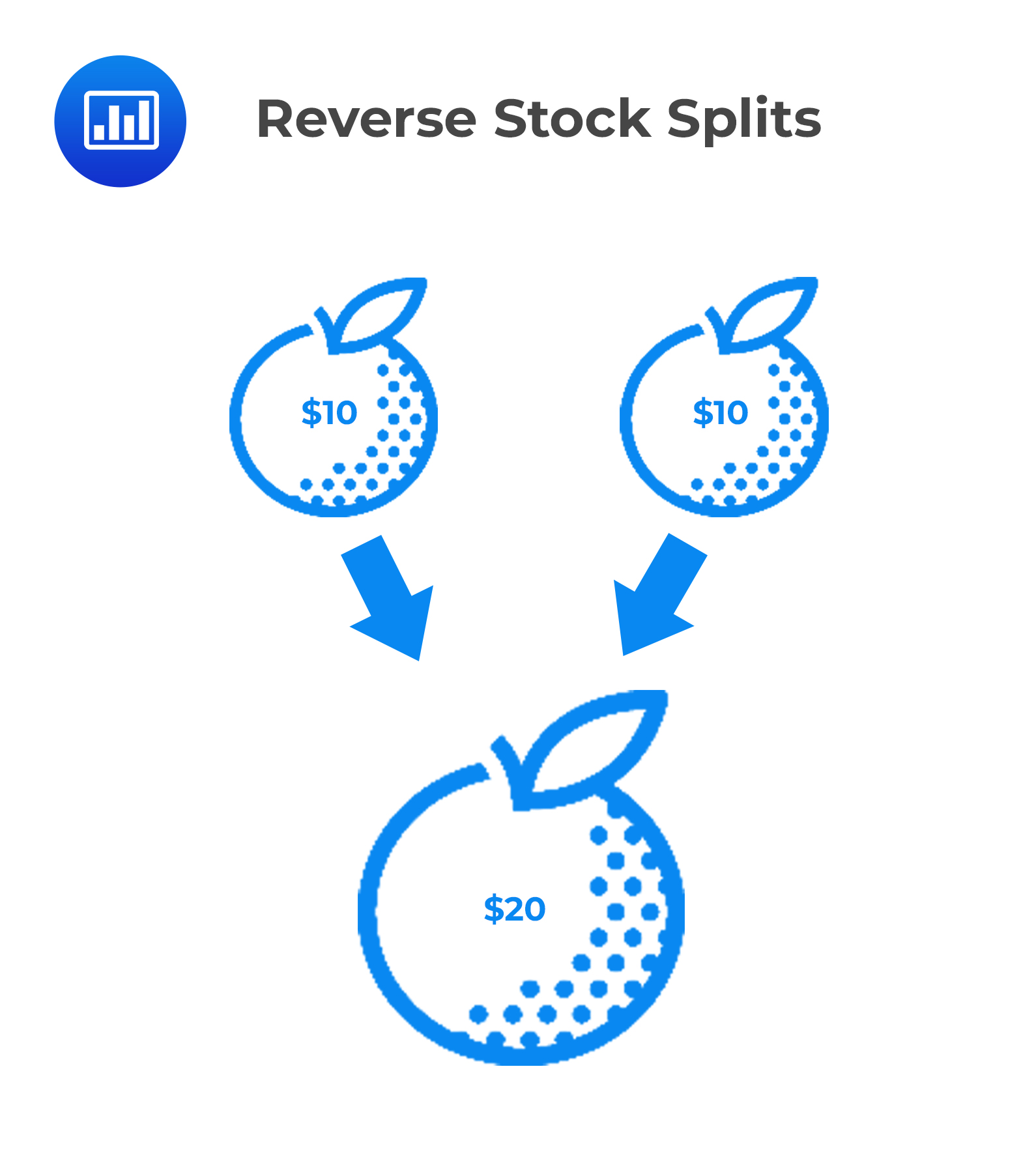

A reverse stock split reduces the number of outstanding shares and increases the stock price. A company’s reverse stock split is considered when a share price is too low to increase the share price to a higher, more marketable range. Reverse stock splits are also issued to attract mutual funds and institutional investors. Reverse stock splits are more common for companies in financial distress or those coming out of financial distress.

Effects on Financial Ratios

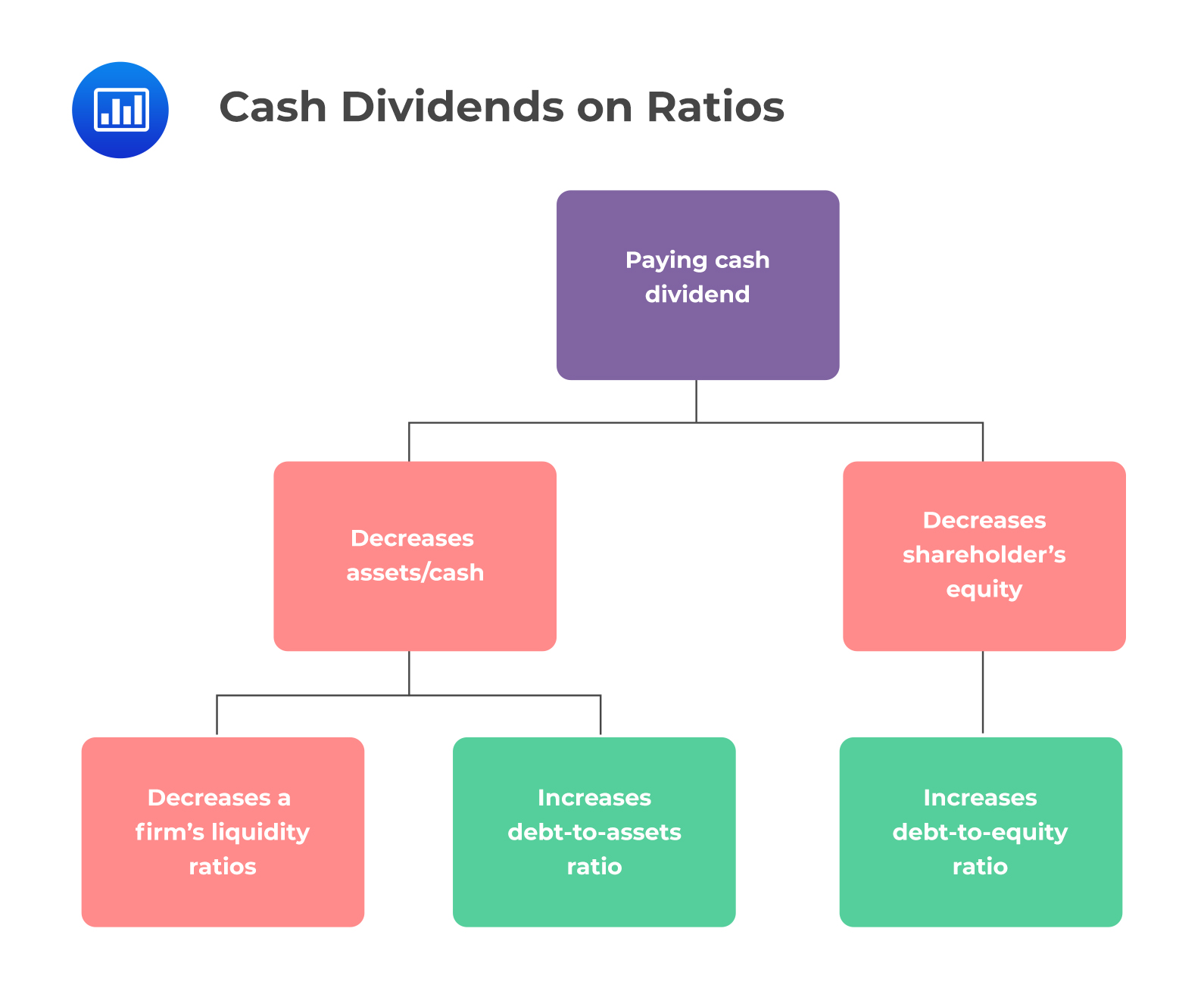

Effects on Financial RatiosCash dividends decrease assets (cash) and retained earnings. All else constant, a decrease in assets will decrease a firm’s liquidity ratios and increase its debt-to-assets ratio. On the other hand, the decrease in shareholder’s equity will increase its debt-to-equity ratio.

On the flip side, stock dividends, stock splits, and reverse stock splits do not affect a firm’s leverage or liquidity ratios. The transactions do not change the value of the firm’s assets and shareholder’s equity. They just change the number of equity shares.

On the flip side, stock dividends, stock splits, and reverse stock splits do not affect a firm’s leverage or liquidity ratios. The transactions do not change the value of the firm’s assets and shareholder’s equity. They just change the number of equity shares.

Question

Which one is the most likely effect of a company’s decision to issue cash dividends instead of stock dividends on a company’s financial ratios?

- The cash will increase, and there will be no effect on the liquidity ratios.

- The cash will reduce, and current ratios will also reduce.

- The retained earnings of the company will increase.

Solution

The correct answer is B.

Cash dividends reduce cash because cash is being paid out. Reduction in cash also reduces the current ratio.

A is incorrect. Paying out cash dividends reduces cash in the company, affecting the liquidity ratios such as cash ratio.

C is incorrect. The issuance of cash dividends reduces a company’s retained earnings (shareholder’s equity), increasing its debt-to-equity ratio.

Reading 18: Analysis of dividends and Share Repurchases

LOS 18 (a) Describe the expected effect of regular cash dividends, extra cash dividends, liquidating dividends, stock dividends, stock splits, and reverse stock splits on shareholders’ wealth and a company’s financial ratios.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.