Valuation of Commodities in Contrast t ...

We can use the following modes of valuation to compare commodities and equities.... Read More

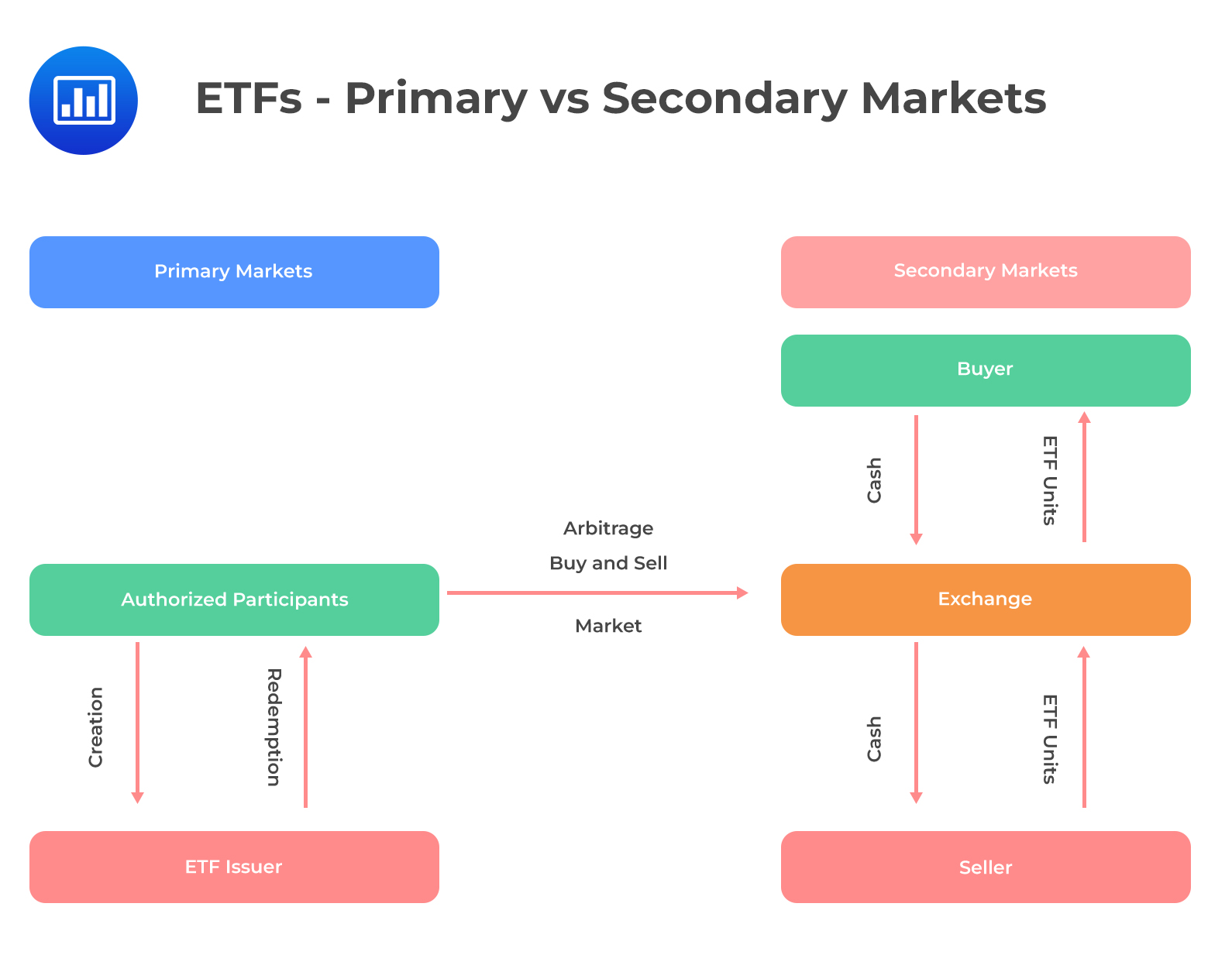

Secondary market trading involves buying and selling of ETFs on exchanges. The trade happens between any pair of market participants, i.e, individual or institutional investors, market makers, and so on. The selling activities of individual investors in the secondary market do not require funds to trade out of its underlying positions. This is because the ETF manager is not aware of the ongoing sale; hence they do not need to change the portfolio to accommodate this transaction.

Further, the redemption of ETF shares in secondary markets occurs in kind, and it is not a taxable event. Therefore, redemptions do not trigger capital gain realizations. For this reason, ETFs are seen as “tax fair.” In contrast, redeeming out the fund by other shareholders in a traditional mutual fund gives rise to tax liabilities.

An AP can sell a particular volume of ETF shares to investors in the secondary market and purchase the securities in the creation basket at the same time. When the value of the ETF shares sold and the creation basket acquired hits equilibrium, then there is no risk in the transaction. This implies that the ETF shares and the securities have fair prices. The following diagram represents the structure of an ETF in the primary and secondary markets.

Question

Which of the following most accurately differentiates ETF trade in the secondary market and primary market?

- Variation of prices in the secondary market depending on demand and supply forces.

- Lack of intermediaries in the secondary market.

- Share creation or redemption takes place in the secondary market.

Solution

The correct answer is A.

There are fixed prices in the primary market. On the contrary, prices in the secondary market vary depending on the demand and supply of the traded securities.

The major difference between the primary market and the secondary market include:

- Securities are initially issued in the primary market. The securities are then listed on a known stock exchange for trading (in the secondary market).

- Investors can directly purchase shares from a firm in the primary market, whereas in the secondary market, investors trade the shares among themselves.

- In the primary market, security can only be sold once, while it can be sold an infinite number of times in the secondary market.

- The amount received from the securities in the primary market is the company’s income while it is the investor’s income in the secondary market.

- Investment bankers do securities trading in the case of the primary market. On the other hand, brokers act as intermediaries while trading in the secondary market.

B is incorrect. Stock exchanges act as the intermediaries in the secondary market.

C is incorrect. Share creation or redemption takes place in the primary market.

Reading 39: Exchange Traded-Funds, Mechanics and Applications

LOS 39 (b) Describe how ETFs are traded in secondary markets.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.