Uses of Multifactor Models and Interpr ...

Uses of Multifactor Models Multifactor models are mainly used for return attribution, risk... Read More

Bond managers must quantify interest rate volatilities for bonds with embedded options because their values depend on the level of interest rate volatilities. Additionally, mitigating the effect of interest rate volatilities on a bond’s price volatility is part of risk management.

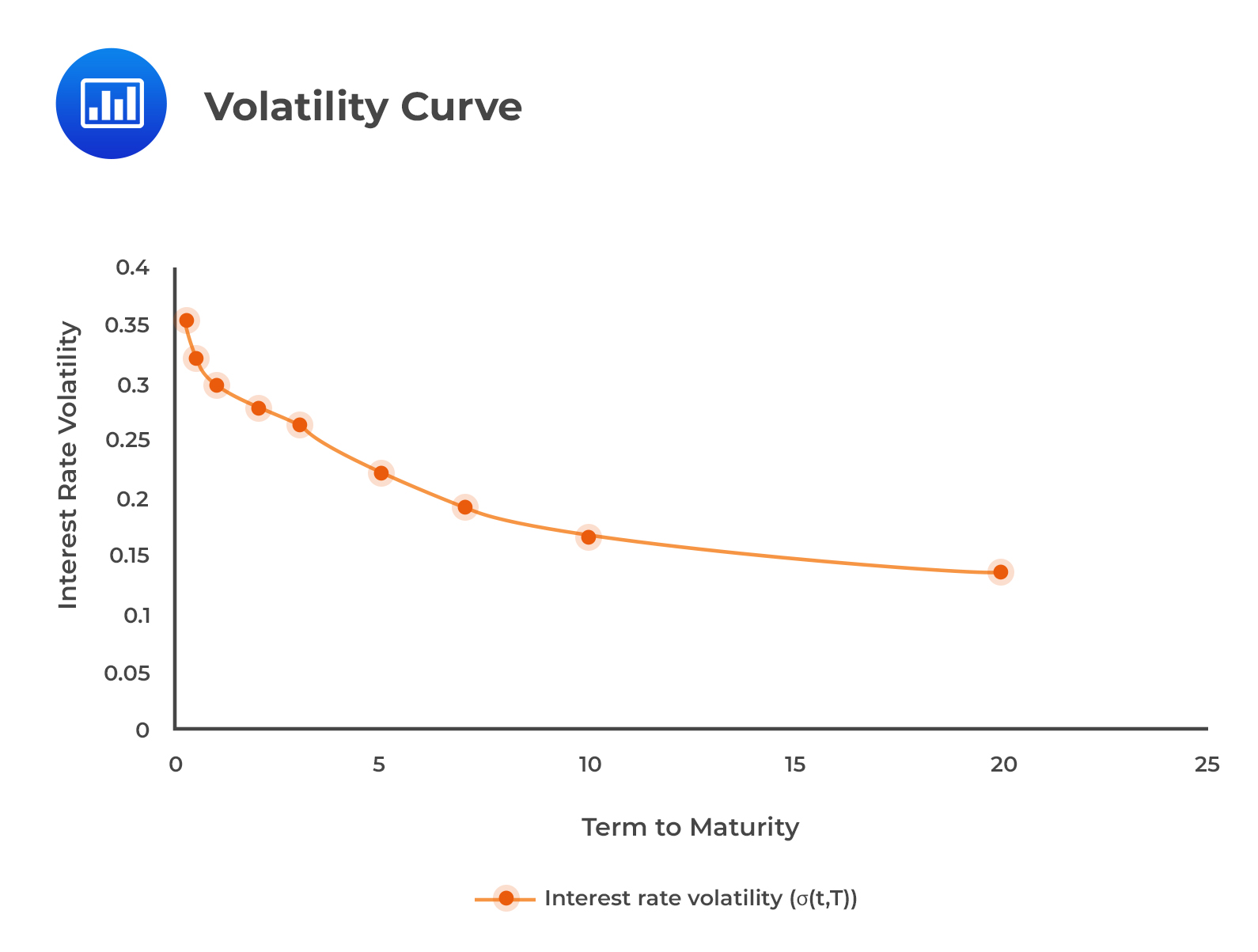

The volatility curve (“vol”) shows the term structure of interest rate volatilities. The term structure of interest rate volatilities shows the relationship between the yield volatility of a zero-coupon bond and maturity.

The volatility curve measures the yield curve risk. The following chart illustrates a typical volatility curve:

The volatility curve implies that short-term interest rates are more volatile relative to long-term rates.

The volatility curve implies that short-term interest rates are more volatile relative to long-term rates.

The volatility of short-term rates can be attributed to the uncertainty with respect to the monetary policy. In contrast, the long-term rates are volatile because of the uncertainty regarding the real economy and inflation.

Question

Which of the following best describes the implication of the volatility curve?

- Short-term rates are more volatile than long-term rates.

- Long-term rates are more volatile than short-term rates.

- Both short-term rates and long-term rates exhibit the same volatility.

Solution

The correct answer is A.

The volatility term structure shows that short-term rates, associated with uncertainty over monetary policy, are more volatile than long-term rates driven by uncertainty related to the real economy and inflation.

Reading 28: The Term Structure and Interest Rate Dynamics.

LOS 28 (j) Explain the maturity structure of yield volatilities and their effect on price volatility.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.