t-Distribution and Degrees of Freedom

A student’s t-distribution is a bell-shaped probability distribution symmetrical about its mean. It... Read More

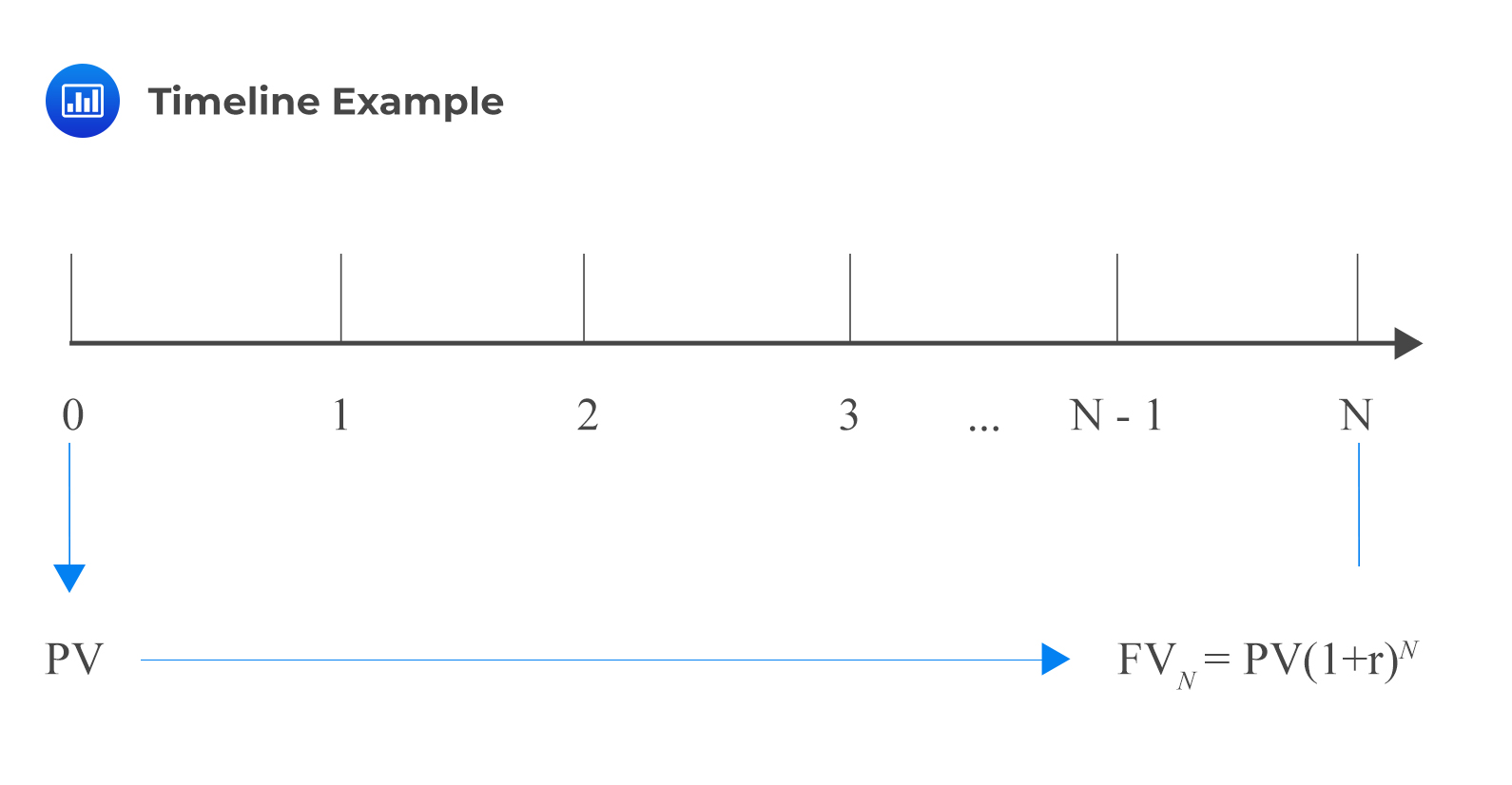

A timeline is a physical illustration of the amounts and timing of cashflows associated with an investment project. For cashflows that are regular and of equal amounts, the standard annuity formula or the financial calculator can be used. However, for cashflows that are irregular, unequal, or both, a timeline is preferred.

Remember that the general formula that relates the present value and the future value of an investment is given by:

$$FV _ {N} = PV \left (1 + r \right)^ {N} $$

Where

\(PV\) = present value of the investment

\(FV_N\) = future value of the investment \(N\) periods from today

\(r\) = rate of interest per period

We can represent this in a timeline:

In a particular timeline, a time index, t, is used to represent a particular point in time, a specified number of periods from today. Therefore, the present value is the investment amount today (t = 0) and by using this amount, we can calculate the future value (t = N). Alternatively, we can use the future value to calculate the present value.

The above argument can be written in terms of the present value. That is:

$$PV = FV _ {N} \left (1+r \right)^ {-N} $$

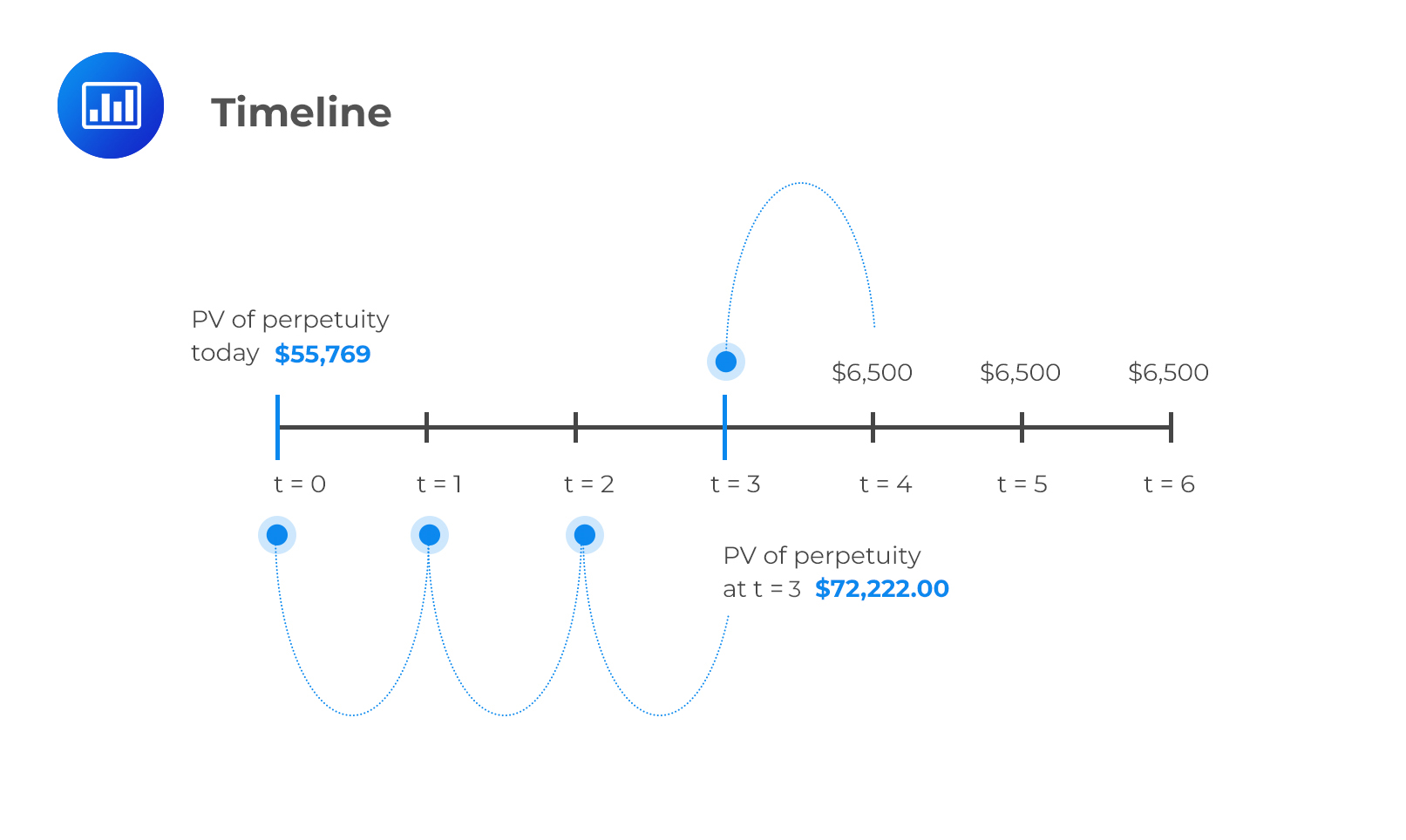

An investor receives a series of payments, each amounting to $6, 500, set to be received in perpetuity. Payments are to be made at the end of each year, starting at the end of year 4. If the discount rate is 9%, then what is the present value of the perpetuity at t = 0?

Solution

We would then draw a timeline to better understand the problem:

Here, we can see that the investor is receiving $6, 500 in perpetuity. Recall that the PV of a perpetuity is given by:

$$ \text {PV of a perpetuity} = \frac {C} {r} $$

So that in this case:

$$ PV_3 = \frac {$6,500} {9\%} = $72, 222$$

This is the value of the perpetuity at t = 3, so we need to discount it for 3 more periods to get the value at t = 0. Using the formula:

$$ PV _ 0 = FV _ {N} \left (1+r \right)^ {-N} $$

The PV at time zero is \(\frac {$72, 222} {{(1 + 0.09)}^3} = $55, 769\).

There are many instances in real life when cashflows are uneven. A good example in this respect is a pension contribution which varies with age. In such cases, it is not possible to apply one of the basic time value formulae. You are advised to draw a timeline even if the question appears quite straightforward. It will help you understand the question structure better. A timeline also helps candidates add cashflows indexed to the same period and apply the value additivity principle.

According to cashflow additivity principle, the present value of any stream of cashflows indexed at the same point equals the sum of the present values of the cashflows. This principle has different applications in time value of money problems. Besides, this principle can be applied to find the NPVs of projects with uneven cashflows.

In the above question, we can combine corresponding cashflows and work out the present values for the two projects at once:

$$ NPV = (0 + 50) + \frac {100 + 100} {1.05^{1}} + \frac {150 + 200} {1.05^{2}} + \frac {250 + 300} {1.05^{3}} + \frac {300 + 400} {1.05^{4}} + \frac{250 + 500} {1.05^{5}} = $2,197 $$

We know that,

$$PV = FV _ {N} \left (1 + r \right)^ {-N} $$

$$ \Rightarrow \text {r} = \left (\frac {FV _ N} {PV} \right)^ {\frac {1} {N}} – 1$$

An investor invested in a $1, 000 security today. It will earn him $1,191 three years from now. The annual rate of return on this investment is closest to?

Solution

Recall that:

$$ \text {r} = \left (\frac {FV _ N} {PV} \right)^ {\frac {1} {N}} -1$$

In this case we have:

$$ \text {r} = \left (\frac {1191} {1, 000} \right)^ {\frac {1} {3}} -1$ = 0.06 = 6%$$

The steps to solve the above example using a financial calculator are given below:

$$

\begin {array} {l|l|l}

\textbf {Steps} & \textbf {Explanation} & \textbf {Display} \\

\hline \text { [2nd] [QUIT] } & \text {Return to standard calc mode} & 0 \\

\hline\left [2^ {\text {nd }} \right] [\text {CLR TVM}] & \text {Clears TVM Worksheet} & 0 \\

\hline 3 [N] & \text {Years/periods} & N = 3 \\

\hline-1, 000 [PV] & \text {Set to } PV \text { to } – 1, 000 & PV = -1, 000 \\

\hline 0 [PMT] & \text {Set annuity payment} & PMT = 0 \\

\hline 1, 191 [FV] & \text {Set to } FV \text { to } 1, 191 & FV = 1, 191 \\

\hline [CPT] [I/Y] & \text {Compute interest rate} & I/Y = 6 \text{ or } 6 \% \\

\end{array}

$$

An investor invests $100 at the end of each of the next five years and receives $750 at the end of the fifth year. The annual rate of return on this investment is closest to:

Solution

Using a calculator, you will solve for I/Y as follows.

\(N\) = 5; \(FV = $750\); \(PMT = –100 \); \(CPT\) \(I/Y\) = 20.40%

An investor invests $1, 000 today and receives a $50 coupon payment at the end of every year for 3 years. In addition, they receive $1,100 at the end of year 3. What is the rate of return of this investment?

Solution

Using the calculator, you will calculate I/Y as follows.

\(PV\) = -$1, 000

\(FV\) = $1, 100

\(N\) = 3

\(PMT\) = 50

\(CPT\) \(I/Y\) = 8.078%

\(N\) can be calculated using the following formula:

$$N = \frac {\text{ln}\left [\frac {FV} {PV} \right]} {\text{ln} (1+r)} $$

An investor invests $3, 000 in a bank account. How many years will it take to double the amount given that the interest rate is 5% per annum compounded annually?

Solution

Using the formula:

$$N = \frac {\text{ln}\left [\frac {FV} {PV} \right]} {\text{ln}(1+r)} = \left(\frac {ln 2} {ln 1.05} \right) = 14.21\ \text {Years} $$

Using the BA II Plus™ Financial Calculator:

\(I/Y\) = 5%, \(PV\) = -$3, 000, \(PMT\) = 0, \(FV\) = $6, 000, \(CPT\) \(N\) = 14.21

The annuity payment, \(A\), can be computed using the following formula:

$$\begin {align} \text {A} & = \frac {\text {PV of Annuity}} {\text {Present value annuity Factor}} \\ & = \frac {\text {PV of Annuity}} {\left[\frac {1-\frac{1} {\left(1+\frac{r s} {m}\right)^ {m N}}} {\frac {r S} {m}}\right]} \end {align} $$

A company has borrowed $100, 000 for the purchase of machinery. The tenor of the loan is five years at an annual rate of 5% compounded monthly. If the first payment is due in one month, the monthly payment is closest to:

Solution

Using the formula:

$$A = \frac {\text {PV of Annuity}} {\left[\frac{1 – \frac{1} {\left(1 + \frac {r s} {m} \right)^ {m N}}} {\frac {r S}{m}} \right]} = \left [\frac {1 – \frac {1} {\left (1 + \frac {0.05} {12} \right)^ {12(5)}}} {\frac {0.05} {12}} \right] = \frac {100, 000}{52.9907} = $1, 887.1237 $$

So, the monthly payment is $1, 887.

Using the BA II Plus™ Financial Calculator:

\(PV\) = -100, 000; \(N\) = 5×12 = 60; \(I/Y\) = 5/12 = 0.41667; \(FV\) = 0; \(CPT \ PMT\) = 1,887.123

A bank is offering a profit rate of 6% on its savings account. How much should an investor deposit each quarter to grow the investment to $20, 000 at the end of 12 years?

Solution

Using the formula:

$$

\begin {aligned}

F V & = A\left [\frac {\left (1+\frac {r S} {m} \right)^ {m N} -1} {\frac {r s} {m}} \right] \\

\$ 20, 000 & = A\left [\frac {\left (1 + \frac {0.06} {4} \right)^ {4 \times 12} -1} {\frac {0.06} {4}}\right] \\

\$ 20, 000 & = 69.5652 A \\

\Rightarrow A & = 287.50

\end{aligned}

$$

Using the BA II Plus™ Financial Calculator:

\(FV\) = -20, 000; \(N\) = 4 × 12 = 48; \(I/Y\) = 6/4 = 1.5; \(PV\) = 0; \(CPT\) \(PMT\) = 287.50

An investor needs to accumulate $3, 000 over the next 5 years. How much should she invest in a savings account every year given that the expected rate of return is 6.5%?

Solution

Using the BA II Plus™ Financial Calculator:

\(FV\) = -3, 000; \(N\) = 5; I/Y = 6.5; \(PV\) = 0; \(CPT \ PMT\) = 526.90

Question

Assume that we have two projects, X and Y, and each has positive cashflows. The annual interest rate is 5%. The projects have the following cashflow:

Project X:

$$ \begin {array} {c|c|c|c|c|c} {t = 0} & {t = 1} & {t = 2} & {t = 3} & {t = 4} & {t = 5} \\ \hline {$0} & {$100} & {$150} & {$250} & {$300} & {$250} \\ \end {array} $$

Project Y:

$$ \begin {array} {c|c|c|c|c|c} {t=0} & {t=1} & {t = 2} & {t = 3} & {t = 4} & {t = 5} \\ \hline {$50 } & {$100 } & {$200} & {$300} & {$400} & {$500} \\ \end {array} $$

What is the present value of the cashflows for both projects combined?

- $ 890

- $ 1,307

- $ 2,197

Solution

The correct answer is C.

The timeline for project X is as follows:

We can calculate the cashflows for project X as:

$$ \begin {align*}

\text {PV for X} & = 100 (1 + r)^ {-1} + 150 (1 + r)^ {-2} + 250 (1 + r)^ {-3} + 300 (1 + r)^ {-4} + 250 (1 + r)^ {-5} \\

& = 100 \times 1.05^ {-1} + 150 \times 1.05^ {-2} + 250 \times 1.05^ {-3} + 300 \times 1.05^ {-4} + 250 \times 1.05^{-5} \\

& = $ 890\end {align*} $$For project Y, the timeline is given by:

$$ \begin {align*} \text {PV for Y} & = 50 (1 + r)^ {-0} + 100 (1 + r)^ {-1} + 200 (1 + r)^ {-2} + 300 (1 + r)^ {-3} + 400 (1 + r)^ {-4} + 500 (1 + r)^ {-5} \\

& = 50 + 100 \times 1.05^ {-1} + 200 \times 1.05^ {-2} + 300 \times 1.05^ {-3} + 400 \times 1.05^ {-4} + 500 \times1.05^ {-5} \\

& = $1307 \end {align*} $$We then simply add the cashflows together:

$$ PV_ {X+Y} = $890 + $1307 = $2,197 $$