Defining Properties of a Probability

Defining properties of a probability refer to the rules that constitute any given... Read More

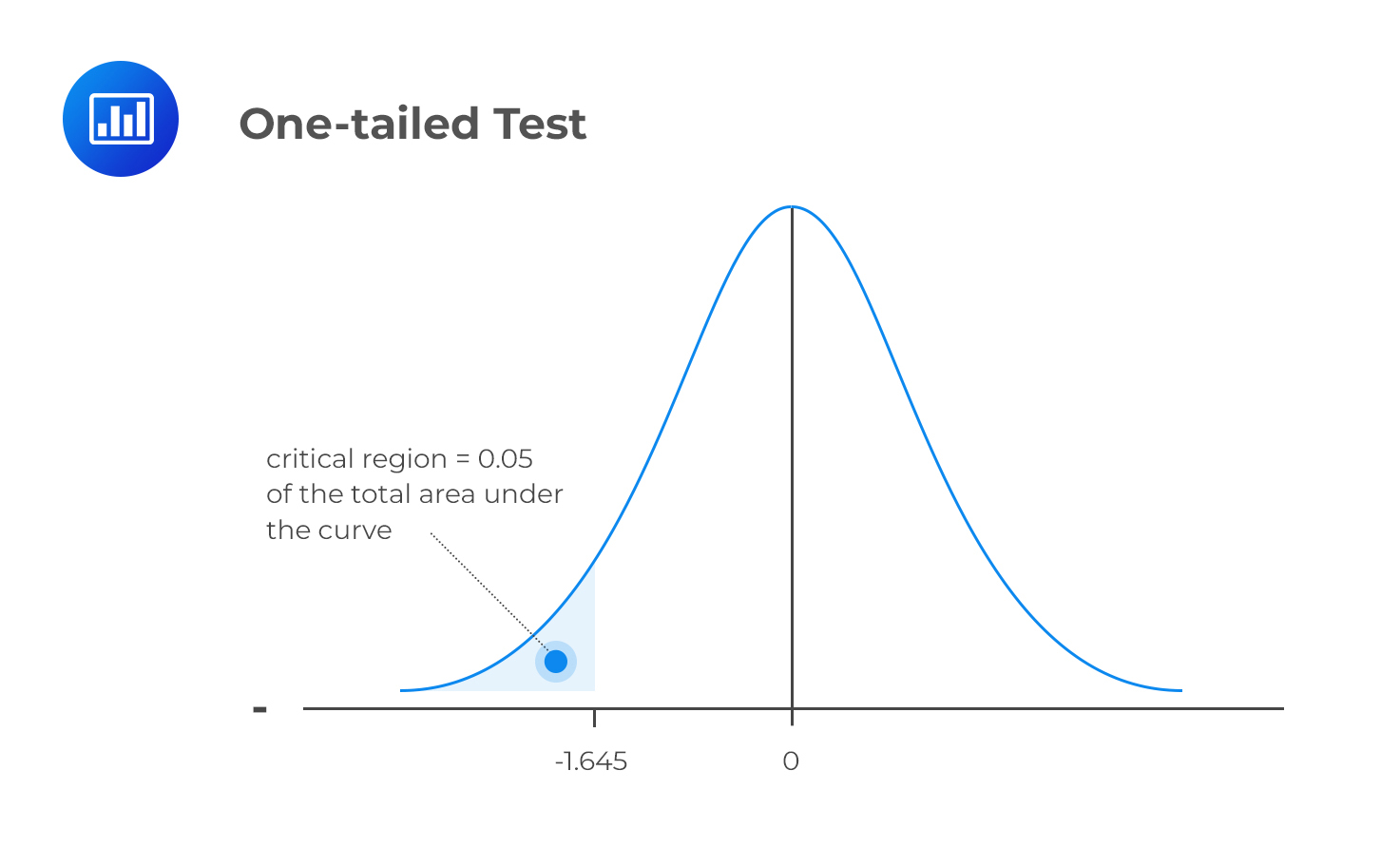

A one-tailed test (one-sided test) is a statistical test that considers a change in only one direction. In such a test, the alternative hypothesis either has a < (less than sign) or > (greater than sign), i.e., we consider either an increase or reduction, but not both.

A one-tailed test directs all the significance level (α) to the testing of statistical significance in one direction. In other words, we aim at testing the possibility of a change in one direction and completely disregard the possibility of a change in the other direction.

If we have a 5% significance level, we shall allot 0.05 of the total area in one tail of the distribution of our test statistic.

Let us assume that we are using the standardized normal distribution to test the hypothesis that the population mean is equal to a given value X. Further, let us assume that we are using data from a sample drawn from the population of interest. Our null hypothesis can be expressed as:

$$ H_0: \ \mu = X $$

If our test is one-tailed, the alternative hypothesis will test if the mean is either significantly greater than X or significantly less than X, but NOT both.

Case 1: At the 95% Confidence Level

$$ H_1: \ \mu < X $$

The mean is significantly less than X if the test statistic is in the bottom 5% of the probability distribution. This bottom area is known as the critical region (rejection region). We will reject the null hypothesis if the test statistic is less than -1.645.

Case 2: Still at the 95% Confidence Level

$$ H_1: \ \mu > X $$

We would reject the null hypothesis only if the test statistic is greater than the upper 5% point of the distribution. In other words, we would reject H0 if the test statistic is greater than 1.645.

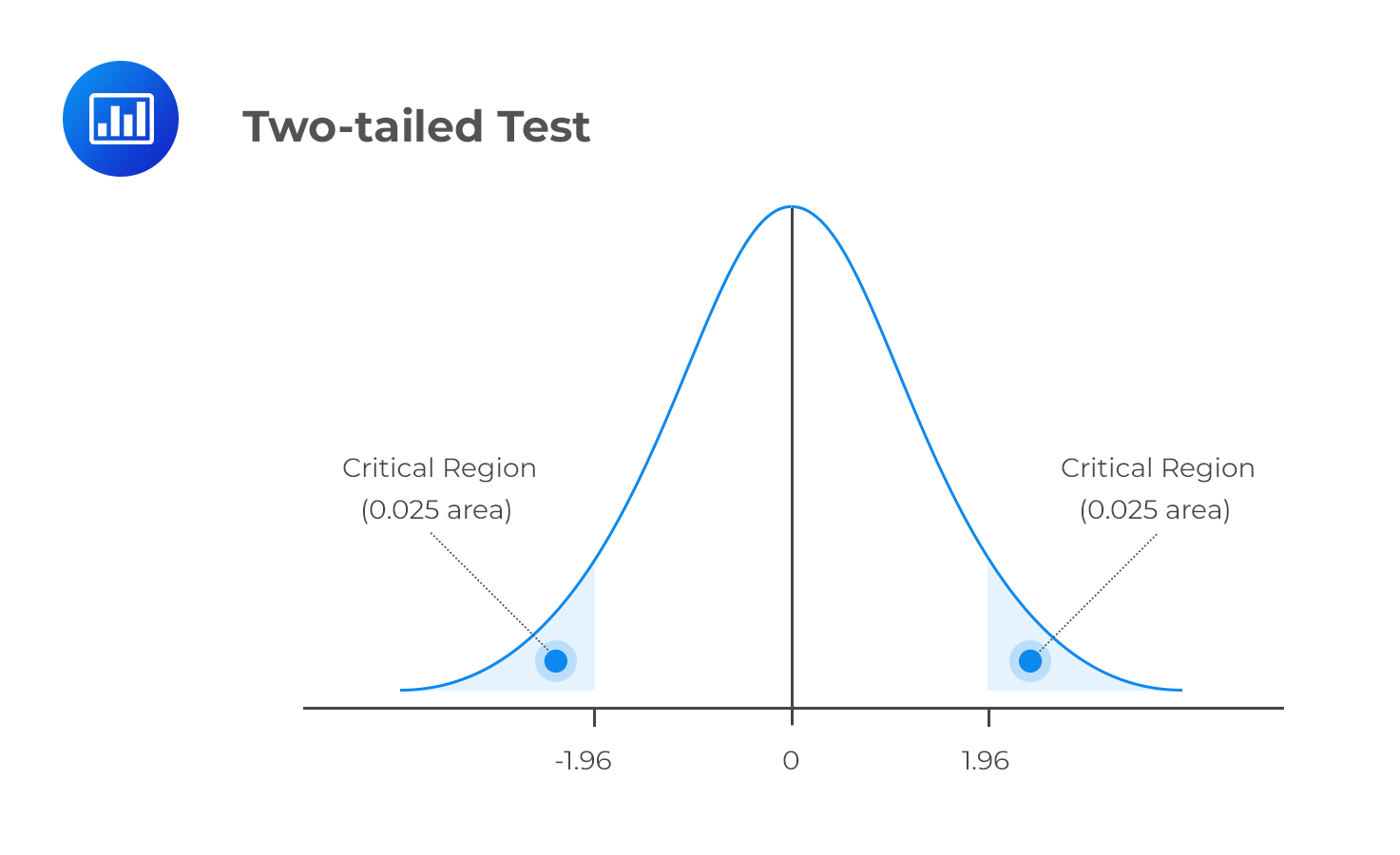

A two-tailed test considers the possibility of a change in either direction. It looks for a statistical relationship in both the positive and negative directions of a distribution. Therefore, it allows half the value of α to test statistical significance in one direction and the other half to test the same in the opposite direction. A two-tailed test may have the following set of hypotheses:

$$ H_0: \mu = X $$

$$ H_1: \mu \neq X $$

Refer to our earlier example. If we were to carry out a two-tailed test, we would reject H0 if the test statistic turned out to be less than the lower 2.5% point or greater than the upper 2.5% point of the normal distribution.