Convert a Company’s Reported Financi ...

Financial statements are interconnected, each serving a unique function in providing detailed information about a company’s financial activities. The four primary financial statements are:

The four primary financial statements are interconnected, each serving a unique function in providing detailed information about a company’s financial activities. These statements include:

Understanding the linkages among the cash flow statement, income statement, and balance sheet is helpful in assessing a company’s financial health and is instrumental in detecting accounting irregularities.

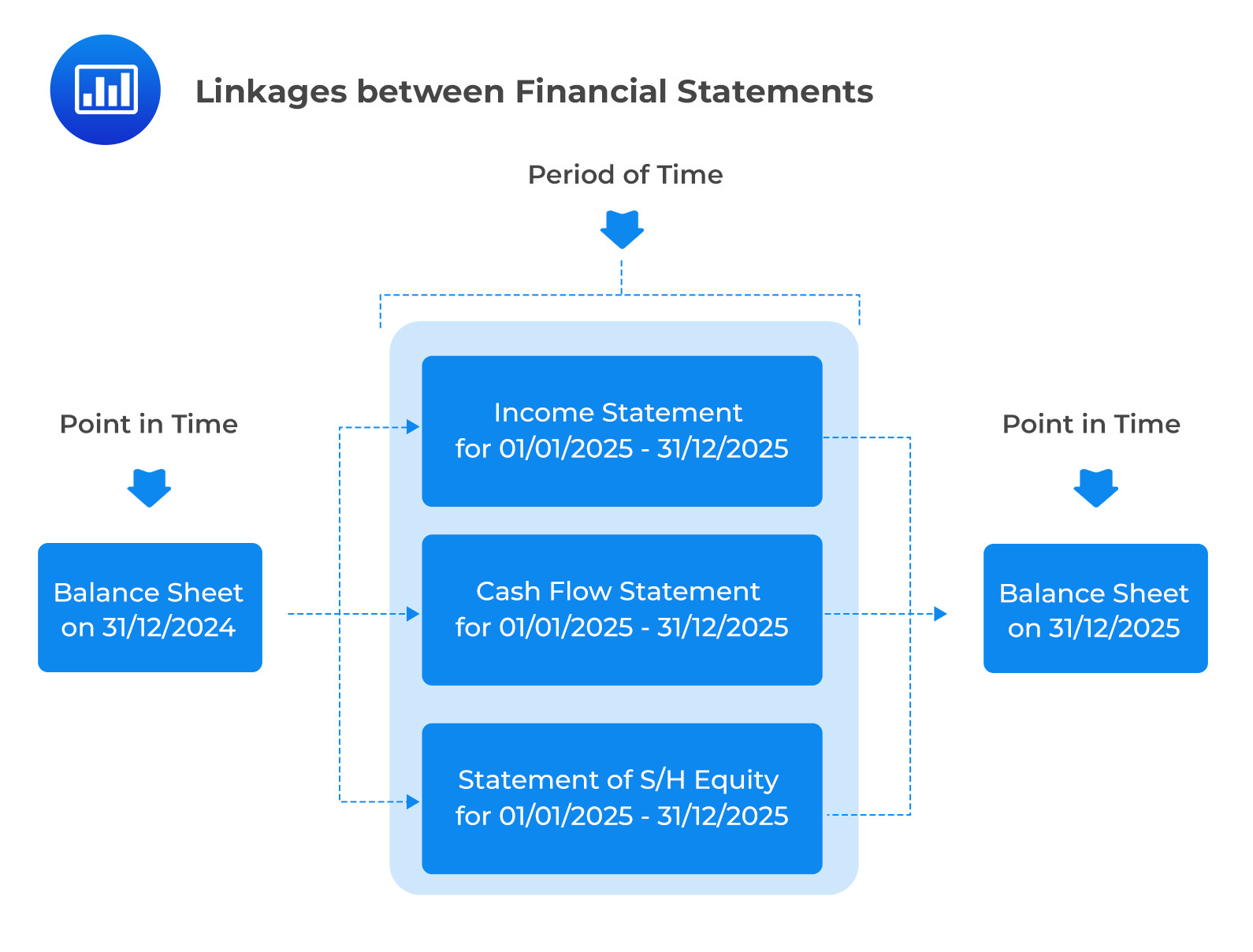

The balance sheet dates are linked by the income statement, cash flow statement, and the statement of shareholders’ equity, as shown below:

For example, the beginning and ending balance sheet amounts of cash and cash equivalents are linked through the cash flow statement. Specifically, the statement of cash flows shows the change in the cash balance during the reporting period, according to the following equation:

Beginning cash balance + Cash inflows from operating, investing, and financing activities – Cash outflows from operating, investing, and financing activities = Ending cash balance

An example involving a statement of shareholders’ equity involves the retained earnings, as shown below:

Beginning Retained Earnings (balance sheet item) + Net Income (Income statement item)D – Dividends (cash flow item)= Ending Retained Earnings (balance sheet item)

Current assets and current liabilities offer insights into a company’s operational choices and activities. Discrepancies between accrual and cash accounting methods in recording these transactions often lead to increases or decreases in these short-term assets or liabilities. For instance, when revenues recognized on an accrual basis exceed actual cash receipts, accounts receivable will increase. Conversely, if expenses recognized accrue faster than cash is disbursed, this will likely result in a reduction in accounts payable or other accrued liabilities.

Furthermore, when a company receives payments in advance for services or products to be delivered in the future, it records the cash as an asset but also acknowledges a liability for the impending delivery, commonly known as deferred revenue. This liability is then removed from the books as revenue is recognized upon fulfilling the delivery obligations.

Additionally, a company’s investing activities are generally associated with changes in the long-term assets section of the balance sheet, whereas financing activities typically impact the sections dealing with equity and long-term debt.

Generally, both the income statement and the statement of cash flows play crucial roles in linking the activities reflected in current assets and liabilities with the broader financial picture, demonstrating the interconnectedness of these financial statements in representing a company’s fiscal health and operational efficiency.

For instance, the beginning and the ending accounts receivable are connected as follows:

Beginning Accounts Receivable + Revenue – Cash collected from customers = Ending Accounts Receivable

Question

When computing the ending cash balance reported on the balance sheet, which of the following is most likely accurate?

- Cash receipts are subtracted from the beginning cash balance.

- Cash payments are subtracted from the beginning cash balance.

- Cash receipts and payments are added to the beginning cash balance.

Solution

The correct answer is B.

Cash payments are subtracted from the beginning cash balance in deriving the ending cash balance.

A is incorrect. Cash receipts are added to, not subtracted from, the beginning cash balance.

C is incorrect. Cash payments are subtracted from, not added to, the beginning cash balance.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.