Production Function Approach to Analyz ...

The production function (or Solow growth model) is used to determine the... Read More

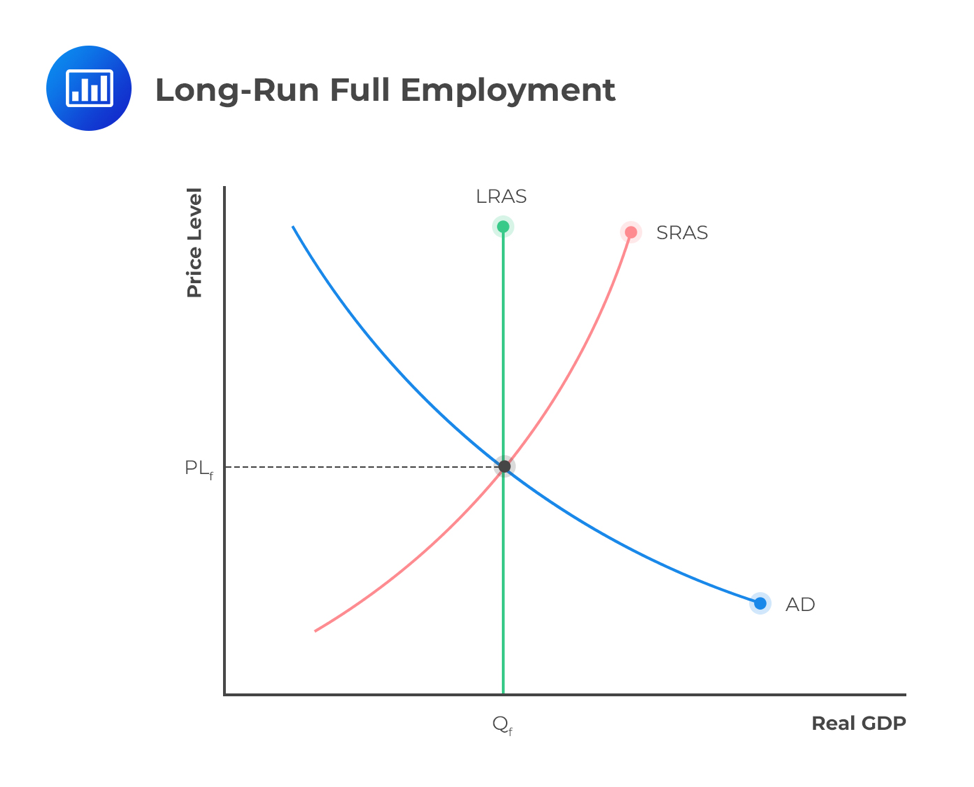

Long-run full employment equilibrium occurs when the aggregate demand (AD) curve cuts the short-run aggregate supply curve (SRAS) at a point on the long-run aggregate supply curve (LRSS):

Since the intersection occurs at a point on the LRSS, the economy operates at potential GDP. Contrary to the inflationary gap, it is characterized by the following factors: capital and labor are fully employed, and jobs are available to everyone in the economy. Eventually, in the long run, potential GDP and equilibrium GDP are both equal.

Potential gross domestic product (GDP) is a theoretical concept in which resources are allocated optimally with no distortions. For example, every worker is matched with the perfect job for his skill level; every good idea is implemented, etc.

It is difficult to measure potential GDP with accuracy. The economy rarely operates at potential GDP because of changes arising from shifts in the aggregate demand curve and the short-run aggregate supply curve.

However, economists expect that the long-run growth rate of potential GDP can be approximated by constructing measures of the trend in actual GDP that smooth out business cycle fluctuation.

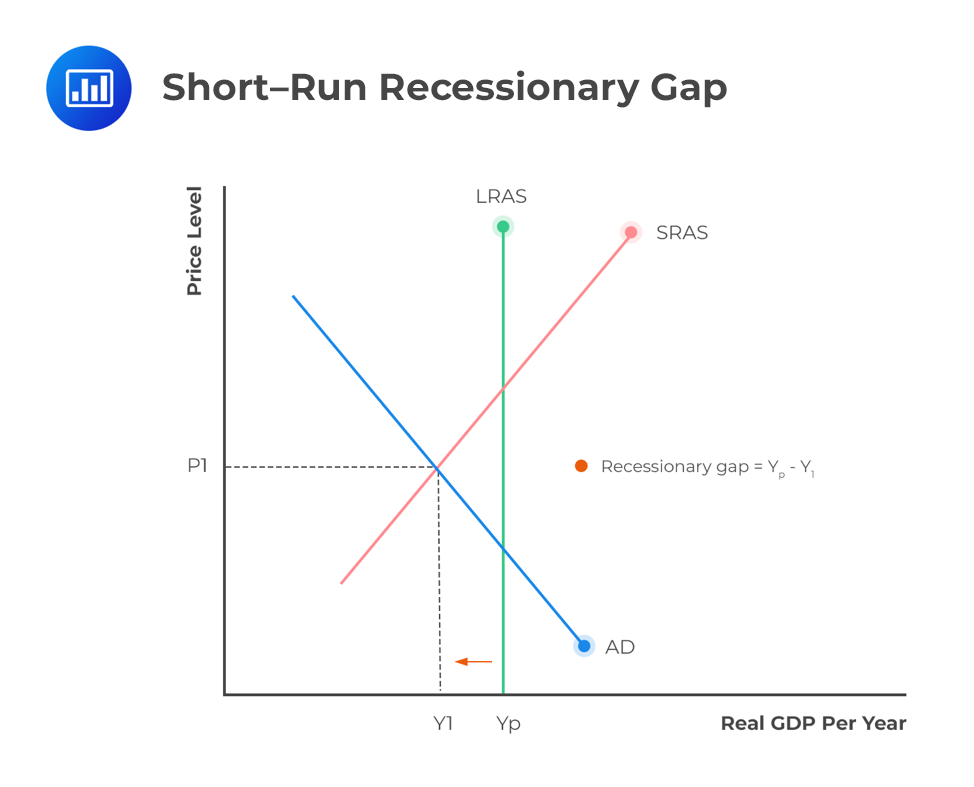

A recession gap occurs when the aggregate demand curve intersects the short-run aggregate supply curve at a point to the left of the long-term aggregate supply.

A shift to the left side of the aggregate demand curve or a decline in quantity demanded leads to lower prices and, hence, a lower GDP. This brings economic contractions, and if such declines drive demand below the potential GDP of the economy, the economy goes into recession. Companies will then tend to reduce their workforce hence raising the rate of unemployment.

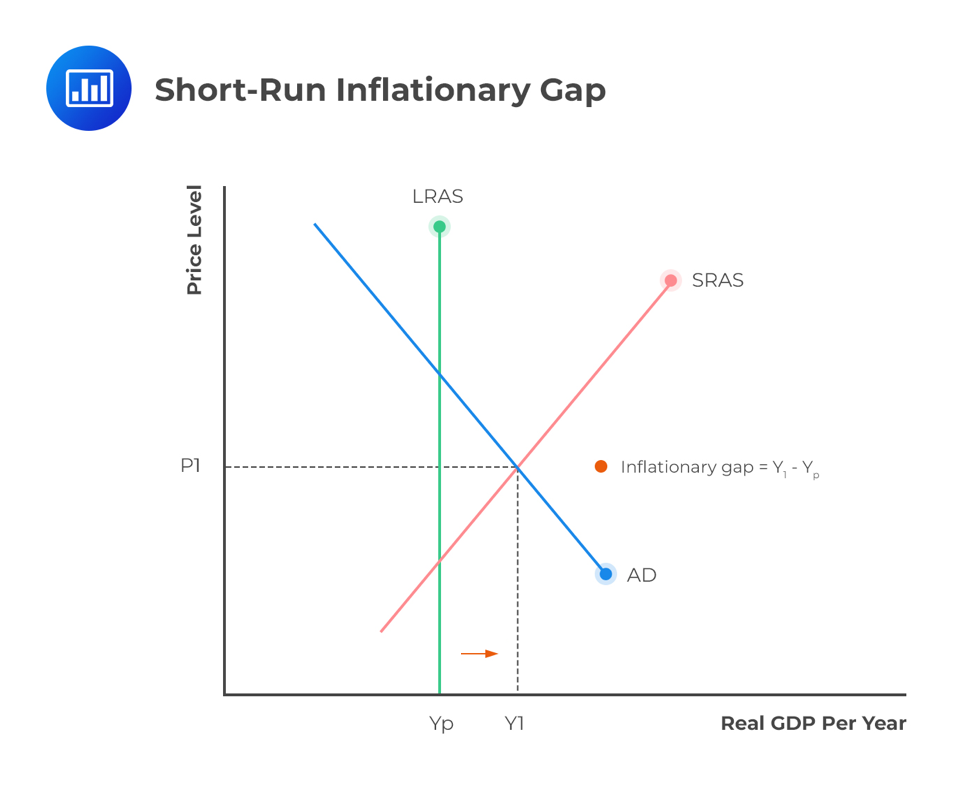

A short-run inflationary gap occurs when the short-run level of equilibrium GDP lies above the potential GDP.

This leads to an upward rise in prices. Due to an increase in aggregate demand, companies will tend to increase their production and employ more workers. As the economy attains its potential GDP, companies pay more wages and other input prices to increase production.

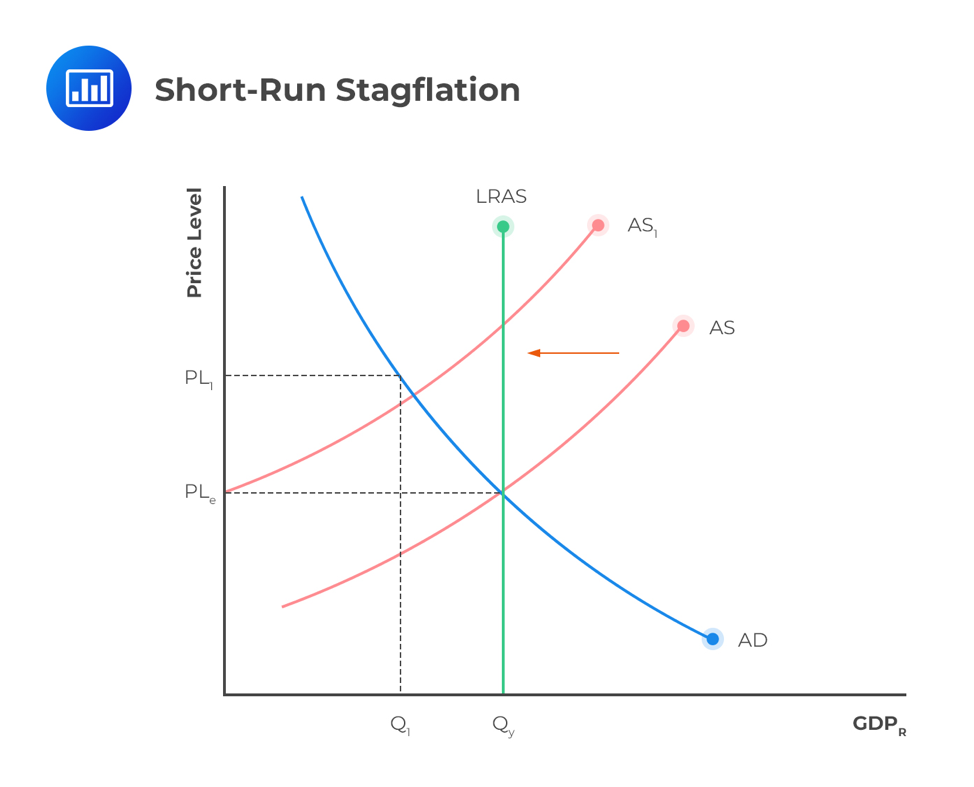

Fluctuations in the short-run aggregate supply cause short-run stagflation. A fall in aggregate supply leads to stagflation, characterized by high unemployment (“stagnation”) and a high inflation rate.

Question

Which of the following is the most accurate statement regarding short-run stagflation?

A. Stagflation occurs when the short-run level of equilibrium GDP of the economy is above the potential GDP.

B. Stagflation is caused by a fall in the short-run aggregate supply.

C. Stagflation occurs when the aggregate demand (AD) curve intersects the short-run aggregate supply curve (SRAS) at a point on the long-run aggregate supply curve (LRSS).

Solution

The correct answer is B.

A decline in the short-run aggregate supply will lead to stagflation, which is characterized by both high unemployment and high inflation.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.