Compare Monetary and Fiscal Policy

[vsw id=”KKHi1HKTpD4″ source=”youtube” width=”611″ height=”344″ autoplay=”no”] Monetary policy and fiscal policy refer to... Read More

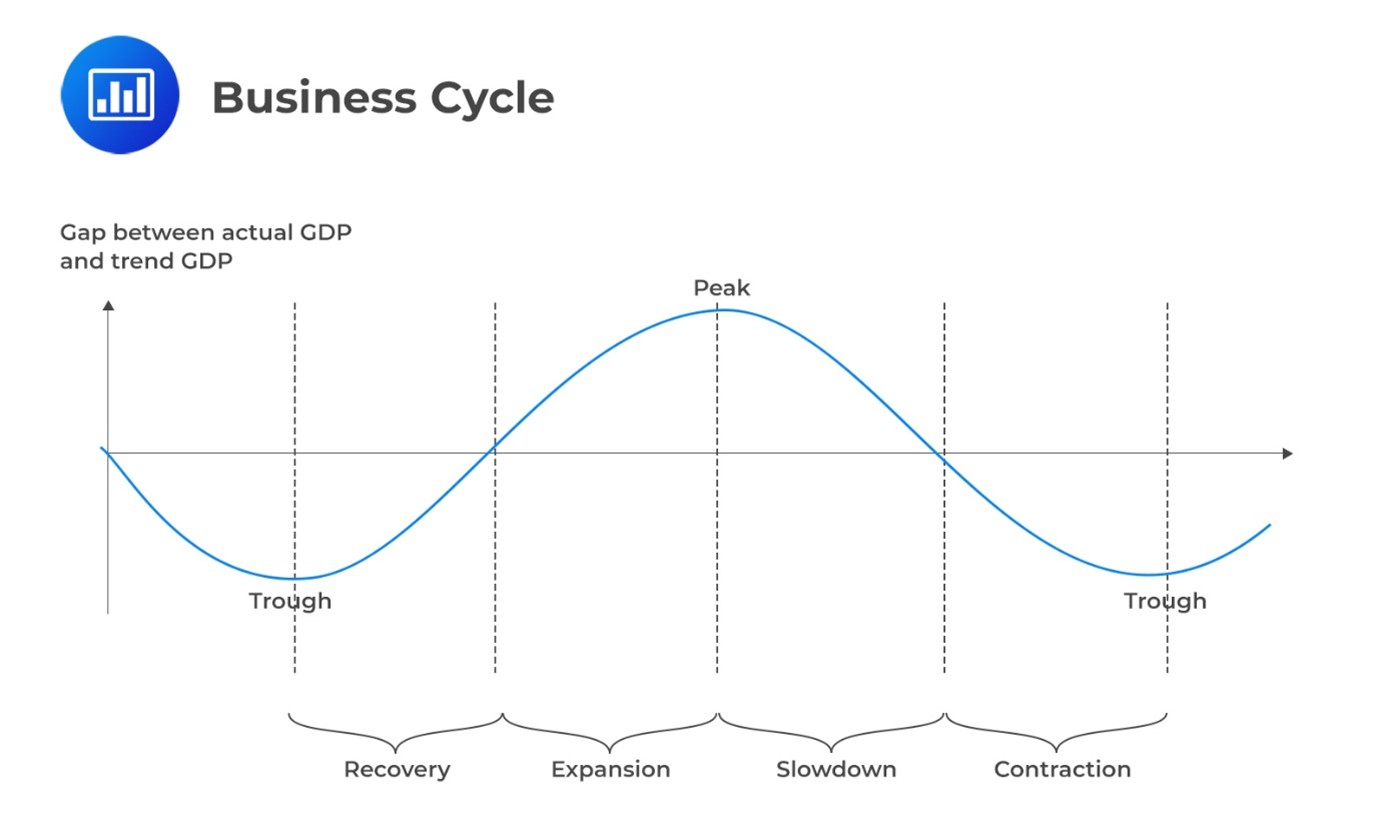

A business or economic cycle is a recurring sequence of alternating expansions (upswings) and contractions (downturns) in economic activity affecting broad segments of the economy.

The phases of a business cycle occur at approximately the same time in an economy. Business cycles are recurrent, meaning that they occur repeatedly over time but not regularly or cyclically.

The different types of business cycles that analysts should be aware of include:

In this section, we will focus on the growth cycle. Precisely, we’ll consider the business cycle as fluctuations around the potential output.

Recall that a business cycle is a series of recurring fluctuations in economic activity, consisting of expansion and contraction. These fluctuations can be divided into four phases: recovery, expansion, slowdown, and contraction. The phases are illustrated in the figure below:

We can rely on the actions of businesses and consumers to identify the cycle’s turning points. Below is a discussion of the market conditions and investor behaviors for each phase.

When the asset markets anticipate the end of a recession and the onset of an expansion phase, the value of risky assets will be adjusted upwards. As an expansion is anticipated, markets will begin to reflect higher profit expectations in the prices of corporate bonds and stocks.

Generally, the stock market reaches its lowest point (trough) approximately three to six months before the economy bottoms out and well before economic indicators show signs of improvement.

The later part of an expansion phase is known as a “boom” During a boom, the economy extends its boundaries, experiences strong confidence, sees significant profit growth, and encounters expanded credit activity.

Businesses might expand to a point where finding skilled workers becomes challenging. To attract employees, they increase wages and keep expanding their operations. Strong cash flows and borrowing as businesses compete against other employers sustain this growth.

If the government or central bank becomes worried about the economy overheating, they may intervene.

In a boom, the riskiest assets often experience significant price hikes. Meanwhile, less risky and risk-free assets like government bonds, which were highly priced during a recession, may have lower prices and, therefore, offer higher yields. Additionally, investors may worry about increased inflation, a factor that may contribute to higher nominal yields.

In the contraction phase, investors often place more value on secure assets. They prefer government securities and stocks of companies with stable or growing cash flows, such as utility companies and essential goods producers. This preference arises because a reliable income stream becomes more valuable during times of employment uncertainty or decline.

Question

Identify the option that is most likely to indicate an economy undergoing a recession.

- The central bank initiates the repurchase of treasury securities.

- The real GDP records negative growth for two consecutive quarters.

- There is a substantial decline in economic activities within the business sector.

Solution

The correct answer is B. Two consecutive quarters of negative growth in real GDP is a widely recognized technical indicator of a recession. Negative GDP growth reflects a declining economic output and is a clear sign of economic contraction.

A is incorrect: When the central bank starts buying back treasury securities, it is usually a monetary policy measure aimed at injecting liquidity into the economy. This action is more associated with stimulating economic growth rather than indicating a recession. Therefore, Choice A is not the most likely indicator of an economy undergoing a recession.

C is incorrect: A notable drop in business sector activity might signal a slowdown, but it doesn’t necessarily mean there’s a recession. A recession is a more extended period of economic decline.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.