Limitations of Monetary Policy

Monetary policy is used in the stabilization of prices and inflation control. However,... Read More

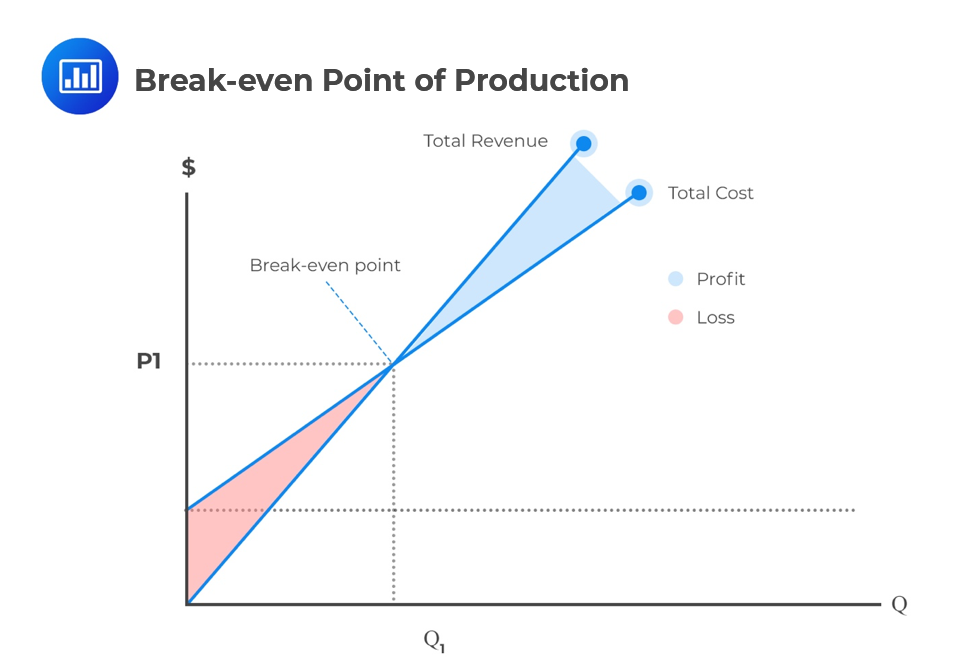

The break-even point can be defined as the production and sales levels of a given product at which the revenue generated from the sales is perfectly equal to the production cost. At this point, the company does not make any profit or loss; it breaks even.

The production cost of every product is divided into two components: the fixed cost components and the variable cost components.

Fixed costs are those costs that remain the same regardless of the level of production of any company. A good example is a cost incurred in setting up production facilities, e.g., rent, fixed interest charges, and depreciation.

Variable costs are directly proportional to the volume produced, and examples include raw materials, wages paid, and other incurred expenses.

A company must fix its selling price above the variable costs incurred per unit of production. The difference between the selling price and the variable costs is referred to as the contribution to fixed costs and profits.

An increase in sales causes a direct increase in contribution. At the break-even point of sales, the contribution is strictly equal to the fixed cost. Therefore, companies will report losses below this point and profits above this point.

After identifying the types of production costs, it is now possible to calculate the break-even point of production because this is where you will either make a profit or a loss.

If we want to determine the number of units that can be produced and sold to break even, we can use the following formula:

Break-even point of production=\(\frac{FC}{P-VC}\)

Where,

\(FC\)=Fixed cost

\(P\)=Selling Price per unit of production

\(VC\)=Variable cost per unit

Note that the denominator of the above formula is the contribution margin per unit of production.

The total fixed cost of a manufacturing company is $300,000, and the variable cost per unit produced is $150. If the selling price of one unit is $300, calculate the break-even point of production.

Solution

We know that:

break-even point of production=\(\frac{FC}{P-VC}=\frac{300,000}{300-150}=2,000\); and

this is the number of units that must be produced and sold to break even.

The shut-down point refers to the minimum price for companies that prefer shutting down their operation instead of continuing to operate. In other words, it is the minimum price and quantity for keeping operations open.

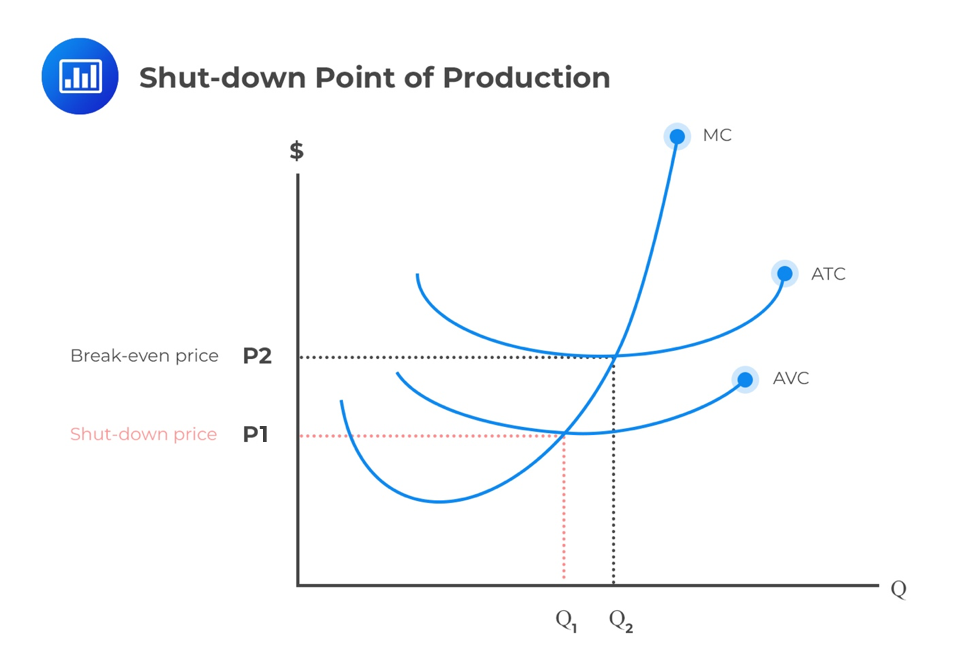

The variable cost per unit (written as marginal cost, MC, on the following graph) falls with an increase in the number of units produced up to a certain point. After this point, the variable cost rises. Consequently, a U-shaped curve is realized when quantity is plotted on the x-axis against the average variable cost on the y-axis.

As seen previously, the break-even point is the point where the marginal cost (MC) equals the average total cost (AT C). The shut-down point of production, on the other hand, is the price at which the marginal cost equals average variable costs (AVC). At this point, the company is better off stopping its production than keeping producing at a loss.

Assume that a manufacturing company produces 1000 units and sells them at $5 each (Total Revenue (TR) is 5 × 1,000=$5,000), Average Total Cost (ATC) is $7,000, fixed cost (FC) is $4000, and a variable cost (VC) is $3,000 for all units. Evidently, this manufacturing company is operating at a loss of -$2000 (economic loss). In economics, we assume that the FC cannot be avoided. The company is obliged to pay it up regardless of whether it operates or not. That is, if it closes its operations, the revenue will be zero, but it will still incur a $4,000 fixed cost.

If it continues its operations, it will earn a revenue of $5000, pay a variable cost of $3000 and use $2000 to pay the fixed cost. In this instance, the company will lose less by continuing its operations. However, the company will exit the market in the long run unless prices increase because, eventually, the average variable costs exceed average revenue (AR). Thus it will shut down at the point of minimum average variable cost (AVC), as seen on the graph.

Question

The short-term shut-down point of production for a firm operating under perfect competition will most likely occur when the price per unit is equal to:

- marginal cost per unit.

- average total cost per unit.

- average variable cost per unit.

Solution

The correct answer is C.

Any firm will shut down its production when the marginal cost is less than average variable cost. We will see later that for a firm in perfect competition to maximize profit, marginal revenue must be equal to marginal cost.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.