Derivatives – Exchange Traded & ...

Derivatives are a class of financial instruments that derive their value from the... Read More

The exercise value, time to expiry, and price of the underlying relative to the option’s exercise price all affect the price of the option.

The exercise value of American and European options is different because of early exercise that is unique to American options. Early exercise gives the holder of an American option the right to buy/sell their contract earlier than the expiration date if the option is at-the-money or in-the-money. European option holders do not have this luxury, and their exercise value is the value of the contract at expiration.

Time value also affects the value of options. A greater length of time until expiration provides further opportunities for the underlying to move in a favorable direction for the option holder. The simplest way to remember this is that as the time to expiry increases, so does the value of both call and put options.

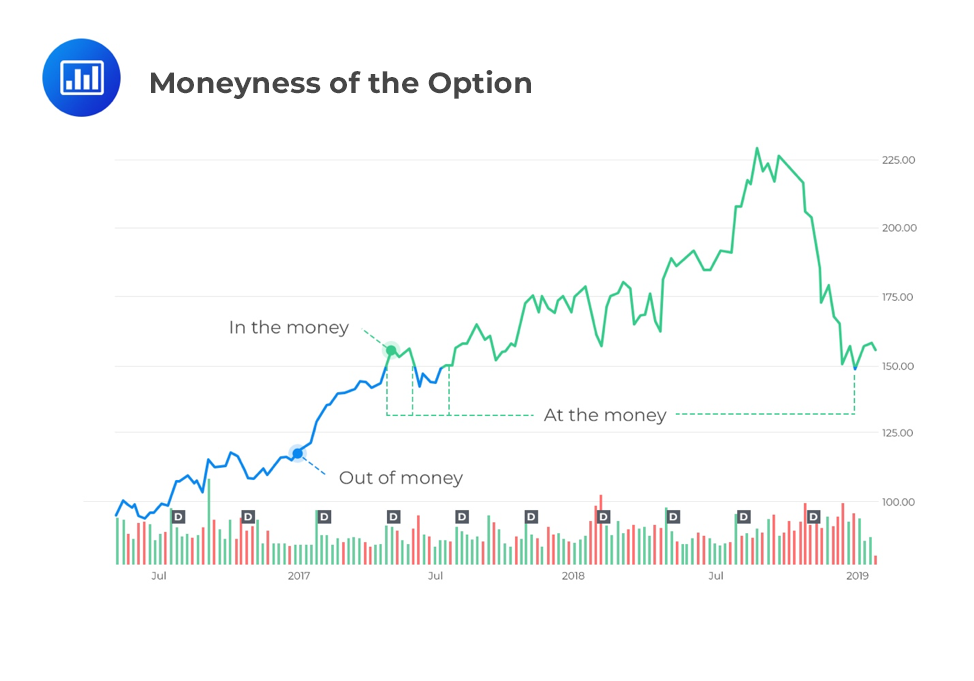

The moneyness of an option is dependent on where the underlying price is relative to the exercise price. When the price of the underlying is above the exercise price in the case of a call option (ST > X) or below the exercise price for a put option (ST < X), the option is said to be in-the-money.

When the price of the underlying is below the exercise price for a call option (ST < X) or above the exercise price for a put option (ST > X), the option is out-of-the-money.

When the exercise price equals the underlying price (ST = X), the option is at-the-money.

In summary, for a call option:

And for a put option:

A great way to visualize this concept is with a graph. Let’s say we have a call option on AAPL with a strike price of USD 150. Whenever the price of the underlying (AAPL stock) is above USD, the option is in the money:

Note that for a put option with a strike price of USD 150, it would be the exact opposite – the option would be out of the money anytime the underlying stock is above USD 150.

Question

What is the difference between a call option being at-the-money and being in-the-money?

A. An option that has a stock price that is less than the exercise price of the option is in the money and when the stock price equals that of the exercise price of the option, it is at-the-money

B. An option that has a stock price equal to its exercise price is at-the-money and if the option’s stock price exceeds that of the exercise price that is called in-the-money

C. An option that is in the money has a stock price that exceeds the exercise price and the option is considered at the money when the stock price is less than the exercise price

Solution

The correct answer is B.

For call options:

At-the-money: Option’s strike price = Market price of the underlying security

In-the-money: Call option’s strike price < Market price of the underlying security

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.