The Role of Arbitrage

In well-functioning markets with low transaction costs and a free flow of information,... Read More

OTC derivative markets can be formal institutions such as NASDAQ or an information connection of parties who buy from and sell to one another.

In OTC derivative markets, derivatives end-users enter contracts with dealers or a financial intermediary such as a bank. The dealers (also regarded as the market markers) engage in bilateral transactions to transfer risk to other parties.

Terms of OTC can be modified to match a desired risk exposure profile. This is a beneficial feature to derivative end users who want to hedge existing or expected exposure.

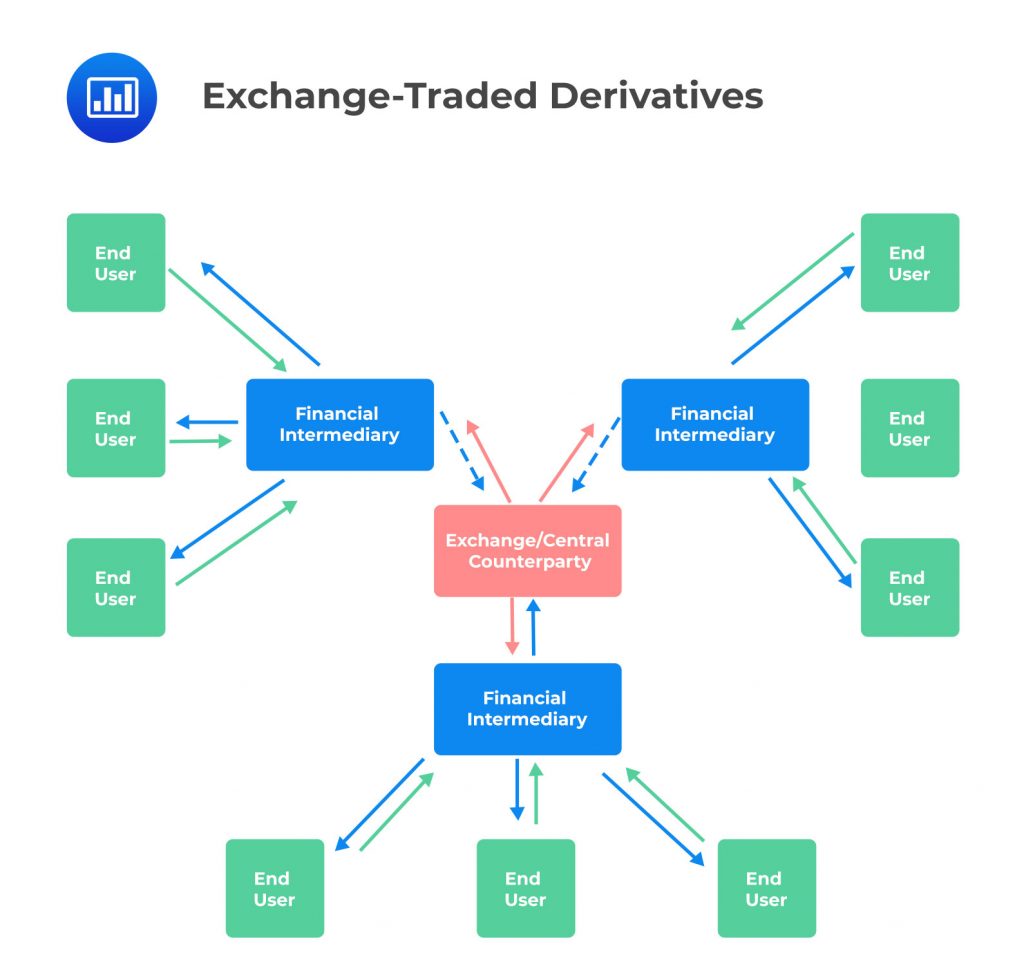

In ETD markets, derivatives are traded in more formal and standardized contracts, promoting higher liquidity and transparency. Such derivatives include futures, options, and other financial contracts at the exchange.

The exchange determines the terms and conditions, including the size of each contract, type, quality, and location of the underlying.

The exchange members consist of dealers (market markers) who are prepared to buy at one price and sell at a higher price. If they cannot find counterparties to trade, risk takers such as speculators may be willing to assume an exposure in the underlying.

Exchange-traded derivatives have standardized terms and conditions. As such, clearing and settlement are done efficiently.

Clearing is a process where the exchange/central counterparty verifies the execution of a transaction, exchange of payments, and records of the participants. On the other hand, settlement refers to the payment of final amounts and/or delivery of securities or physical commodities between the counterparties based upon exchange rules.

Exchange-traded derivatives demand collateral on deposit upon initiation and during the life of a contract to reduce counterparty risk. The deposit is paid through a financial intermediary, which assures counterparty default.

Question 1

Which statement best describes the OTC derivatives market?

A. Contracts are flexible, and there is a high degree of reporting to the regulatory authorities.

B. Contracts are standardized, cleared, and settled through a centralized clearing house.

C. Contracts are flexible, often cleared and settled between transacting parties with a low level of regulatory oversight.

Solution

The correct answer is C.

Exchange-traded derivative contracts are standardized, cleared, and settled through a centralized clearinghouse and accompanied by a high level of regulatory reporting. OTC contracts are far more flexible and less regulated.

Question 2

Consider the following draft commercial contract extracted from Clap company’s records.

$$\small{\begin{array}{l|l} \text{Contract date} & \text{Today} \\ \hline

\text{Goods seller} & \text{ABZ Limited, Japan} \\ \hline \text{Goods buyer} & \text{Clap Company, USA} \\ \hline \text{Goods description} & \text{Oil drilling machine} \\ \hline \text{Quantity} & \text{Two} \\ \hline

\text{Delivery date} & \text{150 days from the contract date} \\ \hline \text{Delivery terms} & {\text{Delivered by ferry. Costs to be paid}\\ \text{by the buyer}} \\ \hline \text{Payment terms} & \text{The amount is payable by the buyer upon delivery} \\ \hline \text{Contract price} & \$17,525\end{array}}$$Which derivative market should ABZ Limited most likely use to hedge its financial risk under this commercial contract?

A. An exchange-traded market since it is standardized and transparent.

B. An OTC market, since the contract can be customized to match ABC’s desired risk profile.

C. The market with the best price regardless of whether it is an OTC or an exchange-traded market.

Solution

The correct answer is B.

An over-the-counter market allows the customization of risk to suit a client’s risk exposure profile.

It would be difficult for ABZ Limited to find a contract that matches the desired 150 days from contract date delivery and the exact contract price in an exchange-traded market.

A and C are incorrect. As seen above, the over-the-counter market is the best-suited market for ABZ Limited.