Cost of Debt Capital

The cost of debt is the cost of financing a debt whenever a... Read More

Marginal cost of capital (MCC) plays a very important role in capital budget decision-making. When used in conjunction with the investment opportunity schedule, an optimal capital budget may be determined.

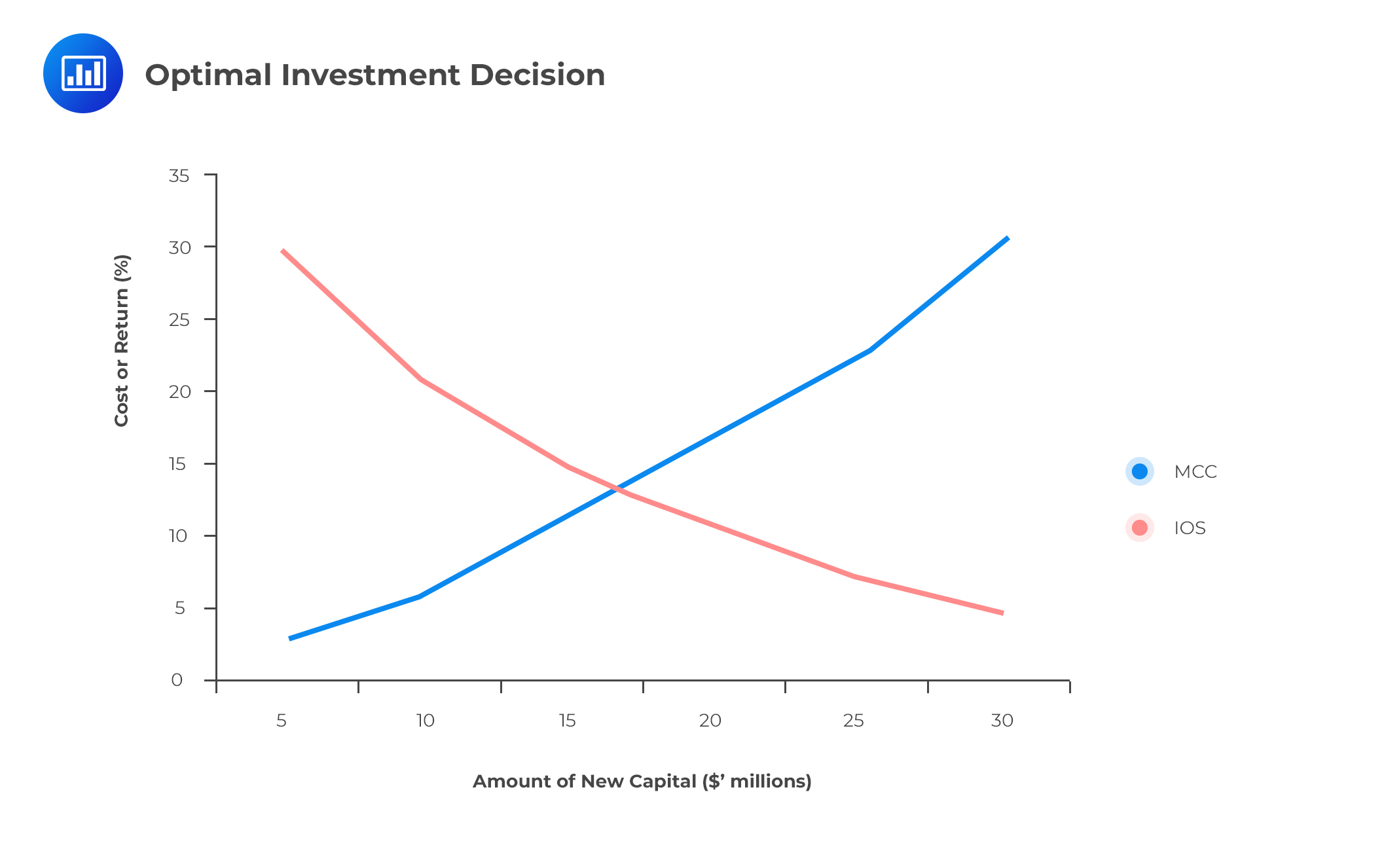

The MCC of a company tends to increase as it raises additional capital. As the company makes additional investments with this new capital, returns on its investments will generally decrease as represented by the investment opportunity schedule (IOS). The relationship between the MCC and the IOS gives an overview of the basic decision-making problem that a company has. The following graph shows the relationship between the cost of capital and investment returns.

As we can see, the upward-sloping marginal cost of the capital schedule is graphed against the downward-sloping investment opportunity schedule.

The graph also indicates that the optimal capital budget, which maximizes the value of investments, occurs whenever the marginal cost of capital intersects with the investment opportunity schedule. The optimal capital budget is simply the amount of capital raised and invested and at which the marginal cost of capital is equal to the marginal return from investing.

Question

Which of the following statements is an accurate representation of the relationship between the cost of capital and investment returns?

- The investment opportunity schedule is upward-sloping.

- The marginal cost of capital schedule is downward-sloping.

- The optimal capital budget is the amount of invested capital at which the marginal cost of capital equals the marginal return from investing.

Solution

The correct answer is C.

The optimal capital budget is the amount of capital raised and invested and at which the marginal cost of capital is equal to the marginal return from investing.

A and B are incorrect because the marginal cost of capital schedule is upward-sloping while the investment opportunity schedule is downward-sloping.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.