Short-term Funding Choices

Regular assessment of short-term funding aims to ensure that a company has the... Read More

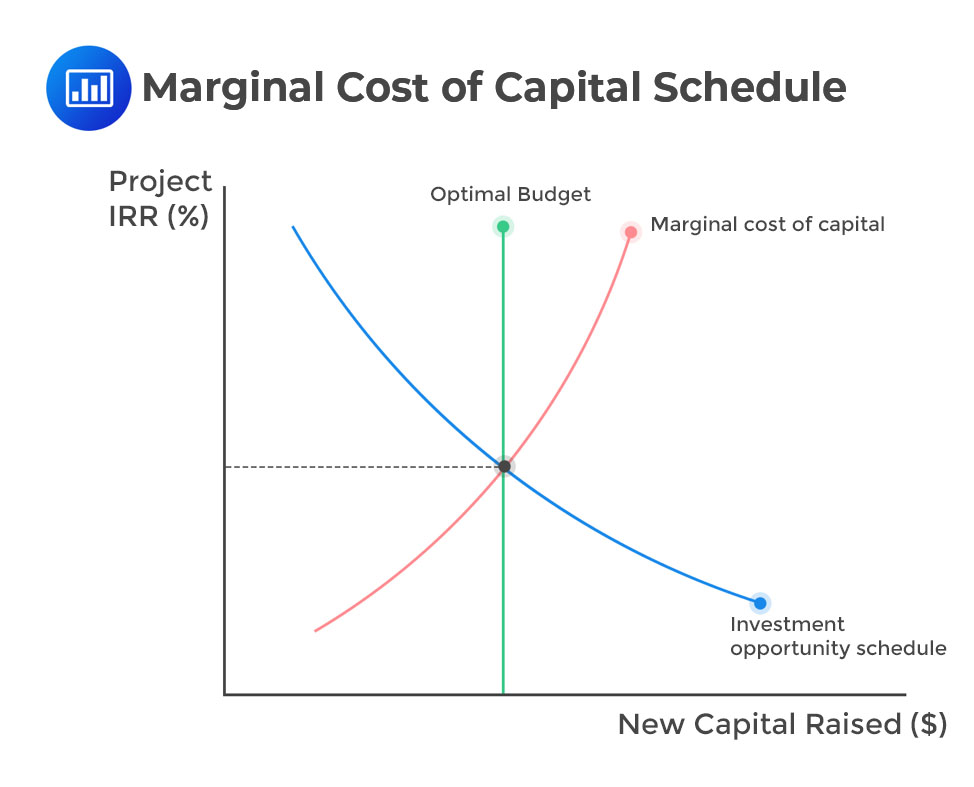

The cost of the different sources of capital tends to change as a company raises additional capital, thereby resulting in a change in its weighted average cost of capital (WACC). The marginal cost of capital (MCC) schedule depicts this relationship by reflecting WACC for various amounts of capital raised.

The MCC schedule is not a smooth graph but tends to slope upwards in a step-up fashion. This is because the MCC tends to increase as additional capital is raised. Two reasons why a company’s marginal cost of capital tends to increase as more capital is raised are: (i) bond covenants or debt incurrence tests may place restrictions on the company’s ability to incur additional debt; and (ii) the company may experience deviations from its target capital structure.

The amount of capital at which the weighted average cost of capital changes is known as the break-point. This occurs whenever the cost of one of the sources of capital changes.

The formula for determining a break-point is:

$$ \text{Break point}=\cfrac {\text{Amount of capital at which the sources’ cost of capital changes}}{\text{Proportion of new capital raised from the source} } $$

A company raises capital according to its target capital structure of 50% debt and 50% equity. Its cost of debt capital remains unchanged when it seeks to raise a debt capital within a celing range of up to an additional $6 billion. However, once it attempts to raise more than this amount of debt capital, its cost of capital increases. Using this information alone, identify one of the company’s break-points.

Solution

Breakpoint = $6 million/0.50 = $12 million

Question

Which of the following statements is the most accurate?

- The MCC Schedule is usually downward sloping.

- The MCC Schedule depicts the relationship between the amount of new capital being raised and the cost of equity capital.

- The MCC Schedule depicts the relationship between the amount of new capital being raised and the weighted average cost of capital.

Solution

The correct answer is C.

A is incorrect. The MCC schedule is upward sloping.

B is incorrect. The MCC schedule depicts the relationship between the amount of new capital and the WACC, not just the cost of one source of capital, i.e., equity.