Describe Pricing Strategy Under Each M ...

Pricing strategy can be described as the range of methods that the firms... Read More

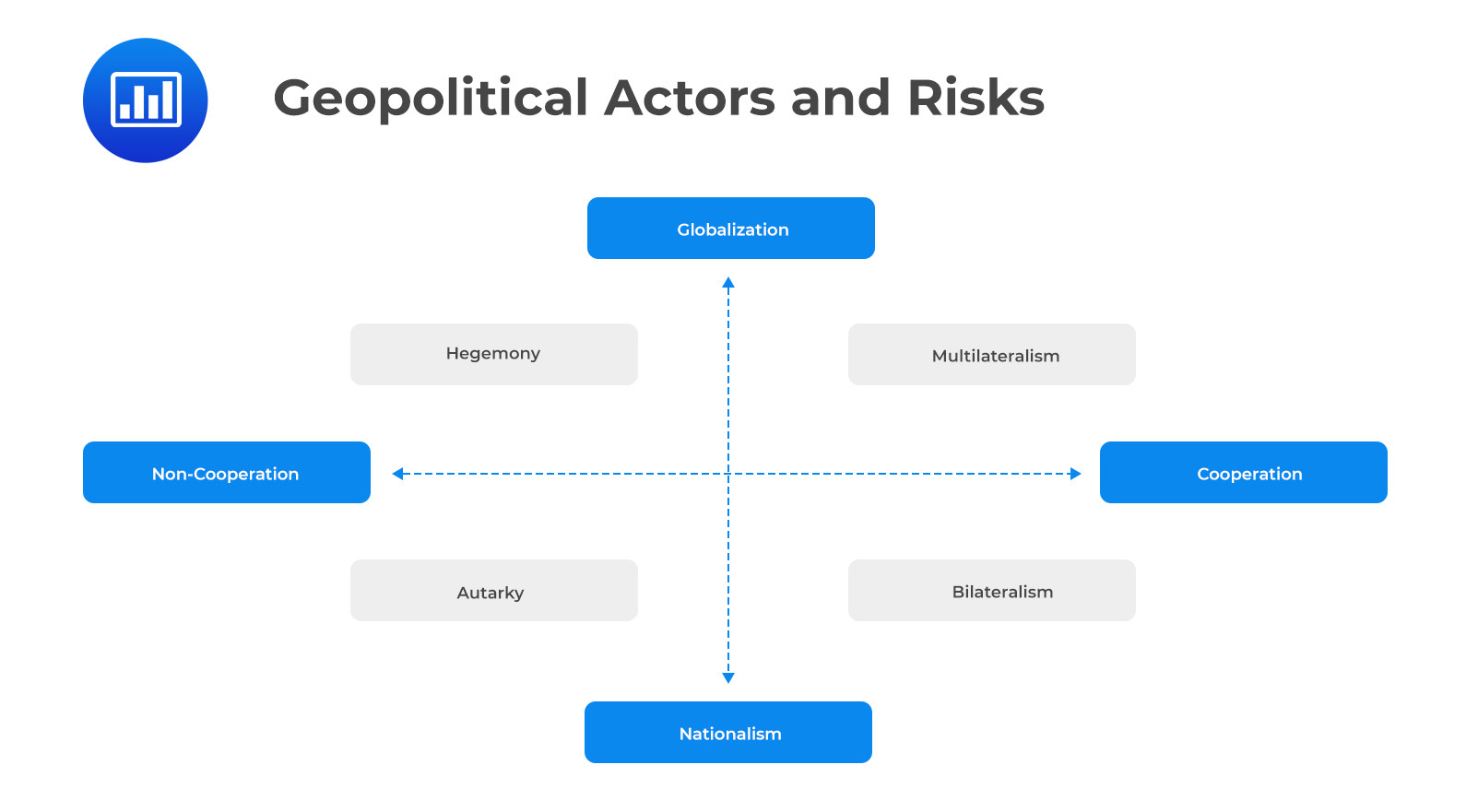

Globalization is the interaction and integration of individuals, organizations, and governments on a global scale. It is characterized by the cross-border movement of goods, information, employment, and culture. However, recently there has been a growth of nationalism, thanks to which cross-border activities have come under heightened scrutiny. Besides, this development has seen some countries’ desire to use imported goods and services reduced.

The promotion of a country’s own economic interests at the expense of or in opposition to those of other nations is known as anti-globalization or nationalism. Microeconomic globalization is also evident. Products are frequently built-in one nation using components from many nations, finished in another, and then marketed in a third one. The best inputs for a company’s product can be found through this procedure.

Additionally, cultural and communication aspects of globalization exist. You might find Asian sauces, Indian spices, French cheese, and coffee from Kenya in a New York supermarket. Global citizen interactions have expanded due to faster and more economical travel.

Globalization is the product of financial and economic collaboration. It is primarily carried out by non-state actors, such as businesses, people, or organizations. It is characterized by cooperation in the economy and finance. Actors who are involved in globalization are inclined to look outside their own country for access to new markets, talent, or education.

Collaboration and globalization frequently go hand in hand. This means that political cooperation can promote or hasten globalization. Nonetheless, globalization also occurs in isolation.

Three potential gains from participating in globalization are:

i. Increasing profits: There are two ways in which this can happen:

ii. Access to resources and markets: Companies looking for long-term access to resources such as people or raw materials may need to work together. They eventually end up globalizing to have access to these resources.

iii. Intrinsic gain: An activity’s intrinsic gain is a byproduct or consequence that results in a benefit that overlaps profit. Accelerated productivity as a result of learning new techniques is a good example.

Potential disadvantages of globalization include:

Jobs are created in a foreign country if a company moves a manufacturing plant to that country. Conversely, this may occasion job losses in the home country. In addition, the foreign country’s businesses may have to compete with the corporation for workers and resources.

Companies that operate in low-cost nations frequently adhere to the local regulations in those nations. Globalization can deplete human, administrative, and environmental resources if standards are lower in one country than in another. Under such circumstances, businesses ultimately lower their production standards.

Since certain nations may benefit from increased labor force utilization while others may experience job losses as a result of a corporation moving outside, globalization can exacerbate income and wealth inequality. This may result in a decline in political cooperation as well as decreased economic and political cooperation.

Increased economic and financial cooperation could make businesses more reliant on foreign resources for their supply chains. This, in turn, could make countries more reliant on foreign countries for certain resources.

There are four archetypes of country behavior:

This refers to nations with little foreign trade or financing and seeking political independence. Since they are self-sufficient, autarkic nations can exert complete control over the flow of products, services, and technology. This makes them politically stronger.

During times of autarky, a nation’s political and economic growth can advance more quickly. A case in point is China in the 20th century. However, it can also result in a gradual loss of economic development. North Korea qualifies as a good example in this regard.

Hegemonic nations frequently serve as regional or world leaders and exercise political or economic dominance over others in order to maintain control over resources. Countries that adhere to the hegemon country’s principles are eligible for benefits offered by the hegemon country.

A country with a hegemonic system can be influential on global affairs, while countries aligning themselves with the hegemon’s rules may enjoy rewards from the global leader. However, as a hegemon’s influence dwindles, it may become more competitive and consequently increase geopolitical risk. An example is Russia’s influence on natural gas supply which gives it influence over countries that rely on its natural gas.

These are nations that engage in rule harmonization and mutually beneficial trade agreements. Their individual businesses have several trading partners and are totally linked to global supply chains.

A good example is Singapore. Among other benefits, multilateralism allows a country to access resources and markets globally. However, such a country may become highly dependent on international cooperation for its economic growth. This makes them more vulnerable to geopolitical risk.

Bilateralism is the practice of two nations cooperating in the political, economic, financial, or cultural spheres. Even though bilateral agreements are made one at a time, governments that engage in bilateralism may have relationships with several distinct nations.

Japan was once a bilateral country that built a strong export market for its products. Bilateral agreements are not enough to deal with global issues such as global tax avoidance.

Question

Which of the following is least likely a motivation for globalization by non-state actors?

- Intrinsic gain.

- Currency exchange.

- Access to resources and markets.

The correct answer is B.

Currency exchange is a characteristic of globalization but not necessarily a motivation for globalization by non-state actors.

A is incorrect. Intrinsic gain is a motivation for globalization by non-state actors. It is a side effect of an activity that generates a benefit beyond profit itself. An example of an intrinsic gain is accelerated productivity that stems from learning new methods. Other motivations include increasing profits and access to resources and markets.

C is incorrect. Access to resources and markets such as talent and raw materials is a motivation for globalization by non-actors. Non-actors may also globalize to access market and investment opportunities.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.