Why Forward and Futures Prices Differ

[vsw id=”j97FeOxxdRk” source=”youtube” width=”611″ height=”344″ autoplay=”no”] Forward and futures contracts share similar features;... Read More

[vsw id=”00HzgJftwpU” source=”youtube” width=”611″ height=”344″ autoplay=”no”]

There are multiple types of derivative contracts that are classified as forward commitments or contingent claims. Within the forward commitment universe, we find forward contracts, futures contracts, and swaps. On the other side of the spectrum, options (calls and puts), credit derivatives, and asset-backed securities are contingent claims. Contracts can be traded on regulated exchanges or on over-the-counter (OTC) markets and provide a pre-defined payoff profile to both the buyers and sellers of the contracts.

Forward contracts, futures contracts, and swaps are forward commitment derivatives that create the obligation to transact in the future.

A forward contract is a commitment in the form of an OTC derivative contract in which the buyer agrees to purchase an underlying asset from the seller at a later date at a fixed price agreed at the time of the contract inception. If one party reneges on their commitment, it is considered a default, and legal proceedings can be instituted to force performance. The amount owed is always the net value between the two parties.

When we consider the payoff profile of a forward contract, we denote the payoff profiles as follows:

$$ \text{Payoff for the buyer} = S_T – F_0(T) $$

$$ \text{Payoff for the seller} = -[S_T – F_0(T)] $$

Where:

ST = the price of the underlying asset at the contract expiration (time T)

F0(T) = the price that the buyer agrees to buy the asset for (or the seller agrees to sell the asset for) at the inception of the contract (at time T=0)

For the buyer of the contract, if the price of the underlying asset at contract expiry (ST) is greater than the price that they agreed to pay at contract inception F0(T), then clearly they can purchase the asset for less than the prevailing price and thus they have profited. The mirror image is true for the seller. If ST is greater than F0(T), then the seller has an equal but opposite loss on the transaction. The buyer and seller are the counterparties in a zero-sum game outside of the transaction costs incurred. If one party loses USD 100,000 on a forward contract, the counterparty gains USD 100,000.

However, an important element of a forward contract is that no money is exchanged when the contract is initiated. Thus, forward contracts can be thought of as having zero value at the start, and they are neither assets nor liabilities. The value deviates from zero as the price of the underlying moves. The ability to “lock-in” a future price for an asset has important practical benefits and is used as an instrument for financial speculation.

Forward contracts do not need to be settled by delivering the physical underlying asset; they may be cash-settled, referred to as non-deliverable forwards (NDFs), or contracts for differences (CFDs).

Futures contracts are specialized versions of forward contracts that are standardized and traded on a futures exchange. Futures exchanges are highly regulated, and the contracts have specific underlying assets, times to expiration, delivery, and settlement conditions and quantities.

An important distinction is the daily settlement of gains and losses and the credit guarantee provided by the exchange through its clearinghouse. This daily settlement process is known as mark-to-market, where the clearinghouse determines an average of the final futures trades of the day and designates that price the settlement price. Each party’s account in the transaction will be debited or credited with the losses or gains for the day. The account is referred to as a margin account and is different from an equity margin account.

In a futures margin account, both parties to the transaction deposit an initial amount of money, typically less than 10% of the futures price, and this is the initial margin. There is no formal loan created for the balance, as is the case with equity markets; the futures margin is more of a “good faith” amount to cover possible future losses. The initial margin is the maintenance margin, the amount of money each party must deposit after the trade is initiated. The maintenance margin is assessed daily by the clearinghouse. After the mark-to-market process, the balance in the account is below the maintenance margin amount. The participant will receive a margin call requiring them to deposit additional funds. In fast-moving markets, the clearinghouse can make margin calls intra-day.

Some futures contracts contain a price limit which is essentially a price range or band relative to the previous day’s price. If a party wants to transact above this band (limit up), the trading is halted until the parties agree on a price below the upper band. Likewise, if a party wants to transact below the band (limit down), then trading also stops until a price above the lower band can be agreed on. When the market hits these bands and trading stops, it is known as a locked limit. The limits are important in helping the clearinghouse manage credit exposure.

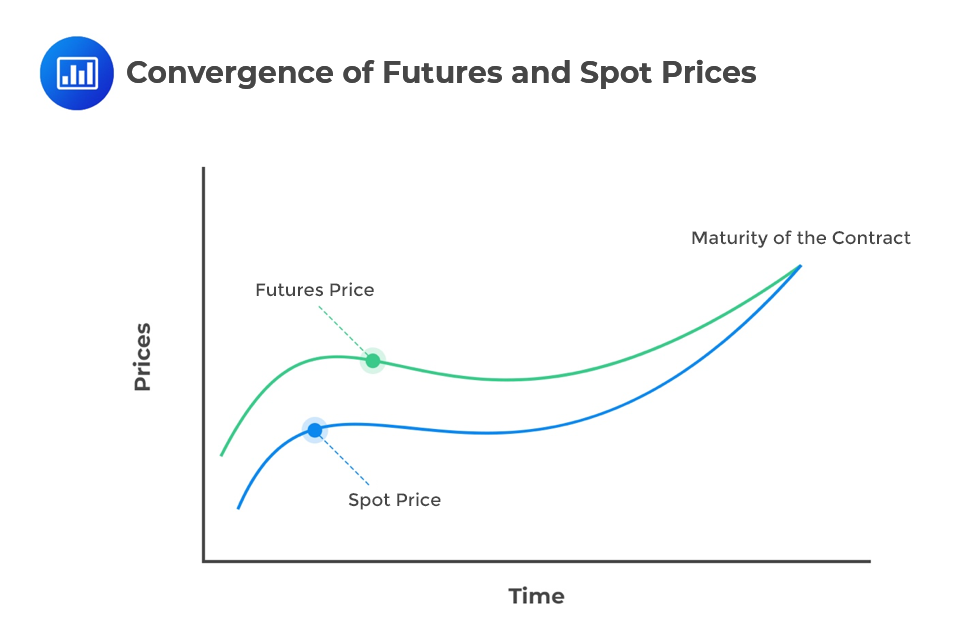

At any given time, the number of outstanding contracts is known as the open interest. Futures contracts can be settled by physical delivery of the underlying or cash on the expiration day. The futures price converges towards the spot price at expiration. In cash-settled transactions, there is a final mark-to-market at expiration with the futures price set to the spot price to ensure convergence:

Besides the obvious difference in standardization, forward contracts realize the full amount of ST – F0(T) at expiration, but futures contracts realize this amount in parts on a day-to-day basis. Due to the time value of money, these are not equivalent amounts. However, the difference tends to be small for shorter duration contracts in low-interest-rate environments. Nevertheless, waiting until expiration to settle, as is the case with forward contracts, does introduce more credit risk than with a daily settled and high regulated futures contract.

The concept of a swap is that two parties exchange a series of cash flows. One set of cash flows is variable or floating, and the other can be variable or fixed. A swap is an OTC contract that is privately negotiated and is subject to default.

The most commonly used swap is a fixed-for-floating interest rate swap, also referred to as a “plain vanilla swap.” The notional principal is the loan balance on which the interest rate payments are determined. As with futures and forwards, no money changes hands at the start of the contract, and the swap value is zero. However, as market conditions change, the value of the swap will change, being positive for one party and negative for the other.

Swaps are subject to default, but as the notional principal is not exchanged, the credit risk of a swap is much lower than that of a loan. The only money that passes from one party to another is the net difference between the fixed and floating rate of interest.

Options, credit derivatives, and asset-backed securities are all types of contingent claims, meaning one of the parties has the right, but not the obligation, to transact at a predetermined price at expiration.

The right to buy is referred to as a call option, while the right to sell is a put option. An option contract may also be exercised before the contract expiry date. Early exercise options are American-style, while European-style options can only be exercised at expiry. However, it is important to note that both types of options trade in all geographies. The fixed price at which the underlying asset can be bought or sold at expiry is the exercise price or strike price.

The purchaser of an option contract pays the writer of the option contract an option premium. The premium represents the value of the option in a well-functioning market. As the buyer has no obligation beyond the premium, only the seller of the option can trigger a default if the buyer exercises the option and the seller does not deliver the underlying.

We will learn more about the value at expiration and profit for call and put options in the next learning objective.

A credit derivative provides credit protection for the buyer in the event of loss from a credit event. There are several types of credit derivatives.

In a total return swap, the underlying is typically a loan or a bond. The credit protection buyer pays the credit protection seller the total return on the bond (interest plus capital) in return for a fixed or floating rate of interest. If the bond defaults, the credit protection seller must continue to pay the interest while receiving no (or very little) return from the buyer.

In a credit spread option, the underlying is the yield spread between the yield on a bond and the yield of a benchmark default-free bond. This yield spread, or credit spread, is a reflection of investors’ perception of credit risk. The credit protection buyer selects the strike spread and pays an option premium to the seller. At expiration, the spread is compared with the strike spread, and if the option is in-the-money, the seller pays the buyer the determined payoff.

In a credit-linked note, the credit protection buyer usually holds a bond that may be subject to default and, to offset that risk, issues a credit-linked note with the condition that if the bond defaults, the principal payoff is reduced accordingly. Thus, the buyer of the credit-linked note takes on the credit risk of the underlying bond.

In a CDS, the credit protection buyer makes a series of regularly scheduled payments to the credit protection seller. The seller makes no payments until a credit event occurs. A credit event could be a declaration of bankruptcy, a failure to make a scheduled payment, or a restructuring. The CDS contract will explicitly define what constitutes a credit event. A CDS is essentially a form of insurance and provides loss coverage in return for the premium paid by the buyer to the seller.

Asset-backed securities alter the payment stream of the underlying asset. They typically divide payments into tranches (slices) in which the priority of the claims changes from all being equivalent to some tranches taking preference on the payments. The differential nature of these claims becomes relevant when prepayments or defaults occur.

When a mortgage asset portfolio is assembled into an ABS, the resulting instrument is called a collateralized mortgage obligation (CMO). When homeowners pay off their mortgages early (prepayment), the mortgage holders suffer, and an expected stream of returns has been terminated early. The funds now have to be reinvested at a typically lower rate. CMOs typically partition the mortgages into A, B, and C classes, and class C will bear the first wave of prepayment risk, followed by class B and class A. As the risk on the tranches is not equal (class C bears the most prepayment risk), the expected returns on the classes vary to compensate investors for the varying risk.

When bonds or loans are assembled into an ABS, they are referred to as collateralized bond obligations (CBO) or collateralized loan obligations (CLO) which collectively are collateralized debt obligations (CDO). A CDO does not have much prepayment risk but does have credit risk. A CDO allocates this risk to different tranches, senior, mezzanine, or junior tranches. When a default occurs, the junior tranche bears the risk first, followed by the mezzanine and then the senior tranche. Therefore, senior tranches have the lowest risk but also the lowest expected return.

Question

Which statement is true when the stock price is above the exercise price (ST > X) on a put option at expiration?

A. The option seller would suffer a loss equivalent to the difference between the stock price and the exercise price

B. The option buyer would suffer a loss equivalent to the difference between the stock price and the exercise price

C. The option seller will show a profit equivalent to the option premium amount, the option buyer will show a loss equivalent to the option premium amount

Solution

The correct answer is C.

If the stock price is above the exercise price at expiration, the put option expires out-the-money and is worthless. The option buyer has lost the premium paid while the option seller has made a gain equivalent to the premium received.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.