Covered Calls and Protective Puts

Call and put options can be used to manage risk for holders of... Read More

Derivative instruments allow allocation, transfer, and management of risks without trading an underlying. The information on cash or spot market prices for financial instruments, goods, and services may assist an investor or issuer in buying and selling. However, issuers and investors are affected by the timing difference between the economic decision and the ability to transact in a cash market.

The ability to buy or sell a derivative instrument today at a pre-agreed price reduces the time between the economic decision and transacting in price risk under different scenarios. For instance, forward commitments or contingent claims can allocate or transfer risk across time and among investors willing to assume those exposures.

Derivative instrument prices provide a price discovery function outside cash or spot markets. More specifically, futures prices may give information about future cash market movement. For instance:

Options prices mirror underlying features such as implied volatility, which measures the expected price risk of the underlying.

The operational benefits of derivatives that differentiate them from the cash or spot market include the following:

Operational efficiency of derivative markets natures greater market efficiency. Derivative markets offer an effective way to exploit mispricing (deviation of prices from the fundamental value). Consequently, fundamental values are frequently reflected earlier in the derivative market than in the cash market. As such, derivative markets lead to more efficient financial markets.

Derivative instruments and positions are complex. As a result, there are potential risks associated with their usage. These include:

High operational efficiency in derivative instruments limits an investor’s initial cash outlay. Consequently, this feature attracts a high degree of implicit leverage compared to cash or spot markets. A high degree of leverage may increase the chances of financial distress.

Derivatives are used to create exposures not found in cash or spot markets. This results in greater portfolio complexity and risks unknown to the investors.

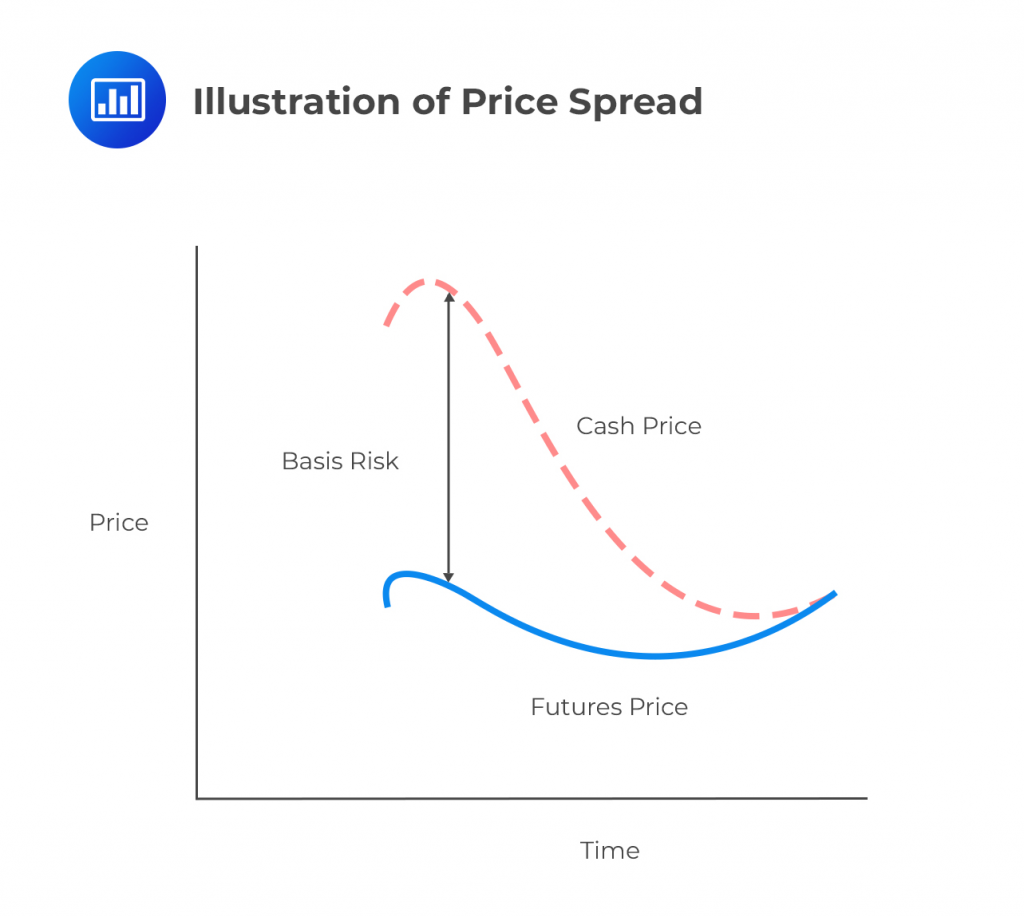

Basis risk occurs when the expected value of a derivative instrument suddenly deviates from that of the underlying or hedged transaction. Basis risk may manifest when a derivative instrument references a price of an index that is similar but does not precisely match the underlying exposure.

Liquidity risk arises when the cash flow timing of a derivative differs from that of the underlying transaction. For instance, if an investor or issuer fails to honor the margin call requirements, its position is closed out.

Counterparty credit risk is the risk of one or more parties in a financial transaction failing to fulfill their side of the contractual agreement. Derivative instruments are associated with counterparty credit exposure leading to differences in the current price compared with the expected future settlement price. However, counterparty credit risk varies with derivatives instrument types and markets in which they are traded.

For example, counterparty credit risk is prevalent in over-the-counter (OTC) markets since credit terms are privately negotiated between counterparties. On the other hand, exchange-traded derivatives are associated with low counterparty risk due to the mark-to-market (MTM) process and margining procedures.

Systemic risk occurs due to extensive risk-taking and the use of leverage in derivative markets (which may lead to market stress). As such, financial market supervisory has increased, with a heightened focus on the effect of financial innovation and financial conditions necessary for market stability.

Question 1

Which of the following best describes basis risk? The risk that:

A. cash flow timing of a derivative instrument differs from that of an underlying transaction.

B. the expected value of the derivative deviates unexpectedly from that of the underlying.

C. arise due to imprudent risk-taking and utilization of leverage that play a part in market stress.

Solution

The correct answer is B.

Basis risk occurs when the expected value of a derivative instrument suddenly deviates from that of the underlying or hedged transaction.

A is incorrect. It describes liquidity risk.

C is incorrect. It describes the systemic risk.