All you Need to Know About the 2020 CF ...

Is there a Need to Pursue Professional Courses? With the rising number of... Read More

If you are a CFA exam candidate, you are probably concerned about how easy it is to pass your exam and how the CFA Institute grades the exams. The CFA Institute applies a unique methodology to come up with a minimum passing score for each exam.

Let us explore how the Institute grades the CFA exams.

All three levels of the CFA exam have multiple-choice questions; while level III has essay-type questions. The machine grades the multiple-choice sections while CFA charterholders grade the constructed response sections. However, to ensure fairness, the graders work in teams. Each team grades only one question, and the names and testing centers of the candidates remain unknown to the graders. In addition, the CFA Institute provides the graders with guidelines and grading keys.

The grading process is thorough and involves checking to ensure high levels of quality and consistency. For instance, human graders check ten percent of the multiple-choice questions graded by the machine. The junior, senior, and grader of grades also counter-check each other’s work to ensure excellence. Next, someone else grades 50% of the distribution scores to give them another chance to pass. The graders do the third round of grading when the two rounds of grading give different results.

Finally, the grading is finalized and collected, and the minimum passing score for each exam is applied.

The minimum passing score is the mark used by the CFA Institute to establish whether a candidate has passed or failed the exam. The minimum passing score for each CFA level exam is determined through workshops and varies each year. The workshops involve various participants who analyze each exam question and make independent judgments on how averagely competent candidates could perform. Secondly, they aggregate and review these judgments and come up with a range for the scores of each exam.

The report from these workshops forms the foundation on which the charterholders on the CFA Institute board of governors set the minimum passing score. However, although the CFA Institute does not announce these scores, research estimates that they are between 60 and 70 percent.

The CFA Institute grades the exam by applying the minimum passing score. For instance, the candidate gets a pass if its score is above the minimum passing score. On the other hand, if the candidate scored below the minimum passing score, they receive a did not pass result.

In addition, candidates receive a summary of their performance on each topic and the maximum score possible on each test topic. However, the CFA Institute expresses the score in ranges, for example, more than 50% or more than 70%.

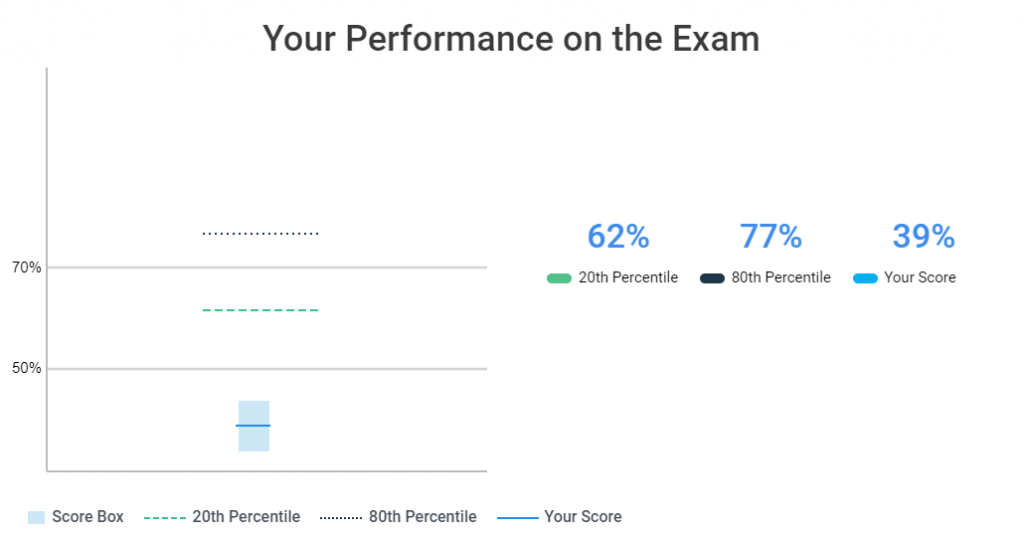

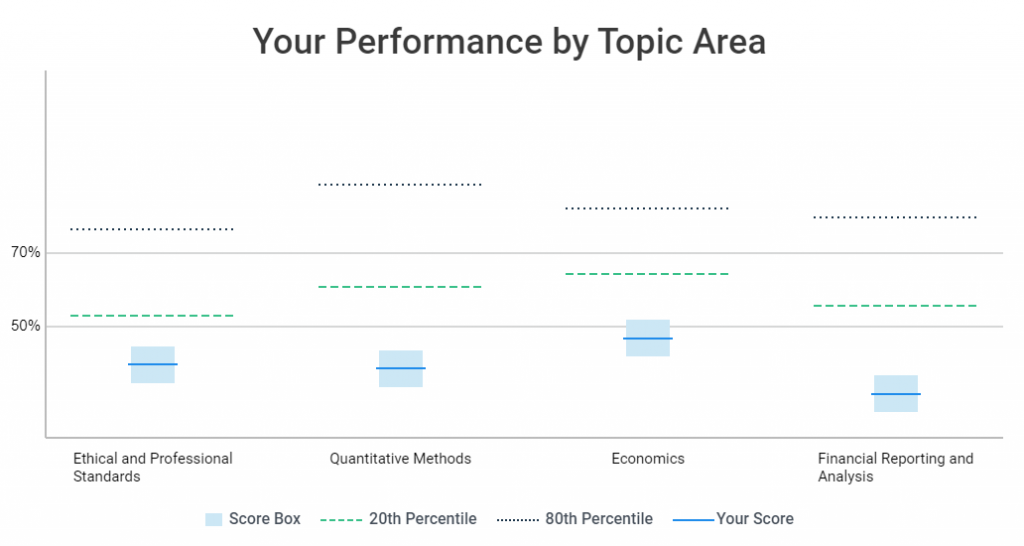

Here are some examples of what your score could look like using AnalystPrep‘s computer-based testing mock exams, which have been created to be as close as possible to the actual exam:

To pass your level I exam, you need to understand the material and have the skills to apply it. The exam will test how to apply what you learned to different scenarios. The CFA Institute recommends that you dedicate at least 300 hours of study for each exam level.

You should set apart a time to study and develop a study strategy to ensure that you get the most out of each session, and starting a study routine as early as possible will go a long way in helping you achieve this.

During your study sessions, it is essential to understand the topics that carry more weight in the exams versus those that do not. For example, here are the topic weights for the level I exam.

$$ \small{\begin{array}{l|c} \textbf{Level I Topic} & \textbf{Level I Weight} \\ \hline \text{Quantitative Methods} & 8-12\% \\ \hline \text{Economics} & 8-12\% \\ \hline \text{Financial Reporting and Analysis} & 13-17\% \\ \hline \text{Corporate Issuers} & 8-12\% \\ \hline \text{Equity} & 10-12\% \\ \hline \text{Fixed Income} & 10-12\% \\ \hline\text{Derivatives} & 5-8\% \\ \hline \text{Alternative Investments} & 5-8\% \\ \hline\text{Portfolio Management} & 5-8\% \\ \hline \text{Ethics} & 15-20\%\end{array}} $$

Specific learning outcomes (also known as learning outcome statements or LOS) refer to what you should be able to do by the end of your studies for each exam level. These are the actual knowledge, skills, and abilities that the CFA Institute intends for you to learn or develop. There are around 500 learning outcomes per level.

You should plan out your study sessions around the core topics and the specific learning outcomes. Planning study sessions around the core topics will help your study sessions be more focused and successful.

Here are some sample learning outcomes:

Note that the command words can either be descriptive in nature (interpret or explain) leading most often to non-mathematical questions or quantitative in nature (calculate) leading to the candidate having to perform a calculation.

The CFA exam tests not just your knowledge of the material but the skill to apply that knowledge to realistic situations. You need to apply what you have learned to solve problems rather than replicate memorized information.

It would be best to remember that you will need to use the material you learn to work in the real world, and relating it to real-life situations makes it easier to remember.

The last but equally important step in preparing for your CFA examinations is to practice taking the exam as much as possible. You can always buy additional resources from Analystprep.com.

Supplementing your studies with a CFA exam study package provided by Analystprep.com will provide you with extra learning materials and online resources to give you an edge, such as video lessons. Our experienced instructors will guide you through challenging concepts and help you gain the confidence to pass the exam.

Is there a Need to Pursue Professional Courses? With the rising number of... Read More

The CFA Institute has transitioned all level testing to be computer-based in 2021.... Read More