How to Study and Pass the CFA® Exam o ...

CFA exams are written twice annually in June and in December. It is,... Read More

You will need to be able to calculate and explain the importance of Price Elasticity on the exam. Elasticity measures the sensitivity of one variable to another. If something is highly elastic, it will experience a large price change in response to a small change in the related variable. Elasticity is calculated as follows:

$$ E=\frac { \%\Delta Q }{ \%\Delta P }\quad or\quad \left( \frac { \Delta Q }{ Q } \right) \ast \left( \frac { P }{ \Delta P } \right) $$

$$ E=Elasticity $$

$$ Q=quantity $$

$$ P=price $$

Knowing both versions of the formula will help you whether the amounts in a problem are expressed as percentages or in whole numbers. The triangle symbol (△) represents the change in a value. In addition to the elasticity of prices (related to demand), there is also Elasticity of Income (related to supply). The formula is very similar to the price formula above:

$$ E=\frac { \%\Delta Q }{ \%\Delta I } $$

$$ I=Income $$

There are two types of goods, as it relates to elasticity of income. Normal goods have positive income elasticity (elasticity greater than 0), which means demand for them increases as consumer incomes increase. Inferior goods that have negative income elasticity (elasticity value less than 0) experience decreasing demand as income increases. A simple example is that a BMW is a normal good while a Kia is an inferior good since people with higher incomes tend to buy more BMWs and fewer Kias.

There are also Cross-Price Elasticities among different goods. Substitutes have positive cross-price elasticities since the increase in the price of one will increase the demand for the other. This is common among different brands of the same product because people only need one or the other. Complements are goods with negative cross-price elasticity. An increase in the price of a goodwill decrease demand for its complements because they tend to be purchased together, like peanut butter and jelly.

The Law of Diminishing Marginal Returns states that the marginal return from increasing input will decrease. One example would be that if you are hungry, eating an additional cookie will make you feel better. As you continue eating cookies, however, each new cookie will bring you less happiness.

Economies of Scale occur when increasing volume of production leads to decreasing average cost. You’ve probably seen this in action when you’ve received per-unit discounts for buying larger quantities of items, such as business cards.

There are several common types of market structures you will need to know on the exam. In a Monopoly, one firm controls a market entirely. They set both the price and quantity of goods available and there are large barriers to entry preventing competition. In an Oligopoly, several firms control the production in a market. There are high barriers to new entrants and the few controlling firms set prices to maximize profits. In Perfect Competition, many firms sell homogeneous goods to many buyers. No one seller can grow enough to influence the market. Monopolistic Competition involves several firms competing based on differentiating products. Due to competition, no one firm can have out-sized profits over the long run.

There are different profit expectations for all four market types. Firms in a Perfectly Competitive market will experience virtually no economic profit over the long term. Any profit they earn will attract new entrants, which will increase supply to the point where Marginal Cost (MC) equals Marginal Revenue (MR) for additional production. Monopolistic Competition will draw new entrants into the market as profits increase, but firms can maintain some of their earnings through spending on marketing to differentiate their products from competitors. In an Oligopoly, firms can earn profits over the long run, but no one firm can earn enough to gain market dominance. As their profits increase, other firms will change their pricing strategy or new entrants will come in. Monopolist firms can earn economic profits over the long term. The firm can use its profit earnings to maintain the barriers to entry to prevent competition from eroding its market control. This is why it’s important to regulate monopolies to keep a properly functioning market.

The four market types also have different optimal pricing strategies for firms. Perfect Competition firms are price takers, and the optimal price for their goods is the equilibrium price on the supply/demand curve. Firms in Monopolistic Competition have control over their own prices because they are able to differentiate their product to prevent consumers from substituting their goods with those from competitors. Oligopoly prices are determined by competitors. The few companies in the market can influence the price levels, but not control them. Monopolists set their own prices. Their only practical limit is not to raise their prices so high that it attracts new entrants to their market.

You will be expected to identify what type of market a firm operates in, given just a few pieces of information. Some common factors include the concentration ratio for the market, which ranges from 0 for Perfect Competition to 100 in a Monopoly. The level of price elasticity is also a good indicator. Monopoly firms have inelastic prices, while more competitive markets display much more elasticity.

Gross Domestic Product (GDP) is a measure of the economic activity of a country. It can be measured as the total income earned by all households, companies, and the government (Income Approach) or as the total of all goods and services produced (Expenditure/Output Approach) over a given time. The formulas for the two approaches are:

Income

GDP = Total National Income + Sales Tax + Depreciation + Net Foreign Factor Income

Expenditure

GDP = Consumer Expenditures (C) + Business Investment (I) + Government Spending (G) + Exports (X) – Imports (I)

There are two ways to denominate GDP. These are Nominal GDP, which is how it is measured using unadjusted, observed values, and Real GDP, which involves adjusting the observations to account for inflation. The principle of nominal GDP is similar to that of finding a present or future value of the GDP amounts, using the inflation rate as the discount rate. One formula you will need to know for the exam is the GDP Deflator, which measures the level of inflation based on how it affects GDP values:

$$ GDP\quad Deflator\quad =\frac { Nominal\quad GDP\quad }{ Real\quad GDP } \ast 100 $$

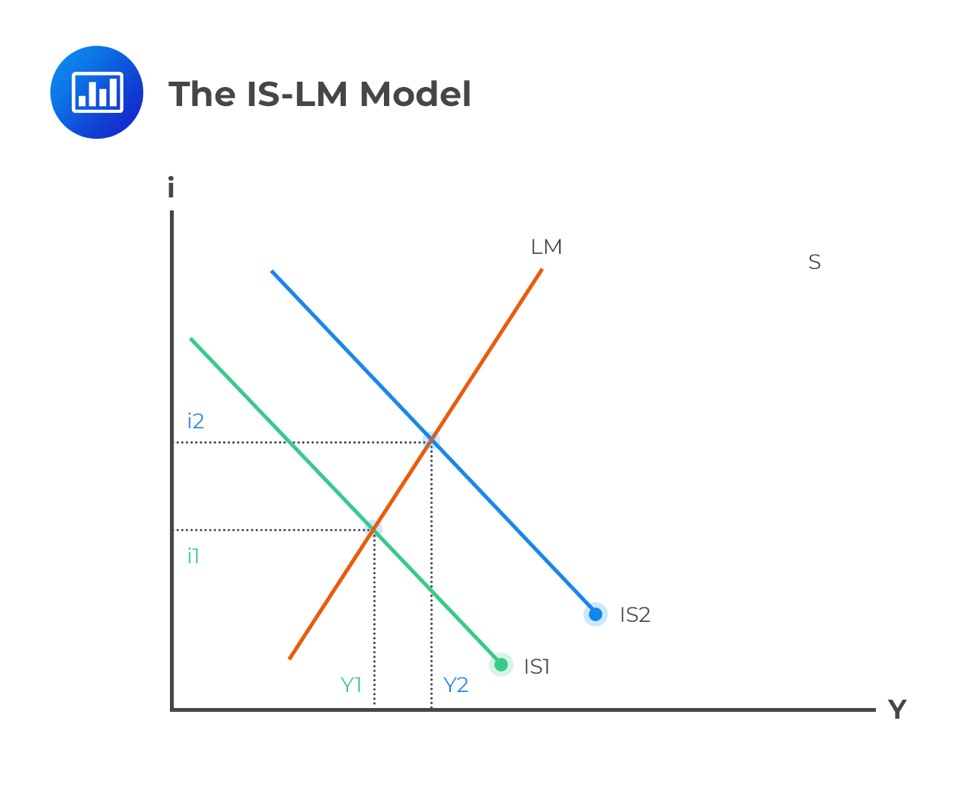

You will also need to understand the importance of the IS-LM Model to analyze interest rate impacts on economic activity. The name stands for Investment-Saving – Liquidity Preference-Saving. This is used to model changes in aggregate economic demand. The equilibrium aggregate demand exists at the intersection of the IS and LM lines. Changes in interest rates can cause shifts in the IS curve, as indicated in the graph above. IS-LM models are used by the US Federal Reserve when making interest rate policy decisions. An important basic principle of the model is that interest rates can have a significant impact on the quantity of money in the economy, which then impacts aggregate demand.

The equilibrium aggregate demand exists at the intersection of the IS and LM lines. Changes in interest rates can cause shifts in the IS curve, as indicated in the graph above. IS-LM models are used by the US Federal Reserve when making interest rate policy decisions. An important basic principle of the model is that interest rates can have a significant impact on the quantity of money in the economy, which then impacts aggregate demand.

Economic growth factors are also an important part of the Econ curriculum. There are several measures for determining expected GDP growth and estimating the sustainability of that growth. Estimated GDP growth can be categorized into three categories: Technology, Labor, and Capital. The best one for estimating potential GDP growth is Labor. The two components of labor in GDP growth are in total hours worked and Labor Productivity.

$$ Labor\quad Productivity=\frac { Real\quad GDP }{ Aggregate\quad Hours\quad Worked } $$

Increases in labor productivity mean that more can be produced by the same number of labor hours. This is captured by the Total Factor Productivity component of GDP modeling. This figure is multiplied by the total labor hours to determine aggregate production. It represents the effects of technological improvements that increase the productivity of workers.

The Business Cycle is the pattern of growth and decline that occurs as part of economic growth over time. While overall growth generally follows an upward trend, the business cycle represents the fluctuations around that trend line.

There are four phases of the business cycle that encompass each wave in the chart above:

1. Expansion features increasing growth, decreasing unemployment, and upward pressure on prices.

2. Peak occurs when inflationary pressure on prices and wages slows down further growth.

3. Contraction is when the economy slows down or declines. Prices start to decrease and unemployment rises.

4. Trough is the lowest point in the cycle.

There are many theories that attempt to explain the causes of business cycles, but the four primary ones in the curriculum are:

1. Models with Money: These models assume that money supply is a primary driver of business cycles and that inflation is a result of these fluctuations.

2. New Classical School: This relies on the assumption of rational expectations for economic agents (buyers and sellers) in the market. Agents rely on rational beliefs about future inflation to influence their current-day buying and selling decisions. The economic results are the aggregation of these decisions made by each individual.

3. Neoclassical and Austrian Schools: These believe that the invisible hand of market forces will reach an equilibrium on its own unless that is prevented by government intervention. They posit that government intervention to increase growth in a recession is actually interrupting the natural flow of supply and demand that would bring growth back in line on its own.

4. Keynesian and Monetarist School: This school of thought believes that intervention is necessary to pull the economy out of a recession. Keynes supported the fiscal policy as a tool to increase economic growth when spending is stuck at low rates.

Understanding Inflation is an important part of Economic analysis. Inflation is the increase in the prices of goods and services over time. Inflation reduces the purchasing power of consumers and can slow economic growth as a result. Some advantages of inflation include a decrease in the real amount of debt and an increase in unemployment due to the stickiness of nominal wages. An extreme case of inflation is known as Hyperinflation. This is when the supply and demand of money are so out of line that the value of money declines at astronomical rates. Deflation occurs when price levels decline, usually a result of a decrease in the money supply. Deflation causes a slowdown of economic activity because consumers defer purchases in expectation of lower prices in the future.

This reading focuses on the two primary mechanisms for market intervention by governments. Fiscal Policy involves decisions about government spending and taxation. Monetary Policy refers to actions by central banks to influence the quantity of money and credit throughout the economy. In trying to stimulate economic growth, monetary policy could be the Federal Reserve lowering interest rates through open market buying operations, while fiscal policy could be the government starting a stimulus program to increase aggregate spending.

Since economic growth is highly related to the supply of money, the CFA program curriculum includes information about the nature of money. There are three important functions that money serves, including being a store of value, a unit of account, and a medium of exchange.

You need to be familiar with the Quantity Theory of Money, which is expressed by the formula:

$$ M\ast V=P\ast Y $$

$$ M=Quantity\quad of\quad money $$

$$ V=Velocity\quad of\quad money $$

$$ P=Price \quad level $$

$$ Y=Real\quad output $$

Another important equation related to money is the Fisher relationship, which is the underlying principle of many central banking decision tools. The Fisher equation tells us:

$$ { R }_{ N }={ R }_{ R }+{ \pi }^{ e } $$

$$ { R }_{ N }=nominal\quad interest\quad rate $$

$$ { R }_{ R }=real\quad interest\quad rate $$

$$ { \pi }^{ e }=expected\quad inflation\quad rate $$

This model assumes that real rates are stable over time and so the primary determinant of nominal interest rates in the economy is the expected inflation rate. The equation itself is very simple, but expect to see questions that try to mislead you into viewing it as more complex than it needs to be.

Central Banks play a major role in economic activity. They serve as the Controller of Credit through the use of monetary policy, where they use buying and selling of government securities to alter the supply of money in the banking system. They are also the custodian of cash reserves for commercial banks, in addition to being the “lender of last resort.” In this role, they provide liquidity to banks through loans when market conditions are bad, and banks cannot get funding from other sources.

Central banks have several mechanisms through which they can apply Monetary Policy to influence economic activity. They set lending rates for banks by altering the rates at which they provide loans to commercial banks. The banks then alter their own lending rates to accommodate those changes while maintaining their earnings on funds. Central banks also use open market operations, wherein they buy or sell Treasury bonds to commercial banks to either decrease or increase, respectively, the total money in circulation.

Monetary policy can be either Expansionary or Contractionary, depending on whether the bank is trying to increase or decrease economic growth rates. Expansionary policies include increasing the money supply and lowering interest rates. These are intended to increase spending throughout the economy. Contractionary policies are activities in the opposite direction and are intended to decrease economic growth. A major indicator that central banks use to determine when they need to perform contractionary activities is when inflation rates begin to get exceedingly high.

Governments also utilize Fiscal Policy in order to influence economic growth and development. The fiscal policy entails spending and taxation programs by governments at different levels. Government spending can include Capital Expenditures, which are investments in infrastructure to increase the productive capacity of an economy, and Current Spending, which is directly spending on goods and services such as defense, health, and education. Another kind of spending is Transfer Payments. These are payments made to change the distribution of income throughout society, such as welfare programs, Social Security, and pensions. These payments are not included in GDP calculations because they do not represent new production.

Like monetary policy, fiscal policy can be both expansionary and contractionary. Programs like tax cuts and spending increases are intended to spur economic growth, while tax increases and spending cuts do the opposite.

https://analystprep.com/shop/all-3-levels-of-the-cfa-exam-complete-course-by-analystprep/

You will be expected to understand the importance of trade between countries and how this affects economic growth within and between nations. International trade has many benefits, including increasing economic growth through specialization, improving the standard of living between countries, and new competition decreasing local monopoly power. There are also important limitations of trade, including increasing income inequality caused by international competition and the loss of certain industries to international competitors who have competitive advantages.

There are two types of competitive advantage related to trading nations. A country has an Absolute Advantage when it can produce goods at a lower total cost than a trading partner. A Comparative Advantage is when a country can produce goods at a lower opportunity cost. Specializing in areas of comparative advantage allows countries to focus on what they do most efficiently and reduces average costs throughout the entire world economy through trade.

There are limits most countries’ government’s place on Trade flows in order to protect their own domestic interests. They can enact Tariffs, which are taxes on certain imported goods done to protect local industries from too much international competition. They can also require Licenses and set Import Quotas that limit the type and amount of goods that can be imported and sold to their citizens. Similar mechanisms can also be used for Capital controls that apply to the flow of money into and out of a country. Too few capital controls can make it difficult for a country (especially a smaller country with large trading partners) to enact the fiscal and monetary policies that it prefers.

These trading interactions are captured by the Balance of Payments between nations. It is a record of all economic transactions between different countries over a period of time and has three components. The Current Account tracks the inflow and outflow of goods or services. The Capital Account includes the moving of all non-financial and non-produced assets. The Financial Account is where all monetary assets are tracked.

There are several important international organizations to help promote and manage international trade. The International Monetary Fund lends foreign currencies to member states to aid them during financial difficulties in order to promote international monetary system stability. The World Trade Organization regulates cross-border trade relationships. The World Bank Group lends funding to projects in developing countries and helps create international economic infrastructure.

Exchange rates represent the price of one currency in terms of another. A EUR/USD exchange rate of 0.75 means that 1 US dollar (USD) will buy 0.75 Euros (EUR). In this example, EUR is the price currency and USD is the base currency. This is known as a Spot Exchange Rate because it involves a transaction of one currency for another at the present time. There are also Forward Exchange Rates, which represent the exchange of one currency for another at a future date.

Forward rates are often expressed in terms of Points, which stands for basis points. This means that in order to convert them to decimals, you need to divide them by 10,000 (a basis point is 1/100th of a percentage). Here is an example:

$$ { USD }/{ EUR }\quad Spot\quad Rate:1.5252 $$

$$ 6-month\quad forward\quad points:3 $$

$$ 6-month\quad forward\quad rate:$$

$$ 1.5252+\frac { 3 }{ 10,000 } =1.5252+.0003=1.5255 $$

Forward rates can also be expressed as a Premium or Discount to the spot rate. This is based on the relative interest rates between the two countries whose currencies are involved.

$$ F=S\frac { 1+i\left( f \right) }{ 1=i\left( d \right) } $$

$$ S=current \quad spot \quad rate $$

$$ F=current \quad forward \quad rate $$

$$ i\left( d \right)=domestic\quad interest\quad rate $$

$$ i\left( f \right)=foreign\quad interest\quad rate $$

The Premium can be represented by itself as:

$$ Forward\quad Premium=S\left( 1+x \right) $$

A common application of these formulas is the calculation of the Forward Trading Premium. This is the same as the prior formula, but includes a time component.

$$ F=S\frac { \left( 1+{ f }^{ t } \right) }{ \left( 1+{ d }^{ t } \right) } $$

$$ t=time\quad to\quad maturity $$

As an example, here is how to find the 90-day forward premium (or discount) based on the following:

$$ \frac { EUR }{ USD } Spot\quad Rate=1.5 $$

$$ EUR\quad 1\quad year\quad rate=4\% $$

$$ USD\quad 1\quad year\quad rate=6\% $$

$$ F=1.5\ast \frac { 1+{ .04 }^{ \frac { 90 }{ 360 } } }{ 1+{ .06 }^{ \frac { 90 }{ 360 } } } =1.5\ast \frac { 1.44721 }{ 1.49492 } =1.45213 $$

$$ F-S=1.45213-1.5=-0.04787 $$

$$ -0.04787\ast 10,000=-478.7 $$

$$ Forward\quad discount=478.7\quad points $$

Exchange rates can also be expressed as Cross Currency Rates, which is the combination of several exchange rates to get a new rate in terms of two different currencies. This looks like:

$$ \frac { EUR }{ USD } \ast \frac { USD }{ CNY } =\frac { EUR }{ CNY } $$

An important consideration when answering cross-currency problems on the exam is to make sure that you are using each rate correctly. In the example above, you’ll see that USD is the price currency in one equation and the base currency in the other. When you are translating these rates, it’s important to make sure that your price and base currencies line up appropriately. It is very common for the exam to quote exchange rates in a different order than what you need for the equation, like in the example below

$$ \frac { EUR }{ USD } =0.75\quad \frac { CNY }{ USD } =7 $$

$$ \frac { 0.75 }{ 1 } \ast \frac { 1 }{ 7 } =0.107=\frac { EUR }{ CNY } $$

According to the Interest Rate Parity theory, the currency of a nation with a lower interest rate should be at a forward premium compared to the currency of a nation with a higher rate.

Reinforce CFA Level I Economics with exam-style questions, step-by-step solutions, and targeted drills across the full topic.

CFA exams are written twice annually in June and in December. It is,... Read More

Today is one of those days that feels heavier than usual. For months,... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.