Understanding CFA® Exam Results and H ...

What is the first thing you do after walking out of the CFA... Read More

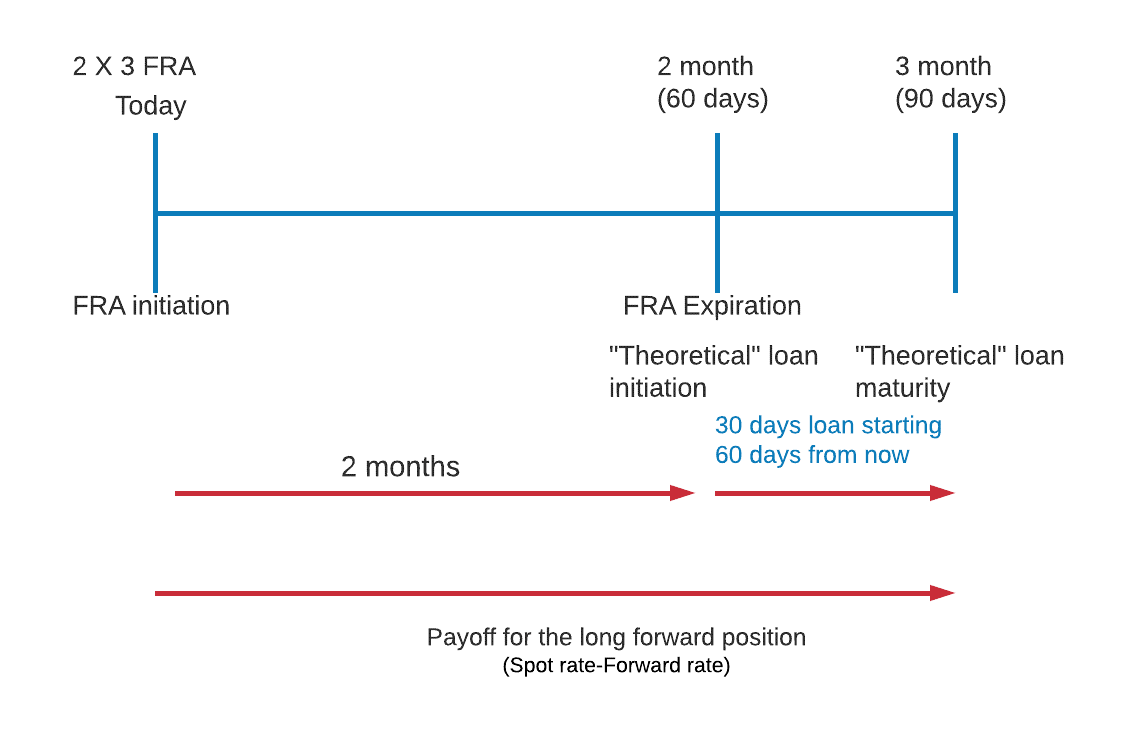

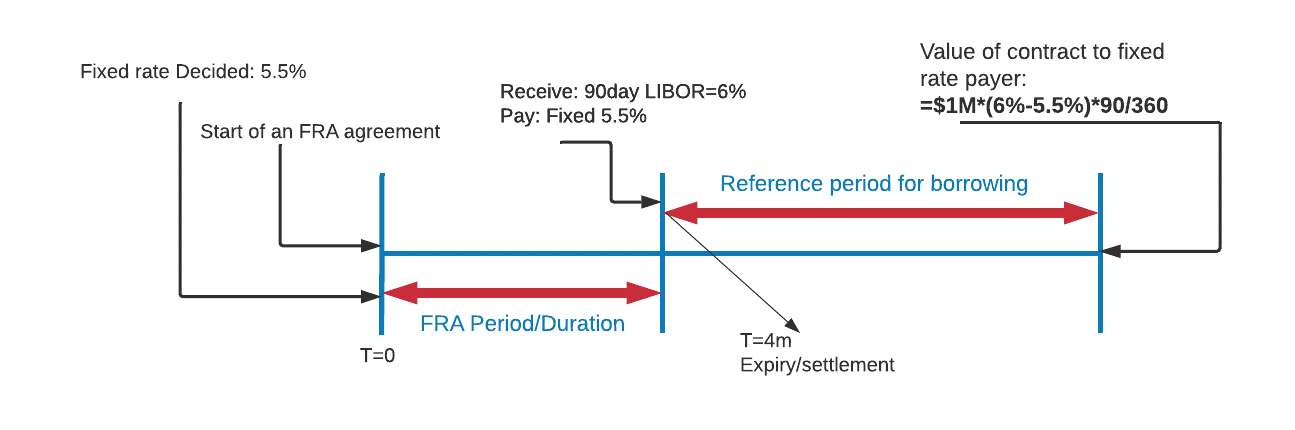

A forward rate agreement (FRA) is a cash-settled over-the-counter (OTC) contract between two counterparties, where the buyer is borrowing (and the seller is lending) a notional sum at a fixed interest rate (the FRA rate) and for a specified period starting at an agreed date in the future.

The purpose of FRA is to lock in borrowing or a lending rate for some time in the future. Typically, it involves two parties exchanging a fixed interest rate for a floating rate.

The FRA buyer enters into the contract to protect itself from a future increase in interest rates; the seller of the FRA wants to protect itself from a future decline in interest rates.

FRM Part 1 and Part 2 Complete Online Course

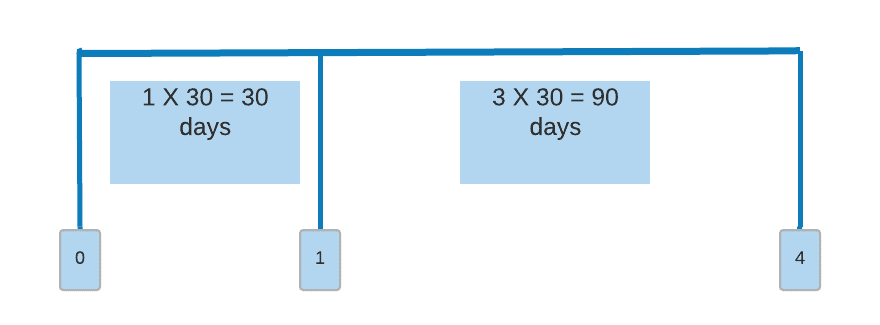

FRAs are denoted in the form of “X × Y,” where X and Y are months. So, a 1 × 4 FRA is called “1 by 4”.

Implying that:

A 1 × 4 FRA expires in 30 days (one month), and the theoretical loan is for a time period of the difference between 1 and 4 (three months = 90 days). That is, a three-month Libor determines the FRA’s payoff, but the FRA expires in one month.

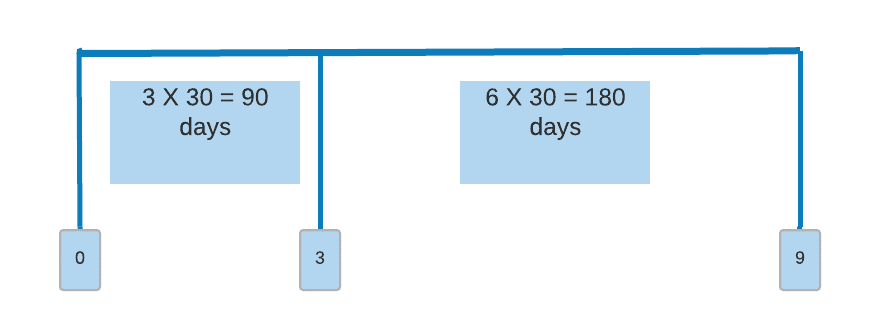

A 3 × 9 FRA refers to:

Solution

The correct answer is C.

3-by-9 means a 180-day LIBOR loan starting 90 days from now.

The forward rate specified in the FRA is compared with the current LIBOR rate, where:

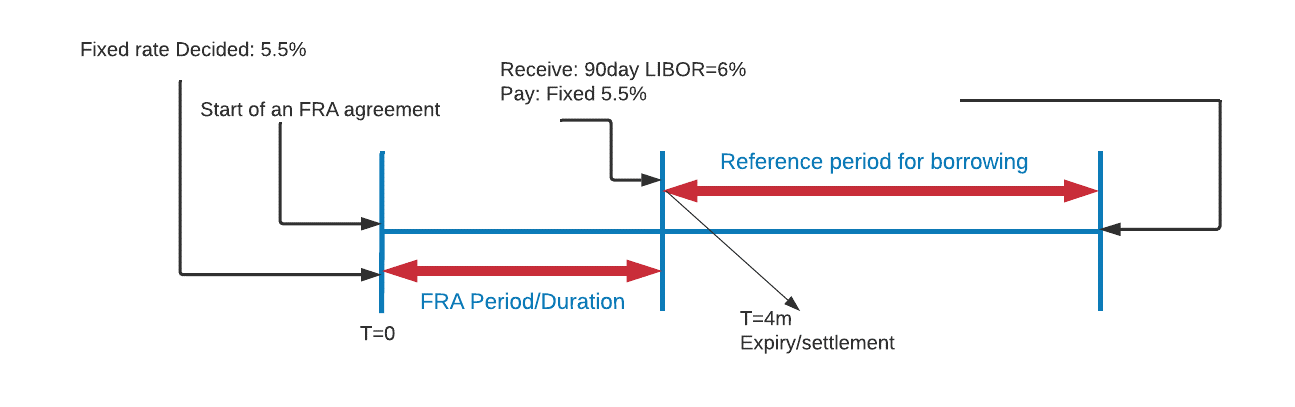

Suppose we have a 1 x 4 FRA with a notional principal of $1 million. At contract expiration, the 90-day LIBOR at settlement is 6% and the contract rate is 5.5%.

The value of the FRA at maturity is closest to:

$$ \begin{aligned} &\begin{array}{c} \text{Payment} \\ \text{to the Long} \end{array} = \text{Notional principal} \times \frac{(\text{Rate at settlement} – \text{FRA rate}) \times \frac{\text{Days}}{360}}{1 + \text{Rate at settlement} \times \frac{\text{Days}}{360}} \end{aligned} $$

Since the settlement rate is higher (6%) than the contract rate (5.5%), the buyer will be receiving money from the seller. The payment to the long at settlement are as follow:

Interest saving:

$$=(6\%-5.5\%)\times\frac{90}{360}\times1\text{m}=1,250$$

Discounted back 90 days @ 6%:

$$=\frac{1,250}{[1+\frac{90}{360}\times6\%]}={1,231.53}$$

$$ \begin{array}{l|c|c} \textbf{Feature} & \textbf{Forward Rate Agreement (FRA)} & \textbf{Forward Contract} \\ \hline \text{Purpose} & \text{Interest Rate Hedging} & \text{Price Hedging} \\ \hline \text{Settlement} & \text{Cash-Settled} & \text{Physical Delivery} \\ \hline \text{Common Use} & \text{Loans & Borrowing Costs} & \text{Commodities, FX} \\ \hline \text{Tested In} & \text{CFA & FRM Exams} & \text{CFA & FRM Exams} \\ \end{array} $$

Practice FRA calculations with full solutions and CFA‑/FRM‑style problem sets.

What is the first thing you do after walking out of the CFA... Read More

As simple as it sounds, selecting a good CFA exam tutor can be... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.