A Simple Step by Step Guide to Prepare ...

You might have heard about how hard the Level I CFA exam is,... Read More

In this CFA study guide, we’ll make it easier to differentiate between the 3 major types of industries covered in the CFA Curriculum: perfect competition, monopoly, and oligopoly. Most of the formulas needed to crush the Economics portion of the CFA exam will be explained here.

In a perfectly competitive industry, all firms are price takers and this means they cannot control the market price of their product. Also, all firms have a relatively small market share and the consumer does not prefer one product to another. The formula for a perfect competition market is pretty simple:

$$\begin{align*}\text{Price}& = \text{Marginal revenue} = \text{Marginal cost} = \text{Average cost}\\

\text{P} &= \text{MR} = \text{MC} = \text{AC}\end{align*}$$

A firm should produce additional units as long as its marginal revenue is greater or equal to its marginal cost. In the short-run, the firm should shut down if its losses exceed its fixed costs.

In the long-run, all firms in a perfectly competitive market will make Economic profit = 0 (Economic profit = Total revenue – Total cost = 0). Long-run equilibrium will occur at the output where Marginal cost = Average total cost (MC = ATC), which is productive efficiency.

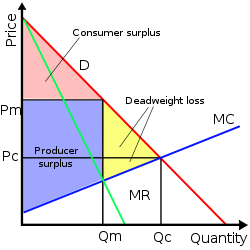

In a monopoly, there is only one producer. The sources of a monopoly power could be big sunk costs, patents, trade secrets (Coca-Cola), regulations, or simply a natural monopoly due to economies of scales (railways). A monopolistic firm’s marginal revenue is calculated as Marginal revenue = ΔTotal revenue / ΔQuantity.

But, a monopoly wants to maximize profits, not revenues. Therefore, a profit-maximizing monopoly chooses an output level where Marginal revenue = Marginal costs (MR = MC). We calculate the monopoly profit with the following formulas:

$$\begin{align*}\text{Monopoly profit} &= (\text{Price} – \text{Average total cost}) \times \text{Quantity}\\

\text{MP}& = (\text{Average revenue}\times \text{Quantity}) – (\text{Average total cost} \times \text{Quantity})\\

\text{MP}& = \text{Total revenue} – \text{Total cost}\end{align*}$$

A monopoly creates a deadweight loss, due to the fact that the monopoly restricts supply below the socially efficient quantity. Another way to see this inefficiency is that the monopoly always chooses a price that is above the marginal cost. The formula to find the deadweight loss is:

$$\begin{align*}\text{Deadweight loss}& = 0.5 \times (\text{Price} – \text{Marginal cost}) \times (\text{Quantity provided in a competitive market} – \text{Quantity produced by monopoly})\\

\text{DL} &= 0.5 \times (\text{P} – \text{C}) \times(\text{Qc} – \text{Qm})\end{align*}$$

If you would like to practice questions on this topic, consider our CFA Level 1 Question Bank.

An oligopoly is a state of limited competition, in which a market is shared by a small number of producers or sellers. If firms within an oligopolistic industry have cooperation and trust with each other, then they can theoretically maximize industry profits by setting a monopolistic price.

If oligopolies collude successfully, they will set price and output such that Marginal revenue = Marginal cost (MR = MC) for the industry overall.

You could also simply think of an oligopoly as a hybrid between a perfectly competitive market and a monopolistic market.

All 3 Levels of the CFA Exam – Complete Course offered by AnalystPrep

Photo by Kyle Glenn on Unsplash

You might have heard about how hard the Level I CFA exam is,... Read More

Portfolio Performance Measures Portfolio management involves a trade-off between risk and return. Most... Read More