What is a Safe CFA Mock Exam Score For ...

CFA mock exams are essential to a candidate’s preparation for CFA main exams.... Read More

“If you fail to plan, you are planning to fail,” is one of the most famous quotes by Benjamin Franklin, and it illustrates the importance of planning not just for your CFA exams, but for every aspect of your life.

This article will create a six months study plan for level I of the CFA Program that we believe will favor every candidate.

Here are the average topic weightings and the average number of questions of the various level I topics. Understanding these topic weightings is crucial in helping a candidate, especially one with limited study time, know where to start and finish.

| Average topic Weight (%) | Average Number of Questions | |

| Ethics | 17.5 | 42 |

| Financial Reporting and Analysis | 15 | 35 |

| Equity | 11 | 26 |

| Fixed Income | 11 | 26 |

| Corporate Finance | 10 | 23 |

| Economics | 10 | 23 |

| Quantitative Methods | 10 | 23 |

| Alternative Investments | 6.5 | 15 |

| Derivative Investments | 6.5 | 15 |

| Portfolio Management | 6.5 | 15 |

Remember that time is of essence not only when preparing for the CFA exams but also when attempting them. CFA Institute requires candidates to use a minimum of 300 hours to prepare for the CFA exams, and the actual exam is to be attempted in 2 sessions of two hours and 15 minutes each. However, the preparation time can be shorter for candidates with a background in finance, investments, accounting, or economic fields.

At AnalystPrep, we recommend that candidates split the 300 hours into reading time (150 hours), practice time (90 hours), and mock exams time (60 hours). For candidates who are employed on a 9-5 schedule, as most CFA Program candidates are, 150 hours translates to three months. Ninety hours translate to roughly one month and three weeks, and 60 hours to roughly one month and one week.

Start your CFA Level I study plan today.Candidates should use the first three months to go over the CFA Program curriculum exclusively. Alternatively, candidates can use AnalystPrep’s Video Lessons and Study Notes, which could really speed up the process by focusing on the essential materials tested in past CFA exams, without extraneous information. Click on the following link to learn more: Learn + Practice Package

The 150 hours to be covered in three months imply that candidates should cover at least 50 hours every month. Fifty hours a month translate to 12.5 hours a week; this means that candidates should strive to cover at least two hours every day from Monday to Friday and then two and a half hours on Saturday. Sundays should be rest days. Rest days help keep the sanity of candidates during the rather rigorous study period and help in rejuvenating their minds. The 12.5 hours a week target can be achieved by having an early morning (4–6 AM or 5–7 AM) or a late-night schedule (7–9 PM or 8-10 PM) on a candidate’s preference.

Candidates are advised to allocate more time to the most challenging topics (Financial Reporting and Analysis, Fixed Income, and Derivatives). In the same regard, they should allocate less time to the less challenging topics (Corporate Finance, Equities, Alternative Investments, and Portfolio Management). Topics that have both (considered easy and have a low topic weighting) should be given the least attention. The table below illustrates how candidates can allocate their time. The table has considered the topic weightings of the various topics, giving more time to the most weight topics.

| Topic | Level of Difficulty | Recommended Minimum Study Time (hours) |

| Ethics | Average | 25 |

| Quantitative Methods | Average | 25 |

| Economics | Average | 10 |

| Financial Reporting and Analysis | Hard | 30 |

| Corporate Finance | Easy | 10 |

| Equities | Easy | 10 |

| Fixed Income | Hard | 15 |

| Derivatives | Hard | 10 |

| Alternative Investments | Easy | 5 |

| Portfolio management | Easy | 10 |

| Total | 150 |

The above stipulated time only represents the study time; the time to go through the study notes, and videos.

Alternative Investments, with only one learning objective, is the shortest topic; this is why it has been allocated the least study time. Despite Derivatives being considered a challenging topic, it has only two readings. That is why it has been allocated less time than the other two challenging topics. Ethics, despite considered an average topic, has the second-highest amount of time since it’s a highly-weighted topic. Quantitative Methods equally has the second-highest amount of time despite being considered an average topic because it is a broad topic spanning statistics, probability, and performance testing. This topic serves as an introduction to all other mathematical topics, so make sure to understand well all of the concepts covering in the six Quantitative Methods readings. As such, candidates are strongly advised to study Quantitative Methods before studying Fixed Income and Portfolio Management because they borrow some of their concepts from Quantitative Methods.

It is also important to note that due to their more descriptive natures, topics such as Ethics, Economics, or Alternative Investments could be studied at the beginning or at the end of the study schedule. However, the curriculum has been made in a way that just studying it in the order it is presented to you is probably optimal for most candidates.

Also, candidates are free to deviate from our suggestion and use whichever topical arrangement they deem appropriate. They are equally allowed to add or reduce the topic study time according to their knowledge and understanding of the various topics.

AnalystPrep’s question bank has over 3,000 questions. Candidates should use at least 90 hours to go through the practice questions. An automated timer on the website helps candidates manage the time they spend on any one question. On the exam, each question should be tackled within a maximum of one and a half minutes on average.

Remember to use the practice questions after every topic to gauge your understanding of the concepts taught. As such, these 90 hours of study times should probably be incorporated after each reading or after each topic.

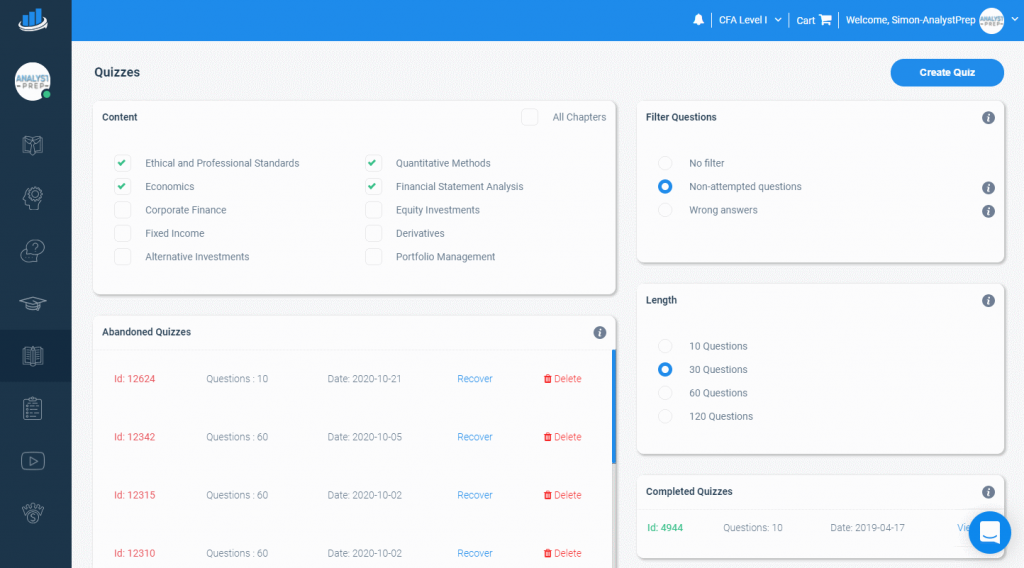

On the AnalystPrep platform, you may also create quizzes that incorporate different chapters in a 10, 30, 60, or 120-questions quiz.

For example, the quiz shown above incorporates the first four chapters of the CFA Program curriculum in a 30-questions quiz. This feature is available in all our packages:

Finally, candidates are to use the remaining one month and one week to attempt mock exams. For mock exams, candidates should put themselves in “exam conditions.” Observe all exam rules. Use precisely 2 hours and 15 minutes to attempt one mock exam. Attempt two mock exams in a day to represent the two exam sessions on exam day. Take an optional break between the two exams if you plan to take one during exam day.

Not all 60 hours will be used to attempt mock exams. Candidates are to attempt at least six mock exams. The remaining time should be used to go through a candidate’s weak areas, as disclosed by the mock exam answers sheet.

FRM Part 1 and Part 2 Complete Online Course

Following this study guide will help candidates plan their time well and thus increase their chances of passing the exams on their first attempt. Remember that passing the CFA exams is one of the hardest things you will be doing in your life, but most CFA charterholders would say it was worth it!

Follow a structured CFA Level I study system with exam-style practice questions, mock exams, and detailed performance tracking to stay on schedule and improve your score.

CFA mock exams are essential to a candidate’s preparation for CFA main exams.... Read More

Congratulations on passing your CFA® level I and level II exams. While it... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.