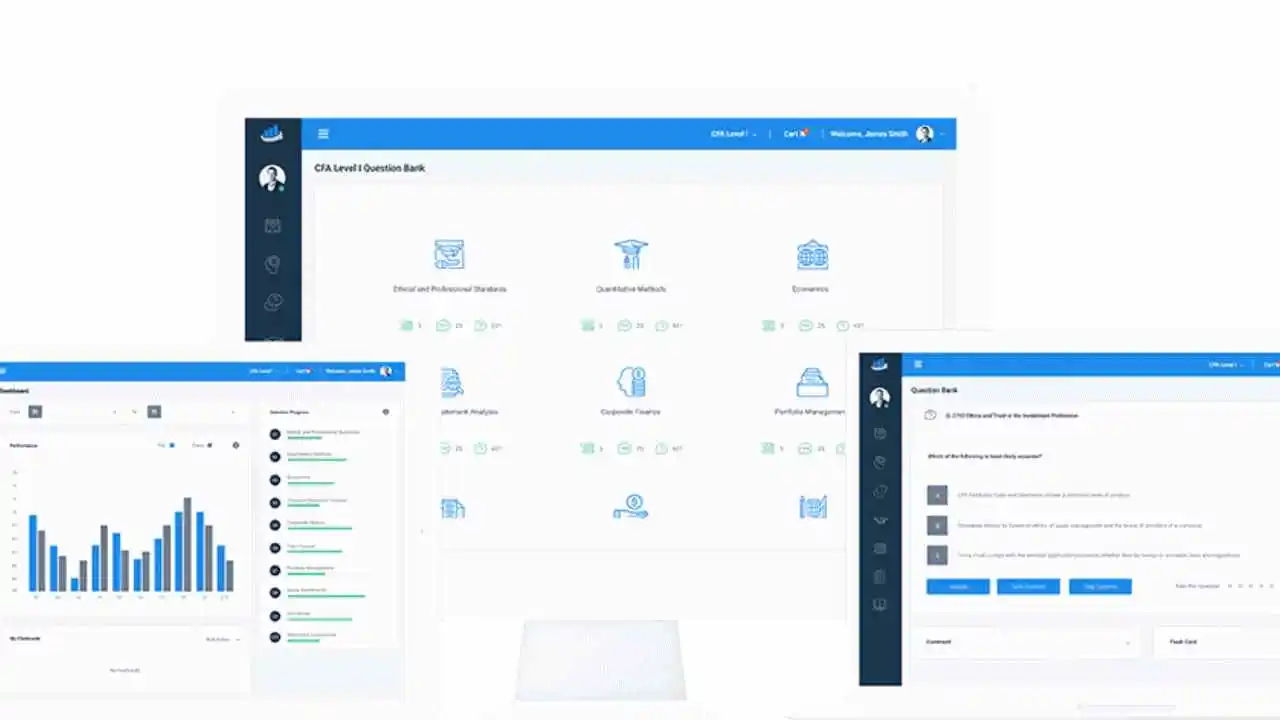

CFA Level I Complete Course offered by AnalystPrep

- video lessons: 60 hours

- practice questions: 4,000+

- full mock exams: 5

- students enrolled: 40,000+

AnalystPrep’s content has been developed by CFA charterholders with first-hand experience of the exam. Our instructors know what it takes to pass. Each question is repeatedly validated to ensure you get the most out of the platform. All our practice questions are adjusted regularly to be consistent with the current CFA® Program curriculum and difficulty level. Join the 20,000 candidates who register yearly and see why AnalystPrep is rated the #1 prep platform for CFA exams.

$399.00

Course Features

- 60 Hours of Video Lessons

- 2,000 Pages of Study Notes

- 4,000 Practice Questions

- 5 Full-length CBT Mock Exams

- Formula Sheet

- Performance Tracking Tools

- 12-Month Access

- 5 Ask-A-Tutor Questions

- 24/7 Tech Support

Course Overview

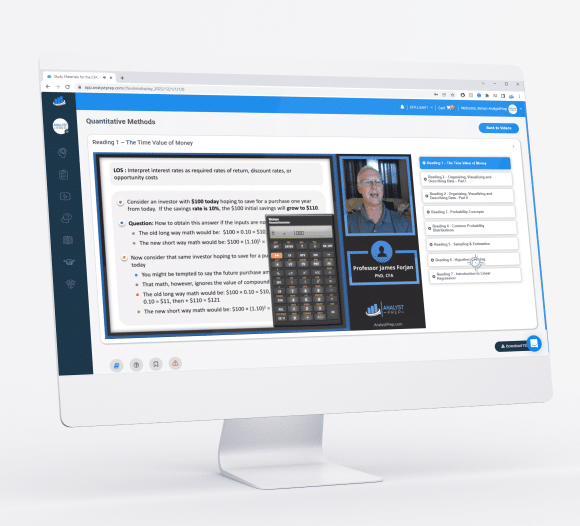

Wouldn’t it be great if studying for the CFA® Exam was as easy as watching TV?

With AnalystPrep video lessons, it is!

Whether you are just beginning to explore the career possibilities the CFA charter has to offer, or are already registered to sit for the CFA exam, AnalystPrep has video content and resources to prep you for success. In addition, AnalystPrep offers question banks, mock exams, and study notes for all levels of the CFA Program. There is sure to be something that will assist you on your path to becoming a CFA Charterholder.

At AnalystPrep, we love to help you learn. Our videos feature professional educators presenting overviews and in-depth explorations of all topics in the curriculum. Our videos are broken down into readings that reflect the format of the CFA exam.

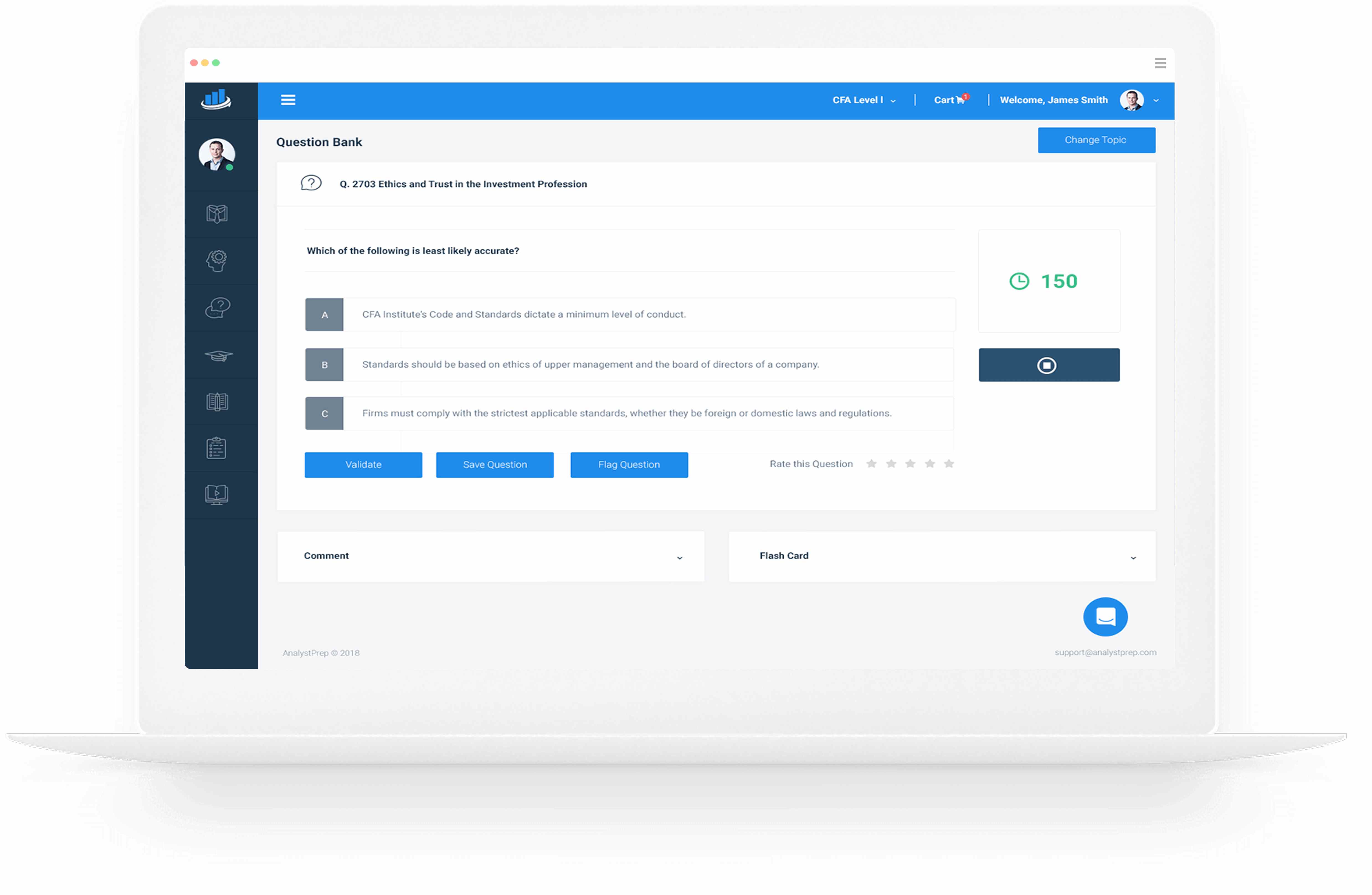

Overview

STUDY NOTES / MOCK EXAMS

Practice

Questions

Explanations

QUESTION AND NOT UNDERSTAND WHY

Course Curriculum

We at AnalystPrep believe in transparency. Feel free to check out some of our free videos below. We are sure you will love them.

- Lesson 1 Rate and Return

- Lesson 2 The Time Value of Money in Finance

- Lesson 3 Statistical Measures of Asset Returns

- Lesson 4 Probability Trees and Conditional Expectations

- Lesson 5 Portfolio Mathematics

- Lesson 6 Simulation Methods

- Lesson 7 Estimation and Inference

- Lesson 8 Hypothesis Testing

- Lesson 9 Parametric and Non Parametric Tests of Independence

- Lesson 10 Simple Linear Regression

- Lesson 11 Introduction to Big Data Techniques

- Lesson 1 Firms and Market Structure

- Lesson 2 Understanding Business Cycles

- Lesson 3 Fiscal Policy

- Lesson 4 Monetary Policy

- Lesson 5 Introduction to Geopolitics

- Lesson 6 International Trade

- Lesson 7 Capital Flows and the FX Market

- Lesson 8 Exchange Rate Calculations

- Lesson 1 Portfolio Risk and Return: Part 1

- Lesson 2 Portfolio Risk and Return: Part 2

- Lesson 3 Portfolio Management: An Overview

- Lesson 4 Basics of Portfolio Planning and Construction

- Lesson 5 The Behavioral Biases of Individuals

- Lesson 6 Introduction to Risk Management

- Lesson 1 Organization Forms, Corporate Issuer Features and Ownership

- Lesson 2 Investors and other Stakeholders

- Lesson 3 Corporate Governance: Conflicts, Mechanisms, Risks, and Benefits

- Lesson 4 Working Capital and Liquidity

- Lesson 5 Capital Investments and Capital Allocation

- Lesson 6 Capital Structure

- Lesson 7 Business Models

- Lesson 1 Introduction of Financial Statement Analysis

- Lesson 2 Analyzing Income Statements

- Lesson 3 Analyzing Balance Sheet

- Lesson 4 Analyzing Statements of Cash Flows 1

- Lesson 5 Analyzing Statement of Cash Flows 2

- Lesson 6 Analysis of Inventories

- Lesson 7 Analysis of Long Term Assets

- Lesson 8 Topics in Long-Term Liabilities and Equity

- Lesson 9 Analysis of Income Taxes

- Lesson 10 Financial Reporting Quality

- Lesson 11 Financial Analysis Techniques

- Lesson 12 Introduction to Financial Statement Modeling

- Lesson 1 Market Organization and Structure

- Lesson 2 Security Market Indexes

- Lesson 3 Market Efficiency

- Lesson 4 Overview of Equity Securities

- Lesson 5 Company Analysis: Past and Present

- Lesson 6 Industry and Competitive Analysis

- Lesson 7 Company Analysis: Forecasting

- Lesson 8 Equity Valuation: Concepts and Basic Tools

- Lesson 1 Fixed Income Instrument Features

- Lesson 2 Fixed Income Cash Flows and Types

- Lesson 3 Fixed Income Issuance and Trading

- Lesson 4 Fixed Income Market for Corporate Issuers

- Lesson 5 Fixed Income Market for Government Issuers

- Lesson 6 Fixed Income Bond Valuations: Prices and Yields

- Lesson 7 Yield and Yield Spread Measures for Fixed rate Bonds

- Lesson 8 Yield and Yield Spread Measures for Floating Rate Instruments

- Lesson 9 The Term Structure of Interest Rates: Spot, Par and Forward Curves

- Lesson 10 Interest Rate Risk and Return

- Lesson 11 Yield Based Bond Duration Measures and Properties

- Lesson 12 Yield Based Bond Convexity and Portfolio Properties

- Lesson 13 Curve Based and Empirical Fixed Income Risk Measures

- Lesson 14 Credit Risk

- Lesson 15 Credit Analysis for Government Issuers

- Lesson 16 Credit Analysis for Corporate Issuers

- Lesson 17 Fixed Income Securitization

- Lesson 18 Asset Backed Security (ABS) Instrument and Market Features

- Lesson 19 Mortgage Backed Secrurity (MBS) Instrument and Market Features

- Lesson 1 Derivative Instrument and Derivative Market Features

- Lesson 2 Forward Commitment and Contingent Claim Features and Instruments

- Lesson 3 Derivative Benefits, Risks, and Issuer and Investor Uses

- Lesson 4 Arbitrage, Replication, and the Cost of Carry in Pricing Derivatives

- Lesson 5 Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities

- Lesson 6 Pricing and Valuation for Future Contracts

- Lesson 7 Pricing and Valuation of Interest Rates and Other Swaps

- Lesson 8 Pricing and Valuation of Options

- Lesson 9 Option Replication using Put-Call Parity

- Lesson 10 Valuing a Derivative using a One Period Binomial Model

- Lesson 1 Alternative Investment Features, Methods and Structures

- Lesson 2 Alternative Investment: Performance and Returns

- Lesson 3 Investments in Private Capital: Equity and Debt

- Lesson 4 Real Estate and Infrastructure

- Lesson 5 Natural Resources

- Lesson 6 Hedge Funds

- Lesson 7 Introduction to Digital Assets

- Lesson 1 Ethics and Trust in the Investment Profession

- Lesson 2 Code of Ethics and Standards of Professional Conduct

- Lesson 3 Standard I – Professionalism

- Lesson 4 Standard II – Integrity of Capital Markets

- Lesson 5 Standard III – Duties to Clients and Prospective Clients

- Lesson 6 Standard IV – Duties to Employers

- Lesson 7 Standard V – Investment Analysis, Recommendations, and Action

- Lesson 8 Standard VI – Conflicts of Interest

- Lesson 9 Standard VII – Responsibilities as a CFA Institute Member or CFA Candidate

- Lesson 10 Introduction to the Global Investment Performance Standards (GIPS)

- Lesson 11 Ethics Applications

Professor James Forjan, PhD, CFA

Professor James Forjan has taught college-level finance classes for over 25 years. With a clear passion for teaching, Prof. Forjan has worked in the CFA exam preparation industry for decades after earning his charter in 2004. His resume includes:

☑ BS in accounting

☑ MSc in Finance

☑ Ph.D. in Finance (minor in Economics and two PhD level classes in Econometrics)

☑ Has taught at different 6 universities (undergraduate and graduate-level Finance classes)

☑ Co-author of investment books

☑ Has crafted, edited, updated, and upgraded a multitude of CFA exam type questions at all levels

☑ And much more…

Reviews 11

Pratham K.2020-08-11 17:43:13

Loved the video series. I love the video series because the explanation is provided in the simplest manner. It is helping me in clearing my concepts.

Mary F.2020-08-11 17:35:01

BIG THANK YOU! I'd like to special thank you for Prof Forjan and the team. [...] I'm more than grateful to have access to these amazing tutorials here which greatly ease my study pressure and gain confidence. [...] Once again, a big THANK YOU!

James B.2019-03-14 14:04:41

"Thanks to your program I passed the first level of the CFA exam, as I got my results today. You guys are the best. I actually finished the exam with 45 minutes left in [the morning session] and 15 minutes left in [the afternoon session]... I couldn't even finish with more than 10 minutes left in the AnalystPrep mock exams so your exams had the requisite difficulty level for the actual CFA exam."

Jose Gary2019-03-04 16:52:14

"I loved the up-to-date study materials and Question bank. If you wish to increase your chances of CFA exam success on your first attempt, I strongly recommend AnalystPrep."

Brian Masibo2019-03-04 16:50:55

"Before I came across this website, I thought I could not manage to take the CFA exam alongside my busy schedule at work. But with the up-to-date study material, there is little to worry about. The Premium package is cheaper and the questions are well answered and explained. The question bank has a wide range of examinable questions extracted from across the whole syllabus. Thank you so much for helping me pass my first CFA exam."

Aadhya Patel2018-10-16 18:21:06

"Good Day! I cleared FRM Part I (May-2018) with 1.1.1.1. Thanks a lot to AnalystPrep and your support. Regards,"

Justin T.2017-09-28 07:55:56

“@AnalystPrep provided me with the necessary volume of questions to insure I went into test day having in-depth knowledge of every topic I would see on the exams.”

Joshua Brown2017-09-28 07:54:27

“Great study materials and exam-standard questions. In addition, their customer service is excellent. I couldn’t have found a better CFA exam study partner.”

Zubair Jatoi2017-09-28 02:47:09

“I bought their FRM Part 1 package and passed the exam. Their customer support answered all of my questions when I had problems with what was written in the curriculum. I'm planning to use them also for the FRM Part 2 exam and Level I of the CFA exam.”

Jordan Davis2017-09-27 08:52:35

“I bought the FRM exam premium subscription about 2 weeks ago. Very good learning tool. I contacted support a few times for technical questions and Michael was very helpful.”

Abdulgadir M.2020-08-11 17:43:47

James Forjan is just Brilliant. I'm totally new to these exams and James Forjan's videos have been really helpful, I'm looking to take my exam this February. I'm from London, highly recommend.