Why the CFA ESG Certificate Still Matt ...

Author’s Note: The CFA Institute now officially brands this qualification as the CFA... Read More

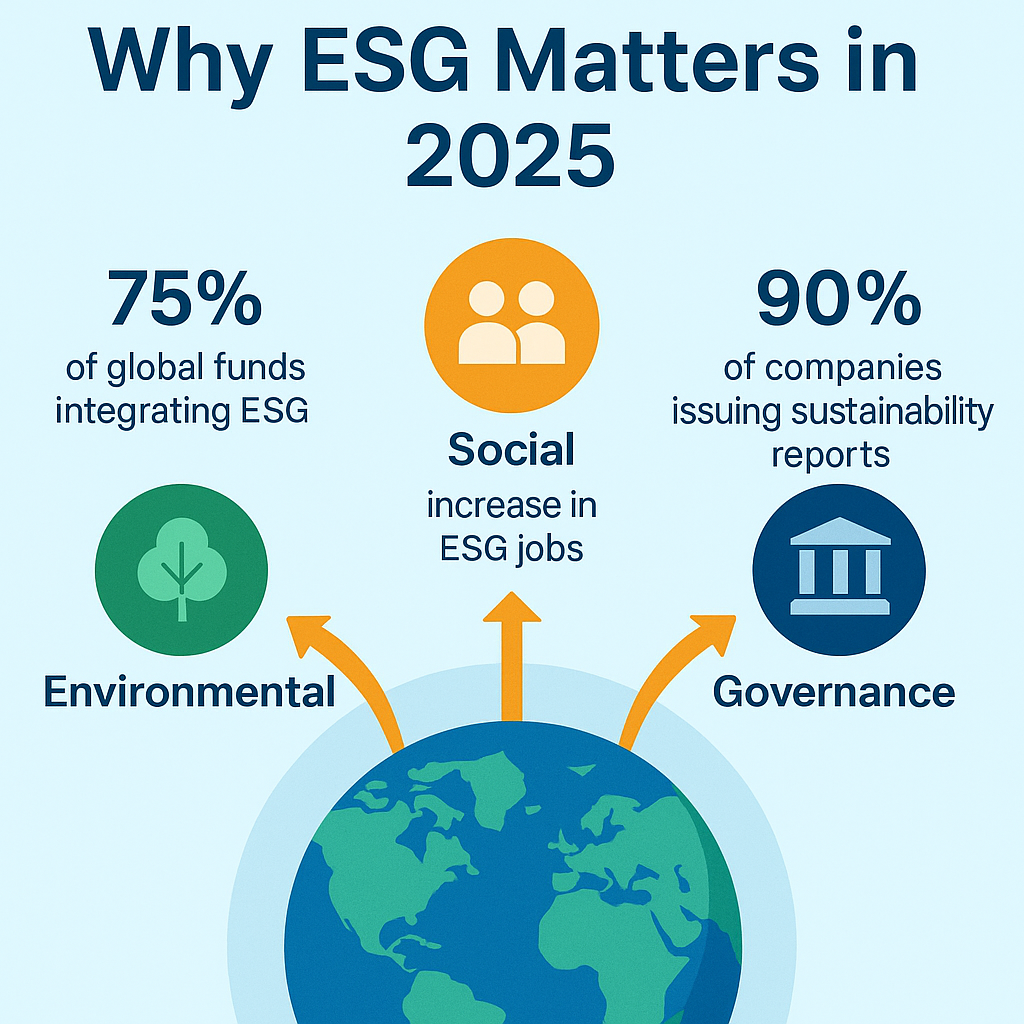

Sustainability isn’t just a corporate talking point anymore. It’s the financial world’s new normal.

From global asset managers to boutique advisory firms, Environmental, Social and Governance (ESG) factors are now critical to how investment decisions are made.

Investors want more than returns.

They want impact, transparency, and responsibility. And if you’re working in finance, you need to speak the language of sustainable investing.

Enter the CFA Institute Sustainable Investing Certificate.

Note: The CFA ESG Certificate has now been rebranded as the CFA Institute Sustainable Investing Certificate. This update reflects a broader commitment to sustainable finance principles and a deepening shift in how the industry views ESG.

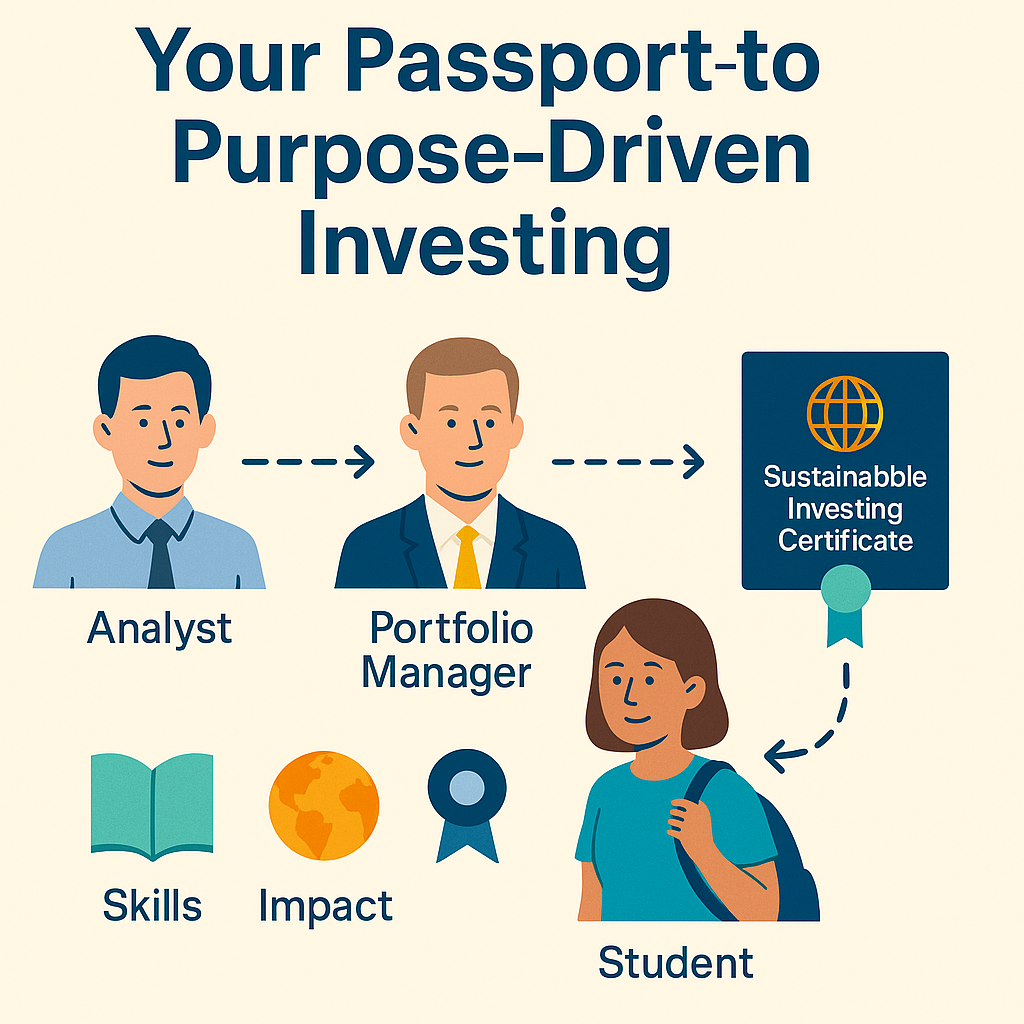

To a portfolio manager, analyst, consultant or someone trying to stay competitive in a rapidly changing field, this certificate is more than just a credential.

It’s a signal.

It tells employers, clients and colleagues that you’re not just watching the trend—you’re leading with it.

So, what’s the real story behind the CFA Institute Sustainable Investing Certificate in 2025? We’re unpacking it all. Let’s get into it!

Let’s face it. ESG isn’t fringe anymore. It’s mainstream. And if you’re still treating it as an optional add-on in your financial toolkit, you’re already a few steps behind.

The CFA Institute Sustainable Investing Certificate is your chance to change that.

Think of it as your passport into a fast-evolving segment of the industry, one where capital doesn’t just chase profits, but purpose too.

This certificate tells the world that you understand how sustainability issues shape financial outcomes, and more importantly, that you know how to act on that understanding.

The CFA Institute, long regarded as a heavyweight in the finance world, developed this certificate to connect ESG data with real investment decisions. In case you’re just starting out or have been in the field for over a decade, this qualification meets you at your level. It’s especially relevant if you fall into any of these categories:

The material is as hands-on as it is forward-looking. You won’t be wading through abstract theory.

Instead, you’ll evaluate climate risk, examine corporate disclosures, scrutinize ESG ratings and learn how sustainability can reshape a portfolio’s risk-return profile.

And for those based in India? The timing couldn’t be better. ESG isn’t just gaining ground. It is exploding across sectors.

The CFA Institute Sustainable Investing Certificate is quickly emerging as one of the most sought-after credentials in this space. It carries credibility. It travels well. And increasingly, it gets you noticed.

This isn’t about jumping on a trend. It is about preparing for a future that’s already arriving.

Let’s be honest. Credentials matter, but cost does too.

Here’s what you can expect to pay in 2025:

That registration fee gives you full access to:

When stacked against other finance certifications, such as the CFA charter, FRM or executive courses, this certificate is refreshingly affordable.

For professionals in India, it’s especially budget-friendly. In fact, compared to most ESG certification options, this program stands out for its global recognition, practical scope and reasonable cost.

This is where the certificate starts to feel like it was designed for real life. No fixed dates. No one-size-fits-all calendar. Just flexibility, the kind that respects your schedule.

Once you register, the clock starts ticking.

You’ll have six full months to prepare and sit for the exam. That’s your window. Whether you want to hop in and take it within a few weeks or spread your study time over a few months, the choice is yours.

Here’s what that flexibility looks like in practice:

This rolling structure is a game changer.

It means you don’t have to drop everything to fit into a rigid exam window. Instead, you get to build the exam around your life, not the other way around.

Just remember: once you register, the six-month countdown begins. So, take control of your timeline early. Plan ahead. Then own it.

Let’s talk format. Because knowing what you’re up against is half the battle.

This exam is built to test your understanding without dragging you through unnecessary complexity. It’s straightforward, focused, and respectful of your time.

Here’s what you can expect:

You choose how you want to take it. You can sit for the exam online using remote proctoring or opt for a test center if you prefer a more traditional setup.

So how difficult is it, really?

The exam is classified as a Level 4 qualification in the UK education framework. That puts it roughly at par with the first year of undergraduate university study. In short, it’s rigorous, but not punishing.

The current pass rate sits around 81 percent. That number tells an honest story. It’s not a breeze, but it’s definitely within reach, especially if you come in prepared.

Most successful candidates report putting in about 100 hours of study time. That’s enough to internalize the core frameworks, work through ESG scenarios and understand how sustainable investing actually plays out in the real world.

This isn’t about memorizing buzzwords. It is about understanding how ESG analysis drives investment performance, risk management, and decision-making.

Put in the time, study smart, and this exam becomes a milestone, not a hurdle.

Let’s get one thing straight.

If you’re aiming to pass this exam on your first try, you can’t just skim the surface. You need a game plan. One that’s smart, efficient and focused on the right things.

This is where AnalystPrep steps in and makes your life a lot easier.

Our prep package for the CFA Institute Sustainable Investing Certificate was built with a simple goal in mind: help you master the material without wasting a second of your time. That means no filler and no confusion.

Here’s what’s inside:

Now, here’s something a lot of candidates overlook: not all topics are created equal. The section on Integration and Valuation carries the most weight on the exam. That’s where you’ll be tested on your ability to apply ESG data directly to investment analysis. It’s practical, it’s dense, and it’s where you’ll need to be sharp.

If you’re serious about scoring well, give that section a little extra attention. Go back to it often. Test yourself. Make sure it sticks.

As for the rest of the curriculum? We’ve already done the heavy lifting. The content is mapped, streamlined and aligned to exactly what the CFA Institute wants you to know. All you have to do is follow the plan.

Stay consistent. Focus on high-impact study sessions. And use tools that actually prepare you for what’s coming.

Pass on your first attempt? Absolutely within reach.

What is the CFA Institute Sustainable Investing Certificate?

It’s a globally recognized credential offered by the CFA Institute that equips professionals with the knowledge to understand, evaluate and apply ESG factors in investment decision-making. It’s designed for anyone looking to embed sustainability into their financial analysis and strategy.

How much does the exam cost in 2025?

As of 2025, the registration fee stands at $890 USD for first-time candidates. If you need to retake the exam, the fee is $690 USD.

Planning to reschedule? That will cost $30 USD, provided you do so at least 72 hours before your scheduled exam time.

What are the exam dates for 2025?

There are no fixed exam dates.

The exam runs year-round. Once you register, you’ll have six months to schedule and complete your test, either online or at a test center near you.

How difficult is the exam?

The exam is considered a Level 4 qualification, comparable to the first year of undergraduate study. The pass rate is around 81 percent, which means it’s accessible for well-prepared candidates. With the right study plan and tools, it’s absolutely within reach.

How can I prepare for the exam?

Choose a prep provider that understands what it takes to succeed. AnalystPrep offers exam-style mock tests, concise study notes, and targeted quizzes that reflect the actual exam format.

With our support, you can focus your efforts where they matter most and build the confidence to pass on your first attempt.

If ESG is shaping the future of investing, then the CFA Institute Sustainable Investing Certificate is your ticket in. It’s practical, globally respected and designed for professionals who want to stay relevant while doing work that actually matters.

This isn’t about chasing another line on your résumé.

It’s about learning how to make smarter, more responsible investment decisions. The kind that align with where markets, and the world, are heading.

So if you’ve been thinking about leveling up your ESG knowledge, now is a good time to act. Whether you’re brand new to the space or looking to sharpen your edge, this certificate puts real skills and real credibility behind your name.

Sign up. Set your pace. And if you want to make your prep journey smoother, let AnalystPrep walk with you. Our tools are built to help you focus on what matters, practice like it’s the real thing, and walk into exam day ready.

Sustainability isn’t a trend. It’s a shift. And this is your chance to move with it.

Begin your exam prep — full access to ESG‑topic questions, notes & mock exams.

Author’s Note: The CFA Institute now officially brands this qualification as the CFA... Read More

Here is the question that begs: is the demand for ESG expertise waning... Read More

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.