CFA vs MBA vs Master’s in Financ ...

The finance world doesn’t lack ambition. But when you’re trying to climb the... Read More

Thinking about investing your time and effort into earning the FRM® certification?

You’re not alone!

Thousands of finance professionals ask themselves the same question every year. And at the heart of it all is one big consideration: Is the FRM certification worth it financially?

Here’s the short answer: Yes — if you’re aiming for strong salary growth, wider career options and a solid foothold in the financial risk management field, the FRM designation is a smart move.

Earning your Financial Risk Manager (FRM) certification can significantly boost your earning potential, setting you up for some of the most lucrative roles in finance risk management.

In fact, the financial risk manager salary landscape in 2025 looks stronger than ever, driven by a global surge in demand for skilled risk professionals.

An FRM certification can open doors to attractive opportunities, no matter if you set your sights on New York, London, Singapore or anywhere in between.

But how much can you realistically expect to earn? How does the FRM salary stack up against other certifications like CFA® and PRM™? And how do experience, job title, and location influence your paycheck?

Let’s look deeper into the FRM salary outlook for 2025 and beyond — covering everything you need to know to make an informed decision about your career and financial future.

The Financial Risk Manager (FRM®) certification, offered by the Global Association of Risk Professionals (GARP), is a big deal — and for good reason.

It’s widely seen as the gold standard if you’re serious about building a career in financial risk management.

Think of it this way: the FRM is your passport to becoming a globally trusted expert in managing all kinds of financial risks — investment, credit, operational and market.

Companies everywhere are scrambling for professionals who know how to steer through today’s unpredictable markets, which means the FRM certification value is higher than ever.

Once you earn that FRM title, employers immediately recognize what you bring to the table.

You’re seen as someone who can anticipate, assess and control financial risks at a global level — not just react to them.

That’s exactly why the financial risk manager salary prospects tied to an FRM are so impressive. The better you are at managing risk, the more valuable you become — and the bigger your paycheck gets.

The FRM program doesn’t just skim the surface. It goes deep into the areas that matter most in finance risk management. Here’s a quick look at what you’ll master:

In short? By the time you’re certified, you won’t just understand risk — you’ll know how to measure it, price it and manage it like a pro.

And that’s exactly what makes the FRM certification salary so competitive across top firms.

Alright, let’s talk numbers.

If you hold an FRM certification, your salary can vary quite a bit depending on your role, your level of experience and, of course, where in the world you work.

But across the board, the financial rewards are seriously attractive.

According to platforms like Glassdoor and Payscale, here’s a quick breakdown of the earning potential:

| Role | Salary Range (USD) |

| Risk Analyst | $61,000 – $89,000 |

| Market Risk Analyst | $56,000 – $144,000 |

| Credit Risk Manager | ~$105,000 |

| Operational Risk Manager | $101,500 – $141,000 |

| Risk Manager | $115,000 – $125,000 |

| Regulatory Risk Analyst | $51,000 – $209,000 |

| Chief Risk Officer (CRO) | $154,000 – $254,000 |

Here’s what else you should know:

Curious about FRM salary in US hotspots?

If you’re working in major cities like New York City, salaries jump even higher. Risk managers in NYC, for instance, regularly earn between $130,000 and $180,000+, depending on their experience and the size of the institution they work for.

Clearly, the financial risk management salary outlook for FRMs is strong — and only getting stronger.

Let’s cut to the chase: absolutely, yes.

If you’re chasing bigger paychecks, stronger job security and a reputation that turns heads in finance circles, the FRM certification delivers — big time.

Here’s why:

But there’s more to it than just the title.

Unlike some designations that let you coast by with only theoretical knowledge, the FRM sets the bar high.

Thanks to the FRM work experience requirement — two full years of hands-on risk management — employers know certified FRMs can actually apply what they’ve learned.

This real-world seasoning makes FRMs hot commodities in finance hubs all over the world, from New York to London to Singapore.

When it comes to finance risk management salary potential, having those three little letters after your name isn’t just an advantage — it’s a game-changer.

Tip: The Power of Real-World Experience

Did you know that an FRM’s real-world work experience is what often sets them apart from other professionals in finance?

Not only do FRM-certified professionals have top-notch technical knowledge, but their practical exposure to risk management strategies makes them incredibly valuable to employers, especially in roles such as credit risk manager or director of risk management.

And with the average FRM certification salary being substantially higher than non-certified finance roles, investing in this certification can significantly boost your earning potential in both the short and long term.

Let’s break it down by role — because knowing what you can earn based on your job title is key to understanding the FRM salary landscape.

Whether you’re just starting out or you’ve worked your way up the ladder, the numbers are promising across the board.

Chief Risk Officer

Operational Risk Manager

Risk Manager

Credit Risk Manager

Regulatory Risk Analyst

Market Risk Analyst

Risk Analyst

Director of Risk Management

With an FRM certification, the earning potential varies depending on your experience and job role, but one thing is clear: the more senior you become, the higher your salary can be. Whether you’re aiming for a Risk Analyst role or an executive position like Chief Risk Officer, your FRM certification salary will give you the competitive edge you need to advance in the finance world.

So, is FRM better than PRM?

In the world of finance, FRM generally takes the edge over PRM—especially when it comes to landing high-level roles at financial institutions. If you’re aiming for those top spots at banks, the FRM certification is often the golden ticket.

PRM, on the other hand, tends to be more of a go-to for those in the insurance or operational sectors.

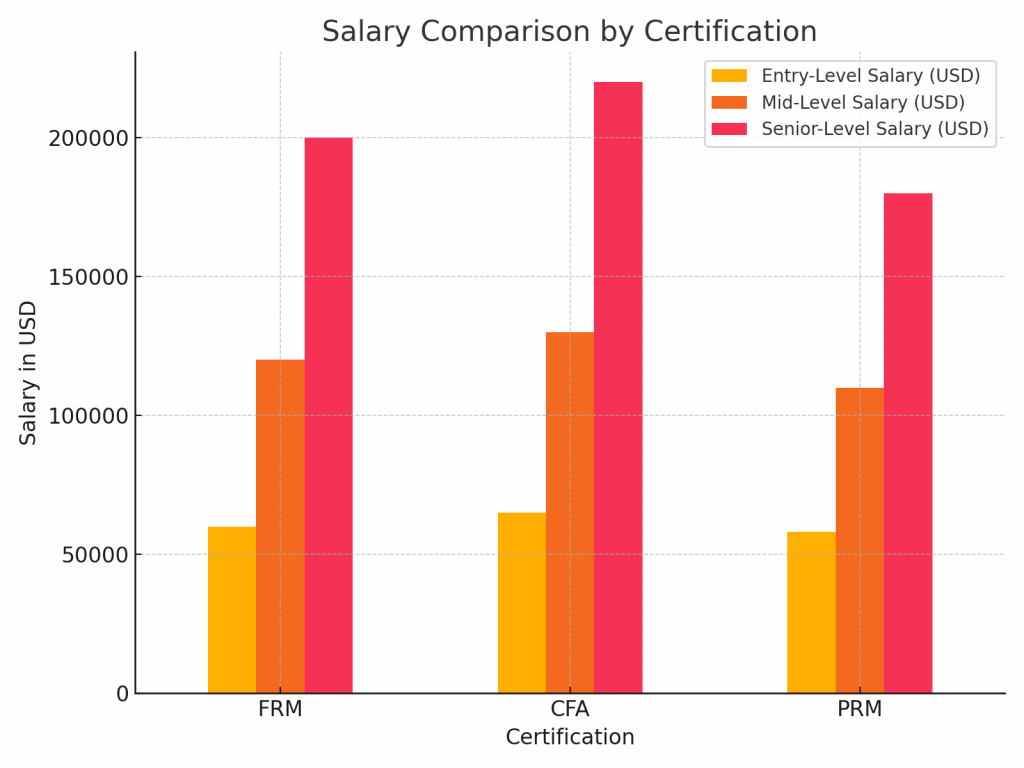

When it comes to a CFA vs FRM salary face-off, here’s what we know:

Now, if you’re one of the lucky ones holding both CFA and FRM? You’re likely to find yourself in a whole different salary league, and it’s a pretty sweet spot to be in!

Want a clearer picture? The chart below gives you a quick glance at how salaries for FRM, CFA, and PRM stack up at various stages of your career. Take a look!

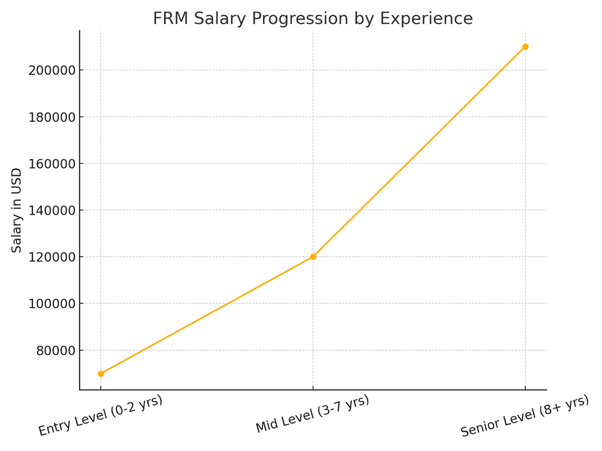

Where you work and how much experience you have really make a difference when it comes to FRM salaries.

So, let’s break it down:

Location, of course, also plays a huge role:

Financial centers such as New York, London, Singapore, and Hong Kong usually offer the best finance risk management salary packages.

So, if you’re willing to relocate, you might see a nice bump in your paycheck!

As you can see, your FRM salary can really take off with the right experience and a strategic choice of location.

Here’s a visual breakdown showing how your FRM salary can grow as you advance in your career.

If you’re serious about stepping up your career in financial risk management, earning the FRM financial risk manager certification is a smart move.

At AnalystPrep, we provide everything you need to succeed:

Ready to take the plunge?

Contact us today at AnalystPrep.com and join the thousands of students passing their financial risk manager exam on the first try.

P.S. Adding FRM after your name isn’t just a credential — it’s an investment in your future income.

The finance world doesn’t lack ambition. But when you’re trying to climb the... Read More

The Executive Assessment (EA) Online has become an essential option for many test-takers.... Read More