The Crypto Ecosystem: Key Elements and ...

After completing this reading, you should be able to: Describe the key elements... Read More

After completing this reading, you should be able to:

Contingent convertible bonds (CoCos) emerged as an innovative financial tool in the wake of the Global Financial Crisis of 2007-2008. Designed to address the “too big to fail” problem, CoCos became a popular bail-in instrument aimed at instant recapitalization of distressed banks, thus helping mitigate the need for taxpayer-funded bailouts and reducing the moral hazard associated with such bailouts. By allowing for quick deleveraging through conversion or write-down, these instruments support the recapitalization of a financially troubled bank.

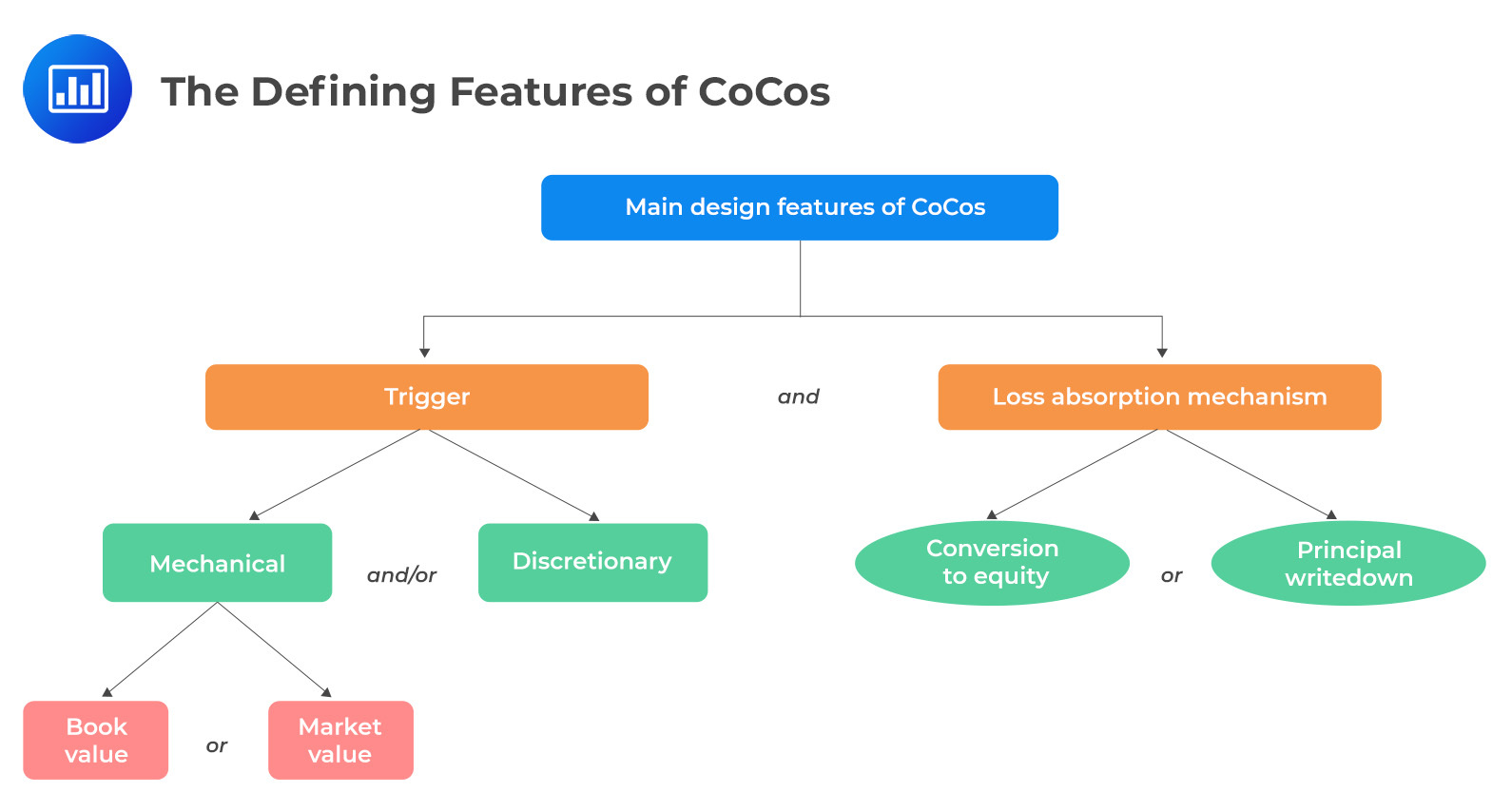

A key feature of CoCos is their loss absorption capability, which is vital for boosting a bank’s capital during distress. This mechanism activates when certain triggers are breached, leading CoCos to either convert into common equity at a pre-specified conversion rate or be subjected to a principal write-down. The conversion rate can be determined based on the market price of the bank’s stock at the time of conversion, a predetermined price, or a combination of both market price and a pre-specified price floor.

Triggers for CoCos can be either:

Conversion Rates and Write-Downs

Conversion Rates and Write-DownsUpon activation of the trigger, CoCos are either converted to equity at a predetermined rate or subjected to a principal write-down, which can be full or partial. However, the majority of the principal write-down CoCos, like those issued by Credit Suisse, tend to be full write-down CoCos, which pose a risk incentive for managers to take actions aligned with shareholders’ interests.

CoCos present an appealing investment opportunity, particularly for long-term investors with a strong understanding of their unique characteristics, including the potential for losses during a crisis. These instruments often offer more attractive yields compared to conventional bonds, primarily because of their contingent nature, their relatively low priority ranking in the event of financial distress, sometimes even below equity investors, and their significant systematic risk component.

Through their unique structure, CoCos allow banks to fortify their capital ratios instantly, hence acting as a preventive measure against crisis situations that might otherwise call for government intervention.

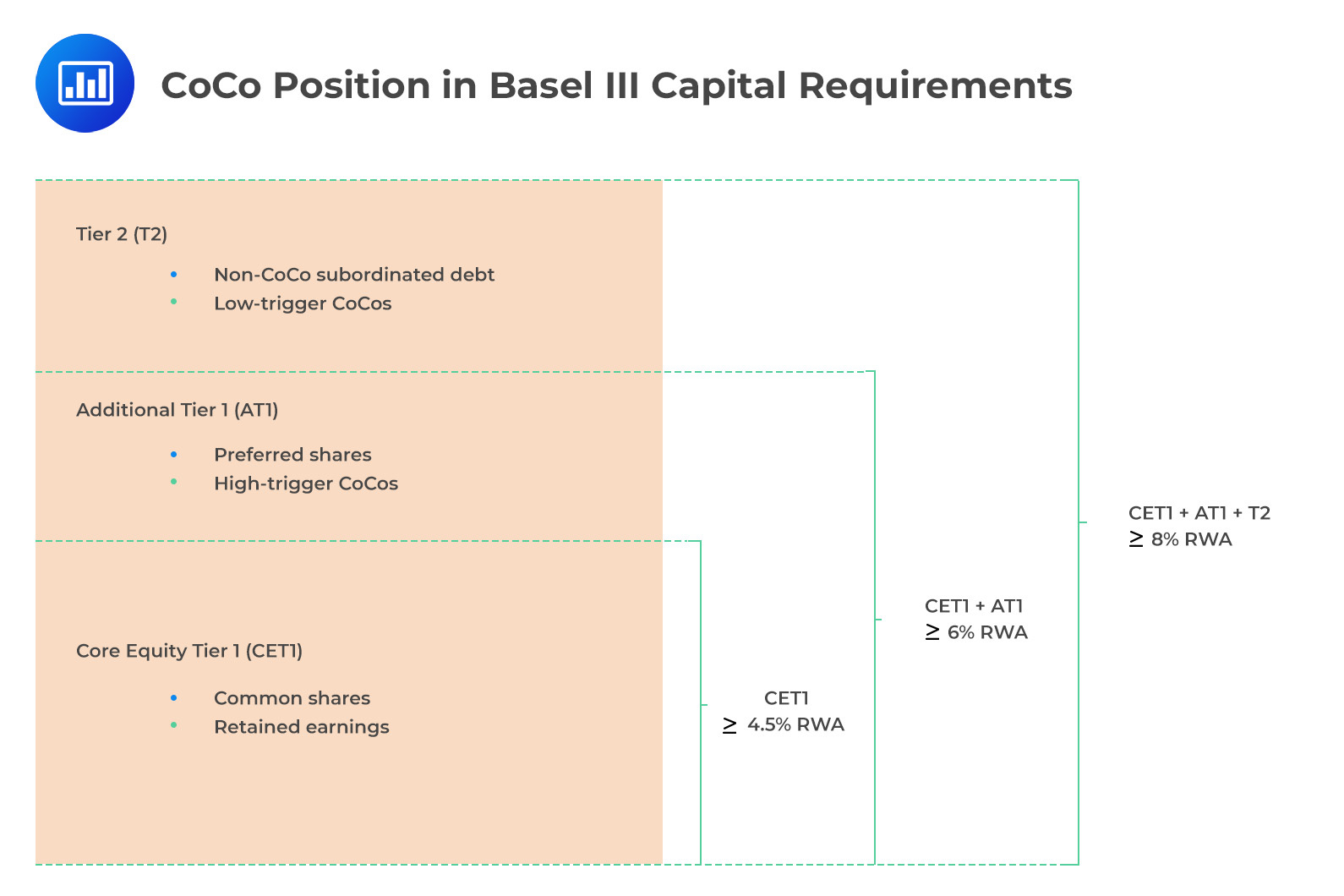

Under the Basel III framework, CoCos must meet specific criteria to qualify as regulatory capital. The first requirement, applicable to both Additional Tier 1 (AT1) and Tier 2 (T2) instruments, involves the implementation of the Point of Non-Viability (PONV) trigger. The PONV trigger is a crucial mechanism that determines when CoCos can convert into equity or be written down. The second requirement is the going-concern rule, which mandates a minimum trigger level of Core Equity Tier 1 (CET1) capital relative to Risk-Weighted Assets (RWA) to qualify as Additional Tier 1 (AT1), with the threshold set at 5.125%. Additionally, AT1 instruments must have a perpetual nature, meaning they have no set maturity date.

Minimizing Taxpayer Burden and Moral Hazard

Minimizing Taxpayer Burden and Moral HazardWhen CoCo triggers are activated, they allow for the transfer of losses to CoCo investors rather than relying on taxpayer-funded bailouts, thus safeguarding taxpayers from the financial costs associated with government bailouts during crises.

CoCos also address the issue of moral hazard, which arises when banks take excessive risks with the expectation of government support in times of crisis. By imposing losses on CoCo investors when necessary, these bonds incentivize banks to maintain prudential risk management practices and discourage reckless behavior.

The global financial crisis (GFC) of 2007–2008 brought to light the critical issue of “too-big-to-fail” financial institutions. This situation necessitated bank bailouts to stabilize the financial markets, prompting post-crisis reforms focused on introducing resolution procedures for systemically important financial institutions. An innovative solution to address the too-big-to-fail problem, particularly outside the USA, was the introduction of CoCos. These bonds emerged as a vital “bail-in” instrument, enabling quick recapitalization of struggling banks. CoCo conversions were designed to efficiently reduce leverage, aiding in recapitalizing an ongoing bank and reducing resolution costs for a failing bank.

The failure of Silicon Valley Bank (SVB) on March 10, 2023, rippled through the global financial landscape, exposing Credit Suisse’s vulnerabilities. Faced with increasing instability, Credit Suisse sought an emergency liquidity provision of CHF 50 billion from the Swiss National Bank (SNB). However, market fears persisted, and the bank continued to face a hemorrhage of deposit withdrawals.

In response to the escalating situation, the SNB, alongside FINMA, stepped in and initiated proceedings for a quick resolution— the takeover of Credit Suisse by UBS. The Swiss financial authorities deduced that the optimal resolution to avoid a cascading financial disaster akin to the Global Financial Crisis (GFC) was through a merger with a robust financial entity like UBS.

A significant development occurred on March 19, 2023, when the Swiss Financial Market Supervisory Authority (FINMA) took an unexpected step in response to a crisis at Credit Suisse. FINMA announced that the contingent convertible bonds, which were a part of Credit Suisse’s Additional Tier 1 (AT1) regulatory capital, had been completely written off. This action was in reaction to a loss of trust and a run on the bank. This move was unforeseen and led to negative reactions in the market. Critics pointed out that this decision contradicted the established priority order of claims, unsettling the balance between debt and equity claims.

The unexpected announcement shocked many market participants, as the AT1 CoCo bondholders faced losses before any impact was felt by the shareholders. In the finalized rescue deal, Credit Suisse shareholders retained approximately $3 billion in equity value, while Principal CoCo investors suffered a complete wipeout of $17 billion.

Swiss financial authorities chose to avert another global financial crisis (GFC) by rescuing Credit Suisse through a merger with a stronger financial institution. This approach mirrored the U.S. Federal Reserve and Treasury’s 2008 strategy with Bear Stearns, involving a merger with JPMorgan, colloquially known as the “Jamie deal.”

Regulatory Authority and Action: The Swiss regulators had more legal power under Swiss emergency law. They utilized this authority to facilitate the Credit Suisse rescue without the need for shareholder approvals. The key action involved triggering the write-down of CoCos, which led to a complete write-down of all AT1 shares of Credit Suisse, effectively increasing the bank’s core capital and enabling swift de-levering of its balance sheet. In contrast, the Fed had limited authority during the 2008 crisis. They relied on Section 13(3) of the Federal Reserve Act for liquidity support under exceptional circumstances. However, they lacked the power to force a merger or sidestep shareholder agreements at Bear Stearns and JPMorgan.

Tools for crisis management: The Swiss used the write-down of CoCos as a tool for crisis management, which was a direct and effective method for de-levering Credit Suisse’s balance sheet. In contrast, the U.S. solution for Bear Stearns was more complex, involving setting up a special-purpose vehicle and negotiating with various stakeholders.

Market Impact and Criticisms: The Credit Suisse rescue, while efficient, led to market consternation due to the unexpected complete write-down of AT1 bonds and the perceived violation of the creditor hierarchy. The Bear Stearns rescue, on the other hand, faced criticism for creating moral hazards by completely bailing out creditors.

Investor and Regulatory Reactions: The Credit Suisse incident was a surprise to investors and global regulators, particularly concerning the hierarchy of creditors. This led to clarifications from European regulatory bodies on their commitment to respecting the creditor hierarchy in future resolutions.

The market’s response to the unexpected wipeout of Credit Suisse CoCos was predominantly negative. The decision to prioritize equity holders over debt holders—by wiping out CoCo principal without first extinguishing equity—contradicted the standard claim’s priority order and prompted significant criticism from market participants and commentators.

Market participants’ reactions varied, with some viewing the write-down as a breach of the traditional debt seniority over equity. Others recognized the discretion embedded in the CoCo mechanisms, acknowledging the regulator’s decision as within their authority, even though it introduced unexpected outcomes.

The situation with Credit Suisse underscores a fundamental aspect of CoCos—their contractual nature and the regulatory discretion they afford. This instance demonstrated that CoCos do not always align with traditional capital hierarchy expectations, particularly when regulatory discretion is invoked.

Investors and issuers alike will likely reassess the risks associated with CoCos, and this may impact the pricing and structure of future issuances. The event has highlighted the importance of understanding the full extent of discretion and trigger mechanisms specified within CoCo contracts for investors.

To prevent misperceptions and improve market stability, it might be beneficial to establish clearer standards and enhanced transparency around CoCo terms, especially concerning regulatory discretion and trigger conditions.

In sum, the Credit Suisse CoCo wipeout represents a watershed moment in the understanding of these financial instruments. The reactions from various market participants have opened a dialogue regarding financial regulation, contract enforcement, and the integrity of capital structure practices.

Practice Questions

Question 1

In March 2023, as part of an emergency package for rescuing Credit Suisse, the Swiss Financial Market Supervisory Authority (FINMA) made a surprising announcement that CoCos, or contingent convertible bonds, which form an integral part of Credit Suisse’s additional Tier 1 (AT1) regulatory capital, were completely written off. This decision stunned market participants, contravening the conventional seniority structure typically observed in distressed scenarios. Considering the sequence of claim seniority in a typical bankruptcy proceeding, which of the following explains why the AT1 CoCo bondholders incurred losses before the shareholders faced a total equity write-off?

- Because AT1 CoCo bonds have a lower priority claim than equity in bankruptcy proceedings.

- Due to a regulatory override by FINMA, asserting systemic risk concerns and exercising discretion.

- As a response to market price triggers that compelled bondholders to accept higher losses.

- Owing to the non-compliance of CoCo bonds with Basel III regulatory capital requirements.

The correct answer is B)

FINMA, leveraging the built-in discretionary power of the CoCos’ Point of Non-Viability (PONV) trigger, made the decision to fully write down the AT1 CoCo bonds issued by Credit Suisse, prioritizing systemic stability over the traditional loss-absorbing sequence—where equity absorbs the first losses before bondholders. The write-down was possible due to the specific contractual characteristics of CoCos, which include loss absorption mechanisms that can be activated discretionally by regulatory assessment.

A is incorrect. AT1 CoCo bonds typically have a higher priority claim than equity in bankruptcy proceedings.

C is incorrect. The decision to write down the CoCos was not triggered by market prices but by regulatory discretion concerning the viability of the bank.

D is incorrect. The CoCos were compliant with Basel III requirements; the write-down was a regulatory decision, not a matter of compliance.

Question 2

With the global financial crisis of 2007-2008 serving as a stark backdrop, regulators introduced contingent convertible bonds—famously known as CoCos—as an innovative financial instrument intended to recapitalize a distressed bank without the need for government bailouts. These instruments come with predefined triggers for loss absorption, either through conversion to equity or a write-down of principal. If a bank like Credit Suisse issues CoCos with a discretionary trigger, what would likely activate the loss absorption mechanism during a distressing period marked by speculation of imminent insolvency?

- A predefined capital ratio falling below a certain threshold, reflecting deteriorating financial health.

- A sudden and significant fall in the market value of the bank’s shares.

- The supervisory judgment of regulatory authorities like FINMA regarding the viability of the bank.

- An automatic response triggered by market events, such as a credit rating downgrade.

The correct answer is C)

CoCos with a discretionary or Point of Non-Viability (PONV) trigger allow regulators the authority to activate the loss absorption mechanism based on their assessment of the bank’s insolvency risk rather than a mechanical, numerical trigger. This was the basis on which Credit Suisse’s AT1 CoCo bonds were fully written down by FINMA in 2023.

A is incorrect. It describes mechanical triggers, which activate loss absorption based on quantitative capital ratio thresholds but are not necessarily applicable to discretionary triggers.

B is incorrect. A fall in market value does not automatically trigger a loss absorption mechanism unless it impacts capital ratios to breach a mechanical trigger.

D is incorrect. CoCos with discretionary triggers are not activated automatically by market events like credit rating downgrades, although such events may influence the supervisory judgment.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.