How the Shape of the Yield Curve Affec ...

The value of a callable or putable bond is also affected by changes... Read More

Commodity prices are generally represented by:

Candidates also need to be aware of the following definitions:

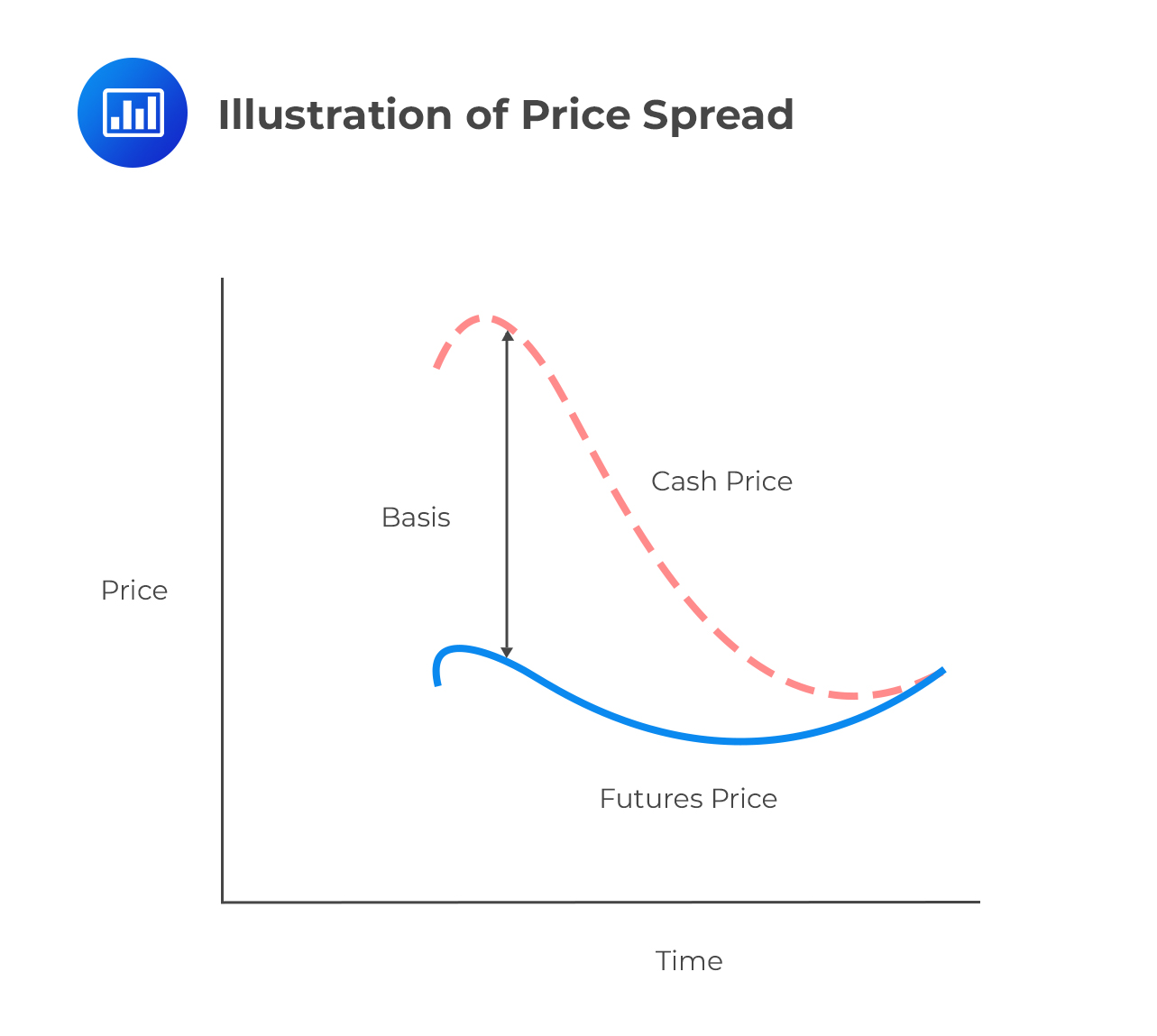

Spot prices are extremely localized and linked to physical delivery, regulating the degree to which interested participants can seek to hedge or speculate on their future direction. In contrast, futures prices can be global (and regional or national in scope).

Future prices are also standardized for trading on exchanges to promote liquidity; act as a reference price point for customized (i.e., forward) contracts; and generate widely available, minimally biased data for market participants and governments to judge supply and demand. Such judgments inform planning decisions.

Question

The current spot price of the futures contract nearest to expiration for Shell BP crude oil is $126.40 per barrel, whereas the six-month futures contract for Shell BP is priced at $102.66 per barrel.

Based on this information, which of the following statements is most likely correct?

- The shipping and delivery cost of Shell BP crude oil for a futures contract expiring in six months with physical delivery is $23.74 per barrel.

- The futures market for Shell BP crude oil is currently in a state of contango.

- The futures market for Shell BP crude oil is currently in a state of backwardation.

Solution

The correct answer is C.

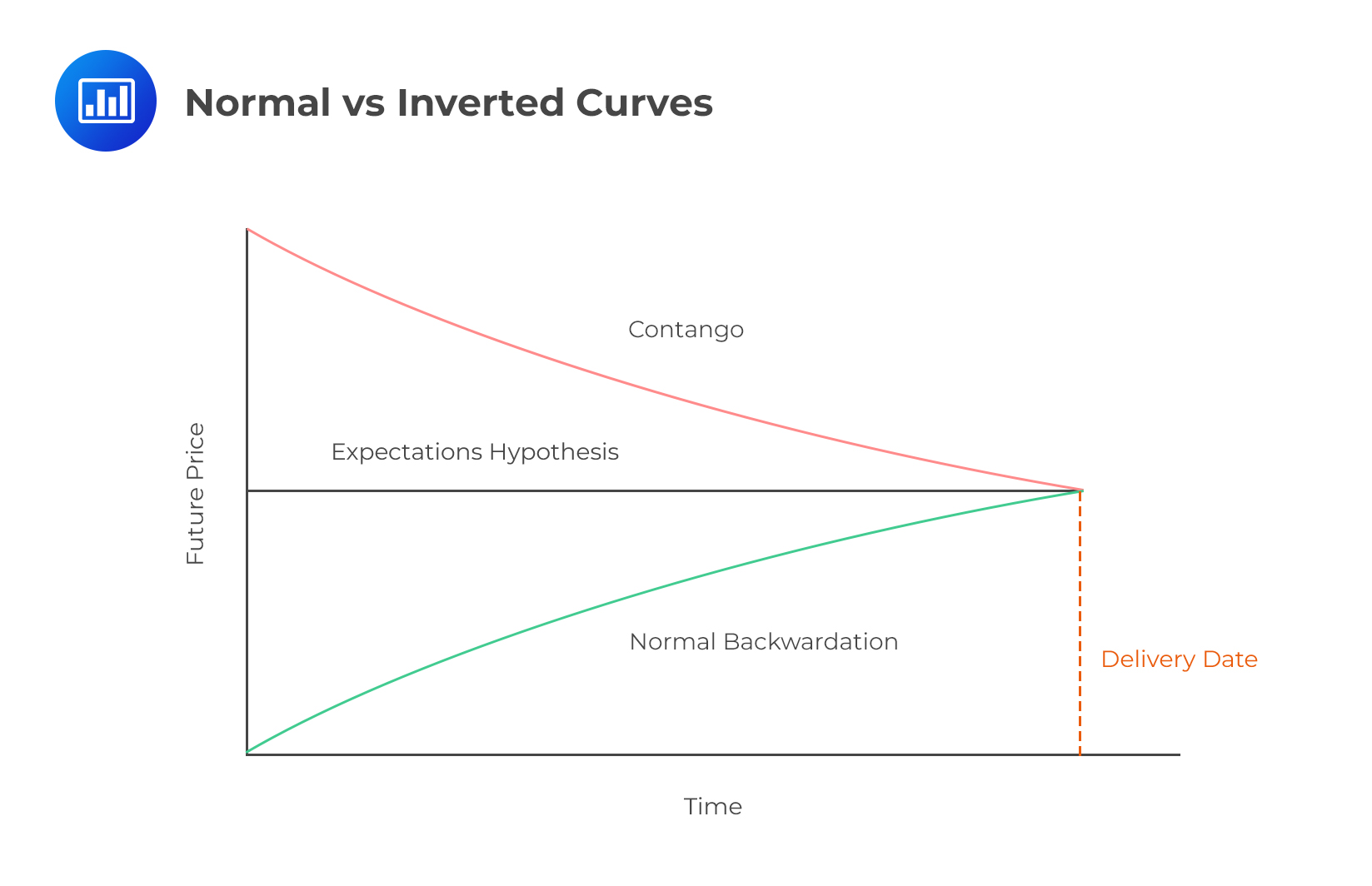

Commodity futures markets are in a state of backwardation when the spot price is greater than near-term (i.e., nearest to expiration) futures contracts. Correspondingly, the price of near-term futures contracts is greater than longer-term contracts.

B is incorrect. The market would be in contango only if the futures price exceeded the spot price.

A is incorrect. The shipping and delivery costs associated with the physical delivery are only one component in determining a commodity futures contract price.

Reading 35: Introduction to Commodities and Commodity Derivatives

LOS 35 (e) Analyze the relationship between spot prices and futures prices in markets in contango and markets in backwardation.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.