Hedge Funds

After completing this reading, you should be able to: Explain biases that... Read More

After completing this reading, you should be able to:

These are simulation exercises implemented to ascertain the resilience of a single bank, or the entire banking sector, to adverse unanticipated occurrences. Solvency tests help to assess banks’ capital planning and capital adequacy, thereby reducing the likelihood of failure. Besides, they help to assess a bank’s ability to balance cash inflows and outflows in a stress scenario.

Stress tests took center stage following the 2007-2008 financial crisis. It was a development deemed to be a means of assessing the ability of financial institutions to withstand adverse events. The idea was to identify and report a bank’s capital sufficiency to evade inherent failures. Stress tests have since become entrenched tools used to gauge the banking sector’s resilience. The emphasis on stress tests to assess and replenish bank solvency was clarified by the fact that capital defines the ability of a bank to withstand losses and continue to lend.

Until the Great Financial Crisis, banks were limited to following the Internal Rating-based Approach for Capital Requirements for Credit Risk under Basel II. They were required to stress test their internal rating models under different scenarios, including market risk and liquidity conditions, among others.

The Basel Committee on Banking Supervision (BCBS) released a publication in May 2009 describing why stress testing failed during the great financial crisis. It addressed the following issues:

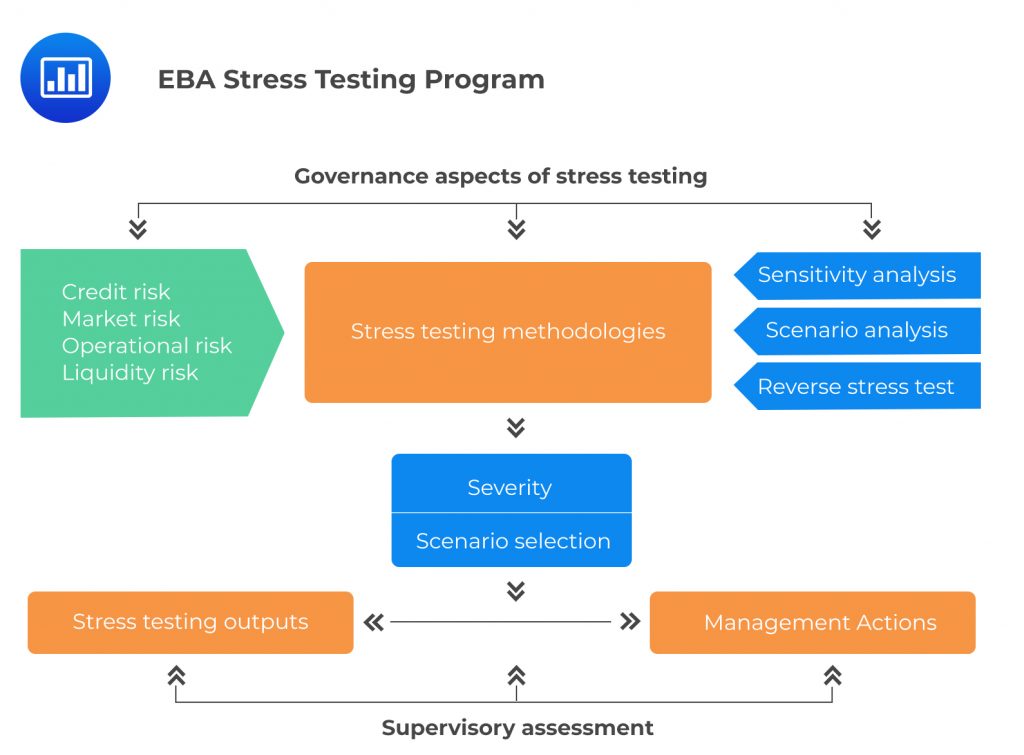

The May 2009 Basel Committee on Banking Supervision (BCBS) publication on the implementation of stress testing principles led to the formation of the Committee of European Banking Supervisors (CEBS) – which eventually became the European Banking Authority (EBA) in 2010.

EBA was developed to set a date for the implementation of these principles at a local institutional level. The EBA conducts regular stress tests to maintain financial stability in the EU’s banking industry. Its stress testing program is shown below:

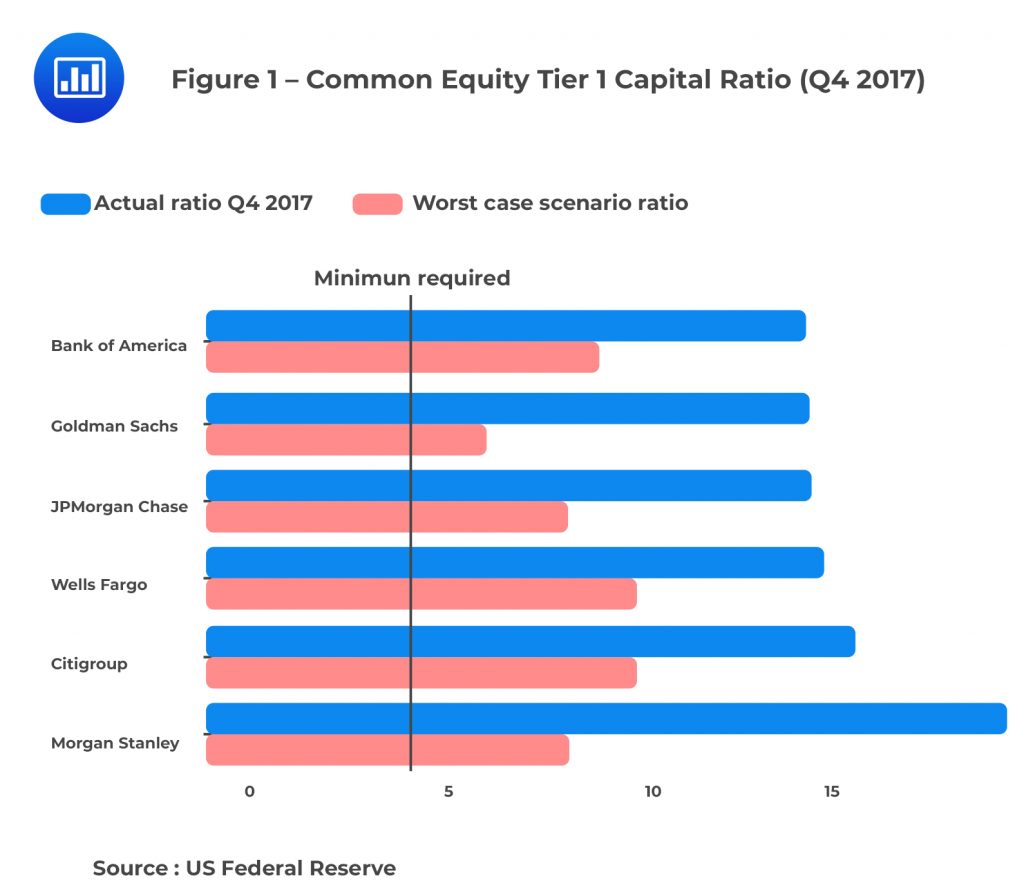

In response to the global financial crisis, the United States Federal Reserve’s Supervisory Capital Assessment Program (SCAP) assessed whether, in spite of the crisis, the largest domestic banks had adequate capital resources to absorb losses and continue operating optimally. This marked the first macro-prudential stress test after the crisis. Macro-prudential stress testing involves analyzing the soundness of the banking system as a whole. On the other hand, in micro-prudential exercises, the authorities use stress test results as part of the supervisory review to assess the strategies, processes, and individual institutions’ risk resilience.

This stress test was key in restoring confidence in the financial sector by publicly disclosing bank balance sheets in terms of the true value of structured products, thereby bringing transparency. US$75 billion of additional capital was raised. SCAP successfully reassured the markets.

In conclusion, SCAP had the following effects on stress testing:

$$ \textbf{Pre-SCAP vs. Post-SCAP Stress Testing Framework} $$

$$ \begin{array}{l|l|} \textbf{Pre-SCAP} & \textbf{Post-SCAP} \\ \text{Mostly single shock} & \text{Broad macro scenarios and market stress} \\ \text{Carried out at the product or business unit level} & \text{Comprehensive, firm-wide} \\ \text{Static} & \text{Dynamic and path dependent} \\ \text{Isolated and not tied to capital adequacy} & \text{Explicit post-stress common equity threshold} \\ \end{array}$$

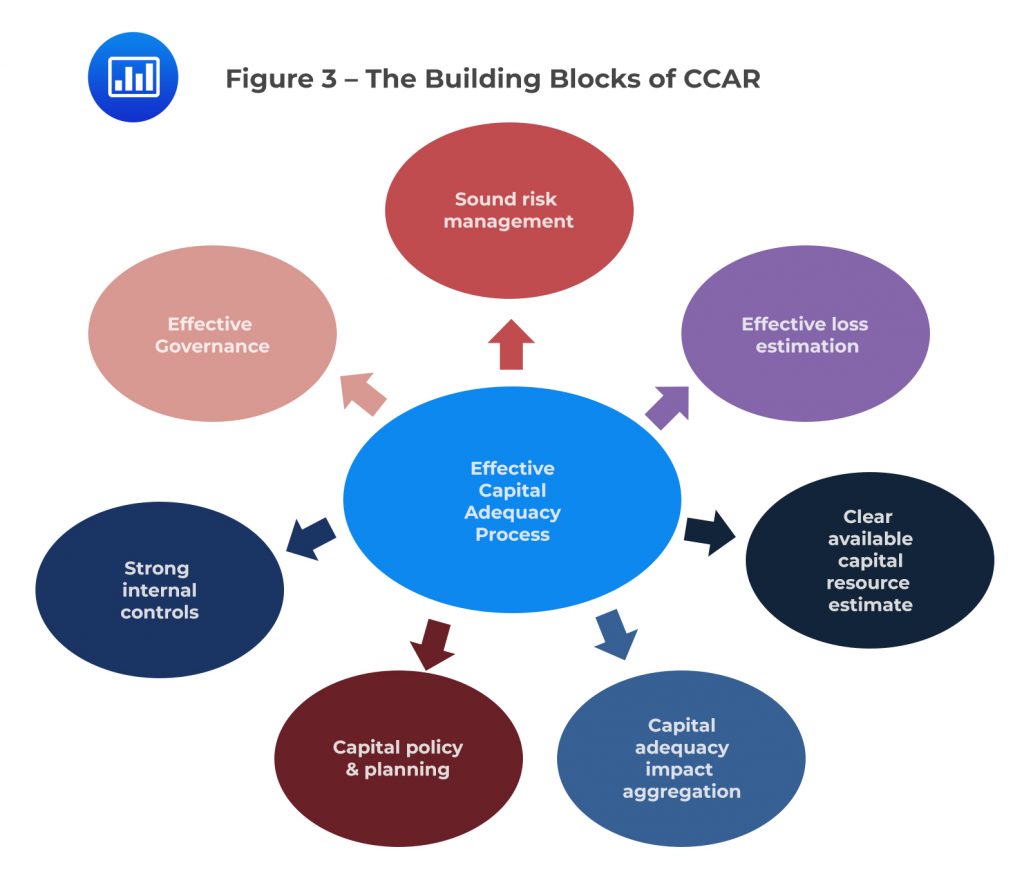

The Federal Reserve System initiated the Comprehensive Capital Analysis and Review (CCAR) for the largest banks. This started the next generation of comprehensive regulatory stress tests.

CCAR’s primary objective is to ensure that a repeat of the 2008 financial crisis is avoided. It is designed to do this by giving regulators better and more advanced visibility of stress testing results of bank balance sheets regularly.

CCAR is a forward-looking operation that gives a detailed view of capital and risk for two years in the future. Supervisors define macroeconomic scenarios that are used to determine the profit and loss for each quarter. It is key to note that failing banks are not authorized to carry out share buybacks or pay dividends. Therefore, CCAR is strictly adhered to by the banking industry. The following diagram illustrates the CCAR processes.

Coherence is one of the challenges of designing useful stress tests. Coherence means that besides the scenarios and sensitivities being extreme, they must be reasonable or possible. However, developing a coherent stress test is difficult because of the reasons discussed below.

Dynamic risk factors change throughout their lives. This makes developing a coherent stress test difficult since all risk factors move simultaneously. For example, not all currencies can depreciate at once; some have to appreciate.

It is insufficient to highlight one risk factor because other risk factors also change. For example, high unemployment coincides with declining equity prices. This makes it challenging to design a coherent stress test.

The problem of coherence is more acute when taking stress scenarios for risks for marked-market portfolios into account. Value at Risk (VaR) is used to manage the risk of traded securities and derivatives portfolios. The many positions in the trading book must be mapped to tens of thousands of risk factors tracked daily. The resulting data is used to estimate parameters such as volatility and correlation. Finding coherent outcomes in such a high-dimensional universe is complicated.

The supervisor deals with the task of specifying a joint outcome that is coherent for all risk factors. Safe-haven assets must be possessed by every market shock scenario that causes flights from risky assets. This challenge is compounded by the complicated task of finding a jointly coherent real and financial factor scenario.

The 2009 SCAP tested simple scenarios with GDP growth, unemployment, and the house price index (HPI) as the state space dimensions. The market risk scenario was based on historical experience. However, historical scenarios never test for emerging phenomena.

The following are challenges in modeling a bank’s losses:

These factors make it difficult to map broader macro-factors to bank-specific stress results.

Practice Question

The Supervisory Capital Assessment Program (SCAP) took place in the spring of 2009 during the financial crisis of 2008-2009. It was intended to measure the financial strength of the nation’s 19 largest financial institutions going forward. SCAP being the first macro-prudential stress test has some features that distinguish it. Which of the differences listed below is NOT a feature that correctly describes the differences between pre-SCAP and post-SCAP?

A. Post-SCAP applies to a broad macro scenario and market stress while pre-SCAP is mostly a single shock.

B. Pre-SCAP is dynamic while post-SCAP is static and path prudent.

C. Post-SCAP applies to losses, revenues, and costs whereas pre-SCAP applies to losses only.

D. Whereas pre-SCAP is not usually tied to capital adequacy, post-SCAP is an explicit post-stress common equity threshold.

The correct answer is B.

On the contrary, post-SCAP is actually dynamic and path-dependent as compared to pre-SCAP which is quite static.

The following are the correct differences between pre-and post-SCAP stress testing.

1. Pre-SCAP is mostly single shock while post-SCAP involves a broad macro scenario and market stress.

2. Pre-SCAP applies to product or business unit level while post-SCAP is more comprehensively applied, firm-wide.

3. Pre-SCAP is static while post-SCAP is mostly path-dependent and dynamic.

4. While pre-SCAP is not usually tied to capital adequacy, pre-SCAP is an explicit post-stress common equity threshold.

5. Pre-SCAP applies to losses only whereas post-SCAP is for losses, revenues, and costs.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.