Striving for Operational Resilience

After completing this reading, you should be able to: Describe elements of an... Read More

After completing this reading, you should be able to:

Internally-focused early warning indicators (EWIs) provide insights on the liquidity profile and health of a firm. These measures are crucial in understanding how the firm’s liquidity position could be fluctuating over time and the types of vulnerabilities that may emerge due to business and strategic decisions.

Liquidity risk managers are responsible for identifying and managing underlying liquidity risk factors. They play an integral part in liquidity risk management. Negative trends serve as early indicators that call for an assessment and a possible response by management to mitigate a firm’s exposure to any emerging risk.

Since EWIs aid in managing risk, liquidity risk managers should ensure the quality and timelessness of the data that feeds into EWIs. A relevant and reliable EWI list alerts top management during or ahead of a crisis. Additionally, it complements the overall risk management capabilities of the institution

For example, management should notice when the bank’s liquidity coverage ratio (LCR) has dropped below a specified threshold. Additionally, a dramatic increase in call center volumes may portend a shift in the bank’s liquidity position.

EWIs should be forward-looking, and selected to furnish a mix of business-as-usual (BAU), and stressed environment information. Besides, they should be assessed against limits at predetermined intervals say, daily, weekly, or monthly. Continued deterioration in a single or combined set of EWIs should trigger the firm’s emergency response tools, such as the contingency funding plan.

The Basel Committee on Banking Supervision (BCBS) provided its “Principles of Sound Liquidity Management and Supervision” (Sound Principles) in September 2008, following the global financial crisis of 2007-2008. The following is a non-exhaustive list of EWIs recommended by the BCBS:

EWIs must align to and be a natural extension of the enterprise liquidity risk management (LRM) framework. For a bank to adequately capture the banking organization’s exposures, activities, and risks, the Federal Reserve Board Supervisory Letter (FRB SR) 12-7 requires the bank’s LRM framework to be end-to-end.

The following figure summarizes fundamental supervisory guidelines, which should act as one of the core guiding principles for EWI selection and monitoring at a bank.

$$\small{ \begin{array}{l|c|c|c} \hline \bf{\text{OCC}-2012^2} & \bf{\text{BCBS}-2008^3} & \bf{\text{BCBS}-2012^4} & \bf{\text{SR} 10-6^5} \\ \hline {\text{A bank should have}\\ \text{EWIs that signal} \\ \text{whether embedded } \\ \text{triggers in certain} \\ \text{products (i.e., call-able} \\ \text{public debt, OTC} \\ \text{derivatives transactions)} \\ \text{are about to be} \\ \text{breached, or whether} \\ \text{contingent risks are} \\ \text{likely to materialize.} }& { \text{A bank should design} \\ \text{a set of indicators} \\ \text{to pinpoint the emergence} \\ \text{of an increased risk} \\ \text{of exposure in its} \\ \text{liquidity risk position or} \\ \text{potential funding needs.}} & { \text{Intraday liquidity} \\ \text{monitoring indicators} \\ \text{include: Daily } \\ \text{maximum liquidity} \\ \text{requirement} } & { \text{Institution management} \\ \text{should monitor} \\ \text{potential liquidity} \\ \text{stress events by} \\ \text{using early-warning} \\ \text{indicators and event} \\ \text{triggers. The} \\ \text{institution should} \\ \text{also tailor these} \\ \text{indicators to its} \\ \text{specific liquidity} \\ \text{risk profile.} }\\ \hline { \text{Early recognition of a} \\ \text{potential event} \\ \text{allows a bank to} \\ \text{enhance a bank’s} \\ \text{readiness. EWI’s} \\ \text {may include:} } & { \text{Early warning} \\ \text{indicators can be} \\ \text{quantitative or} \\ \text{qualitative and may} \\ \text{include but are} \\ \text{not limited to:} } & {\text{Daily maximum} \\ \text{liquidity requirement}} & {\text{Early recognition of} \\ \text{potential events} \\ \text{creates an allowance} \\ \text{for the institution} \\ \text{to position itself} \\ \text{into progressive} \\ \text{states of readiness} \\ \text{as the event unfolds} \\ \text{while providing a} \\ \text{framework to report} \\ \text{or communicate within} \\ \text{the institution and} \\ \text{to outside parties.}} \\ \hline {\text{A reluctance of} \\ \text{traditional fund } \\ \text{providers to continue} \\ \text{funding at historic} \\ \text{levels}} & { \text{Rapid asset growth,} \\ \text{primarily when funded} \\ \text{with possible volatile} \\ \text{liabilities}} & { \text{Available intraday} \\ \text{liquidity}} & { \text{Early-warning signals} \\ \text{include, but are} \\ \text{not limited to:}} \\ \hline { \text{Pending regulatory} \\ \text{action (both formal} \\ \text{and informal) or} \\ \text{CAMELS component or} \\ \text{composite rating } \\ \text{downgrade(s)} } & { \text{Growing concentrations} \\ \text{in assets or} \\ \text{liabilities}} & {\text{Total payments}} & { \text{Negative publicity} \\ \text{regarding an asset} \\ \text{class owned by} \\ \text{the institution}} \\ \hline { \text{Widening of spreads} \\ \text{on senior and} \\ \text{subordinated debts,} \\ \text{credit default swaps,} \\ \text{and stock price} \\ \text{declines}} & { \text{Increases in currency } \\ \text{mismatches} }& { \text{Time-specific and} \\ \text{other critical} \\ \text{obligations}} & { \text{Increased likelihood} \\ \text{of deterioration in} \\ \text{the institution’s} \\ \text{financial condition} \\ \text{of off-balance-sheet} \\ \text{items}} \\ \hline { \text{Difficulty in accessing} \\ \text{long-term debt} \\ \text{markets}} & {\text{Decrease of weighted} \\ \text{average maturity of} \\ \text{liabilities.}} & { \text{Value of customer} \\ \text{payments instead} \\ \text{of financial institutions} \\ \text{customers}} & { \text{Widening debt or} \\ \text{credit default swap} \\ \text{spreads}} \\ \hline {\text{Rising funding costs} \\ \text{in an otherwise} \\ \text{stable market}} & { \text{Repeated incidents of} \\ \text{the positions approaching} \\ \text{or breaching internal} \\ \text{or regulatory limits}} & { \text{Intraday credit lines} \\ \text{expanded to financial} \\ \text{institution customers}} & { \text{Increased concerns} \\ \text{over the funding}} \\ \hline {\text{Counterparty resistance} \\ \text{to off-balance} \\ \text{sheet products} \\ \text{or increased margin} \\ \text{requirements}} & {\text{Negative trends or} \\ \text{increased risk associated} \\ \text{with a product} \\ \text{line}} & {\text{Timing of intraday} \\ \text{payments}} & {} \\ \hline {\text{The elimination of} \\ \text{committed credit lines} \\ \text{by counterparties}} & {} & \text{Intraday throughput} & {} \\ \end{array}}$$

2OCC: Liquidity booklet of the OCC’s Comptroller’s Handbook (2012)

3BCBS: Basel Committee on Banking Supervision, “Principles for Sound Liquidity Risk Management and Supervision” (2008)

4BCBS: Basel Committee on Banking Supervision, “Monitoring Indicators for Intraday Liquidity” (2012)

5Interagency Policy Statement on Funding and Liquidity Risk Management (2010)

The EWI framework can be summarized as M.E.R.I.T. (Measures, Escalation, Reporting, Integrated systems, and Thresholds).

To obtain a forward-looking view of liquidity risk, a bank must employ metrics that examine the structure of the balance sheet in addition to metrics that (b) project cash flows and future liquidity positions, taking into account (c) off-balance sheet risks. These measures must span vulnerabilities across normal and stressed conditions over various time horizons.

For prudent risk management, a firm requires these internal and external metrics. These measures ideally need to be leading (forward-looking) and sharp (sufficiently granular). A leading indicator provides information and signals possible stress before the occurrence of an actual event. On the other hand, sharp indicators are signals that do not go unnoticed within the mass of data. For example, detecting a drop in overall deposit balances is an acceptable EWI. However, detecting drops in deposit balances of more volatile segments, such as high-net-worth customers or rate-sensitive product balances, brings into focus that certain crucial classes of customers are leaving the bank.

EWIs that are both forward-looking and sharp give management more time to take mitigating actions. Additionally, it helps to ensure that managers have a better understanding of risk drivers and trends than broad, lagging indicators may otherwise provide.

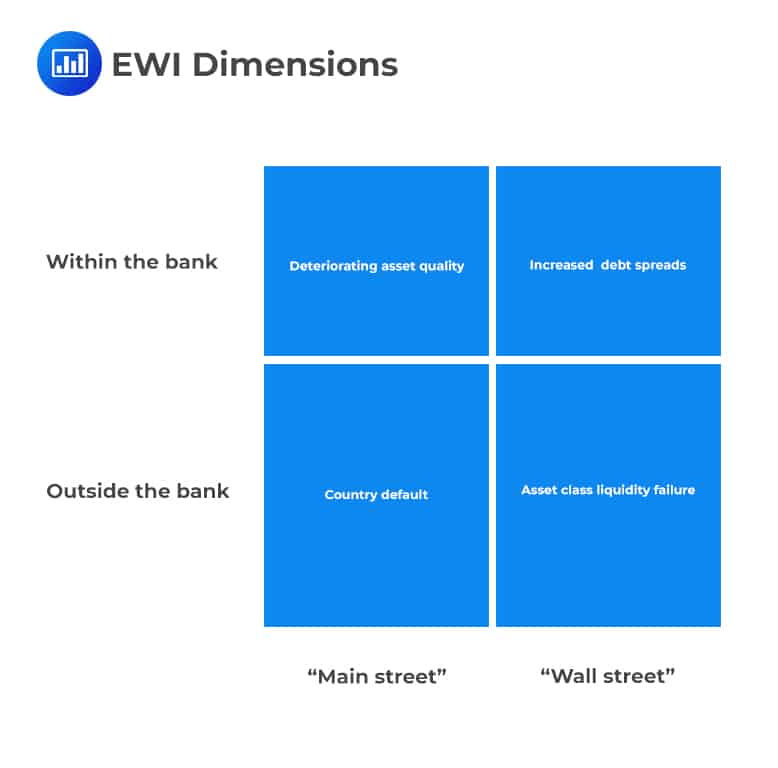

Liquidity events can start either within a bank or may be influenced by external elements triggered by the environment in which the bank is set up. EWIs should be positioned to capture emerging internally-driven stress events before becoming public knowledge, for example, through monitoring of loan performance, planned significant accounting adjustments, and operational losses.

Alternatively, a systemic crisis such as a sovereign default or banking system crisis may trigger liquidity dislocations in parts of the financial market system, disrupting the funding of any institutions that are exposed to those markets. The following figure shows EWI dimensions.

EWIs provide signals for a potential future disaster. It is essential to track appropriate EWI metrics during a business-as-usual environment as any deterioration in these metrics will alert the bank’s leadership of weaknesses in the bank’s balance sheet or of the emergence of challenging circumstances in the markets that the bank operates within.

Including stressed measures and limits in institutions’ EWI lists aids to gauge the adequacy of the firm’s liquidity buffer for a stressed environment. Finally, stress testing results may expose previously unidentified or emerging concentrations and risks that could threaten the viability of the institution.

EWI coverage must reflect various time horizons to match the institution’s unique balance sheet needs, including the market and economic conditions under which it operates, the time horizons that match banking forecasts and business operations can be daily, weekly, or monthly. EWIs may even be monitored on an intraday basis, as warranted by business conditions or required by regulators.

Leading firms select and gauge EWIs to transmit meaningful signals to management about the need for corrective action in light of impending firm-specific distress.

Once an EWI registers a change in status, a robust and well-established escalation process aids in ensuring that the management reviews the trends to understand the cause better, identify the potential impacts of evolving business dynamics, and take appropriate measures. The firm’s selection of EWIs and their calibration should be reviewed to reflect any changes to business mix and activities and the changing nature of the macroeconomic and market environments.

The EWI dashboard should be reported daily to provide managers with adequate time to make adjustments in response to potential crises. Companies with substantial trading focus use intraday reporting because they are more exposed to external market conditions. Reporting should be broad enough to provide comprehensive coverage. Additionally, it should be specific enough to communicate vital information.

Integrated data and systems provide liquidity managers with the ability to ensure that reported metrics are accurate and in sync with each other. Automation and integration are crucial as EWI frameworks supplement traditional market-based metrics with a vast array of internal indicators.

Typically, firms employ the stoplight system to represent and communicate their performance against the thresholds of their EWIs. A green indicator implies that the measure is within the normal range. An amber measure should be investigated further while a red indicator should be an alarm of a significant concern and may warrant an immediate response. Furthermore, the threshold boundaries for which an EWI moves from green to amber should not be so broad that movements go undetected, and the metric continually indicates that the economic and internal environments are healthy.

Firms, particularly banks, have increased the attention and resources for developing and maintaining EWI dashboards and their overarching governance. This can be massively attributed to demands from supervisory bodies in the form of matters requiring attention (MRAs). In some instances, the firm’s leadership self-initiatives should be given credit to enhance its liquidity management and solidify risk reporting.

Question

Marissa, the Head of Risk Management at Apex Bank, is looking to refine the bank’s Early Warning Indicators (EWIs) framework to better identify and mitigate liquidity risk. In her presentation to the risk committee, she discusses the evolution of EWIs, comparing them to warning lights on a car dashboard, indicating various severity levels of potential issues. After emphasizing the need for a forward-oriented perspective in liquidity risk exposures and covering both balance sheet and off-balance sheet items, she touches upon the necessity of considering both normal and stressed states for different time horizons. At the end of her presentation, she presents four potential additions to the bank’s current EWI system.

Which of the following additions to Apex Bank’s EWI framework would most effectively enhance its predictive capability for liquidity risk?

A. Focusing primarily on widely-accepted lagging indicators to provide a historical perspective of liquidity events.

B. Analyzing bank deposits across all clients without differentiating between specific client groups.

C. Using EWIs that are leading, granular, and consider different time horizons such as hourly, daily, and weekly.

D. Relying on external measures exclusively, disregarding the bank’s internal balance sheet metrics.

Solution

The correct answer is C.

An effective EWI system should be forward-looking and predictive. Utilizing leading indicators provides warning signals before potential liquidity events occur, allowing more time for response and mitigation. Granular indicators, such as specific client group deposit behaviors, offer sharp insights, reducing the risk of important signals being lost in broader data sets. Additionally, considering multiple time horizons, like hourly, daily, and weekly, captures variances in liquidity needs and exposures across different periods.

A is incorrect: Lagging indicators, while providing insights into past events, are not as effective as leading indicators for predicting future liquidity risks. The main objective of EWIs is to provide early warning and be proactive, which is best achieved by focusing on leading rather than lagging indicators.

B is incorrect: Simply analyzing bank deposits across all clients can dilute the visibility of specific risk factors. A more granular approach, such as observing deposit behaviors among specific client groups, would provide sharper and more actionable insights.

D is incorrect: While external measures are crucial to provide a macroeconomic perspective on potential liquidity risks, disregarding the bank’s internal balance sheet metrics would be a significant oversight. An effective EWI system should consider both internal and external measures to offer a comprehensive view of potential liquidity risks.

Things to Remember

- Early Warning Indicators (EWIs) are pivotal tools in identifying and mitigating liquidity risks before they materialize.

- For effective liquidity risk prediction, an EWI system should be forward-looking, relying primarily on leading indicators.

- Granularity in data, such as understanding specific client group behaviors, offers nuanced insights, helping in accurate risk identification.

- Multiple time horizons in EWIs ensure comprehensive coverage, addressing short, medium, and long-term liquidity needs and risks.

- Both internal balance sheet metrics and external measures are essential components of a robust EWI system for liquidity risk.

Prepare for FRM Part II by understanding how early warning indicators signal emerging liquidity and funding risks.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.