Governance

After completing this reading, you should be able to: Define risk management responsibilities... Read More

After completing this reading, you should be able to:

Credit scoring and credit rating systems are fundamental tools in assessing credit quality. They quantify the level of credit risk for a borrower, considering available information related to the borrower’s ability and willingness to repay debt obligations. While both systems assess credit risk, they differ in context and application.

In the realm of credit rating systems, two distinct methodologies exist: Through-the-Cycle (TTC) and Point-in-Time (PIT), as recognized by the Basel Committee on Banking Supervision. TTC credit assessments are designed with a long-term perspective in mind, often encompassing an entire business cycle. These ratings aim to be robust against short-term economic fluctuations and, as a result, are updated less frequently. Their stable nature suits scenarios where a long-term view of credit risk is essential.

Contrastingly, PIT assessments focus on the present and imminent outlook of a borrower, typically not looking beyond a year. These ratings are inherently more volatile, adhering to the principle of timeliness to reflect any immediate changes in a borrower’s credit status. PIT assessments call for regular updates to ensure the credit rating mirrors the most recent risk levels. It’s important to note, though, that research has yet to conclusively endorse one approach over the other regarding predictive power and accuracy. The decision between TTC and PIT ratings ultimately aligns with the specific purposes they serve, with TTC favoring enduring stability and PIT accommodating the need for a current risk snapshot.

Additionally, it’s important to acknowledge that while defining credit risk and default is more straightforward in a PIT case (for example, a default occurring during a 1-year period), extending this definition to a TTC framework presents challenges. This requires a clear definition and analytical modeling of the time until default.

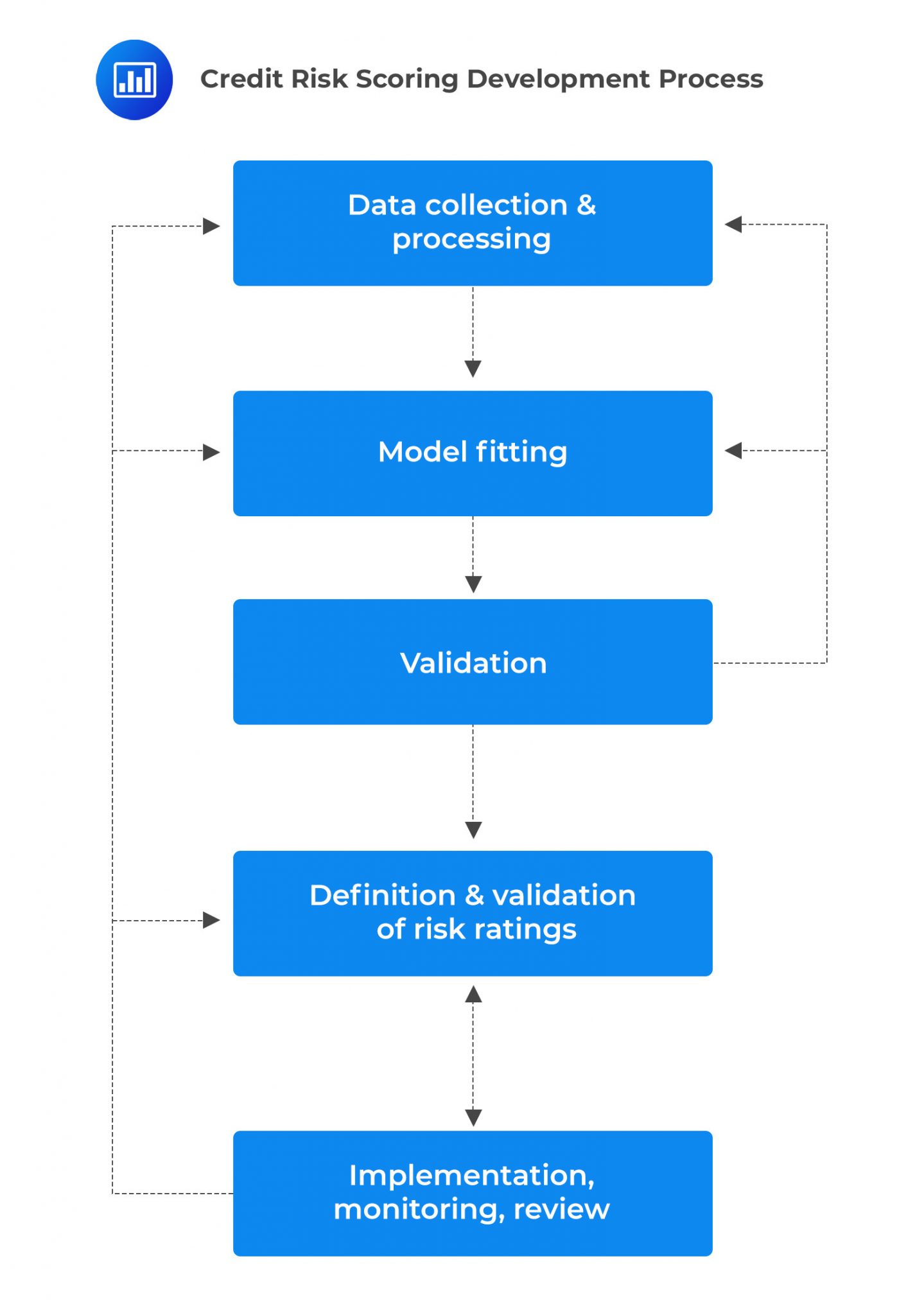

Developing credit risk scoring and rating models is a data-intensive process, requiring both analytical expertise and judgment. It involves various stages, from data collection to model validation.

The journey of constructing credit risk scoring and rating models begins with data collection and preprocessing. This essential step involves gathering extensive data to form a foundational database that underpins all subsequent model-building activities. The data illustrates individual instances of borrower behavior, encompassing past credit scores, payment histories, rating changes, and probability of default estimates.

Preprocessing tasks refine this data into risk attributes, critically vetted for their predictive power. This transformation ensures that only the attributes that can truly predict risk are selected.

Model Fitting

Model FittingOnce the data has been curated, model fitting takes center stage. This process involves identifying parameters that best describe the collected data. Techniques and algorithms are employed to iteratively adjust model parameters, aiming to create the closest fit between the model’s predictions and actual historical outcomes. This empirical approximation minimizes discrepancies and paves the way for a validated credit risk model.

Model validation is a critical checkpoint in the model development process. It assesses the predictive performance of the model using different samples and time periods to ensure robustness against new and unforeseen data. A model must demonstrate its effectiveness across both statistical and economic parameters before it can be deemed reliable for practical use.

After achieving a satisfactory level of validation, the process proceeds to define and validate ratings. This entails mapping the generated credit scores to distinct risk rating classes, which delineate the ladder of creditworthiness. The validation of these ratings checks their stability and consistency over time and in varying economic conditions, ensuring the credibility of the risk assessment.

In the development of credit risk scoring and rating models, a key aspect is the use of the Probability of Default (PD) to define risk grades. For instance, a credit scoring model might estimate PD to categorize borrowers across a spectrum of risk levels, ranging from low risk (with PDs less than 0.25%) to high risk (PDs of 50% or higher). These risk grades are validated by comparing the number of actual defaults in each grade to the total number of borrowers, ensuring the model accurately differentiates between varying levels of risk.

The final phase is the implementation of the model in real-world scenarios, where it guides decision-making and risk anticipation. Continuous monitoring and regular reviews are crucial to ascertain that the model’s performance aligns with the dynamic nature of the credit environment, allowing for necessary adjustments and enhancements to maintain its accuracy and relevance in risk measurement and management.

Credit rating agencies (CRAs) play a pivotal role in determining the creditworthiness of an obligor. An issuer credit rating is essentially a forward-looking opinion on the creditworthiness of an entity, and it can be of either a long-term or short-term nature, depending on the scope under examination.

Types of issuer ratings include:

Issuer ratings are sought for various reasons, with the most common being to facilitate the issuer’s access to capital markets or other forms of funding. A high rating on the scale often signifies a good historical record of the issuer in repaying its debt and hence implies a lower risk of default.

The ratings agencies such as Moody’s, Standard and Poor’s (S&P), and Fitch, which hold dominant positions in the market, have developed multi-grade rating schemes to classify the spectrum of credit risk. These ratings are communicated using an ordinal scale that ranges from top-rated issuers (indicating low credit risk) to entities that are in default. Investment grades typically correspond to low-risk borrowers, whereas speculative grades point to borrowers of low creditworthiness and higher default risk.

$$\small{\begin{array}{l|l|l|l}

\textbf{Category}& \textbf{Moody’s} & \textbf{S&P/Fitch} & \textbf{Description} \\ \hline

\text{Investment grades} & \text{Aaa} & \text{AAA} & {\text{Highly recommended.}\\ \text{Small risk of default. Stable investment.}} \\ \hline

\text{Investment grades} & \text{Aa} & \text{AA} &{\text{High-quality investment.} \\ \text{Slightly higher level of long-term risk.}} \\ \hline

\text{Investment grades} & \text{A} & \text{A} & {\text{High-medium quality investment.}\\ \text{Vulnerable to economic changes.}} \\ \hline \text{Investment grades} & \text{Baa} & \text{BBB} & {\text{Medium quality. Quite secure at present,}\\ \text{ with risk problems in long-term period.}}\\ \hline \text{Speculative grades} & \text{Ba} & \text{BB} & {\text{Medium quality. Not well-secured investment.}} \\ \hline \text{Speculative grades} & \text{B} & \text{B} & {\text{Quite secure in present. Likely to default in the future.}} \\ \hline \text{Speculative grades} & \text{Caa} & \text{CCC} & \text{Poor quality. High likelihood of default.} \\ \hline \text{Speculative grades} & \text{Ca} & \text{CC} & \text{Highly speculative investment. Close to default.} \\ \hline \text{Speculative grades} & \text{C} & \text{C} & {\text{Low quality. High likelihood of default.}\\ \text{Still paying at present.}}\\ \hline \text{Speculative grades} & \text{C} & \text{D} & \text{In default.} \end{array}}$$

The methodologies adopted by CRAs in assigning these ratings involve a comprehensive risk assessment of various debt instruments, which include:

The rating system is integral in the complex financial market landscape, providing essential risk assessments that investors, financial institutions, supervisors, and other stakeholders rely on for making informed decisions.

While credit rating agencies fulfill a crucial function in financial markets, they have faced criticisms over several facets, such as:

Together, these criticisms underscore the complex nature of credit rating agencies’ assignment methodologies and highlight the need for continuous scrutiny and potential reforms to ensure that rating practices remain robust and contribute positively to market stability.

Practice Question

Understanding the different types of credit scoring systems is essential for an analyst assessing credit risk. Which of the following best describes a type of credit scoring system that could be employed by financial institutions?

- A system that assigns ordinal risk grades associated with empirically estimated probabilities of default, typically applied to bond issues or sovereign ratings.

- A scoring system that uses automated models to assign a numerical score to each borrower based on historical data, facilitating the management of credit portfolios.

- A scoring mechanism that provides ratings in the form of letter grades, indicating the borrower’s historical record of repaying debt and associated default risk.

- A public model crafted by credit rating agencies to assist investors, relying solely on qualitative scales for assessing creditworthiness.

Correct Answer: B.

Financial institutions commonly use credit scoring systems that apply automated models to generate numerical scores for borrowers. These scores are based on historical data and are employed to inform decisions such as loan approvals and credit portfolio management. They are a crucial part of the credit risk assessment framework used internally by banks and other lending institutions.

A is incorrect. It describes credit rating systems, which provide ordinal risk grades commonly used for corporate or sovereign ratings, rather than credit scoring systems.

C is incorrect. Letter grades are typically the output of credit rating systems, not credit scoring systems, which use numerical scores to reflect creditworthiness.

D is incorrect. Public models developed by credit rating agencies are not considered credit scoring systems. These tend to use qualitative assessments along with quantitative data and are aimed at a market audience, not internally for financial institutions.

Things to Remember

- Credit scoring systems provide a numeric representation of a borrower’s risk of default and are integral to the internal processes of credit risk management within financial institutions.

- These scoring systems are derived from statistical models using historical transactional data, such as payment history and loan utilization.

- Different types of credit scoring models include application scoring, behavioral scoring, collection scoring, and fraud scoring, each serving a specific function in credit risk assessment.