Private Client Level of Service and Ra ...

Mass Affluent Segment The Mass Affluent segment is the largest among the three... Read More

Private equity transactions, including venture capital and growth equity investments, play a significant role in the financial landscape.

Venture capital investments are a significant driver for new and emerging technologies and industries. These investments are high-growth, high-risk, and are typically concentrated in industries such as information technology or health care. The investments are usually targeted at startups that aim to transform an existing market or establish a new one.

Historically, new ventures were funded directly by wealthy individuals and families. However, the most common approach today involves a VC general partner soliciting limited partner (LP) investors such as pensions, endowments, family offices, or high-net-worth individuals in a closed-end fund. These funds are usually composed of a portfolio of minority investments in startups with a drawdown, investment, and return harvesting.

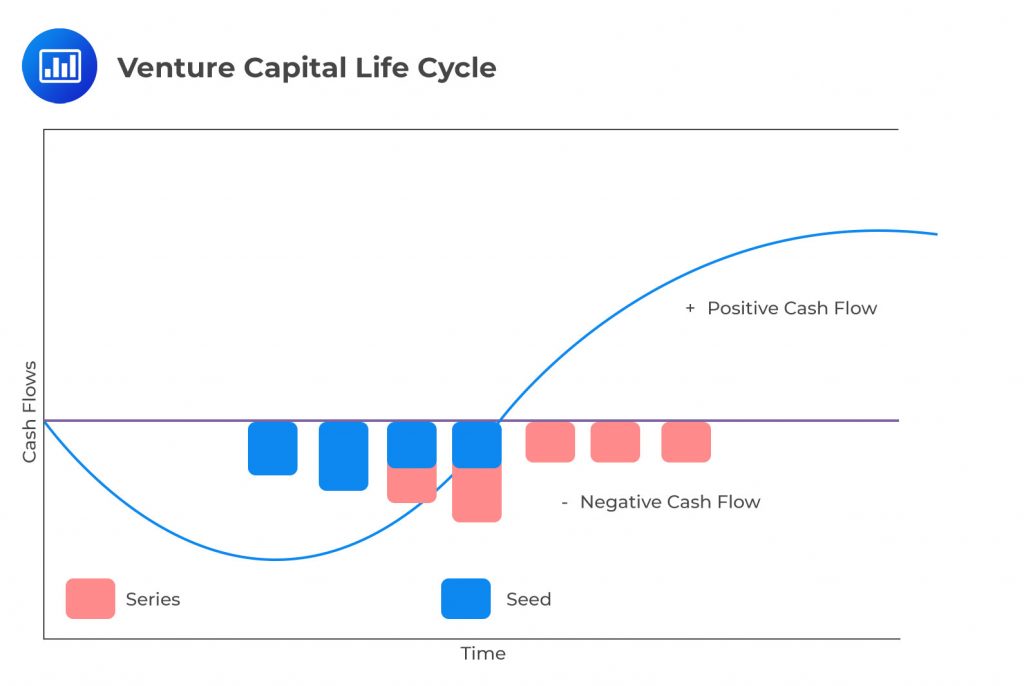

The typical drawdown or initial capital deployment phase of a VC fund usually starts with seed capital, which is used to launch new businesses. This committed capital is called over time. As new firms proceed to launch a new business idea, some fail, whereas others reach the next stage of development and require additional capital. This investment phase is often characterized by several follow-on equity injections or so-called series financings that are often staggered in phases over the next few years.

Given the high failure rate among new companies, VC investors often refer to 100/10/1 rule of thumb , which involves reviewing 100 startup pitches, conducting due diligence on just ten of the 100 reviewed and selecting only one of the ten as an investment. Despite the high degree of selectivity, VC investors still expect most investments to fail and very few to earn an outsized return.

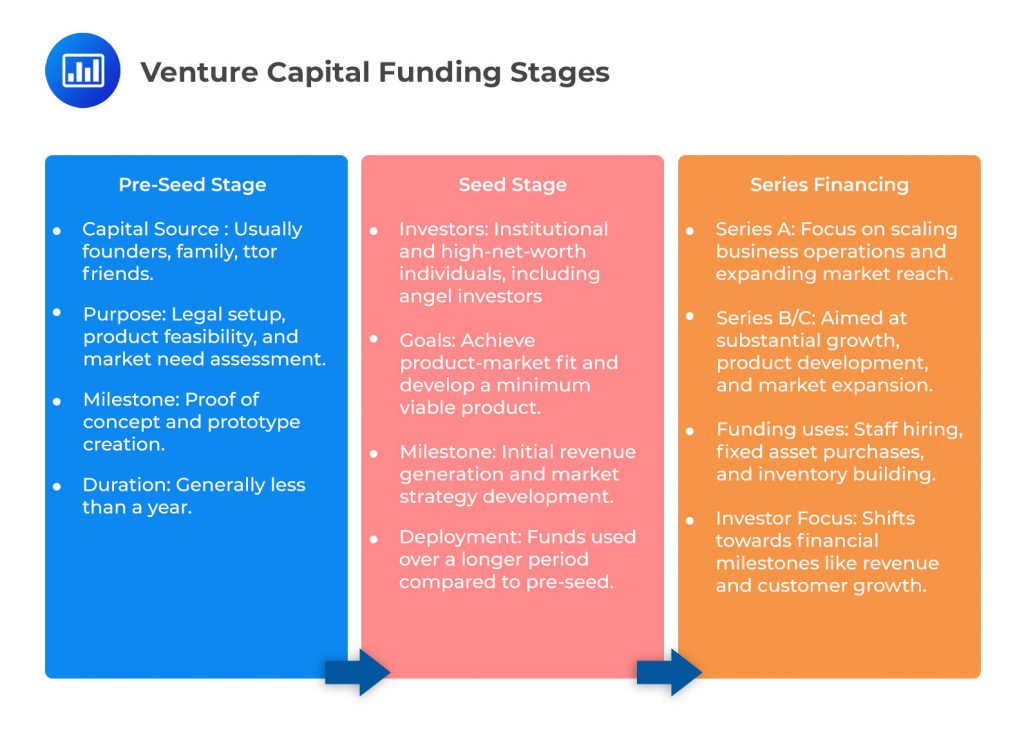

The initial focus of VC investors is often on founders and their credentials; their business, product ideas, and intellectual property; and the potential total addressable market, competitors, and barriers to entry. The initial capital deployment phase of a new firm often occurs in two phases, namely, pre-seed capital funding and seed funding.

Once a new idea, technology, or product clears the initial hurdle of potentially addressing a customer need, young businesses shift to execution mode in seeking rapid growth by investing in resources necessary to establish markets for their new product. Investors in later stages of follow-on or series financing face lower risk than at the pure startup phase, given that the company generates some revenue, but also expect to pay a higher price per share than initial investors.

These new investors often include, but may not be limited to, the original VC or angel investors from a prior funding phase, who often face ownership dilution in the event of follow-on financing. Uses of series funding differ markedly from startup phase financing as companies hire staff, purchase fixed assets, build inventory, and create capacity to meet initial market demand. Investor focus shifts from non-financial milestones to revenue, new customers, and other financial criteria to track company progress in reaching its market potential.

While most series financing is provided as common equity, in other cases, it is a hybrid involving the upside potential of equities and downside protection of debt-like fixed claims.

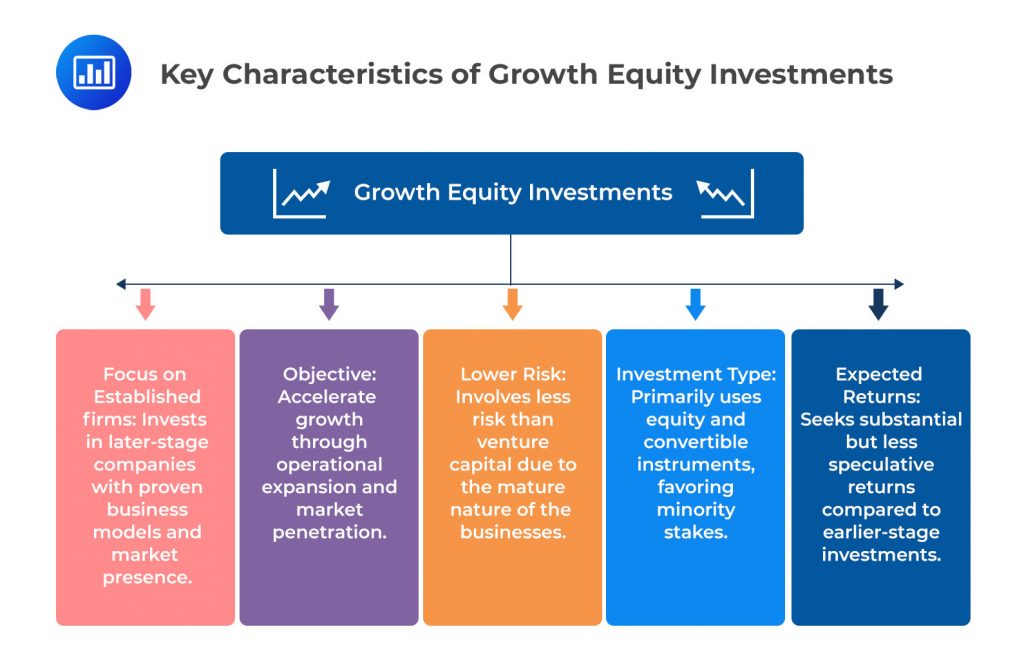

Growth equity is a unique asset class within private equity that aims at profitable earnings growth, usually through a minority equity investment. Unlike venture capital, which focuses on startups in a few rapidly expanding industries, growth equity is less industry-specific and targets later-stage companies with established products and business models for expansion. These companies may be profitable but often lack the necessary cash flow to fund significant growth initiatives.

Companies can expand in several ways, including:

Companies can achieve growth through various means, such as increasing their scale of production, marketing, and distribution in an existing product or market. For example, a software company might expand its marketing efforts to reach a larger audience. Growth can also be achieved through business acquisition, new channels, or new markets. For instance, a retail company might acquire a competitor to increase its market share.

Investors in growth equity often contribute capital in the form of convertible preferred shares (CPS) rather than ordinary shares due to several attractive features. CPS are a type of preferred stock that may pay a dividend and be converted into common shares at a fixed conversion ratio, or number of common shares received for each preferred share, after a specific period. These shares have both debt- and equity-like features.

Convertible Preferred Shares have several debt-like features, including:

Convertible Preferred Shares (CPS) represent claims senior to those of common shareholders. This means that in the event of a company’s liquidation, CPS holders are paid before common shareholders. CPS holders may receive a fixed dividend and/or a liquidation preference payout, or predefined cash distribution to preferred shareholders made in full before any payment to common shareholders.

Convertible Preferred Shares also have equity-like features, such as the conversion right to exchange preferred shares for ordinary shares in the future represents an equity-like return. This gives CPS holders the potential to benefit from the company’s growth.

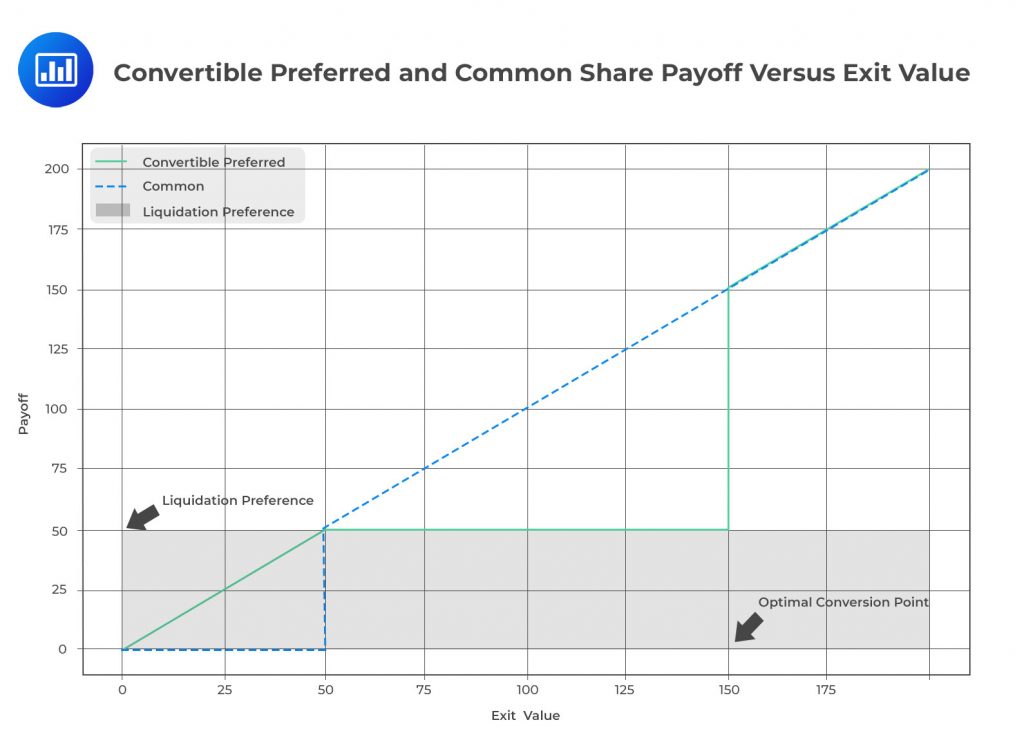

How convertible preferred shares payoff works depends on the exit value of a company as shown in the above figure:

When the exit value is below the liquidation value:

When a company undergoes an exit event, such as an acquisition or IPO, convertible preferred shareholders receive a payout equal to the exit value. This means that they are entitled to a predefined amount of money or a percentage of the exit value before any distribution is made to common shareholders. In contrast, common shareholders receive nothing in such scenarios, as their claims are subordinate to those of preferred shareholders.

When the exit value is above the liquidation value but below the conversion price:

At the optimal conversion point:

When the exit value of a company reaches a level that makes converting preferred shares into common shares advantageous, convertible preferred shareholders may choose to convert their shares to common shares. The optimal conversion point is typically determined based on various factors, such as the terms of the convertible preferred shares, the company’s valuation, and the potential benefits of holding common shares versus preferred shares.

$$\text{Optimal Conversion Point} = \frac{\text{Total Liquidation Preference Value}}{\text{Conversion Ratio} \times \text{Number of Preferred Shares}}$$

Where:

When the exit value is beyond the optimal conversion point:

After convertible preferred shareholders convert their shares to common shares, they now share in the exit value gains as common shareholders. However, the rate of increase in value for original common shareholders decreases due to the dilution from the issuance of new common shares. This dilution causes the slope of their payoff line to become less than one. The new distribution of ownership reflects the proportion of shares held by original common shareholders and those converting from preferred shares.

Investors in Convertible Preferred Shares have several rights, including:

Preferred shares may come with various rights, including redemption rights, which allow investors to redeem their preferred shares for cash, providing a way for them to exit their investment. Participation rights offer preferred shareholders greater upside by allowing them to receive distributions similar to common shareholders without fully converting to common equity, enabling convertible preferred shareholders to benefit from the company’s success. Governance rights may include board seats, special voting rights, or the ability to observe board meetings, giving investors a say in the company’s management.

The risk and return of growth equity are below that of venture capital. Growth equity financing is typically associated with a more detailed business plan mapping out a company’s projected revenue and income and cash flow as well as balance sheet assets over the investment horizon.

Practice Questions

Question 1: In the realm of private equity transactions, different types of deals are made, each with its own characteristics and risk-return profiles. Buyout equity transactions and venture capital investments are two such types. Buyout equity transactions involve the acquisition of a controlling interest in a company, usually a mature one, and make up about half of all private equity volume. On the other hand, venture capital investments, which constitute approximately one-third of total investment volume, are typically smaller deals involving early-stage companies and carry higher risk but also the potential for higher returns. Based on this information, which of the following statements is most accurate?

- Buyout equity transactions typically involve smaller deals with early-stage companies and make up about half of all private equity volume.

- Venture capital investments usually involve the acquisition of a controlling interest in a mature company and constitute approximately one-third of total investment volume.

- Buyout equity transactions typically involve larger deals with mature companies and make up about half of all private equity volume.

Answer: Choice C is correct.

Buyout equity transactions typically involve larger deals with mature companies and make up about half of all private equity volume. This statement is accurate as per the information provided in the question. Buyout equity transactions are characterized by the acquisition of a controlling interest in a company, usually a mature one. These transactions are larger in size and constitute about half of all private equity volume. The aim of these transactions is to gain control over the company and potentially restructure it to increase its value. The risk associated with these transactions is generally lower than that of venture capital investments, but so are the potential returns.

Choice A is incorrect. Buyout equity transactions do not typically involve smaller deals with early-stage companies. This statement is a mix-up of the characteristics of buyout equity transactions and venture capital investments. Buyout equity transactions involve larger deals with mature companies, not smaller deals with early-stage companies.

Choice B is incorrect. Venture capital investments do not usually involve the acquisition of a controlling interest in a mature company. This statement is a mix-up of the characteristics of venture capital investments and buyout equity transactions. Venture capital investments are typically smaller deals involving early-stage companies, not acquisitions of controlling interests in mature companies. They carry higher risk but also the potential for higher returns.

Question 2: The private equity landscape is diverse, with different types of transactions playing significant roles. While buyout equity transactions, involving the acquisition of a controlling interest in mature companies, make up about half of all private equity volume, venture capital and growth equity also have substantial shares. Venture capital makes up approximately one-third of total investment volume, and growth equity accounts for a sixth. These latter two types of transactions usually involve smaller deals in the early stages of a company’s life cycle, carrying higher risk but also offering higher potential returns. Given this information, which of the following statements is most accurate?

- Growth equity transactions make up about half of all private equity volume and typically involve larger deals with mature companies.

- Venture capital transactions make up approximately one-third of total investment volume and usually involve smaller deals with early-stage companies.

- Buyout equity transactions account for a sixth of total investment volume and typically involve smaller deals in the early stages of a company’s life cycle.

Answer: Choice B is correct.

Venture capital transactions make up approximately one-third of total investment volume and usually involve smaller deals with early-stage companies. This statement is accurate as per the information provided in the question. Venture capital is a type of private equity investment that is made in early-stage companies that have high growth potential. These investments are typically smaller in size compared to buyout equity transactions, which involve the acquisition of a controlling interest in mature companies. Venture capital investments carry a higher risk due to the uncertainty associated with early-stage companies, but they also offer the potential for higher returns if the companies succeed. The venture capital sector is a significant part of the private equity landscape, accounting for about one-third of total investment volume.

Choice A is incorrect. Growth equity transactions do not make up about half of all private equity volume and they do not typically involve larger deals with mature companies. According to the information provided, growth equity accounts for a sixth of total investment volume and these transactions usually involve smaller deals in the early stages of a company’s life cycle.

Choice C is incorrect. Buyout equity transactions do not account for a sixth of total investment volume and they do not typically involve smaller deals in the early stages of a company’s life cycle. As per the information provided, buyout equity transactions make up about half of all private equity volume and involve the acquisition of a controlling interest in mature companies.

Private Markets Pathway Volume 1: Learning Module 3: Private Equity; LOS 3(b): Discuss the Characteristics of Venture Capital and Growth Equity Investments

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.