Traditional and Risk Based Approaches ...

To effectively analyze a portfolio or potential investment opportunities, investors must establish a... Read More

Selecting a manager involves assessing both returns and risk attribution. The objective is to choose the most suitable manager(s) based on portfolio requirements and limitations. It’s not always about picking the highest-returning manager. Often, the first step is analyzing a manager’s risk exposures compared to the benchmark, which helps narrow down the potential manager pool.

Returns-based and holdings-based style analyses are tools to understand the risks and sources of return for a specific strategy. Style analysis should:

Returns-based and holdings-based style analyses are particularly valuable when dealing with managers who trade in public securities. However, when applied to assets like those in hedge funds or private equity, which have less frequent valuations, this analysis often serves as an initial step for further investigation.

Returns-based style analysis (RBSA), stemming from top-down analysis, assesses how sensitive a portfolio is to various market indexes. While RBSA involves estimating risk factors instead of relying on third-party or self-reported style categorization, it is a straightforward process and typically doesn’t require extensive data. RBSA helps identify key components of return and risk factors in the portfolio.

RBSA comes with a drawback – it lacks precision. While the additional computational effort isn’t demanding, it can compromise accuracy. RBSA essentially attributes performance to an unchanging average portfolio over a period, limiting the ability to spot the impact of dynamic investment decisions and potentially distorting the breakdown of value-added sources.

Moreover, the analyzed portfolio may not reflect current or future exposures. If it contains illiquid securities, outdated prices can underestimate the strategy’s risk exposure. This is a significant issue for managers in private equity (PE) and venture capital (VC) who hold illiquid or non-traded securities. VC and PE firms report performance based on cash distributions’ internal rate of return and ongoing project appraisals. Consequently, reported performance may underestimate return volatility for shorter periods with limited liquidity events. Longer timeframes generally offer more accurate estimates of the manager’s underlying return standard deviation. Timeliness depends on securities with the longest pricing time, posing challenges for illiquid or non-traded securities.

Holdings-based style analysis (HBSA) HBSA takes a bottom-up approach, estimating risk exposures from the portfolio’s underlying securities. This method allows for the estimation of current risk factors and provides several advantages. Similar to RBSA, HBSA should:

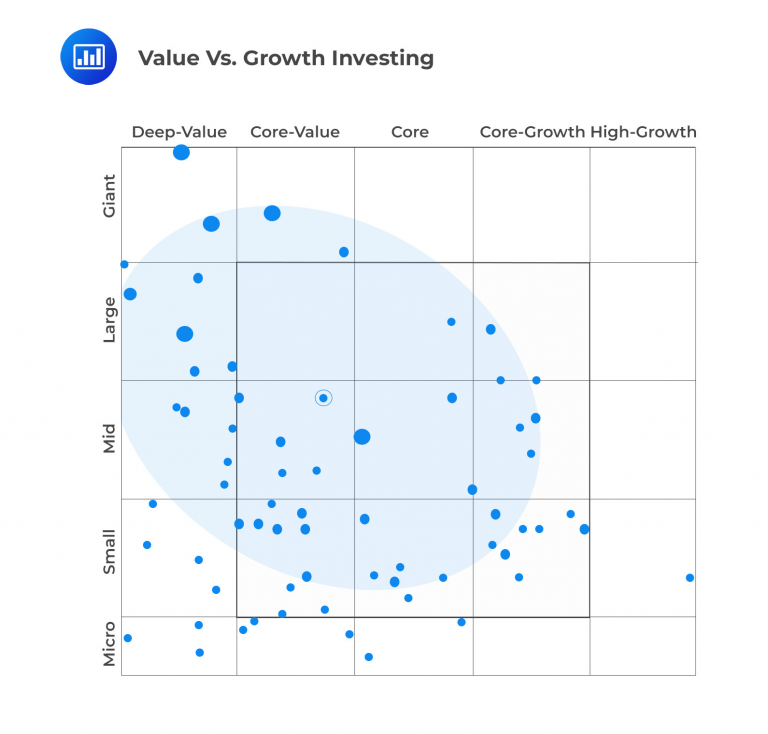

Below is an example of the output created by an HBSA. The manager in question shows a slight bias toward value vs growth investing and also a tilt toward smaller-cap stocks.

$$\text{Source: Morningstar Direct, The Mutual Fund Research Center.} $$

As with RBSA, HBSA has some disadvantages.

In general, HBSA is typically easier with equity strategies. If the portfolio has illiquid securities, stale pricing may underestimate the risk exposure of the strategy. The report’s timeliness depends on the securities that take the longest to price, which can be challenging for illiquid or non-traded securities.

Question

Which of the following is a disadvantage of RBSA?

- It is a less precise tool than HBSA.

- Computational difficulty increases.

- Be comparable across managers across time.

Solution

The correct answer is A.

RBSA is generally considered to be less precise or less accurate than HBSA (Historical-Based Simulation Analysis). HBSA uses historical data to simulate potential outcomes, which can be more accurate in certain cases. RBSA relies on risk budgeting and sensitivity analysis, which may not capture all the nuances of real-world market behavior.

B is incorrect. RBSA is often used because it’s relatively straightforward and computationally less intensive compared to some other risk assessment methods. Computational difficulty is more of a concern in complex models or simulations.

C is incorrect. This answer choice doesn’t describe a disadvantage of RBSA. In fact, one of the advantages of RBSA is that it can provide a framework for comparing risk across different managers and over different time periods. RBSA is designed to facilitate risk assessment and comparison, so this statement is not a drawback.

Reading 13: Investment Manager Selection

Los 13 (c) Describe uses of returns-based and holdings-based style analysis in investment manager selection